What are the Different Types of Private Equity Funds?

Karan Singh | Updated: Aug 18, 2021 | Category: SEBI Advisory

In different Equity & debt instruments, the collective investment scheme is used to make investments called Private Equity Funds. Private Equity is a common term used to recognise a relation of alternative investing methods: it can comprise growth equity funds, leveraged buyout funds, venture capital funds, certain real estate investment funds, special debt funds (distressed, Mezz, etc.) & other types of unique situations funds. In this write-up, we are going to understand the different types of Private Equity Funds.

The investment tenure horizon ranges between five to ten years with an option of yearly extension. One appropriate aspect of a Private Equity Fund is that money invested for investment fund is not traded in the stock market and is not available for every people for subscription due to which capital is generally increased from Investment Banks and HNI who afford to grow a tremendous amount of money for a more extended time. A team of professional investment from a particular Private Equity Firm deals to raise capital which they further use to increase new capital, invest in other private equity firms, fund new start-ups or technology, and future acquisition. Companies Act 2013, Prospectus & Allotment of Securities Rules, 2014 and Shares Capital & Debentures 2014, if the statutory regulatory frameworks that govern Private Equity Funds.

Table of Contents

Advantages and Disadvantages of Private Equity Funds

Before we discuss the different types of Private Equity Funds, lets first understand the advantages and disadvantages of Private Equity Funds, and you can check the same below:

Advantages of Private Equity Funds

- Private Equity is preferred by entities because it permits them access to liquidity as an alternative method to conventional financial mechanisms, such as high-interest bank loans or listing on public markets;

- Certain types of Private Equity Funds such as Venture Capital Funds, also finance plans and initial stage entities;

- In the case of companies or entities that are de-listed, Private Equity Financing can aid such entities or companies attempt unconventional growth strategies away from the shine of public markets.

Disadvantages of Private Equity Funds

- It can be hard to liquidate holdings in Private Equity because, unlike public markets, a ready-made book ordered that matches buyers with sellers are not available. A firm has to commence a search for a buyer to make a sale of its investment or entity.

- Shares pricing for a company in private Equity is determined via negotiations between sellers & buyers and not by market forces, as is usually the case for publicly-listed entities.

- The rights of Private Equity shareholders are usually decided on a case-by-case basis via negotiations instead of a broad governance structure that typically mandates rights for their counterparts in public markets.

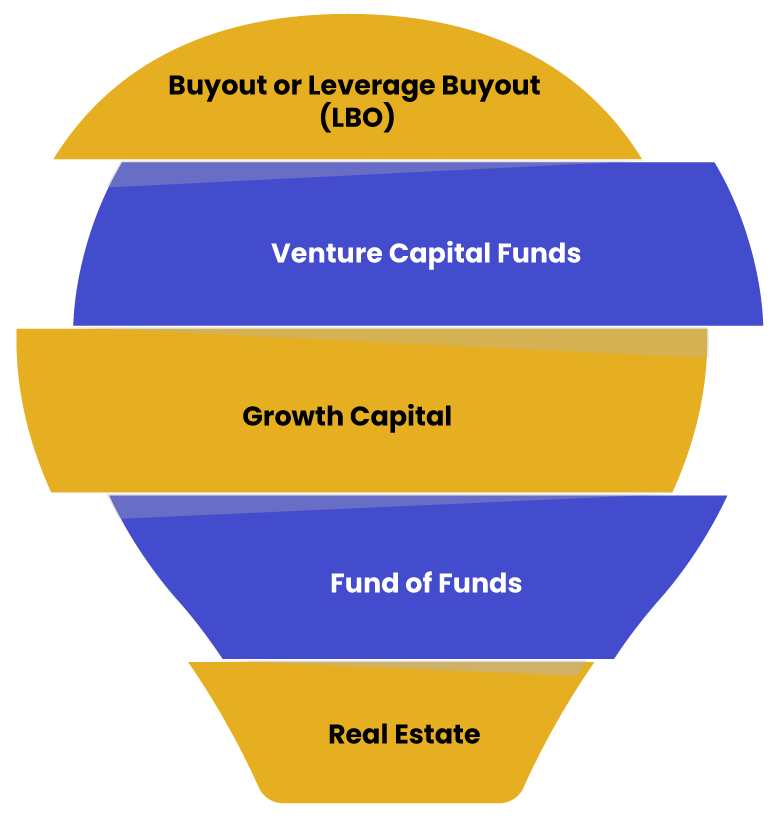

Types of Private Equity Funds

Following are different types of Private Equity Funds:

