Union Budget 2021: Key Highlights of the First Digital Budget

Shivani Jain | Updated: Feb 02, 2021 | Category: News

The Union Finance Minister, Ms Nirmala Sitharaman, on 01.02.2021, has presented the first ever paper less budget in Parliament. That means the same was presented from a Tablet instead of traditional Bahi Khata.

In her fourth consecutive budget speech, she stated that India’s fight against COVID 19 pandemic continues to exist in 2021 as well, and this is the time when the relations concerning the political, economic, and strategic aspects are changing at a global level. So, in the dawn of a new era, India is well-poised to be the land of promise and hope.

In this blog, we will discuss the aim and key highlights of the first ever digital budget.

Table of Contents

Objective of Union Budget 2021

The utmost objective of the Union Budget 2021 is to uplift the Indian Economy post COVID-19 pandemic. The said budget is divided in to two parts, which are as follows:

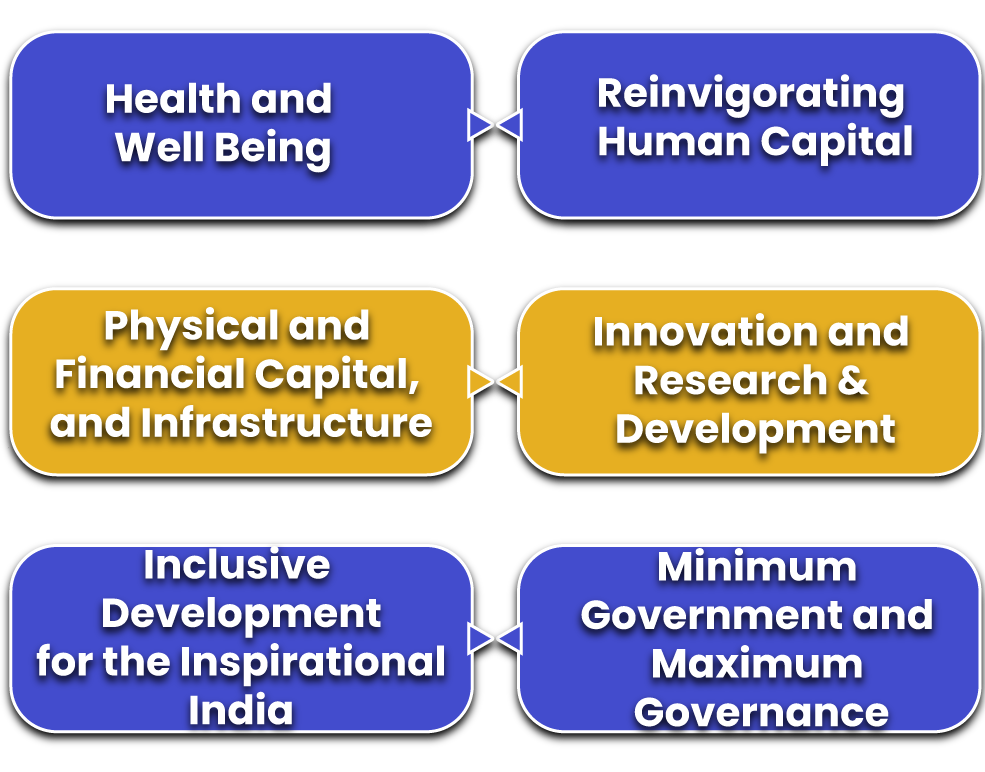

- Part A, which deals with the six pillars as follows:

- Health and Well Being;

- Physical and Financial Capital, and Infrastructure;

- Inclusive Development for the Inspirational India;

- Reinvigorating Human Capital;

- Innovation and Research & Development, and;

- Minimum Government and Maximum Governance;

- Part B, which aims to deals with the aspects as follows:

- Simplification of the Tax Administration;

- Litigation Management;

- Ease the Compliance of the Direct Tax Administration;

Key Highlights of the Part A of the Union Budget 2021

The key highlights of the Part A of the Union Budget 2021 are as follows:

Health and Well Being

In the budget 2021, there has been a significant increase in the level of investment allocated towards the development of the Health sector. Earlier, in the financial year 2020 – 2021, the total investment made in this sector was Rs 94452 crore.

However, the same has been increased by 137%, i.e., Rs 223846 crore, in the financial year 2021 – 2022. The same has been done by keeping into consideration the fight against COVID 19 pandemic.

