All You Need to Know About Investment Trends in Venture Capital

Karan Singh | Updated: Aug 19, 2021 | Category: SEBI Advisory

The funding of Venture Capital which Venture Capital Firms generally fund, high net-worth individuals etc. is provided in the form of institutional funding to start-ups during their development phase; thus, in today’s era, this principle is not just limited to the development phase, but rather the Venture Capital Financing is attracted to almost all the steps of the business expansion. Scroll down to check the different investment trends in Venture Capital.

Table of Contents

What is a Venture Capital?

Before we move forward to different investment trends in Venture Capital, let’s first understand the meaning of Venture Capital. Venture Capital or VC is a sort of private equity financing that is furnished by Venture Capital Firms to initial-stage, start-ups, and rising companies that have been considered to have high development potential or which have been showing high growth (in terms of annual revenue, number of employees, etc.). Venture Capital Firms invest in these initial-phase entities in exchange for equity or a proprietorship stake. Venture capitalists take on the danger of funding risky start-ups in the hopes that some of the firms they assist will become successful.

Because start-ups face high doubt, Venture Capital investments have high rates of failure. The start-ups are generally based on a business model or innovative technology, and they are typically from the high technology industries, like Biotechnology, Information Technology (IT), or Clean Technology.

Reason Behind the Venture Capital Investors to Invest in Small Businesses

The reason behind the Venture Capital investors to invest in small businesses is that they are exponentially excellent commercial ideas with innovative products or services & upgraded technology. Other than the primitive & high returns, Venture Capital investors seek to gain significant control over the businesses in the long-term, and hence they invest in exchange for either equity shares or proprietorship stake or acquisition of voting rights. Further, for Venture Capital investors, modification is an unwritten rule. They seek investments in numerous opportunities, thus not restricting their objective or goal with the high and more sensible return.

Recent Investment Trends in Venture Capital Investments

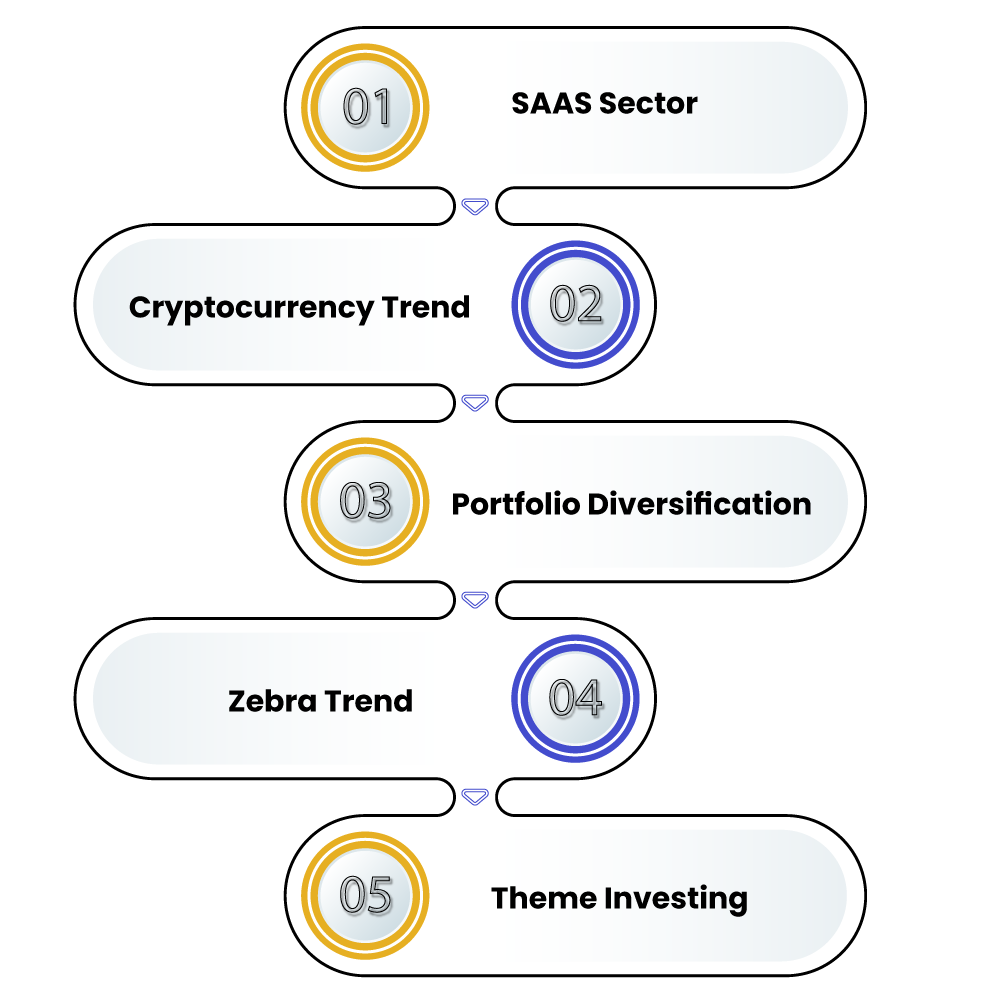

Following are some recent investment trends in Venture Capital Investments:

