All You Need to Know About Money Market Funds in India

Karan Singh | Updated: Aug 31, 2021 | Category: SEBI Advisory

Money Market Funds (MMF) invest in short-term debt instruments, cash & cash equivalent, rated high quality. So, investors with lower risk patience are always on the lookout for investments options that can provide them good returns in the future while maintaining liquidity for their funds. Different debts funds have been designed to keep this remember. Also, the majority of investors tend to compare the returns on their debt fund investments with bank deposits. When it comes to short-term debt investing, Money Market Funds is the best option among such investors. The average maturity of a Money Market Fund is one year. In this write-up, we are going to discuss about Money Market Funds in India.

Table of Contents

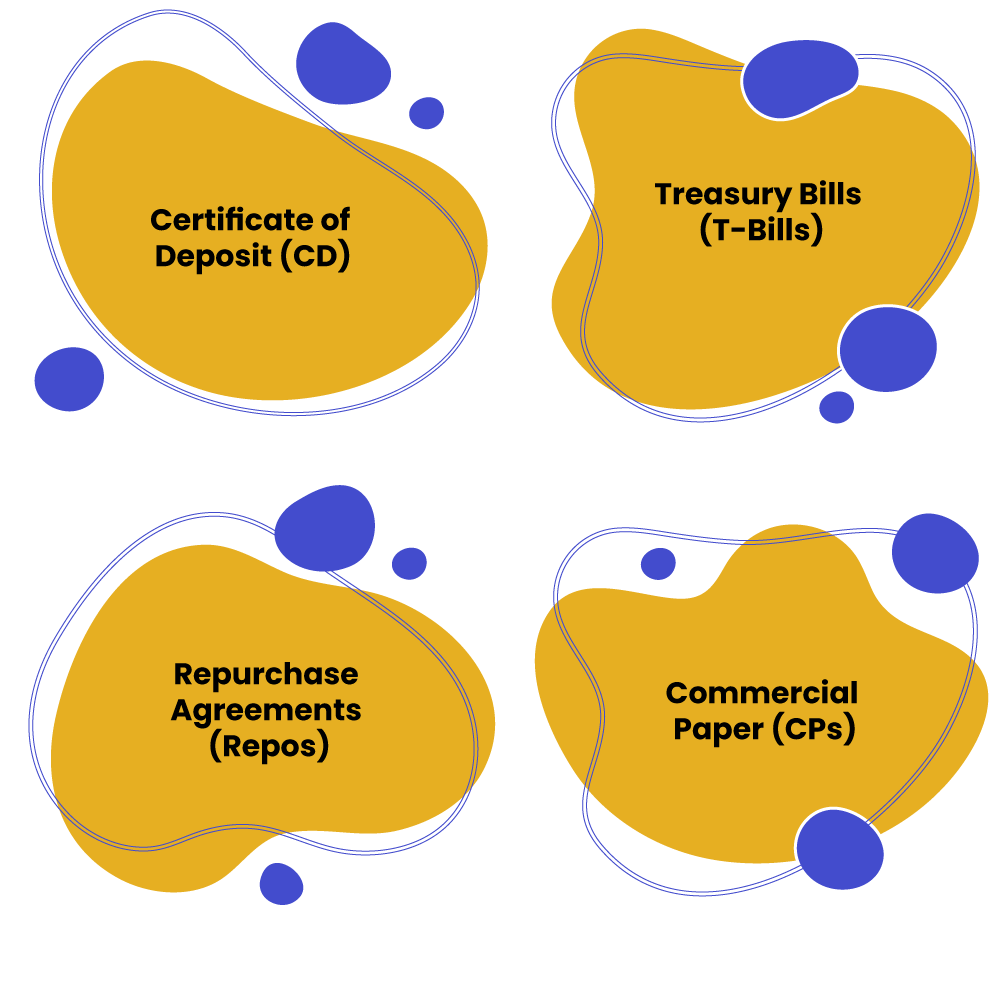

What are the Different Types of Money Market Instruments?

Money Market is an exchange where the deal of cash and cash-equivalent instruments takes place. Following are some vital money market instruments in India:

- Certificate of Deposit (CD): It is a term deposit that is provided by scheduled commercial banks which doesn’t have the option of premature redemption. The main difference between a Certificate of Deposit and FD is that CDs are generously negotiable, and the investors are not authorised to withdraw CD until maturity.