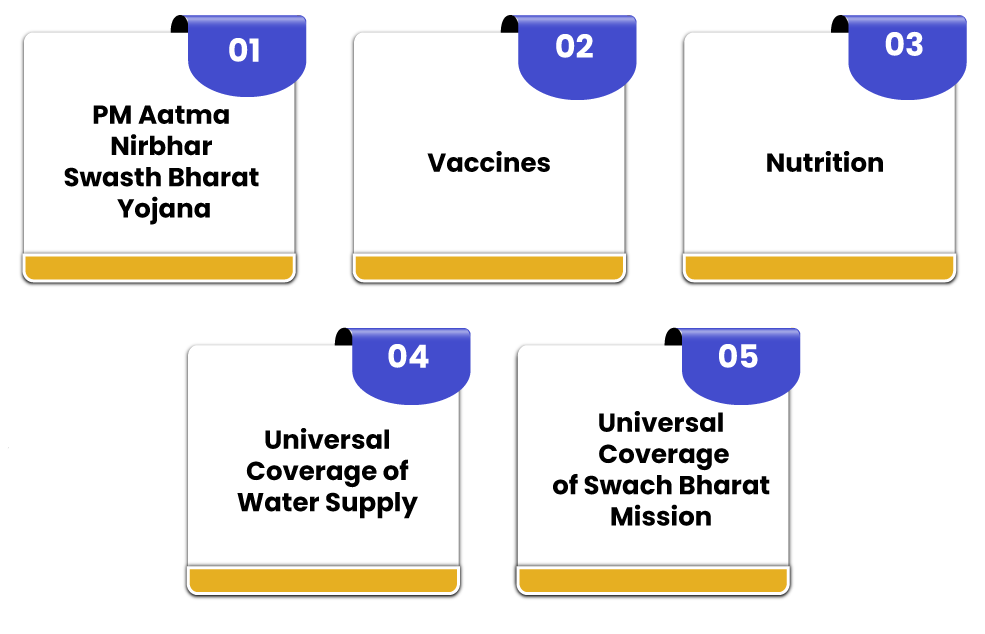

Further, the other proposals declared by our Union Finance Minister under the garb of Health and Well Being are as follows:

PM Aatma Nirbhar Swasth Bharat Yojana

Based on the digital budget 2021, a new health scheme named “PM Aatma Nirbhar Swasth Bharat Yojana” will be launched, with a total outlay of Rs 64180 crore for over 6 years.

The purpose behind the unveiling of this scheme can be summarised as:

- Developing Capacities in the Primary, Secondary, and Tertiary Health Care Systems;

- Strengthening of Existing National Institutions;

- Creation of New Institutions;

- Catering Early Detection and Cure of the New and Emerging Diseases;

Further, the main features of this scheme are as follows:

- Will provide support to 17788 rural and 11024 urban Health and Wellness Centres;

- Will set up Integrated Public Health Laboratories in all Districts;

- Will set up Integrated Public Health Laboratories in 3382 Block Public Health Units in 11 states;

- Will establish 12 Central Institutions and Critical Care Hospital Blocks in 602 districts;

- Will Strengthen NCDC (National Centre for Disease Control), its 5 Regional Branches, and 20 Metropolitan Health Surveillance Units;

- Will Expand the Integrated Health Information Portal in all the States/ Union Territories to easily connect with all the Public Health Laboratories;

- Will start the operation of 17 New Public Health Units;

- Will strengthen 33 existing Public Health Units at the point of entry of 32 Airports, 11 Seaports, and 7 Land Crossings;

Vaccines

Budget 2021 has made a provision of Rs 35000 crore specifically for COVID – 19 vaccine.

Further, the Pneumococcal Vaccine, an Indian based medicine, which has earlier been limited to only 5 states, will now be rolled out across the nation and aims to avert 50000 child deaths annually.

Nutrition

In order to strengthen and reinforce Nutritional Content, Delivery, Outcome, and Outreach, the government will now merge the Poshan Abhiyan and Supplementary Nutrition Programme to launch Mission Poshan 2.0.

In this scheme, the government will embrace an intensified strategy and plan to improve and mend the nutritional outcomes across 112 aspiring districts.

Universal Coverage of Water Supply

By way of the Union Budget 2021, the finance minister has announced a Jal Jeevan Mission, which will aim to supply water in all 4378 urban local bodies. The same will also provide 2.86 crore household tap connections and liquid waste management in 500 Amrut Cities. Further, the said mission will be implemented in 5 years, with a total outlay of Rs 287000 crore.

