Key Highlights of Atma Nirbhar Bharat Package 3.0

Shivani Jain | Updated: Nov 18, 2020 | Category: Business, News

“Diwali” the festival of lights brings new hopes and joys among everyone and thus “Dhanteras” kick starts the celebratory festivities. However, this year has been a bane for Indian Economy, as it has suffered a lot due to COVID- 19 pandemic. As a result, our Union Minister, Mrs Nirmala Sitharaman, has come up with the much required Financial Stimulus Package, known as Atma Nirbhar Bharat Package 3.0 on 12.11.2020.

Earlier, the government had provided a similar stimulus package in the form of Atma Nirbhar Bharat 1.0 and Atma Nirbhar Bharat 2.0 to review the financial health and condition of the industry.

In this blog, we will discuss the key highlights of Atma Nirbhar Bharat Package 3.0.

Table of Contents

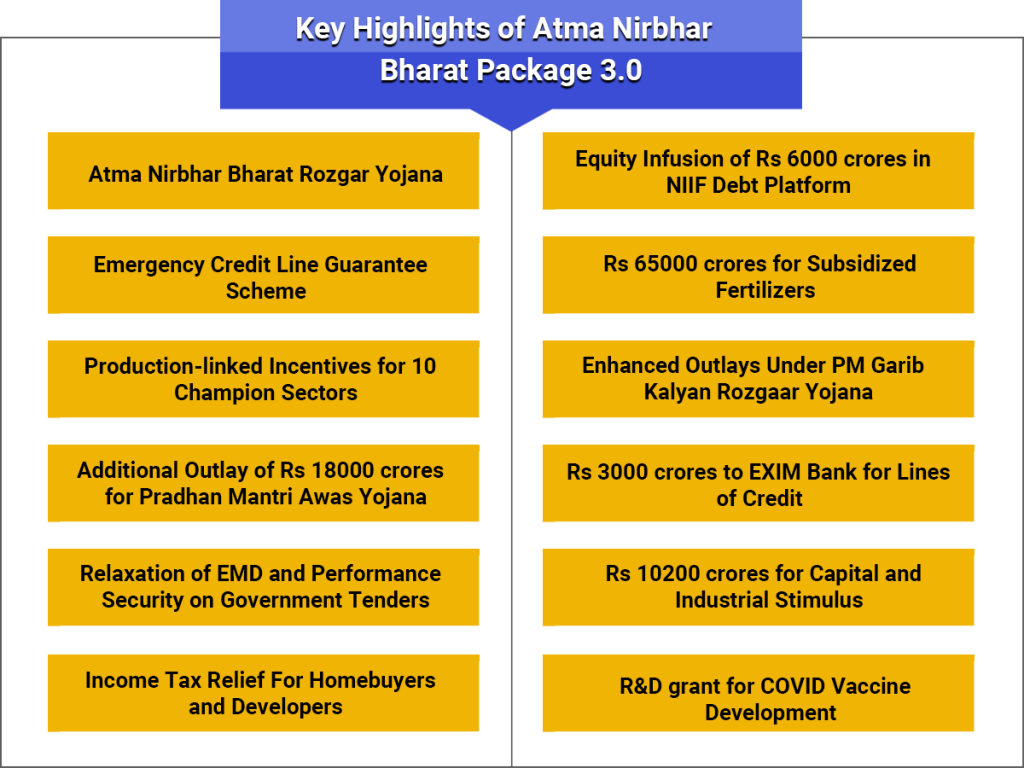

Key Highlights of Atma Nirbhar Bharat Package 3.0

The key highlights of Atma Nirbhar Bharat Package 3.0 are as follows:

Atma Nirbhar Bharat RozgarYojana

The government has launched a new scheme, known as Atma Nirbhar Bharat RozgarYojana to increase the level of job creation and new employment prospects amid COVID- 19 recovery phase. Further, this specific scheme has been made effective from 01.10.2020 and will remain operational till 30.06.2021.

Subsidy Support from the Central Government

As per this scheme, the Central Government will offer 2 year subsidy to the newly eligible employees who have joined on or after 01.10.2020 at the scale as follows:

- The establishments that are employing up to 1000 employees, the employer and employee contribution will be 12% of the wages each, i.e., 24% of the wages;

- The establishments that are employing up to 1000 employees, then in that case only an employee will contribute 12% of the wages;

Further, the PF Subsidy Support will get credited upfront in the Aadhar seeded EPFO Account of the newly eligible employee.

Also, more than 95% of the total establishments and 65% of the total employees, who are working in the formal sector are predicted to be covered in the first category, wherein the EPF contributions will be provided by the Government by way of Subsidy Support.