- Buyout or Leverage Buyout (LBO): It is different in nature from Venture Capital. They usually invest capital; in a bigger business as compared to Venture Capital Funds along with extra leverage to have encouraging returns when invested in an organisation. The capital invested is also vast as compared to Venture Capital. When a company or entity borrows a massive sum of money in the forms of bonds & loans, then leverage buyout takes place to provide its acquisition of another company. To have a favourable return, a person should have a significant stakeholding in a company for a longer time to manage or regulate the funds within a company.

The objective of investment in Leverage Buyout is to have favourable returns on the acquisition of another company which will overshadow the interest paid on the debt. It is a good option when a firm executes LBO to have favourable returns while investing a small amount of account. Private Equity firms usually opt for a leveraged buyout as it enhances a great return on equity and Internal Rate of Return (IRR)[1] if it all goes well as per the plan by putting a small sum of money at risk. There is only one demerit is that as it increases equity returns, at the same time, risk also rises.

2. Venture Capital Funds: It is one of the essential types of Private Equity Funds. Initial stage start-ups and small companies have limited or no financial supply from outside, so the funds which are invested in these entities or companies are called Venture Capital Funds. These initial-stage start-ups are usually in their initial stage of formation but ultimately have a high opportunity of growth potential in the future. The new rising companies with determining values & goals have Venture Capital Funds as an outstanding funding source. It can generate unexpected returns if it is invested in a promising young start-up. In an initial-stage start-up or small entities/companies, Venture Capital plays an essential role in funding the capital. Limited, Corporation, Trust, or another company that accepts assets from investors & invests as per the investment strategy for the advantage of its stakeholders can also be founded as Venture Capital Funds.

3. Growth Capital: In mature entities, which usually have successful business models, then growth capital Private Equity Funds to expand, enter new markets, reorganise their operations or finance a significant acquisition. Growth Capital is usually a small investment as the company in which it invests is basically a vast profit-generating enterprise. Such entities are not able to use their current assets to finance the necessity of growth, so they take advantage of growth capital to fund to enter a new market, obtaining a company or other investments. Growth Capital investors usually choose companies that have low leverage or zero debt at all. The minority investment mainly executes these types of Private Equity Funds’ deals, and usually preferred shares are the form of conduct for the investment.

4. Fund of Funds: It’s an investment plan in which funds are invested in other funds. It is invested in other types of Private Equity Funds instead of directly investing in stocks, securities, or bonds. It benefits the investors as it expands the risk via investing in numerous funds plans wrapped in a single portfolio. There are different types of funds that accordingly work under different investment schemes. Private Equity, Hedge Fund, Mutual Fund, Investment Trust in which the fund of funds can be incorporated.

5. Real Estate: Firms that increase capital to acquire, operate, develop, sell buildings to create returns to their investors are called Private Equity Real Estate Firms. Like Real Estate Private Equity Firms, General Private Equity Firms raise money from limited partners who are insurance companies, university endowments, and pension funds. Real Estate Funds invest money in the proprietorship of Real Estate properties.

Conclusion

After discussing different types of Private Equity Funds, it is clear that the companies which are in their early stage of growth of development Private Equity are an approval for them to increase the capital as they lack money for more expansion. The small entities or initial-phase start-ups and the mature companies are also based on Private Equity for their development & other business deals. Usually, Private Equity Firms invest for five to six years.

Their primary objective is to exit from the company with positive investment returns. When the investors exercise their exit right, they accept a wait & watch approach because they estimate the market recovery before practising their exit right. As it has been observed, business activity is improving increasingly with investment as the economy changes it to the normal.

Read our article:Disclosure in Research Reports Required by SEBI