Process of NBFC Merger as per Companies Act 2013

Karan Singh | Updated: Sep 09, 2021 | Category: NBFC

NBFCs or Non-Banking Financial Companies are financial companies that provide all the financial-related services. NBFCs are registered under the Companies Act 2013. Non-Banking Financial Companies also provide asset financing support, loans for working capital and also give credit facilities & provide investment in different properties that are beneficial in trading money market instruments. It is compulsory to get NBFC Registration Certificate from RBI (Reserve Bank of India) because, without the certificate, no NBFC can do business in India. It must be registered or incorporated under the Companies Act 1956 or 2013 and must have a NOF of not less than Rs. 20 million for a systematically important one. Whereas for Non-deposit taking Non-Banking Financial Companies who don’t accept/hold public deposit RBI consents a NOF of 5 Billion or more as per their current audited balance sheet. In this blog, we will discuss the process of NBFC Merger as per the Companies Act, 2013.

Table of Contents

What is NBFC?

Before we discuss the process of NBFC Merger, let first understand the meaning of NBFC. An NBFC or Non-Banking Financial Company is a finance-related company registered under the Companies Act 1956 or 2013 involved in the business of loans & advances, Acquisition of shares/bonds/debentures/stocks/securities issued by the local authorities or Government or other marketable securities of a like nature, hire-purchase, chit business, leasing, etc. but doesn’t comprise any institution whose principal business is that of agriculture activity, industrial activity, sale/purchase of any gods other than securities or offering any services and purchase/construction/sale of immovable property.

What is NBFC Merger?

A merger means the combination of two companies that form into a new company. A merger is a part of a corporate strategy wherein two companies or two Non-Banking Financial Companies merge and create a new one to boost both organisations’ financial & operational strength. The acquiring company can make the most of equity shares of target companies, or the other acquired company may surrender the majority of shares to the acquiring company. According to the RBI (Reserve Bank of India), only the Non-Banking Financial Companies can undertake NBFC Takeover, which has got registered under the Companies Act, 2013.

Different Types of Merger

- Vertical Merger: It’s a merger between companies that operate along the same supply chain. This type of merger is the combination of companies along with the distribution & production process of a business. The grounds behind this merger comprise a better flow of information along with supply chain, higher quality control, and merger synergies. A significant vertical merger occurred between Time Warner and America Online in 2000. The merger was deemed a vertical merger due to the different operations of each company in the supply chain.

- Horizontal Merger: It is a merger between companies that directly battle against each other. These mergers are done to gain market power, i.e., market share, further use economies of scale, and exploit merger synergies. One of the famous examples of this merger was that between Compaq and HP in 2011. The successful merger between these two entities or companies created a worldwide technology leader valued at over 87 billion US dollars.

- Market-Extension Merger: It’s a merger between companies that sell similar products or services, but that run in various markets. This merger aims to gain access to a huge market and hence an enormous customer base. For instance, the merger of RBC Centura with Eagle Bancshares Inc. in 2002 was a market-extension merger that aided RBC with its growing operations in the North American market. Eagle Bancshares owned Tucker Federal Bank, one of the leading banks in Atlanta, with more than 250 workers and 1.1 billion dollars in assets.

- Product-Extension Mergers: This is a merger between companies that sell related goods or services and that run in a similar market. By employing a product-extension merger, the merged company is capable of grouping their products together & gaining access to more clients. It is vital to note that the goods and services of both entities are not identical, but they are related. The point is that they use the same distribution channels & common/related production processions or supply chains. For instance, the merger between Broadcom and Mobilink Telecom Inc. is a product-extension merger. Two companies operate in the electronic sector, and the resulting merger permitted the companies to merge technologies. The merger enabled the combination of 2G and 2.5G technologies of Mobilink with Broadcom’s 802.11, Bluetooth, and DSP products. Hence, two companies or entities are able to sell products or goods that balance each other.

- Conglomerate Merger: This is a merger between companies or entities that are totally unrelated. There are two different types of Conglomerate Merger:

- Pure Conglomerate Merger: It involves companies that are completely unrelated and that operate in different markets.

- Mixed Conglomerate Merger: It involves companies that are looking to increase product lines/target markets.

