How do Insurance Companies Steer Clear of Their Liability in Case of Double Insurance?

Karan Singh | Updated: Jul 13, 2021 | Category: IRDA Advisory

There may be certain conditions wherein an individual may come across few examples wherein they may find that they had taken overlapping insurance covers over a similar subject matter. So does these overlapping insurance cover indicates that he or she has obtained extra protection over the subject matter, or is it simply money wastage? Such questions bring to use the most confusing part of insurance law that is the Law of Double Insurance. This blog aims to deliver few insights into the idea of Double or Multiple Insurance and make them recognize the different clauses in an insurance policy by use of which an insurer can steer clear of their liability in case of Double Insurance.

Table of Contents

Double Insurance – An Overview

Double Insurance is the way of getting a similar risk or the similar subject matter insured with exceeding one insurance company or with a similar insurance company but by two dissimilar policies. No rule under the Insurance Act, 1938, or under any other rule, for the time being, forbids double Insurance; instead, the Insurance Act provides the idea of multiple Insurance. The legal meaning of double Insurance is provided under Section 34 of the Marine Insurance Act, 1963[1]. So, every individual is at freedom to take as many policies on a similar subject as they want. The idea of double Insurance is possible in all different insurances types, may it be general or life or health.

In some of the examples, people intentionally obtain their property insured with many policies; however, there are certain conditions wherein an individual may unintentionally fall into the danger of multiple Insurance. For example, when I ride your bike with your consent, in this case, I have the third party insurance cover under my own policy, and I also have the safety under your Motor Vehicle Insurance Policy. Thus, in such a case, the problem arises when both of these insurance policies have an “Escape Clause”, by which both of these insurers may avoid their liability. Hence, it is vital for the public to know the clauses.

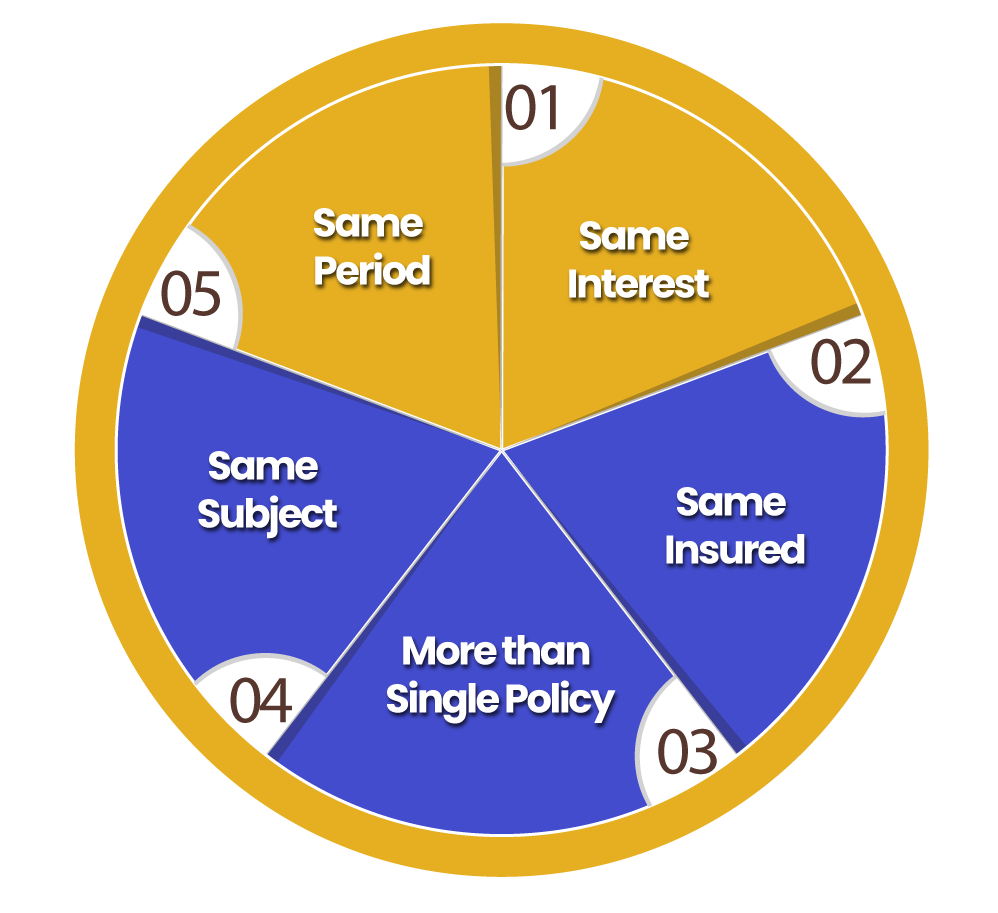

What are the Different Features of Double Insurance?