- Treasury Bills (T-Bills): These bills are issued by the Indian Government to raise money for a short period of 365 days. These bills are considered as one of the secured instruments as the government support and monitor these. The return rate, also known as the risk-free rate, is low on Treasury Bills compared to other money market instruments.

- Commercial Paper (CPs): Companies & financial organisations with a high credit score can issue a Commercial Paper (CP), a short-term, unprotected promissory note. CP allows such companies or organisations to expand their short-term borrowing sources. Generally, Commercial Papers are issued at a discounted rate while the redemption is done at face value. The investor earns the difference.

- Repurchase Agreements (Repos): This type of money market instrument is made between a bank and the Reserve Bank of India to provide short-term loans. It can also be made between two banks.

What is the Objective of Money Market Funds for Investors?

- An investor holding a bunch of mutual funds from a single fund company may occasionally want to transfer assets from one fund to another. If the investor desires to sell a fund before deciding on another fund to purchase, a Money Market Mutual Fund provided by a similar fund company may be a wise place to park the sale proceeds. Then, at a suitable time, the investor may exchange their MMF holding for shares of some other funds in the fund family.

- To benefit their customers, brokerage firms regularly use Money Market Mutual Funds to provide the services of Cash Management. Investing a customer’s latent cash into Money Market Mutual Funds will earn the customer an additional percentage point or two in yearly returns more than those earned by other competent investments.

- Money Market Mutual Funds provide a convenient parking place for cash reserves when an investor is not quite ready to invest or is anticipating a near-term cash outlay for a non-investment objective. Money Market Mutual Funds provide protection and liquidity eventually. This means that investors will have an anticipated amount of cash at the very moment that they require it.

How do Money Market Funds work?

These funds invest in money market instruments with the purpose of providing good returns (interest income) and keeping the NAV (Net Asset Value) fluctuations minimal.

Over the last 5 years below are some best Money Market Funds in India based on the performance:

- HDFC Money Market Fund;

- SBI Savings Fund;

- Aditya Birla Sun Life Money Manager Fund;

- Edelweiss Dynamic Bond Fund;

- Franklin India Savings Fund.

It is essential to make sure that you follow your investment plan before start investing and the above is not a suggestion but a list of well-performing Money Market Funds in India.

Who Can Invest in Money Market Funds?

An MMF tries to provide the highest short-term income by maintaining a well-diversified portfolio of money market instruments. Investors having a short investment prospect of up to one year may invest in these funds. Those individuals with a low-risk appetite having their additional cash collected in a saving account can invest in Money Market Funds. These funds have the capability to provide higher returns than a regular savings bank account. The investors could be corporate and retail investors.

In case you have a medium-term to long-term investment horizon, then MMF is not a perfect option. Instead, you may go for active bond funds or balanced funds, which are competent in offering comparatively higher returns.

