Procedure for Prepaid Wallet License in India

Japsanjam Kaur Wadhera | Updated: Feb 20, 2021 | Category: Prepaid Wallet, RBI Advisory

Since after the demonetisation, the Reserve Bank of India (RBI) has prioritized and given special importance on the use of digital transfer of money for any cash purpose. To ease in transferring money and being proficient in the use of modern technology, the Reserve Bank of India has taken many initiatives and steps to make fast payments, and therefore, the payment wallet license or prepaid wallet license was introduced. This article will discuss about the procedure for prepaid wallet license in India.

Table of Contents

Understanding Prepaid Wallet

Prepaid wallets are financial instruments through which money is transferred in the digital form. The Reserve Bank of India authorizes in granting licenses for prepaid wallet and is responsible for issuing guidelines and rules for it. The prepaid wallet instruments facilitates the purchase of goods or services against the stored value on such instruments such as mobile wallets, internet accounts, mobile accounts, smart cards, paper voucher and etc. the value stored on such instruments means the value paid for by the holders either by debit or cash to a bank account or by credit card.

Also, Read: How to Start a Mobile Wallet Business in India?

Instruments of Prepaid wallet

- Internet accounts

- Mobile accounts

- Internet wallets

- Mobile wallets

- Smart cards

- Paper vouchers

- Magnetic stripe cards

- Any other instrument which may be used to access prepaid amount

Before using these prepaid instruments, an entity is required to obtain the prepaid wallet license from the RBI. The RBI issues guidelines and make rules at regular periods for the use of prepaid wallet license. All the entities who have obtained the prepaid wallet license must abide with these rules.

What are the Types of Prepaid Wallet in India?

The types of prepaid wallet in India are as follows:

Closed System Payment

The closed system wallet is a form of wallet that is offered by the company/ business establishments to its customers that can be used only for the purpose of purchasing on the online platform that the company / business establishment usually operates on. The withdrawal of cash or cash redemption is not permitted from these apps. For example, Ola, Myntra etc

Advantages:

- The customer receives cash back and refunds.

- The customer can easily purchase goods and services.

Disadvantages:

- The redemption and cash withdrawal is not permitted from the wallet.

- Since this instrument is closes, the balance in the wallet can only be used for the purpose of purchasing on the same platform and nowhere else.

Semi-Closed Payment

The semi- closed payment is a form of wallet that is used to purchase goods or services and acts as a payment instrument but does not permit redemption or cash withdrawal. Since, these instruments do not facilitate payments or settlements for third party services, the operations and issues of such instruments are not classified as payment systems. For example, Paytm wallet, Mobikwik etc.

Advantages:

- It is used for purchasing goods from affiliated merchants.

- Money transfer among holders of wallets.

- Can be used to purchase from wallet.

Disadvantages:

- Withdrawal of money is not possible in this type of wallet.

Open System Wallet

The open system wallet is a form of wallet that covers all the disadvantages of the closed and semi- closed system. Such form of wallet can be used to buy goods or services and also allows withdrawing cash at an ATM. For example, Master Card, Visa Card, Rupay Card etc.

Advantages:

- Such form of wallet can be used to withdraw cash.

- Is used to purchase goods or services by swiping a card.

- Is used at the PoS machine to make payments.

- It is used for internet and mobile banking.

What is the Eligibility Criterion to Issue Prepaid Wallet License in India?