Universal Coverage of Swach Bharat Mission

The Urban Swaach Bharat Mission will be launched with a total outlay of Rs 141678 crore for 5 years, i.e., for 2021 to 2026.

Further, to tackle the increasing issue of air pollution, the proposed government will allocate an amount of Rs 2217 crore for 42 urban centres.

Moreover, a policy named Voluntary Vehicle Scraping Policy has been phased concerning the old and unfit vehicles. For such a scheme, vehicle fitness test centres have been proposed in the Automated Fitness Centres. It shall be considerate to take into note that in case of Personal Vehicles the scrap limit is 20 years and in case of commercial vehicle it is 15 years.

Physical and Financial Capital and Infrastructure

The schemes and initiatives proposed under this pillar are as follows:

Aatma Nirbhar Bharat Production Linked Incentive Scheme

Based on the budget speech given by our Union Finance Minister, for a US $5 trillion economy, it is important to make the manufacturing sector an integral part of the following:

- Global Supply Chains;

- Core Competence, and;

- Cutting-edge Technology;

So, to achieve all the factors mentioned above, government has announced the implementation of Production Linked Incentive Schemes in 13 sectors. The same has been done to create Indian Manufacturing Sector the Global Champions.

Further, the government has decided to allocate an amount of Rs 1.97 lakh crore in this sector for the next 5 years. Also, the said initiative will assist in increasing the size and scale of the sector, together with the creation of jobs for youth.

Textiles

In the similar fashion, to enable the textile sector in becoming the global player and attract large investments, together with the boost in employment generation, the central government has decided to launch the MITRA Scheme. The term MITRA stands for Mega Investment Textiles Parks. The same will be in addition to the Production Linked Incentive Scheme.

The main aim behind such a scheme is to establish world class infrastructure, together with Plug and Play facilities, which will make the textile sector the global champions. Also, by the next 3 years, the government will establish 7 textile parks.

Infrastructure

The NIP or National Infrastructure Pipeline scheme, which the Finance Minister had announced in December 2019 is the first of its kind, the whole of the government exercise ever undertaken.

The National Infrastructure Pipeline was launched with 6835 projects. However, the said project pipeline has now been expanded to 7400 projects.

Further, it shall be significant to take into consideration that around 217 projects worth Rs 1.10 lakh crore under some key infrastructure Ministries have been successfully completed.

Development Financial Institution

Further, specifying more on the infrastructure sector, our Finance Minister, Ms Nirmala Sitharaman has stated that this sector needs long term debt financing, therefore, it is necessary for a professionally managed DFI (Development Financial Institution) to operate as a provider, enabler, and catalyst for financing infrastructure.

Based on the same proposition, a bill has been drafted to establish a DFI. Also, it shall be necessary to take into consideration that the same government has decided to release a sum of Rs 20000 crore in order to capitalise this institution. Further, the government aims to have the lending portfolio of at least Rs 5 lakh crore in 3 years for this DFI.

Monetization of Asset

For the purpose of Constructing New Infrastructure, monetization of public infrastructure plays a crucial role of Financing Option. Therefore, the government has decided to launch “National Monetization Pipeline” for the potential brownfield infrastructure assets.

Further, an asset monetization dashboard will be created as well for tracking the progress and providing the visibility to investors.

Some key measures taken in the direction of asset monetization are as follows:

- NHAI (National Highways Authority of India), together with PGCIL have sponsored one InvIT each, which will attract both International and Domestic Institutional Investors. Further, 5 operational roads of worth Rs 5000 crore has been transferred to the NHAIInvIT as well. Also, the transmission assets of worth Rs 7000 crore will be transferred to the PGCIL InvIT as well;

- Railways will monetize DFC (Dedicated Freight Corridor) assets for the operations and maintenance, after commissioning;

- For the purpose of operations and management concession, a lot of Airports will be monetized;

- The remaining core infrastructure assets that will be used under the Asset Monetization Programme are as follows:

- NHAI Operational Toll Roads;

- Transmission Assets of PGCIL;

- Oil and Gas Pipelines of GAIL, HPCL, and IOCL;

- AAI Airports in Tier II and III cities;

- Other Railway Infrastructure Assets;

- Warehousing Assets of CPSEs, such as Central Warehousing Corporation (CWC) and NAFED among others;

- Sports Stadiums;

Railways and Highways Infrastructure

As per the budget speech given by our Finance Minister, roads of more than 13000 km in length, worth Rs 3.3 lakh crore, has been granted under the Rs 5.35 lakh crore “Bharatmala Pariyojana Project”. Out of the said project roads of 3800 Km have already been constructed.