- SAAS Sector: Even with the Covid-19 pandemic affect many industries around the world, the SAAS (Software As A Service) investments have proved to be helpful for many players in the market. Rather the ongoing Covid-19 has increased the demand for more cloud-based models that are effective and economical at the same time. The need is challenging to convert into digital space, which in turn is increasing the expenditure of SAAS[1] & other cloud service providers.

The SAAS products permit users to use the platform or application directly on their device through the internet, for updating & running, without downloading. This investment emphasises that there are numerous services that can be operated by SAAS technology; hence, the game is not just restricted to a few dominating players but rather the open space is available easily for entrepreneurs, which means good opportunities for investors.

2. Cryptocurrency Trend: It is one of the prevalent investment trends in Venture Capital, cryptocurrency investments set up an entry gateway in the cryptocurrency market. The blockchain industry or cryptocurrencies is relatively much newer in age & hence limits high-risk factors compared to other industries, especially take into account the fact that technology scams are also uncontrolled nowadays.

So one question may arise that how different is cryptocurrency investment from traditional investments? The crypto-induced start-ups that seek funding should be leading, organise from a well-prepared ground along with a working product that can control the decisions of such Venture Capitalists. In other terms, as these investments are not easy to decode, businessmen must develop or improve a white paper that can perform as a road map for investors.

The growth of cryptocurrencies seen in other nations makes us deem the great potential it can have in India. When opportunities allow, Indian investors must join the bandwagon.

3. Portfolio Diversification: It is a method to reduce the risk that is otherwise possible due to focus in this type is not just restricted to shares but also in assets, bonds, and stocks. It is again a no guaranteed solution of higher return, but it can definitely save investors when they make long-run investments. For instance, if the portfolio of investors only includes stock of the airline industry, any severe change in the airline policies or pilots going to strike will have the severe capacity of decreasing the market value of such investments. But, if the same investor had few stocks invested in other transportation schemes, the damages caused by the loss of airline can be counterbalanced when people prefer such other transport for their means. With a similar principle, investors decide to expand their funds not just to be restricted to one sector but in all possible angles that can be matching to their invested sectors.

On the other hand, when investments are invested in very dissimilar industries, the loss caused by one entity can be compensated by the expansion in shares of a totally opposite company.

4. Zebra Trend: This is also one of the well-known investment trends in Venture Capital which is known for investing in companies that are sustainable, profitable, and useful to society. Zebra companies intend to generate yearly revenue between 1 million to 5 million US dollars. They may not be techno-related companies but are often seen as technology-enabled.

The aspect that helps these companies to perform as a good thing is that they are more accessible to the growing demands of the customers and are flexible to alter their course and functions to satisfy the same. Where the Unicorn Companies such as Uber can alter the way or working and bring revolutionary products & services. Zebra entities are practical companies or entities; they intend to endeavour for both revenue generation & culture enclosure, together without damaging the other objective.

5. Theme Investing: The investors are eager to vigorously investing in more focussed investments that can accomplish greater allocation of illiquid assets & extensive portfolios rather than conventional investment schemes. The achievement in thematic investments is based on an in-depth understanding of the long-term economic, social impact, and political of these investment opportunities.

As for the benefits to investors, such investments do prove to be helpful in different forms like it beholds opportunities for investors to concentrate on latest trends where capital can be diffused in advanced range; due to extensive research on the ongoing trends, thorough research is required which eventually creates value addition in such investments.

Conclusion

After understanding the current investment trends in Venture Capital, it is clear that in India, many Venture Capital Firms are making escalating investments in different business opportunities, which are slowly & certainly representing good outcomes. The well-known Venture Capital Firm in India is Sequoia Capital India, often invests in healthcare, financial sectors & customer and has currently invested in iYogi, Practo, and JustDial. Another recommended Venture Capital Firm is Accel Partners has invested in Flipkart, Bookmyshow, BabyOye companies. Pointless to say, India’s development and growth in investing in Venture Capital seems brighter, making possibilities for future investors more beneficial.

Read our article:What are the Different Types of Private Equity Funds?