The most significant risk in this merger is the immediate shift in business operations resulting from the merger, as the two entities or companies operate in totally different markets and provide unrelated goods or services. For instance, the merger between ABC (American Broadcasting Company) and The Walt Disney Company was a Conglomerate Merger. ABC is a US commercial broadcast television network (News & Media Company), while Walt Disney Company is an entertainment industry.

Pros and Cons of NBFC Merger

Following are some pros and cons of NBFC Merger in India:

Pros:

- It aids in providing economies of scale, helps in the development and competes with Government and Multi-National Banks so that they can later apply for Bank Licenses.

- NBFC Merger helps to avoid the time & cost as may be required to commence NBFC on its own.

- They also provide tax benefits.

- They help in giving enough fuel to compete with conventional banks; they help in increasing the market share, expanding the goodwill & decreasing their NPA (Non-Performing Assets).

Cons:

- There are functional changes due to the immense scale of NBFC businesses.

- They may create trouble among employees because of a merger in the organisation; there is always an operation risk, and management problems cannot be ignored.

Things to Know Before NBFC Merger as per Companies Act 2013

Following are some important points to remember before the process of NBFC Merger:

- A takeover of NBFC is an essential way of increasing business. It is great to obtain through for those entities who fail to register Non-Banking Financial Companies; however, precaution requires to be exercised before starting takeovers.

- Due Diligence is essential to conduct comprehensive research into the background of target entities.

- Before purchasing a company, it is necessary to check by making a proper checklist of different factors, which requires a detailed examination for more alignment with the significant goals for this Takeover and consider whether this new target company will aid in pleasing those objectives.

- It is crucial to estimate the financial position of the company which getting firm wishes to acquire and needs to cautiously assess and evaluate the maximum amount of payment which would be essential for Takeover as per the cash flows & confirm the perfect payment mode as the company will decline the offer below market value, so it is better to estimate the correct pricing before providing the deal.