Beneficiaries of Atma Nirbhar Bharat RozgarYojana

The beneficiaries of Atma Nirbhar Bharat RozgarYojana are as follows:

- Any new employee who has joined an EPFO (Employee Provident Fund Organisation) registered establishment on a monthly wage of up to Rs 15000;

- Any EPF member who was drawing a monthly wage of up to Rs 15000 and has made an exit from the employment due to COVID epidemic from 01.03.2020 to 30.09.2020 and got employed on or after 01.10.2020.

Establishments Eligible for Atma Nirbhar RozgarYojana

The establishments eligible for Atma Nirbhar RozgarYojana are as follows:

- The establishments that are having EPF Registration, and have added new employees as compared to the reference employee base as in September 2020 as under:

- A minimum of 2 new employees if the employee reference base is 50 or less;

- A minimum of 5 new employees if the employee reference base is above 50;

- The establishments that have obtained EPF Registration after the commencement of Scheme will acquire subsidy for all new employees.

Emergency Credit Line Guarantee Scheme

The main aim behind the launch of the Emergency Credit Line Guarantee Scheme is to provide business loans to MSMEs, MUDRA borrowers, businesses, and individuals. Further, this scheme has been extended till 31.03.2021.

Further, ECLGS 2.0 will benefit the Healthcare sector and other 26 stressed sectors that are having an outstanding credit of above Rs 50 crores and up to Rs 500 crores as on 29.2.2020.

Also, the entities will get an additional credit up to 20% of the outstanding credit for a tenure of five years, which includes 1 year of the moratorium on principal repayment.

Key Features of Emergency Credit Line Guarantee Scheme

The key features of Emergency Credit Line Guarantee Scheme are as follows:

- This scheme was announced as a part of the Atma Nirbhar Bharat Abhiyaan;

- The scheme is extended till 31.03.2021;

- It is a fully guaranteed and collateral-free scheme;

- It provides an additional credit up to 20% of the outstanding loans as on 29.2.2020 for the entities with an outstanding credit up to Rs 50 crores as on 29.2.2020 and the annual business turnover up to Rs 250 crores, which were due up to 60 days as on 29.2.2020;

- The eligible entities are MSME Units, Individuals, Business Enterprises, and MUDRA Borrowers;

- The scheme got updated as on 12.11.2020;

- Sanction of Rs 2.05 lakh crores to 61 lakh borrowers;

- Disbursal of Rs 1.52 lakh crores;

Production-linked Incentives for 10 Champion Sectors

Earlier, the Government of India has already approved Production Linked Incentive Schemes for 3 sectors at a total cost of Rs 51355 crores, which is bifurcated as below:

- Mobile Manufacturing & specified electronics components at a total cost of Rs 40995 crore;

- Critical KSM (Key Starting Materials), Drug Intermediates and API (Active Pharmaceuticals Ingredients) at a total cost of Rs 6940 crores;

- Manufacturing of Medical Devices at a total cost of Rs 3420 crore;

The Central Government has decided to launch PLI (Production Linked Incentive) Scheme in the sectors as follows in order to boost and uplift the domestic manufacturing:

| Champion Sectors | Estimated Expenditure on the new PLIs (Rs. Crore) |

| Advance Cell Chemistry Battery | Rs 18100 |

| Electronic/Technology Products | Rs 5000 |

| Automobiles and Auto Components | Rs 57042 |

| Pharmaceuticals Drugs | Rs 15000 |

| Telecom and Networking Products | Rs 12195 |

| Textile Products | Rs 10683 |

| Food Products | Rs 10900 |

| High Efficiency Solar PV Modules | Rs 4500 |

| White Goods (ACs and LED) | Rs 6238 |

| Specialty Steel | Rs 6322 |

| Total | Rs 1,45,980 |

Additional Outlay of Rs 18000 crores for Pradhan MantriAwasYojana

Nowadays, the government is actively taking a number of measures for the Revival of the ‘Housing and Real Estate Sector’.

These measures have fairly contributed in the recovery of this sector,and till now 135 real estate projects have been approved with a total outlay of Rs 13200 crores under the scheme of Special Window for Affordable and Mid-Income Housing (SWAMIH). Further, this total outlay will result in the completion of 87000 stuck houses or flats.

However, there was a need for the government to take some additional measures to make sure that the sector is generating enough employment.

As a result, Rs 18000 crores will be catered for the Pradhan Mantri Awas Yojana- Urban (PMAY- U)[1] in the Budget estimates for 2020- 2021. Further, the same will be done by Additional Allocation and Extra Budgetary Resources.

Also, it shall be relevant to note that out of 18000 crores, 8000 crores have already been allocated this year.

Further, this additional outlay will assist in settling up of 12 lakh houses and completion of 18 lakh houses. Moreover, the same result in 78 lakhs additional jobs, Cement- 131 LMT, and Steel- 25 LMT.