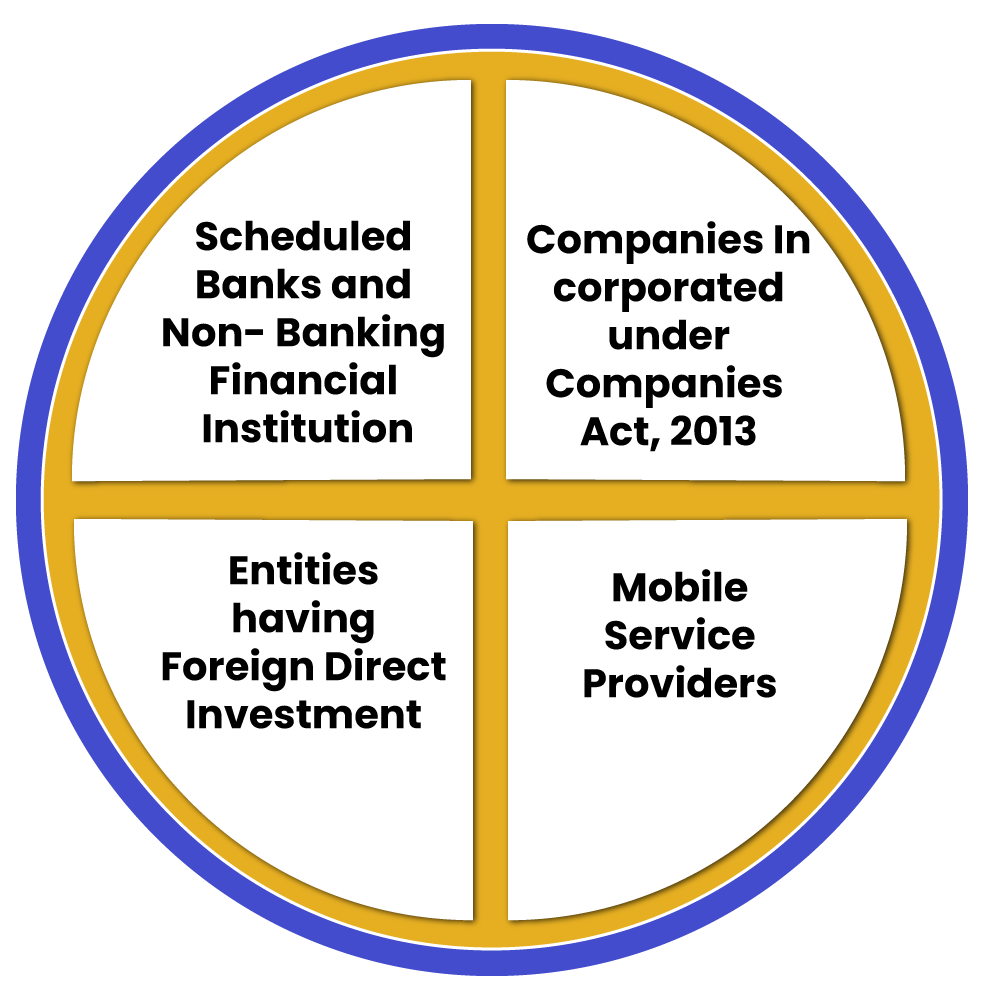

Scheduled Banks and Non- Banking Financial Institution

Those banks which are granted permission from the Reserve Bank of India (RBI) to provide mobile banking transactions shall be allowed to launch mobile based prepaid wallet instruments.

Companies Incorporated under Companies Act, 2013

Such companies that are incorporated under the Companies Act, 2013 can issue a prepaid wallet only is allowed as per the object clause of the Memorandum of Association (MOA).

Entities having Foreign Direct Investment

Those entities having a minimum capital in accordance with the Foreign Direct Investment policy guidelines of Government of India are eligible to issue prepaid wallet license.

Mobile Service Providers

The mobile service providers are allowed to issue mobile prepaid value. Such value can be used to purchase talk time and shall be restricted only to the purchase of value added services or digital contents which are used in mobile phones. The buying of other goods or services will not be allowed by using such prepaid value.

Capital Requirements for Entities which are eligible to Issue Prepaid Wallet License

Companies

Those entities registered under the Companies act, 2013 having primary objective of financial business looking for prepaid wallet authorization should have a minimum net worth of Rs. 5 crore.

Banks and Non-Banking financial Companies

Those entities that meet the capital adequacy requirements prescribed by the RBI shall be allowed to issue prepaid wallet instrument. Such requirements are needed to be fulfilled from time to time.

FBI Entities

Those entities which are governed by the Foreign Exchange Management Act (FEMA) who are authorized to issue foreign exchange, prepaid wallets are exempted from the influence of these guidelines. The use of payment wallets shall be permitted and limited to the current account transactions only and must be in accordance to the restrictions and limits prescribed under the Foreign Exchange Management (Current Account Transactions) Rules, 2000 as amended from time to time.

Procedure to obtain Prepaid Wallet License

- Step 1: Formation of company in accordance with the Companies Act, 2013 by applying to the registrar of companies.

- Step 2: Application is required to be filed for approval in Form A in accordance with the regulation 3(2) of the Payment and Settlement Systems Regulations, 2008 along with the prescribed fee to the Reserve Bank of India for grant of the prepaid wallet license.

- Step 3: The RBI will perform a basic screening process to ensure the prima facie eligibility of the applicant.

- Step 4: Once the eligibility criteria and other conditions are fulfilled, the Reserve Bank of India shall issue an “in- principle” approval. The validity of the approval shall be 6 months from the date of granting such approval.

- Step 5: The company is required to submit a satisfactory system audit report to the Reserve Bank of India within the 6 months failing of which the “in- principle” approval granted by the Reserve Bank of India will eventually lapse and the company can appeal for an extension of the 6 months in advance in writing, specifying the valid reasons.

- Step 6: After considering all the particulars that were furnished, the entities shall be granted final approval. The company shall commence business within the 6 months from the grant of the Authorization Certificate.

Documents required for Prepaid Wallet License

- Proof of registered office

- Incorporation certificate

- Status of the applicant

- The company’s detailed report regarding its principle business

- Details regarding the management of the company

- Latest audit balance sheet

- Statutory audit report

- Payment system details with technology, interoperability, process flow and security features

- Name, address and details of the bankers of the company

- Proposed capital amount

- Benefits expected to the Indian Financial system from the company

- Funding sources

- Any other information that is required by the Reserve Bank of India

Conclusion

There are many advantages of the prepaid wallets as it has become the new way of money transfer for any purposes of the customers. Such wallets ease the transaction process while buying any goods or services and are available 24* 7 for the people. The procedure for prepaid wallet license in India is discussed above in the article and once the prepaid wallet license is obtained by the entities there are no extra charges for the activation and utilization of such wallets.

Also, Read: How to Start a Prepaid Wallet License Business in India?