Further, by March 2022, the government has decided to award another 8500 km, together with the completion of additional 11000 km of national highway corridors.

Also, to boost the road infrastructure, the government has decided to provide a total outlay of Rs 118101 lakh crore for the Ministry of Road Transport and Highways. Out of the total outlay mentioned, the amount of Rs 108230 was dedicated only towards the capital development, which is the highest ever provided fund till now.

Railways Infrastructure

To make the Indian Railway System future ready, the government has decided to implement a “National Rail Plan for India – 2030”. The main aim behind the implementation of this plan is to cut down the logistic cost of the industry to enable the scheme of “Make in India”.

For the same, it is expected that Eastern Dedicated Freight Corridor and Western Dedicated Freight will be commissioned by the Ministry of Railways by June 2022.

Further, the measures taken for the safety and convenience of customers are as follows:

- Introduction of Artistically designed “Vista Dome LHB Coach” on tourist routes to offer better travel experience;

- To more rigorously implement the decided measures, the government has decided to provide the high density and highly utilised network routes, together with an indigenously developed automatic train protection mechanism, which will eliminate the chances of Train Collision due to human mistakes;

- The government will allocate Rs 110055 crore towards the betterment of Railways, out of which a sum of Rs 107100 will only be dedicated towards the capital expenditure;

Urban Infrastructure

In the financial year 2021 – 2022, the government will work towards increasing the share of public transport in the urban areas by expanding the metro rail network and augmenting the city bus service.

Further, for the purpose of augmenting city bus service, the government has decided to launch a new scheme of worth Rs 18000 crore.

Also, it shall be significant to take into consideration that at present, a total of Rs 702 km conventional metro is in operation and 1016 km of metro, together with RRTS is under construction in 27 cities.

Moreover, to reduce the cost of the Metro Rail Mechanism, two new technologies named, “MetroLite” and “MetroNeo” will be deployed by the government in the Tier 2 cities and peripheral areas of Tier 1 cities.

Power Infrastructure

In the last 6 years, the nation have witnessed many significant reforms and success in the power sector, such as follows:

- Addition of the 139 Giga Watts of installed capacity;

- Addition of the 1.41 lakh circuit km of the transmission lines;

- Connection to Additional 2.8 crore household;

Further, in view of the Viability of Distribution Companies, the Finance Minister has proposed to implement a scheme named “Reforms Based Result Linked Power Distribution Sector”, with a total outlay of Rs 305984 crore over the 5 years.

Further, the main aim behind this scheme will be to provide assistance to DISCOMS for creating infrastructure, including pre-paid smart metering and feeder separation, up gradation of systems, etc.

Ports, Shipping, and Waterways

Based on the budget speech given by Ms Nirmala Sitharaman, majority of Ports will now be privatised, and the government has decided to allocate more than Rs 2000 crore for the said cause. Further, such a privatisation is based on the concept of Public Private Partnership.

Also, the government has decided to initiate a scheme to promote merchant ships. The same will be done by offering subsidies to the Indian Shipping Companies in the tenders floated by Ministries and CPSEs. A total amount of Rs 1624 crore will be provided for the same in 5 years.

Moreover, the same initiative will result in providing training and employment opportunities to the Indian Seafarers, together with an enchantment in the share of Indian Companies in global shipping.

Natural Gas and Petroleum

As per the speech given by Ms Nirmala Sitharaman, taking into consideration the lives of people, the government has kept the fuel supplies running during lockdown without any interruption. In the same manner, some other initiatives announced for the public welfare are as follows:

- Ujjwala Scheme, which has benefited around 8 crore people, will now aim to benefit further 1 crore beneficiaries;

- In the City Gas Distribution Network, the government has decided to add further 100 cities in the next 3 years;

- A Gas Pipeline project will be initiated in the Union Territory of Jammu and Kashmir;

- An Independent Gas Transport Mechanism Operator will be established for the facilitation and coordination of the booking of common carrier capacity in all natural gas pipelines. The same will be done on non discriminatory basis;

Financial Capital

Now, the government has decided to consolidate the provisions of the Regulatory Acts as follows into a single securities market code:

- SEBI Act 1992;

- Depositories Act 1996;

- Securities Contracts (Regulation) Act 1956;

- Government Securities Act 2007;

Further, the government has decided to support the establishment of the world class Fintech Hub at the GIFT – IFSC.