Support for Construction and Infrastructure

Relaxation of EMD (Earnest Money Deposit) and Performance Security on Government Tenders. The measure named support for Construction and Infrastructure can be summarised as:

Reduction of Performance Security

Now, the performance security on contracts will be reduced to 3% instead of 5% to 10%. Further, the same will be applicable to the following:

- Ongoing Contracts that are free of disputes.

- Public Sector Enterprises.

- States are also encouraged to adopt the same.

No EMD required for Tenders

Now, as declared by the government, there is no need to pay EMD (Earnest Money Deposit) for tender and the same will be replaced by Bid Security Declaration.

Validity for Relaxations

As per the General Financial Rules, all the relaxations given will remain valid till 31.12.2021 and will provide benefit to the contractors by minimizing locking up capital and cost of BG.

Income Tax Relief For Homebuyers and Developers

Nowadays, due to economic slowdown, the prices of residential units are continuously declining. At present, section 43 CA of the Income Tax Act restricts the difference between the Circle Rate and Agreement Value at 10%, even if the prices are actually lower than this.

Therefore, the government has decided to increase the difference under section 43 CA to 20% from the earlier 10%. Further, the same will come into force from the date of announcement and will remain valid till 30.06.2021 and will have the applicability only on the primary sale of the residential units of value upto Rs 2 crores.

Moreover, as per section 56 (2) (x) of the Income Tax Act, the consequential relief of 20% will be allowed to the buyers for the said period as well.

Also, the main aim behind this measure is to reduce or minimize the hardships faced by the developers and home buyers, and the same would assist in clearing the unsold inventory as well.

Equity Infusion of Rs 6000 crores in NIIF Debt Platform

The central government has decided to make an equity investment of Rs 6000 crores in the NIIF (National Investment and Infrastructure Fund) Debt Platform. Further, by way of this equity investment, NIIF will provide a debt of Rs 1.1 lakh crores for the Infrastructure Projects by 2025.

Moreover, the key points of this measure are as follows:

- Actual Investment made by 3 NIIFs in the downstream funds, platforms, and operating companies is Rs 19676 crores;

- NIIF Strategic Opportunities Fund has set-up a “Debt Platform” comprising of an NBFC Infra Finance Company and NBFC Infra Debt Fund;

- The Platform has a Loan book of Rs 8000 crores and deal pipeline of Rs 10000 crores;

- NIIF IFL (AAA rating) and AIFL (AA rating) will raise Rs 95000 crores debt from the market, including project bonds;

- By the end of 2025, NIIF will provide an infra project financing of Rs 110000 crores;

- NIIF has already invested around Rs 2000 crores inequity of the Platform;

- Government has decided to invest Rs 6000 crores as equity;

- Rest of the equity will be raised from the private company investors;

Rs 65000 crores for Subsidized Fertilizers

Over the period of time, there has been a significant increase of 17.8% in the usage of fertilizers than the actual estimated usage of 571 lakh metric tons for the F.Y. 2019 – 2020. Further, the reason behind the increase is favourable monsoons.

Earlier, in the financial year 2016 – 2017, the fertilizer consumption was marked at 499 lakhs MT. However, the same is projected to increase to 673 lakhs MT for the financial year 2020 – 2021.

Therefore, the government has decided to increase the supply of fertilizers and provide the same at subsidized rates. Further, for providing fertilizers at subsidized rates, the government will invest Rs 65000, which will help more than 140 million farmers and will ensure timely availability of fertilizers in the coming crop season as well.

Enhanced Outlays Under PM GaribKalyanRozgaarYojana

To boost the Rural Employment, the Prime Minister on 20.06.2020 had announced a scheme known as PM GaribKalyanRozgaarYojana (PMGKRY). At present, this scheme is operative in 116 districts and Rs 37543 crores has been spent on it till date.

Further, PMGKRY merges several schemes, such as the PMGSY (Pradhan Mantri Gram SadakYojana) and MGNREGA (Mahatma Gandhi National Rural Employment Guarantee Act), etc.

Moreover, Rs 61500 crore was allotted towards MGNREGA in the financial budget for 2020 – 2021, and Rs 40000 crore was provided additionally in Atma Nirbhar Bharat 1.0.

Till date, Rs 73504 crores has been released by the government under MGNREGA and more than 251 crore person-days of employment have been generated.

However, in the Atma Nirbhar Bharat Package 3.0, the government has decided to provide an additional outlay of Rs 10000 crores in the current financial year. The main purpose of this measure is to accelerate the growth level of the rural economy.

Rs 3000 crores to EXIM Bank for Lines of Credit

To promote project exports under IDEAS (Indian Development and Economic Assistance Scheme), the government has decided to provide Rs 3000 crore to EXIM Bank.

