Ways to Claim and Check the Status of Online TDS Refund

Shivani Jain | Updated: Dec 19, 2020 | Category: TDS

‘TDS’ or ‘Tax Deducted at Source’ denotes the amount deducted by the person at the time of making the payment if the said payment exceeds the prescribed threshold. However, the term ‘Claim Online TDS Refund’denotes a situation wherein the amount deducted as TDS is more than the actual taxable amount paid at the end of the financial year. In this blog, we will discuss the concept of Claim Online TDS Refund, together with the process to check the Status of Online TDS Refund

Table of Contents

Concept of Tax Deducted at Source

The term TDS or Tax Deducted at Source denotes the percentage of the amount deducted by the employer from the employee’s salary. It is a type of Advance Tax paid by the deductor to the Central Government on a periodic basis.

Further, the deductee, from whose salary TDS has been deducted, has the right to claim an online TDS Refund by filing form 26AS or the TDS Certificate issued by the deductor. However, the same can be done by the deductee only after filing the Income Tax Return.

Concept of TDS Refund

The term TDS Refund denotes a situation wherein the tax paid in the form of TDS is more than the actual tax paid for that year. Further, the amount to be claimed as TDS Refund needs to be calculated after consolidating income from various sources.

Example

Sumit works at a reputed post with an MNC situated in Hyderabad. But, he was late in furnishing his documents for IDFC premium, which is exempted under section 80C of the Income Tax Act 1961. Therefore, an extra amount of Rs 10000 was deducted as TDS.

- Further, the total amount of tax to be paid by Sumit for the financial period 2017 to 2018 is Rs 40000;

- The amount of tax that got deducted from Sumit’s salary was Rs 50000;

- Sumit’s eligibility to claim tax refund is Rs 50000 – Rs 40000 = Rs 10000;

Hence, with the example mentioned above, it is clear that the Sumitwas supposed to pay only an amount of Rs 40000 as TDS. However, he ended up paying Rs 50000 due to not timely submitting the insurance premium payment receipt to the employer.

Different Statuses of TDS Refund

The different statuses of TDS Refund are as follows:

- No e-Filing has been done for the Assessment Year;

- Not Determined;

- Refund Successfully Paid;

- No Demand No Refund;

- ITR Successfully Processed;

- Refund Determined and Sent out to the Refund Banker;

- Refund Unpaid;

- Contact the Jurisdictional Assessing Officer;

- Demand Determined;

- Rectification Processed and Refund Determined and sent out to the Refund Banker;

- Rectification Processed and Demand Determined;

- Rectification Processed No Demand No Refund;

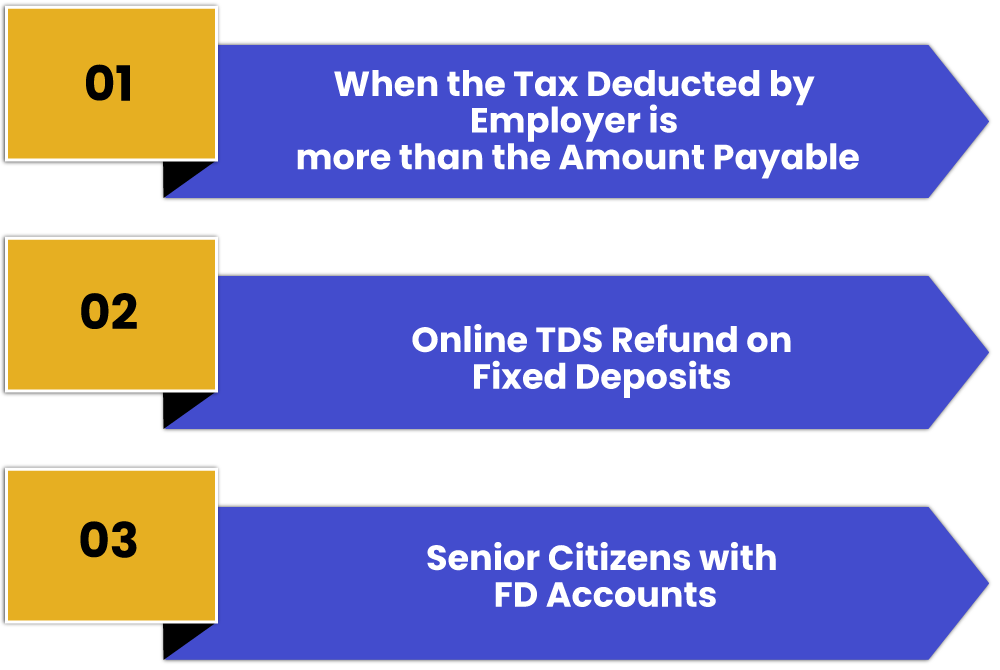

When Can Deductee Claim Online TDS Refund?