Process of NBFC Merger as per Companies Act 2013

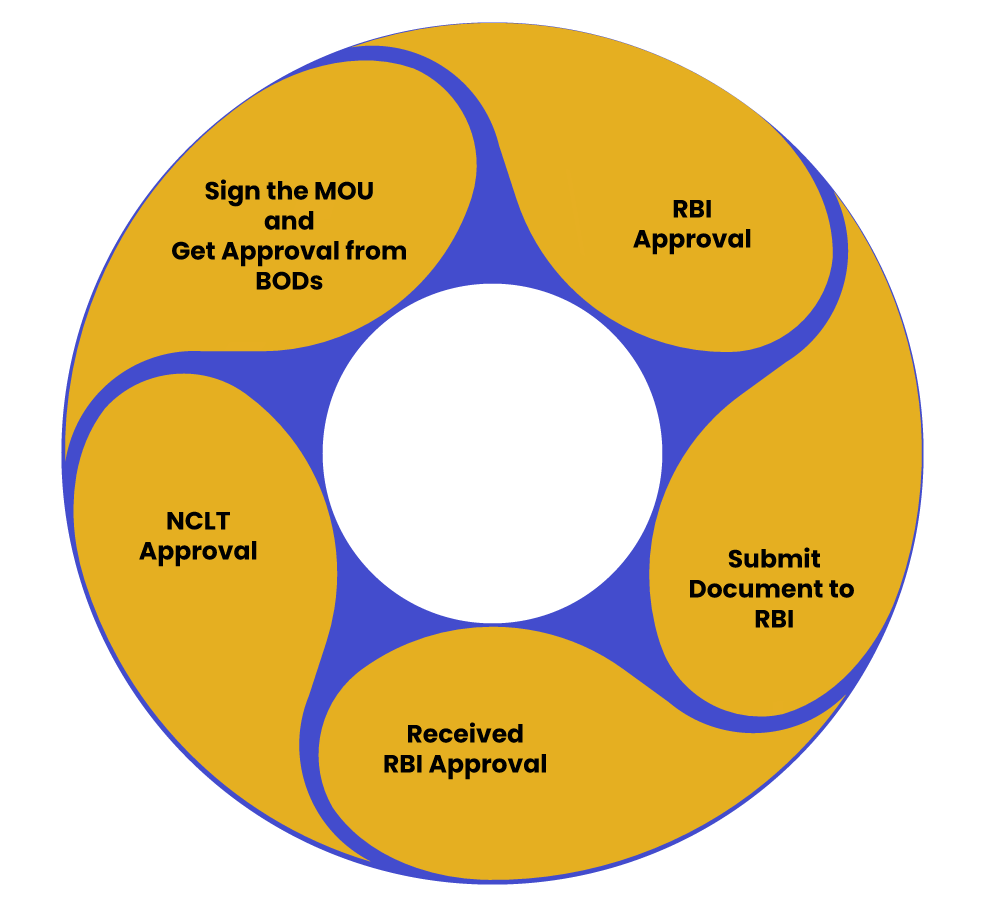

Following is the process of NBFC Merger as per Companies Act 2013;

- Sign the MOU and Get Approval from BODs

- The NBFC Merger process is activated when both companies sign the MOU (Memorandum of Understanding). It describes that both companies are ready for the agreement of Takeover. The directors of the Target Company and Acquiring Company come together & sign them. The MOU contains the needs & responsibilities of all companies, and when the MOU get approved, the Acquiring Company pays the amount of token to the Target Company so as to confirm the transaction.

- Approval from the bank for the merger is taken.

- Prepare all documents of directors in companies for KYC.

- Prepare the business plan.

- RBI Approval

- A company needs approval from RBI[1] if there is a change in management after the Acquisition. For example, if there is any discrepancy in the shareholding of a Non-Banking Financial Company that turns more than 26% (after the Acquisition) of the paid-up equity capital.

- If the Takeover of NBFC tends to alter the management of around 30% of the number of directors.

- Approval of RBI is not required if the shareholding change is due to some buyback offer or directors’ rotation.

- Submit Document to RBI

- Details of the proposed directors or shareholders.

- Details about the sources of funds.

- Report of bankers for directors or shareholders.

- An affidavit and declaration of non-criminal background.

- Financial record of last three years.

- Received RBI Approval

- Conduct a board meeting to discuss matters concerning public notice, date, time of EGM.

- Publish a public notice in two languages (English is compulsory) after thirty days of RBI approval & invite any objection to the proposed arrangement. The following need should be completed before Takeover:

- Get NOC or No-Objection Certificate from creditors.

- Comes into a formal agreement for the purchase share or management transfer or transfer of shares or such interest for the Takeover of NBFC.

- Notice to the regional office of RBI.

- Company valuation as per rules prescribed by the Reserve Bank of India.

- Transfer of Assets; they are in compliance with signed agreements.

- After 30 days or a month of the signing of the formal agreement, publish a 2nd public notice in two languages; the notice should capture:

- Intention to transfer/sell ownership or control;

- All vital particulars of the transferee;

- Reasons for NBFC Takeover Agreements/the transfer of ownership or control.

- NCLT Approval: File an application to NCLT under Section 230-233 of the Companies Act 2013 looking for consent for a scheme of Merger or Amalgamation. Following are some documents that should be submitted to NCLT for consent:

- Application with NCLT for conducting the general meeting.

- Tribunal will give an order to conduct a meeting of shareholders.

- Meetings of shareholders will be conducted by the company for approval of the merger.

- Submit a certified copy of the current audited balance sheet and P&L statement.

- SEBI approval, in case of a listed company.

- Prepare the merger scheme with a descriptive statement.

- Creditor list with their outstanding dues.

- Authorised liquidator report.

- Get a report of valuation.

- Information of statutory proceedings by or against the company.

NCLT may look for the following observations in the application:

- They can ask questions on the material statements of the bank latest financial position auditor report and any such observation.

- The creditor/member or any class of them are fairly shown by those who attended the meeting.

- The scheme should be in the public interest if possible.

- The scheme is in the company’s interest and its members & creditors.

Conclusion

Takeovers and Mergers are on the growth and are a vital source of increase the development in an exponential way. It has become one of the crucial sources of business enlargement in a short time. NBFC Takeover proves to be a hope for all those entities who fail to register an NBFC of their own.

Read our article:How can NBFCs utilize Voice AI to formulate Differentiated Customer Experiences?