Increment in Insurance Sector

As per the Union Budget 2021, the Government has decided to amend the provisions of the Insurance Act 1938. The same has been done to increase the limit of Foreign Direct Investment (FDI) from 49% to 74% and to permit the foreign ownership and control with safeguards.

Further, based on the new proposed structure, the majority of Directors of the BOD (Board of Directors) and KMP (Key Managerial Personnel) will be Indian citizens. Also, 50 % of the directors will now be Independent Directors, and the prescribed percentage of profits will be retained as general reserve.

Disinvestment and Strategic Sale

Despite the COVID 19 pandemic, government has continued working towards the strategic disinvestment, some of the transactions, which will be completed by the Financial Year 2021-2022 are as follows:

- BPCL;

- Air India;

- Shipping Corporation of India;

- Container Corporation of India;

- IDBI Bank;

- BEML;

- Pawan Hans;

- Neelachallspat Nigam Limited;

Further, the government has proposed to take up the Privatisation of two Public Banks and one General Insurance Company in the current financial year.

Also, the government has decided to bring IPO (Initial Public Offer) for LIC (Life Insurance Corporation) this year.

Moreover, an important announcement has been made by the Finance Minister that in the Aatma Nirbhar Package, the government has approved the policy of Strategic Disinvestment. For the said scheme, government has chosen 4 areas, out of which except CPSEs, rest all will be privatised.

Also, Read: What are the Major Income Tax Cuts in Union Budget 2020?

