FFMC Compliances: A Guide on Pre & Post Registration Compliances

Shivani Jain | Updated: Jan 18, 2021 | Category: Other Services

In India, the utmost authority to deal with foreign currencies, coins, and forex is only with the Money Changers or the entities who are having Full Fledged Money Changer License as per section 10 of the FEMA 1999. The said license is given by the Apex Bank after the due inquiry and verification. That means in the case of default the same is liable to be forfeited or revoked. However, it is necessary for every license holder to duly comply with FFMC Compliances, else the same will result in the levy of the hefty fines and penalties.

Table of Contents

Concept of Full Fledged Money Changer

The term “Full Fledged Money Changer” signifies a person or an entity that is having a valid FFMC License issued by the authorities. The same is issued to grant permission to deal in forex and currencies.

Further, it shall be relevant to note that RBI and section 10 of FEMA 1999[1] act as the governing force and regulatory law for same respectively.

Different Types of Full Fledged Money Changers

As per the provision of the Foreign Exchange Management Act 1999, the different types of full fledged money changers prevalent in India are as follows:

- Authorised Money Changer Category I Banks;

- Authorised Money Changer Category II;

- Full Fledged Money Changers;

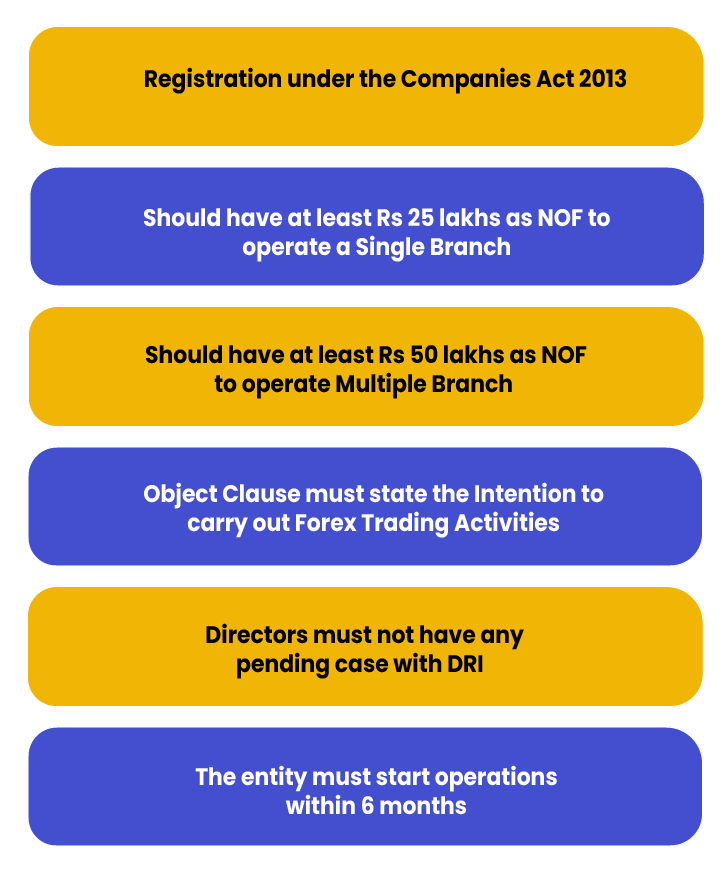

Pre-Registration FFMC Compliances

The pre-registration FFMC Compliances for an entity to obtain FFMC Registration from RBI are as follows:

- Registration under the Companies Act 2013;

- Should have at least Rs 25 lakhs as Net Owned Funds to operate a Single Branch;

- Should have at least Rs 50 lakhs as Net Owned Funds to operate Multiple Branch;

- Object Clause of the MOA must state the Intention to carry out Forex Trading Activities;

- Directors must not have any pending case with DRI (Department of Revenue Intelligence);

- After obtaining FFMC Registration, the entity must start operations within 6 months;

Post Approval Requirements by FFMCs

The post approval requirements by FFMCs are as follows:

- All the directors of the company need to submit the copy of the documents as follows with the Apex Bank:

- Possession Certificate;

- Lease Agreement;

- Shop and Establishment License;

- The directors of the company need to adhere to all the circulars, guidelines, and timely directions issued by the Apex Bank;

- The license holder requires to display a copy of FFMC License at every business place;

- To carry out forex trading in a smooth and hassle free manner, the licensee requirement to implement Concurrent Audit Mechanism;

- Every licensee company requires to submit its Audited Balance Sheet and Financial Statements at the Regional Office of RBI;

FFMC Compliances Concerning Maintenance of Registers

After obtaining the Money Changer License from the Reserve Bank of India, the licensee company needs to abide by the FFMC Compliances concerning the Maintenance of Registers as follows:

|

Form No |

Reasons |

|

FLM- 1 |

For the purpose of summarizing the financial records or particulars concerning foreign currency, notes, coins on a daily basis. |

|

FLM- 2 |

For the purpose of summarizing the records of cheques received by thetravelers. |

|

FLM- 3 |

For the purpose of summarizing the records concerning the purchase of foreign currencies and coins from the general public. |

|

FLM- 4 |

For the purpose of summarizing the records concerning the purchase of foreign currency and coins from the Authorized Money Changers (AMCs). |

|

FLM- 5 |

For the purpose of summarizing the details and particulars concerning the sale of foreign currency, notes/coins or traveler’scheques to the public. |

|

FLM- 6 |

For the purpose of summarizing the records pertaining to the sale of foreign currency notes or coins and traveler’s cheques to the Overseas Banks and Authorized Money Changers. |

|

FLM- 7 |

For the purpose of summarizing the records pertaining to the sale of traveler’s cheques to AMCs (Authorised Money Changers), Authorised Dealer, and Full-Fledged Money Changer License Holders. |

Annual FFMC Compliances for Authorised Money Changers

The Annual FFMC Compliances for Authorised Money Changers are as follows:

- An AMC must ensure the Proper Maintenance of the Registers as prescribed with regard to Travelers’ Cheque, Foreign Currency Logbooks;

- Must makeMonthly Submission of the Statements regarding Trading of Foreign Currency to RBI;

- Must make Monthly Submission of the Receipts, together with the Purchase of the US $10000 or above transaction, both at the Foreign Exchange Department and RBI’s Regional Office;

- The Licensee must submit the Quarterly Statement concerning Foreign Currency Account on a timely basis;

- All the registered AMCs must furnish their Audited Balance Sheet and Financial Statements, together with the Certificate issued by the Statutory Auditor concerning Net Owned Funds on the mentioned Due Date;

- An AMC (Authorised Money Changer) must implement such an Auditing Mechanism which is both robust and transparent;

- All the registered AMCs must submit their Annual Statements at the FED’s (Foreign Exchange Department) Regional Office without any delay;

Conclusion

In a nutshell, to start a business that deals with foreign currencies, coins, and forex, it is mandatory to obtain FFMC Registration from RBI. However, if we talk about the FFMC Compliances, it must be taken into consideration that the same is not that tough and intricate as it seems.

That means the same is easier than obtaining FFMC Registration from RBI. At Swarit Advisors, our experts in the field of RBI and FEMA will not only guide with the mandatory FFMC Compliances but will assist you with the process and way to comply with the above mentioned FFMC Compliances.

Also, Read: FFMC Registration from RBI: A Complete Guide on the Process