Following are the different features of Double Insurance:

- Same Interest: The interest desires to be the same in all the relevant insurance policies.

- Same Insured: The insured individual should always be the same in double insurances; if the same individual is not entitled to the advantages of all the policies, it cannot be termed as double or multiple Insurance.

- More than Single Policy: A specific subject matter needs to be insured with more than one Insurer or with a similar Insurer but by two dissimilar policies.

- Same Subject: All the insurance policies must be the same risk or a similar matter; if it’s not the same, it cannot be called double Insurance.

- Same Period: The time or period for which the policy running should be the same.

Sum Recoverable in Double Insurance

In the case of double Insurance, the total recoverable varies in Life Insurance & General Insurance. Since life insurance deals are not the contract of protection and are possible in nature, the full amount can be alleged from all the insurance policies. However, this condition varies in the case of general insurances, as we recognize that general insurance contracts are contracts of Insurance, so nothing above the actual loss can be recovered. In such cases, the Principle of contribution will be applied, and each Insurer will have to pay their relevant share accordingly. An insured is not eligible to recover in complete from all the insurance companies; if such recovery is granted, then it will be against the public policy. It should further be noted that if the loss experienced is more than the real value of the policies; then a complete amount can be claimed from all the insurers. So from a sums recoverability outlook, Life Insurance Policies may prove to be advantaging. On the other side, it may prove to be unfavorable to the interest of an insured.

Different Clauses that the insurers use to Steer Clear of their Liability

Generally, most insurance companies include “Other Insurances” clauses in all the policies so as to avoid their liability in the case of Double Insurance. As per the universal rule, all the insurance holders are eligible to claim the loss experienced to them from whatever insurance company they desire, but to restrict the application of the idea of double Insurance & the doctrine of contribution, the insurers use such clauses.

Usually, the insurance company uses the following clauses to avoid their liability in the case of Multiple Insurance. They can use any one or combination from the following clauses:

- Notification Clause: According to this clause, the insured individual is required to given written notice to the insurance company if he or she gets a similar risk insured with some other company; if the insured fails to supply such notification, the liability of the former insurance entity will be avoided. It is appropriate to note here that the insured individual has to give a notice in writing only oral notification didn’t work.

Usually, such clauses are inserted by the words: No claim will be considered if the insured didn’t give notice of any earlier or ensuing Insurance taken on the same matter. This clause is examined by the court in numerous cases; some essential cases on this point are F&B Trading Co. Vs Stradfast Insurance Co. (1972) and Sandhers vs Australian Agricultural Co. (1875).

- Excess Clause: According to this clause, the liability of one Insurer will begin only in case when the loss experienced crosses the limit of the other Insurance.

- Liability Exemption Clause: According to this clause, the Insurer accepts their liability upon a condition that, if the similar risk is insured somewhere else also, then, in this case, their liability will not occur. Such clauses save the insurers from two different types of liability:

- If the Insurer takes the claim from any single insurance policy, then the past Insurer will be released to that extent;

- In case of any loss, exemption from the liability to indemnify the insured.

These clauses may also be known as “Escape Clauses”. Usually, such clauses are included by the words: If the liability covered under this insurance policy is insured with any other policy, either completely or in part, we will not be accountable to pay any damages, loss, etc.

- Rateable Proportion Clause: By the addition of such clauses, the insurance entities can steer clear of partial liability. According to this clause, one insurance company will only cover a bit of loss, is some other insurance policy also reply on the same risk.

Conclusion

In the end, we can conclude that double insurances are the ones wherein the similar subject matter or risk is insured with more than one insurance company or with the similar Insurer but with dissimilar policies. The way of double Insurance can also be known as Multiple Insurance. The sums recoverable in these cases of Multiple Insurances can never exceed the total amount of loss (except in Life Insurance Contracts). In multiple insurances, the standard of contribution is the key to deciding the proportion of amount each insurance company is liable for.

Moreover, we have seen various types of clauses in which the insurance company uses to steer clear of their liability in multiple insurances. We also look as to what happened in the cases in which both insurance companies includes such exemption clauses in their policies. In the end, it can be concluded, taking multiple Insurance does nothing else than raising problems for you. It does not raise the sums recoverable; rather, it delays the amount payable & raises an issue for us.

Read our article:Insurance Broking Opportunities & Critical Aspects – An In-depth View