Key feature of IFSCA (Finance Company) Regulations, 2021

Kandarp Vanita | Updated: Apr 30, 2021 | Category: Other Services

The Government via notification has brought the International Financial Services Centres Authority (Finance Company) Regulations, 2021 where the provisions related to registration, exposure ceiling, capital ratio, permissible activities, Corporate Governance, currency of operations, disclosure requirement and know your customers have been discussed in details. International Financial Services Centres Authority (IFSCA) permitted the inclusion of investment advisory services and portfolio management in the authorised activities for the banking units at IFSCs. In this article, we will read about the key feature of IFSCA (Finance Company) Regulations, 2021.

Table of Contents

What is IFSCA?

The central government has established International Financial Services Centres Authority[1] to regulate and manage all the financial services in International Financial Services Centres (IFSCs) with the headquarters in Gandhinagar (Gujarat). IFSCA is the active nature of business in the IFSCs and IFSCA requires high level of inter-regulatory coordination within the entire financial sector. The IFSCA has been recognized as an integrated regulator with a wide vision with the purpose to offer world class regulatory environment and promote the ease of doing business in the IFSC.

The foremost objective of the IFSCA is to build up a strong global connection and to keep focusing on the necessities of the Indian economy and also to provide as an international financial platform for the global economy as a whole.

What Are the Functions of IFSCA ?

- The authority is responsible to regulate the financial products which include deposits securities, financial services, contracts of insurance, and financial institutions which previously have been approved by the concerned regulators such as the Securities and Exchange Board of India (SEBI), Reserve Bank of India (RBI), etc in an IFSC.

- Any other regulation as notified by the central government will also be regulated UNDER the key feature of IFSCA concerning any other financial services, financial products, or financial institutions in an IFSC.

- The IFSCA may also suggest the central government regarding any other financial services, financial products, or financial institutions, which can be allowed in an IFSC.

What are the services an IFSC can provide?

The key feature of IFSCA provides various services like:

- Fund-raising services for corporations, individuals and governments

- Global portfolio diverseness and management of Asset undertaken by the insurance companies, pension funds and mutual funds

- Wealth management

- Optimization of cross-border tax liability and Global tax management which gives business opportunities for the accountants, financial intermediaries and law firms.

- Regional and Global management of corporate treasury operations that involve liquidity management and investment, fund-raising and asset-liability matching.

- Operations of Risk management such as reinsurance and insurance

- Activities of Merger and acquisition among the trans-national corporations.

What is the requirement of IFSC?

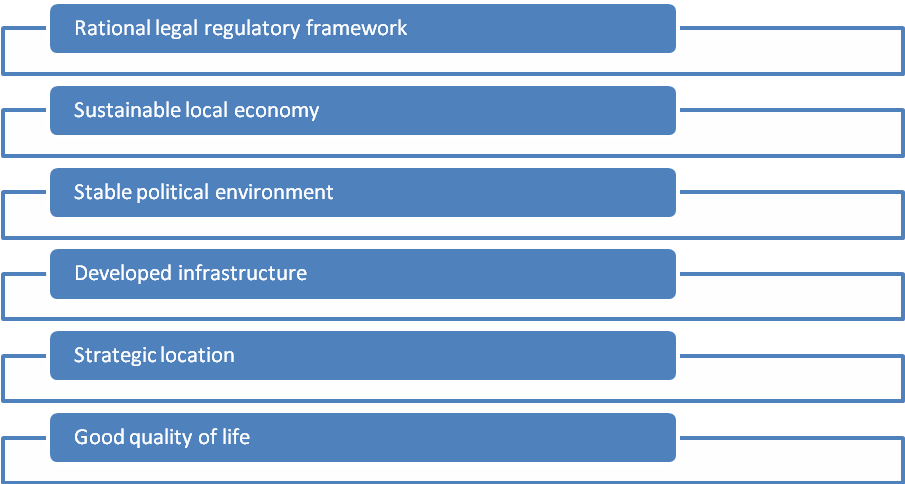

IFSCs like Shanghai International Financial Centre and Dubai International Financial Centre that are located within SEZs, they are having six major building blocks:

The Benefits of IFSCA

The following points are the benefits and key feature of IFSCA :

- Unification under one authority: IFSCA will unify all the banking, insurance sectors, capital markets in IFSC as all are regulated by these multiple regulators – the SEBI,RBI, and IRDAI and now will be integrated under the authority of IFSC.

- The regulatory institution of the single window would now speed up the development of India’s first IFSC at Gandhinagar.

- Both the national and international institutions that deal with the services of international financials shall make use of the platform of IFSC for outbound and inbound investments with enhanced ease of doing business, in this manner making the GIFT IFSC a universal financial hub.

Prudential Regulatory Requirements of IFSCA

- Applicable prudential regulations -The prudential regulations that shall be applicable according to the key feature of IFSCA to the Finance Unit or the Finance Company, shall be such as may be prescribed by the Authority.

- Capital Ratio (CR) – the Financial Company or any Financial Institution in accordance with the regulation shall have to maintain the minimum capital ratio which should be of eight per cent of its capital of regulatory to risk-weighted assets or as may be specified by the Authority regarding such percentage.

- Liquidity Coverage Ratio (LCR) – As may be decided by the Authority it is obligatory on the Financial Company or the financial institution at all times as the case may be, to maintain the liquidity coverage ratio on stand-alone basis. The proviso applies to the Finance Unit, where the parent entity shall maintain the LCR only with the specific approval of the authority.

- Exposure Ceiling (EC) – In accordance with the case the total sum of all the exposures of the Financial Company or any financial institution to any single counterparty or the group of associated counterparties shall not go beyond twenty-five percent of the existing eligible capital base without the authority’s approval.

Explanation: The operational guidelines shall be issued by the Authority with reference to the execution of the requirements as the key feature of IFSCA given under sub-regulations (1) to (4) of regulation.

Few other key feature of IFSCA

- In accordance with the case as permitted by the Authority the key feature of IFSCA includes that the Finance Company or any Financial institution shall carry its function in a freely convertible foreign currency and with such individuals, including resident or non- residents.

- A Finance Company or a Financial institution shall be allowed to have an INR account from the freely convertible foreign currency with the purpose to bear the expenses of their administrative and statutory sector and for such other purposes as prescribed by the Authority.

- Every Financial Company and the financial institution shall mandatorily follow the norms of Know Your Customer, which aims for the purpose of combating of requirements of anti-money laundering and financing of terrorism, including requirements of reporting, as prescribed for the Banking Unit in IFSCs.

Conclusion

Any entity shall start its business as the Financial Company or as a Financial Unit, in the International Financial Services Centres (IFSCs) only after attaining the registration certificate from the Authority for proceeding with the activities prescribed in the Schedule to the regulations. Therefore, these institutions must get itself registered and comply with the key feature of the regulation in order to carry out activities according to IFSCA.