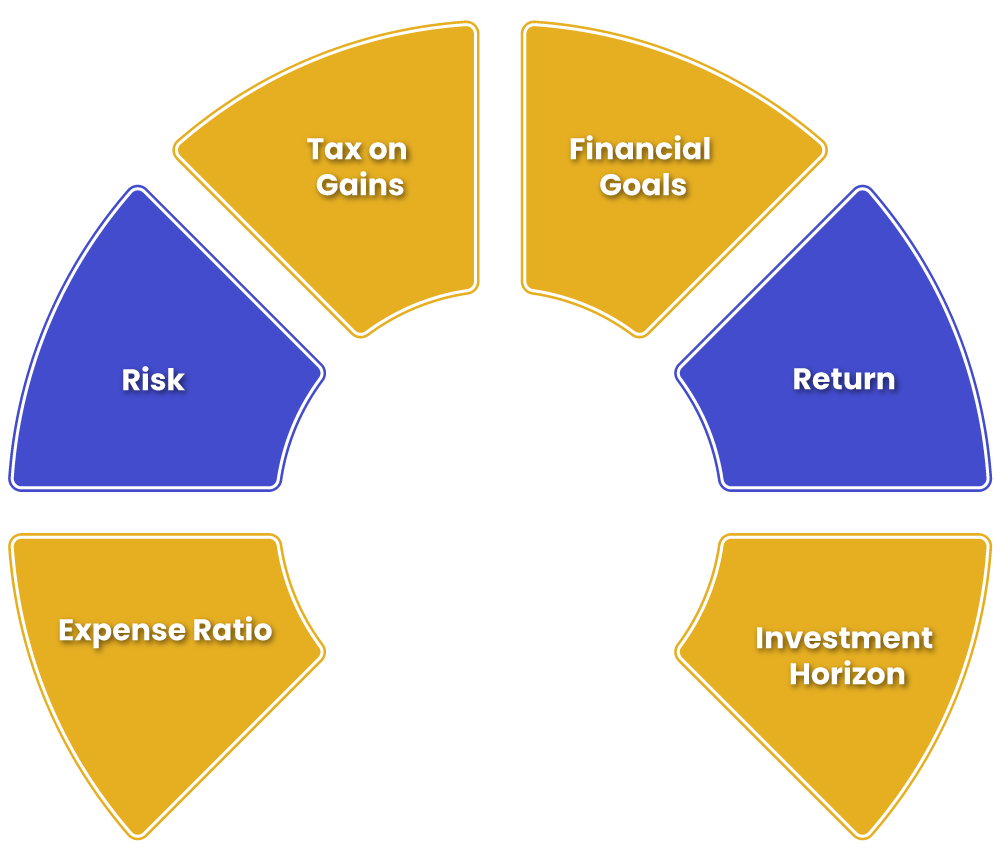

Important Points to Remember Before Investing in Money Market Funds in India

Following are some crucial points to remember before investing in Money Market Funds in India:

- Expense Ratio: It is a tiny percentage (%) of the total assets of the fund charged by the fund house towards Fund Management Services. Since the returns are not good, then the Expense Ration plays a vital role in determining your earnings from an MMF. Preferably, you must look for funds with a lesser Expense Ratio to increase your returns.

- Risk: These funds face credit risk, interest rate risk & reinvestment risk. In the interest rate risk, the prices of the underlying asset increase as interest rates decline and decrease as interest rates increase. The fund manager may invest in unsafe securities which have a higher probability of default.

- Tax on Gains: Investing in debt funds offers you with taxable capital gains. The rate on tax depends on the holding period, that is, for how long you stayed invested in the fund. You make an STCG (Short-Term Captain Gain) when you stay invested for the time of less than 3 years.

Long-Term Capital Gains (LTCGs) are made when you stay invested for more than 3 years. Short-Term Captain Gain from MMFs are added to your income and taxed as per your income slab. Long-Term Captain Gain from MMFs is taxed at the rate of 20% after indexation.

- Financial Goals: In case if you have to make payments in EMI or invest additional cash while maintaining liquidity, then you can use MMFs. A small amount of your portfolio can be invested in these for diversification.

- Return: MMFs have the capability to provide higher returns than a regular savings bank account. But, the returns are not assured. The NAV (Net Asset Value)[1] alters with changes in the overall interest rate rule. A decrease in interest rates may raise the prices of a fundamental asset and deliver good returns.

- Investment Horizon: MMFS are valid for very short-term to long-term investment horizons, i.e., 3 months to 1 year. For medium-term horizons, you may invest in other debt funds such as Dynamic Bond Funds.

What are the Taxation Rules in the case of Money Market Funds?

Capital Gains Tax

If you hold the scheme units for time up to 3 years, then the capital gains earned by you are called Short-Term Capital Gains (STCG). STCG is added to your taxable income and taxed according to the applicable income tax slab. If you hold the scheme units for more than 3 years, then the Capital Gains earned by you are called Long-Term Capital Gains (LTCG), and it is taxed at 20% with indexation advantages.

Conclusion

Like equity & fixed-income mutual funds have deeply simplified the world of investing, Money Market Funds have made money market investing more accessible to separate retail investors. These funds are among the safest & most liquid available financial instruments. Furthermore, Money Market Funds provide reserved early investment necessities and provide simple procedures for withdrawing funds by transferring to a bank.

Read our article:How Can You File An Offer Document with SEBI?