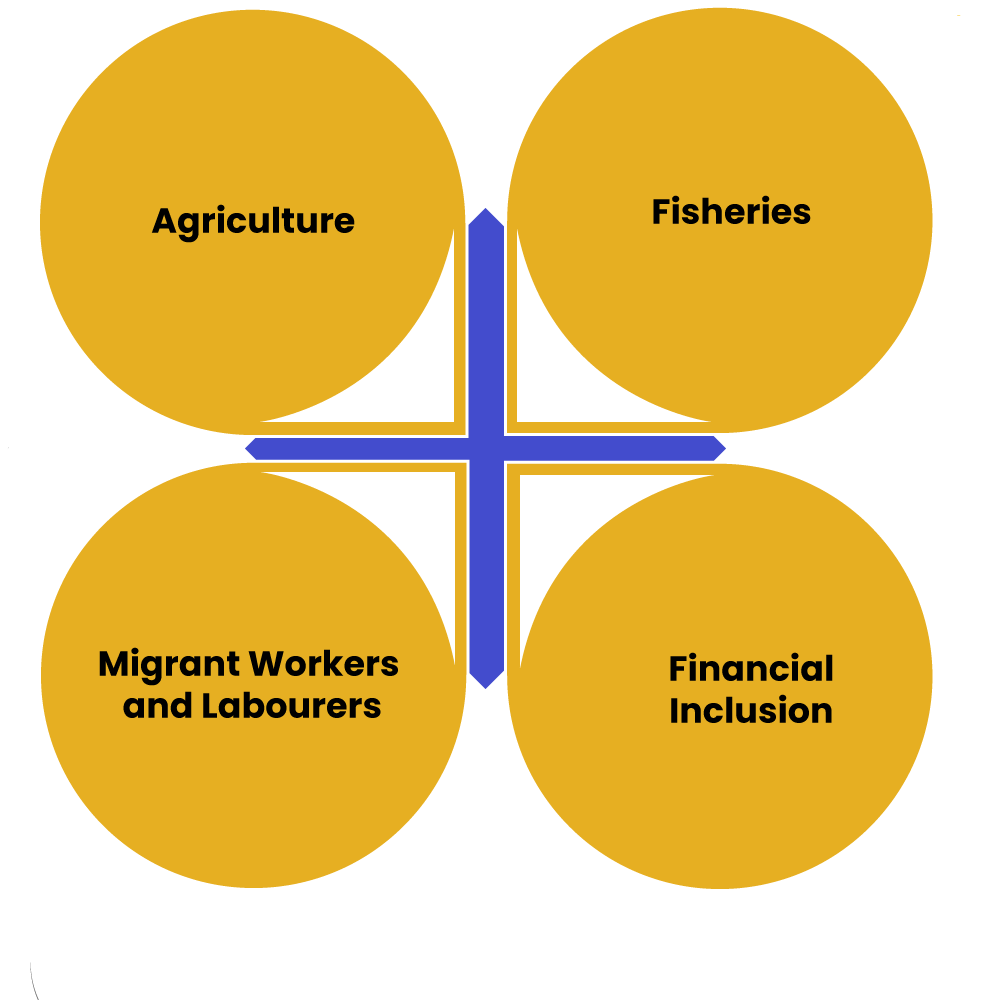

Inclusive Development for Aspirational India

Under this pillar, the government has decided to cover agriculture and allied sectors, which will directly work for the aspects as follows:

- Farmers Welfare;

- Upliftment of Rural Areas;

- Migrant Worker;

- Labour Welfare;

- Financial Inclusion;

Agriculture

Based on the budget speech, the Finance Minister stated that the current government is committed towards to betterment and Upliftment of farmers. As a result, MSP Regime has undergone a massive revolution and now it assures at least 1.5 times of the cost of production for all commodities. The said scheme has resulted in rising the payment to farmers substantially.

In the case of Wheat, the total amount paid to the farmers in the F.Y. 2019 – 2020 was Rs 62802 crore. However, the same has been increased to Rs 75060 crore, which has increased the count of benefiting farmers from 35.57 lakhs to 43.36 lakhs.

In the case of Paddy, the total amount paid to the farmers in the F.Y. 2019 – 2020 was Rs 141930 crore. However, it is estimated that the same will increase to Rs 172752 crore, which will increase the count of benefiting farmers from 1.24 crore to 1.54 crore.

In the case of Pulses, the total amount paid to the farmers in the F.Y. 2019 – 2020 was Rs 8285 crore. However, the same has been increased to Rs 10530 crore.

In the case of Wheat, the total amount paid to the farmers as on 27.01.2021 was Rs 25974, which has stupendously increased from Rs 90 crore in 2013 – 2014.

Further, in the starting of this year, the Prime Minister has launched a schemed named “SWAMITVA Scheme”. As per this scheme, a record of rights have been given to the property owners of the villages. Till present, around 1.80 lakh property owners in 1241 villages have been provided with the card. The government aims to cover all the states and union territories by the end of the Financial Year 2021 – 2022.

Also, to offer adequate credit assistance to the farmers, the government has now enhanced the agricultural credit target to Rs 16.5 lakhs crore in the F.Y. 22. In a similar fashion, it has decided to increase the funding of the Rural Infrastructure Development Fund to Rs 40000 crore from previous Rs 30000 crore.

As per the Union Budget 2021, the Micro Irrigation Fund, created under NABARD, its total value of Rs 5000 crore has now been doubled.

The government has decided to increase the scope of the “Operation Green Scheme” to boost the value addition in the agricultural sector and allied products. Earlier, only tomatoes, potatoes, and onions were included under the said scheme. However, now it will comprise of 22 perishable products.

By implementing e-NAM in the agricultural sector, the government aims to infuse more transparency and competitiveness in the sector. Under the said scheme, around 1.68 crore farmers have been registered and a trade of value Rs 1.14 lakh has been carried out. Further, around 1000 more mandis will be included with e-NAM.

Lastly, the Agriculture Infrastructure Funds will be made available to APMCs for boosting the infrastructure facilities.

Fisheries

As per the Union Budget 2021, the government has decided to make substantial investments for developing modern fishing landing centres and fishing harbours. In starting, the 5 major ports selected are as follows:

- Kochi;

- Chennai;

- Vishakhapatnam;

- Paradip, and;

- Petuaghat;

Migrant Workers and Labourers

As per the speech given by Ms Nirmala Sitharaman, the government has decided to launch a scheme named “One Ration Card Scheme”, by way of which the beneficiaries will be able to get ration from any corner in the country.

At present, the government has planned to implement the scheme in 32 states and union territories, to benefit around 86% of the beneficiaries registered. The remaining 4 states and union territories will be included in the next few months.

Further, it shall be considerate to take into consideration that for the first time government has decided that the social security benefits will be applicable to the gig and platform workers as well. Also, the provisions of the Minimum Wages Act 1948 and Employees State Insurance Corporation will be applicable on every category of worker.

Moreover, from now onwards, women are allowed to work in night shifts, as it is the duty of the organisation to take adequate measures.

