Legal Entity Identifier: Implementation of LEI by RBI for Large Value Transactions

Shivani Jain | Updated: Feb 10, 2021 | Category: News, RBI Advisory

Recently, the Reserve Bank of India, by way of Notification No RBI/2020 – 21/ 82, issued on 05.01.2021. The said notification deals with the implementation of the Legal Entity Identifier, which will come into effect from 01.04.2021.

Further, it shall be taken into due consideration that the scheme of Legal Entity Identifier will be applicable to only those industries who are dealing in the transactions worth Rs 50 crore and above, and the same has been undertaken by way of Centralised Payment Systems.

In this blog, we will discuss in detail the concept of Legal Entity Identifier, together with the process to obtain the LEI Code.

Table of Contents

Concept of Legal Entity Identifier

The term Legal Entity Identifier (LEI) means a 20 digits unique alpha numeric code granted by RBI. It is based on the ISO 17442 standards established by the International Organisation for Standardisation.

Further, the main function of LEI is to connect the key information of the legal entities involved in the financial transaction, as the same facilitate clarity and unique identification.

Also, Read: All You Need to know about Limitations of Trademark Law

Purpose of Legal Entity Identifier

The main reason behind the implementation of the concept of Legal Entity Identifier was to cut down the cases of the financial crisis and improve transparency and accountability in the Financial Data Systems.

Also, the same aims to improve the quality and accuracy of the financial data systems, as the same will facilitate better risk management.

RBI Notification on Legal Entity Identifier

Based on the notification issued by the Reserve Bank of India, it is mandatory for all the entities who are engaged in fund transfers of Rs 50 crore or above needs to obtain LEI on a mandatory basis. Further, the LEI number issued to the beneficiaries and remitters need to be included on the dealing and payments of Rs 50 crore or above, which are made through Real Time Gross Settlement (RTGS) and National Electronic Funds Transfer (NEFT).

Further, the apex bank has introduced the said scheme in a phased manner for the participants dealing in the Over the Counter Derivative and Non-derivative Markets, together with large corporate borrowers.

Further, as per the RBI guidelines, all the non-individual entities that transfer funds of Rs 50 crores or above need to acquire LEI numbers from the Legal Entity Identifier India Limited. Also, it shall be the duty of the banks, who are facilitating such large value transactions, to maintain records for their customers.

