Process for Right Issue: A Simplified Guide

Shivani Jain | Updated: Mar 04, 2021 | Category: Rights Issue, SEBI Advisory

Any company that wishes to offer shares to its existing shareholders or members in proportion to their shareholdings needs to undergo the process for Rights Issue. It is one of the easiest and the flexible modes of raising the subscribed capital, that, too, with less documentation and compliance requirements. Also, it shall be noted that there is no need to involve any bank and financial institution in the procedure for the right issue.

In this learning blog, we will cover the concept, requirements, and process for Right Issue in India.

Table of Contents

Concept of Right Issue

The term Right Issues denotes a pre-emptive right given to the existing shareholders to subscribe to the new shares of the company. That means it works as a formal invitation to the existing shareholders. Further, it shall be noted that the provisions of section 62 of the Companies Act 2013 regulates the requirements and process of the right issue in India.

Also, Read: Accounting for Right and Bonus Issue

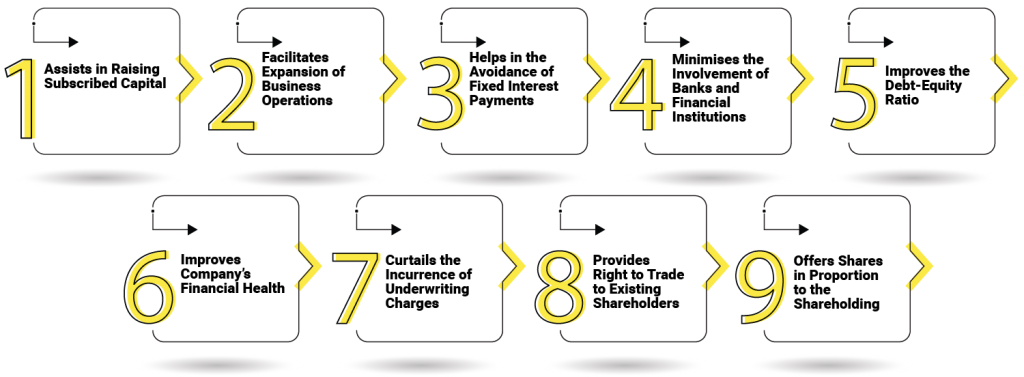

Benefits of the Process for Right Issue

The key benefits of the Process for Right Issue are as follows:

- Assists in Raising Subscribed Capital;

- Facilitates Expansion of Business Operations;

- Helps in the Avoidance of Fixed Interest Payments;

- Minimises the Involvement of Banks and Financial Institutions;

- Improves the Debt-Equity Ratio;

- Improves Company’s Financial Health;

- Curtails the Incurrence of Underwriting Charges;

- Provides Right to Trade to Existing Shareholders;

- Offers Shares in Proportion to the Shareholding;

Minimum Requirements for the Process for Right Issue in India

The minimum requirements for the process for Right Issue in India are as follows:

- It is obligatory for every unlisted company to get their securities and shares converted into the dematerialised form prior to the offer of the right issue;

- All the Promoters, Key Managerial Personnel, and Directors need to hold their securities based on the provisions of the Depositories Act 1996;

- Any shareholder who wishes to subscribe to the shares offered needs to get their existing securities converted into dematerialised form as well;

- Every company that proposes to issue the Right Shares need to check the availability of authorised capital as well. If in case, the said company does not have enough amount as Authorised Capital, then, in that case, the company requires to alter its Capital Clause;

- It shall be noted that only the existing shareholders are eligible to get the Right Shares in India;

- Every company that wants to issue the right shares needs to check the authorisation from the Articles of Association. If in case not allowed, then, in that case, the company needs to alter its AOA or Articles of Association accordingly;

Who can apply for the Right Issue in India?

Based on the provisions of section 62, the ones eligible to apply for Right Issue in India are as follows:

Employees

Under the scheme of the Employee Stock Option Plan (ESOP), a company can issue the right shares to its employees. However, the same is possible only after passing the Special Resolution and adhering to the conditions specified.

Existing Shareholders

A company can offer the right shares to its existing members or shareholders in proportion to their shareholdings. The same can be done by sending a letter of offer to the shareholder. However, it shall be noted that a company required to fulfil the conditions as follows for issuing rights shares:

- A company requires to send a letter of offer (LOO) to the existing shareholders;

- The LOA sent must specify the number of shares offered under the process for Right Issue;

- All the shareholders need to accept the offer sent in a minimum of fifteen days and a maximum of thirty days;

- The offer stands declined if the shareholders do not accept the same in the given time;

- Also, it shall be noted that a letter of offer includes the right to renounce to another person as well;

- After the expiry of the period prescribed or on the receipt of rejection from the shareholders, the Board of Directors can dispose of the shares offered in the manner advantageous for the company and shareholders;

Any other person

A company can offer the right shares to any other person as well by passing a Special Resolution (SR). The same can either be issued in the form of cash or for any consideration other than cash. However, it shall be noted that the registered valuer calculates the price of such shares by preparing a valuation report subject to prescribed conditions.