Lastly, by way of Single Registration, Licensing, and Online Returns, government has decided to reduce the compliance burden on employers.

Financial Inclusion

In order to facilitate the flow of credit under the scheme of “Stand Up India” for women, SCs, and STs, the government has proposed reduction in the margin money requirement from 25% to 15%. Also, it will include loan facility for the allied activities of the agricultural sector.

Moreover, it shall be significant to consider that the government has decided to support more to MSME sector and has provided Rs 15700 crore funds to this sector.

Reinvigorating Human Capital

As per the Union Budget 2021, 15000 schools will be added in the NEP (National Education Policy) to get qualitatively strengthen. Also, 100 new sainik schools will be established under the partnership with Private Schools/ NGOs/ States.

Further, our Finance Minister stated that the government will establish a HECI (Higher Education Commission of India), which will an umbrella body comprising of 4 different vehicles, such as follows:

- Standard Setting;

- Accreditation;

- Regulation, and;

- Funding;

Further, for making education accessible in Ladakh, the government has proposed to establish a Central University in Leh.

Welfare of Scheduled Castes and Scheduled Tribes

In the Union Budget 2021, the government has taken a task to establish 750 Eklavya Model Residential Schools in the Tribal Areas. Further, the cost involved in each school has been increased to Rs 38 crore from Rs 20 crore, and in the case of Hilly areas, the same has been increased to Rs 48 crores.

In the similar fashion, the Post Matric Scholarship Scheme will work for the welfare of Scheduled Castes. The central assistance for the same have been increased to Rs 35219 crore, for a period of 6 years, i.e., till 2025 – 2026. This scheme will benefit around 4 crores SC students in total.

Skilling

In order to provide benchmark skill qualifications, certifications, and assessments, together with the deployment of certified workforce, the Indian Government in partnership with the UAE (United Arab Emirates) have decided to implement the said initiative.

Further, the government has entered into a collaboration with the Japan Government to provide TITP (Training Inter Training Programme). The main aim of this collaboration is to facilitate transfer of Japanese Industrial and Vocational Techniques, Skills, and Knowledge to India.

Innovation and Research and Development

The various initiatives taken under this pillar of the Union Budget 2021 are as follows:

National Research Foundation

The establishment of NRF (National Research Foundation) with a total outlay of Rs 50000 crore for the period of 5 years will ensure to strengthen the research ecosystem of the country, together with the focus on the identified national priority thrust areas.

National Language Translation Mission

The initiative named National Language Translation Mission (NTLM) will make sure that the wealth of governance, together with the policy concerned knowledge on the internet is made available in major Indian Languages.

New Space India Limited

The NSIL (New Space India Limited), a Public Sector Unit, working under the Department of Space will execute the launch of the PSLV – CS51. The same will carry out the Amazonia Satellite from Brazil, together with some other smaller Indian Satellites.

Gaganyaan Mission Activities

Under the Gaganyaan Mission Activities, 4 Indian astronauts will be trained on “Generic Space Flight Aspect” in Russia. Further, the first unmanned launch will decided for December 2021.

Minimum Government and Maximum Governance

Under the sixth pillar of the Union Budget 2021, the government has decided to bring reforms in the working of Tribunals to ensure the aspects as follows:

- Speedy Delivery of Justice;

- Rationalised working of Tribunals;

Bill of National Commission for Allied Healthcare Professionals

The government has introduced the bill of National Commission for Allied Healthcare Professionals in the parliament to ensure transparency and efficiency in the regulation of 56 Healthcare professions.

Digital Census

In the Union Budget 2021, the Finance Minister announced that the forthcoming census could become the First ever Digital Census in the history, for which the government has decided to allot the funds of Rs 3768 crore in the F.Y. 2021 – 2022.

Key Highlights of the Part B of the Union Budget 2021

The key highlights of the Part B of the Union Budget 2021 are as follows:

Proposals for Direct Tax

The major reforms proposed in the Direct Tax deals with the aspects as follows:

- Relief to Senior Citizens from filing ITRs;

- Reduction in the Time Limit for Tax Proceedings;

- Establishment of DRC (Dispute Resolution Committees);

- Faceless ITAT;

- Relaxation to NRI;

- Increment in the Exemption Limit of Audit;

- Relief for Dividend Income;

- Relief in Affordable Housing and Renting;

- Tax Incentives to IFSC;

- Relief to Small Charitable Trusts;

- Incentivizing Start-ups;

- Minimum Burden on Taxpayers;

- Abolition of Dividend Distribution Tax;

- Increment in Rebate for Small Taxpayers;

- Dividend Payment to InvIT and REIT is exempt from TDS;

Relief to Senior Citizens

The government has decided to provide Relief to Senior Citizens who are above the age of 75 years and are having only pension and interest income are exempt from filing ITRs.