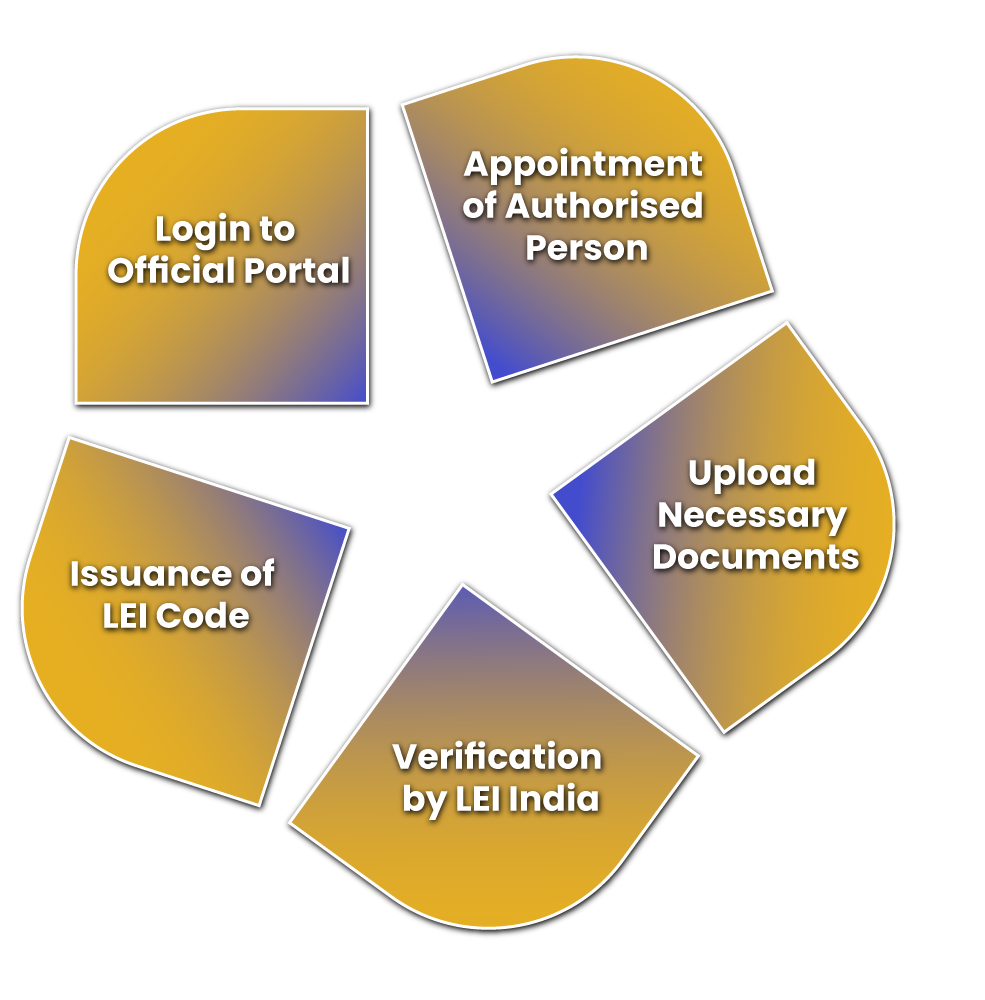

Process to Obtain Legal Entity Identifier

The steps involved in obtaining LEI are as follows:

Login to Official Portal

In the first step, the applicant requires to visit the official portal at https://www.ccilindia-lei.co.in and click on the fourth tab, i.e., Downloads.

Further, the checklist for documents and format necessary for filing are available based on the legal structure of the entity.

Appointment of Authorised Person

In the next step, a person will be appointed as “Authorised Person”, who will carry out the process of obtaining the LEI Code. The modes of appointing such an authorised person are as follows:

- Passing of Resolution;

- Power of Attorney;

- Voluntarily;

Also, such an Authorised Person will have the opportunity to create an account.

Upload Necessary Documents

Now, the applicant requires to upload all the prescribed documents in an e-mail. However, it shall be considerate to take into consideration that the total size of the uploaded documents must not increase 40 MB. If in case, it is not possible for the applicant to upload the documents, then, in that case, he/ she can courier the same at the LEI India Limited, CCIL Bhawan, 3rd floor, SK Bhole Road, Dadar, West Mumbai – 400028.

Verification by LEI India

After sending or emailing the documents, the LEI India will verify the filed application form and will ask for the additional document, if in case required.

Issuance of LEI Code

Once the application filed, and the documents submitted are duly verified, then, in that case, the authorities, will issue an LEI Code to the applicant. The same will be granted by way of an email sent to the concerned entity on its registered email. Further, this code is provided to the banks.

Concept of Local Operating Unit

The term Local Operating Unit means a body designated by RBI for the implementation of LEI and its use in India. The said body needs to obtain accreditation from the Global LEI Foundation. Further, to become a Local Operating Unit, one needs to apply as well on the above mentioned portal.

Conclusion

In a nutshell, LEI means a 20 digits unique alpha numeric code granted by RBI. It is used to connect the key information of the legal entities involved in a financial transaction. Further, based on the RBI guidelines, all the non-individual entities that transfer funds of Rs 50 crores or above need to acquire LEI numbers from the Legal Entity Identifier India Limited. Also, the same will become effective from 01.04.2021.

Lastly, in case of any other doubt or perplexity, reach out to Swarit Advisors, our team of experts are available to cater all your doubts and queries effectively.

Official RBI Notification

Official-RBI-Notification-for-Legal-Entity-IdentifierAlso, Read: De-Criminalisation of Compoundable Offences under LLP: A Complete Guide