Steps involved in the Process for Right Issue in India

The steps involved in the process for Right Issue in India are as follows:

Prepare a list of Shareholders

In the first step, the directors require to prepare a list of the shareholders existing, together with the particulars of the shares held by them. The same is required to determine the total number of shares received by the shareholders.

Prepare Necessary Documents

The directors require to draft and prepare the necessary documents as follows:

- Share Application Form;

- Letter of Renunciation (LOR);

- Letter of Offer (LOO) for the right issue;

Send Notice for Board Meeting

Further, a notice concerning the Board Meeting needs to be sent at least seven days prior to the date of the meeting. Also, the notice sent must be in a manner prescribed under the provisions of section 173 (3) of the Companies Act and clause 1 of the Secretarial Standard – 1.

Hold a Board Meeting

Now, in the Board Meeting (BM) held, the directors require to discuss and pass the resolution on the following agendas:

- Approval of the Letter of Offer (LOO);

- Approval of the Share Application Form;

- Approval of the Right Issue;

- To decide the proportion for the right offer;

- To decide the issue price of shares;

- To fix a record date for the offer;

- To authorise Company Secretary or Directors to sign the document;

Prepare Minutes of the Meeting Held

Now, in the next step of the process for Right Issue, the Company Secretary needs to prepare the minutes of the Board Meeting held. Also, he/ she requires to circulate the same to the directors within a period of fifteen days, beginning from the date of the conclusion of the meeting.

Further, the company needs to send minutes by either of the methods as follows:

- Hand Delivery;

- Registered Post;

- Speed Post;

- Courier;

- E-mail;

- Any other recognised means;

Furnish Form MGT – 14

After passing the BR (Board Resolution), the directors of the company need to file MCF Form MGT – 14 with the Registrar of Companies within a period of thirty days.

However, it shall be noted that a public limited company is exempt from filing the board resolution pertaining to the right issue.

Dispatch Letter of Offer

In this step, the directors need to dispatch a letter of offer (LOO) to all the existing shareholders by way of a registered post/ courier/ speed post/ hand delivery or e-mail, etc., at least three days prior to the opening of the right issue.

Further, the letter of offer sent must specify the number of shares offered. Also, the same needs to be kept open for a minimum period of fifteen and a maximum period of thirty days.

However, it shall be noted that in the case of private limited companies, a period not less than three days is valid as well if 90% of the shareholders or members have given their consent for the same.

Convene a Board Meeting

In the next step of the process for Right Issue, the directors require to hold a board meeting after getting the following listed from the holders:

- Acceptance/ Rejection/ or Renunciation of the right;

- Share Application Money;

The company needs to dispatch the notice for the board meeting at least seven days prior to the date of the meeting.

Allot Shares within 60 Days

Now, in the next step of the process for Right Issue, the company will require to allot the shares within a period of sixty days, starting from the date of receipt of the share application money.

Further, if in case the company was unable to allot the shares, then, in that case, it requires to refund all the application money received within a period of fifteen days, starting from the completion of sixty days.

However, it shall be noted that if in case the company fails to refund the amount received, it will be held liable to pay interest at a rate of 12% from the expiry of the 60th day.

Prepare a Complete List of Shareholders

Further, in the process for Right Issue, the directors need to make a complete list of shareholders, together with the details as follows:

- Name of the Renouncing Shareholders;

- Name of the Declining Shareholders;

- Name of the Shareholder, who have subscribed more than the shares offered;

Call a Board Meeting

After that, the directors of the issuer company need to call a board meeting within a period of sixty days from the date of receipt of application money. The reason behind the same is to discuss and pass resolutions on the issues as follows:

- Allotment of Shares to the applicants who have applied for shares;

- Approval for the issuance of Share Certificates;

- Approval for making relevant entries in the Register of Members;

Prepare Minutes of Meeting Held

In the next step of the process for Right Issue, the Company Secretary (CS) prepares the minutes of the Board Meeting held and circulates the same to all the directors within a period of fifteen days, commencing from the date of conclusion of the meeting.

Further, the different ways of sending the minutes of the meeting are as follows:

- Speed Post;

- Hand Delivery;

- Courier;

- Registered Post;

- E-mail;

- Any other recognised means;

Make a list of Allottees

Now, to proceed further in the process for Right Issue, the directors of the company require to make a complete list of the Allottees and will file it with the ROC.

Furnish MCA Form PAS 3

The directors require to furnish the Return of Allotment in MCA Form PAS 3, together with all the necessary attachments to the ROC (Registrar of Companies). The same must be done within a period of thirty days from the date of allotment of shares.

Make required Alterations in the Register

In the last step for the process for Right Issue, the company requires to make necessary entries in the Register of Members within a period of seven days of passing of the BR for the allotment of shares.

Conclusion

In a nutshell, Right Issue is a formal invitation to the existing shareholders to subscribe to the new shares of the company in proportion to their shareholding. Further, it is one of the easiest and flexible modes of raising subscribed capital and involves fewer documentation and compliance requirements. However, to undergo the process for Right Issue in India, the company needs to comply with the requirements and steps mentioned above.

Also, Read: Step by Step Procedure for Rights Issue of Shares