Relief in Affordable Housing and Renting

In the Union Budget 2021, the Finance Minister has proposed to extend the period of eligibility for claiming Additional Deduction for the Interest of Rs 1.5 lakh paid for the loan taken to purchase affordable housing by 31.03.2022.

Further, to promote of affordable renting of houses, the government has announced a new tax exemption for the notified rental projects.

Incentivizing Start-ups

To incentivize start-ups, our Finance Minister in the Union Budget 2021 has announced an extension in the eligibility for claiming Tax Holiday by one more year, i.e., til 31.03.2022.

Further, the exemption in Capital Gains for start-ups have extended by one year as well, i.e., till 31.03.2022.

Timely Deposit of Employee’s Contribution

To protect the interest of employees against the delayed deposition of interest, the government has announced that the late deposit will not be allowed for deduction from now onwards.

Reduction in the Time Limit for Tax Proceedings

To reduce the compliance burden on taxpayers, the government has decided to reduce the time limit for tax proceeding. Further, in the case of serious tax evasions, where the amount in question is Rs 50 lakh or more, the assessment can now be opened till 10 years, but on the prior approval from Principal Chief Commissioner.

Establishment of Dispute Resolution Committee

To reduce the litigation of small taxpayers, the government has proposed the establishment of DRCs (Dispute Resolution Committees). Such committees will deals only with the cases where the taxable income is up to Rs 50 lakhs and the disputed income is Rs 10 lakhs.

Further, based on the provisions of the Union Budget 2021, the government will establish National Faceless Income Tax Appellate Tribunal Centre.

Incentivize Digital Transactions

The government has decided to increase the limit of tax audit for the person who is carrying out 95% or more digital transactions from Rs 5 crore to Rs 10 crore.

Relief to Small Charitable Trusts

To reduce compliance burden on small charitable trusts, the government has decided to increase the limit of Annual Receipts from Rs 1 crore to Rs 5 crore.

Proposals for Indirect Tax

The major reforms proposed in the Indirect Tax deals with the aspects as follows:

- Capacity of GSTN Mechanism has been announced;

- Deployment of Deep Analytics and Artificial Intelligence to determine Tax Evaders and Fake Billers;

- Revised Custom Duty Structure will be enforced from 01.10.2021;

- Exemptions of New Custom Duty will have a validity till 31st March succeeding 2 years, starting from the date of issue;

- Withdrawal of Exemption Parts of Chargers and Sub parts of Mobile Phones;

- 2.5% GST will be charged on some mobile parts, which were earlier categorised in NIL Category;

- Reduction of Custom Duty to 7.5% on flat, semi, and long product of non- alloy and stainless steel;

- Exempting Duty on Steel Scrap up to 31.03.2022;

- Reduction of BCD rates in Caprolactam, Nylon Fiber, Nylon Chips, and Yarn to 5%;

- Rationalization of Custom Duty on Silver and Gold;

- Notification of the Phased Manufacturing Plan for Solar Panels and Cells to build up Domestic Capacity;

- Rationalization of Exemption on the Import of Duty Free Items;

- Increment in the Custom Duty of the Cotton, Raw Silk, and Silk Yarn;

- Levy of Agriculture Infrastructure and Development Cess on small and tiny items;

- Implementation of provisions concerning ADD and CVD levies;

- Prescription of Timelines for the completion of Customs Investigation;

Conclusion

In a nutshell, the Union Budget 2021, presented by our Union Finance Minister, Ms Nirmala Sitharaman is the first ever digital budget in the backdrop of unprecedented COVID 19 pandemic. By way of this budget, the government aims to work further on the vision of Aatma Nirbhar Bharat. The said budget will be known for its Pragmatic, Forward Looking, and Growth Oriented Approach, together with a Strategic Vision and Clear Action Pathway.

In case of any other doubt or complexity, reach out to Swarit Advisors.

Official Copy of the Union Budget 2021

Budget_SpeechAlso, Read: Union Budget 2020-21: Key Highlights