Under this scheme, most of the recipient countries will compulsorily import 75% value of the Line of Credit (LOC).

Further, the Indian firms executing projects under IDEAS, are transmission lines, railway lines, road and transport, sugar components, auto and auto parts, etc. At present, 811 export contracts with an aggregate value of USD 10.50 billion are being financed under LOC.

Therefore, the government has decided to release Rs 3000 crores to EXIM bank for the promotion of projects under IDEAS by way of Line of Credit.

Rs 10200 crores for Capital and Industrial Stimulus

The government has decided to provide an additional budget outlay of Rs 10200 crore towards the Capital and Industrial Expenditure. Further, the term Capital and Industrial Expenditure includes the following:

- Domestic Defense Equipment;

- Industrial Incentives;

- Industrial Infrastructure;

- Green Energy;

R&D grant for COVID Vaccine Development

The government has decided to provide Rs 900 crores towards the “COVID Suraksha Mission” for the Research and Development of Indian COVID Vaccine. Such a grant has been given to the Department of Bio-Technology.

Also, Read: Real Estate Act 2016: A Detailed and Conceptual Analysis

Additional Expenditure Including Capital

| Particulars | Expenses Incurred |

| Housing for All – PMAY-U | Rs 18000 crores |

| Boost for Rural Employment | Rs 10000 crores |

| R&D Grant towards the COVID Suraksha for the research and development of Indian COVID Vaccine | Rs 900 crores |

| Industrial Infrastructure, Industrial Incentives, and Domestic Defense Equipment | Rs 10200 crores |

| Boost for Project Exports – Support to the EXIM Bank | Rs 3000 crores |

| Boost for Atma Nirbhar Manufacturing – Production Linked Incentives | Rs 145980 crores |

| Support for Agriculture – Fertilizer Subsidy | Rs 65000 crores |

| Boost for Infrastructure – Infusion of the Equity in the NIIF Debt PF | Rs 6000 crores |

| Atma Nirbhar Bharat RozgarYojana (overall Rs 36000 crores) | Rs 6000 crores |

| Total | Rs 265080 crores |

Summary of Till Date Announced Stimulus Measures

| S. No | Particulars | Rs in Crore |

| 1. | PMGKP (Pradhan MantriGaribKalyan Package) | Rs 192800 |

| 2. | Atma Nirbhar Bharat Abhiyaan 1.0 | Rs 1102650 |

| 3. | PMGKP Anna Yojana – an extension of 5 months from July to November | Rs 82911 |

| 4. | Atma Nirbhar Bharat Abhiyaan 2.0 (till 12th October) | Rs 73000 |

| 5. | Atma Nirbhar Bharat Abhiyaan 3.0 | Rs 265080 |

| 6. | RBI Measures announced till 31.10.2020 | Rs 1271200 |

| Total | Rs 2987641 |

Impact of Atma Nirbhar Bharat Package 3.0 on Indian Economy: An Analysis

The latest announcements made by the government are based on the ideology of “Fiscal Conservatism”, i.e., instead of large cash transfers, the growth philosophy revolves around establishing an ecosystem that promotes domestic demand, incentivizes companies to create jobs and boost production, and at the same time extends benefits and privileges to those who are in severe distress, be it individuals or firms.

Further, the measures follow a “Multi-pronged Approach”, which aims at generating employment and promising formalization of the workforce in urban areas by the following methods:

- Increasing the scope of the distress employment provided in rural areas;

- Easing out the credit flow in the stressed parts of the economy;

- Expanding the incentives recommended to boost domestic manufacturing;

- Kick-starting the cycle of Real Estate among others;

Altogether, the reasons behind the announcement of COVID- 19 measures by the government is to increase the Centre’s Fiscal Outgo by 2% of GDP (Gross Domestic Product) in the year 2020 – 2021.

Further, according to the Central Government and RBI, the total fiscal stimulus announced to fight over COVID – 19 pandemic till date (inclusive of Atma Nirbhar Bharat 1.0 and Atma Nirbhar Bharat 2.0) is Rs 29.87 lakh crores, which makes around 15% of the National GSP. Also, out of this, the financial stimulus worth9% of the GDP has already been offered by the government.

Conclusion

In a nutshell, even though the Indian Economy has shrunk due to the COVID 1- pandemic and has suffered negative growth in its first two quarters. Therefore, the economy is on the verge of revival. Also, the GST collection for the month of October has crossed Rs 1.05 Lakh crores.

Further, as per the market predictions made by the Apex Bank, there are strong chances that the Indian Economy will return to positive in its third quarter of the financial year 2020 – 2021.

Also, the financial stimulus package will further strengthen and reinforce the economy and will assist in achieving the target of $ 5 trillion Economy.

Also, Read: Latest updates by RBI Chief Shaktikanta Das amid COVID-19 to boost economy