The situations in which a deductee can claim Online TDS Refund are as follows:

When the Tax Deducted by Employer is more than the Amount Payable

- When the amount deducted as TDS is more than the actual tax payable, then, in that case, one can calculate his/her income tax and file ITR (Income Tax Return) to claim online TDS Refund;

- During the filing of ITR, the deductee needs to provide his/ her bank name and IFSC code to get the refund of the excess amount paid as tax from the IT Department;

- In case the deductee doesn’t have the taxable income, then, in that case, he/she can apply for the NIL TDS Certificate in form 13 from the authorised Tax Officer. Moreover, the same must be in accordance with section 197. Moreover, the deductee needs to submit the order passed to TDS Deductor as well.

Online TDS Refund on Fixed Deposits

- In case a deductee doesn’t have the taxable income, then, in that case, he/she needs to submit a declaration in Form 15 G prior to the end of the financial year to the respective bank for notifying them that he/she does not have any taxable income. Therefore, there will be no TDS or Tax Deducted at Source on the interest income;

- If in case the banks deduct TDS despite furnishing Form 15 G declaration, then the deductee is eligible to claim a refund by filing ITR;

Senior Citizens with FD Accounts

- If an individual is 60 years or above in age and has an FD Account, then he/she is exempt from the tax deductions levied on the FD interest up to Rs 50000 on an annual basis;

- Further, in case the said person is left with no taxable income for that Financial Year after claiming a tax deduction of up to Rs 50000 on the interest income, then, in that case, he/she needs to submit the Form 15 H to the respective bank to notify them that there is no remaining taxable income;

- In case the said bank still deducts TDS from the FD, then the deductee can claim a refund by filing Income Tax Return;

Concept of TDS Refund Period

Normally, it takes around 3 to 6 months to process a refund and credit the amount in the respective bank account. However, it shall be relevant to state that the same depends on the completion of the process of e-verification as well.

Process to Claim Online TDS Refund

The steps involved in the process to claim Online TDS Refund are as follows:

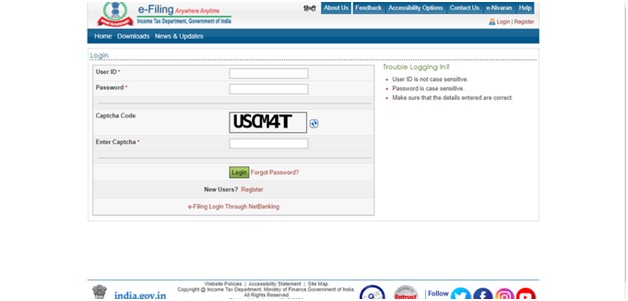

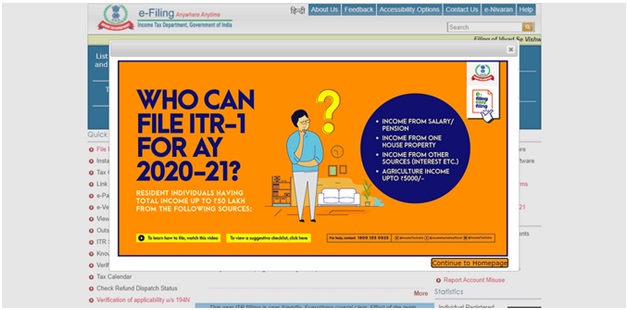

- Firstly, visit the official portal of the Income Tax Department[1].

- Now, login to your account by entering the provided login credentials

- In the next step, the taxpayer needs to download the suitable ITR (Income Tax Return) form, fill in the needed details, upload the documents, and submit the form;

- After that, the taxpayer requires to verify his/her submitted ITR by either of the ways as follows:

- Aadhar based OTP;

- Digital Signature Certificate; or

- Net Banking Account;

- Lastly, the taxpayer will receive an Acknowledgment and processing of TDS Refund mail from the Income Tax Department;

Process to Check the Status of Online TDS Refund

There are two ways to check the status of the Claim Online TDS Refund, which are as follows:

- With Income Tax Login

- Without Income Tax Login

With Income Tax Login

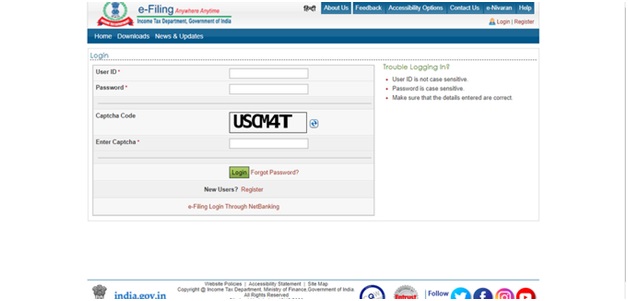

The steps involved in the process to check the status of Online TDS Refund are as follows:

- Firstly, visit the official portal of the Income Tax Department.

- Now, login to your account by entering the provided login credentials (Username and Password);

- After that, go to the “My Account” section;

- Now, select the “Refund/Demand Status”;

- Lastly, the assessment year, TDS status, the reason for rejection (in the case of a failure), and the mode of payment will be displayed;

Without Income Tax Login

The steps involved in the process to check the status of Online TDS Refund are as follows:

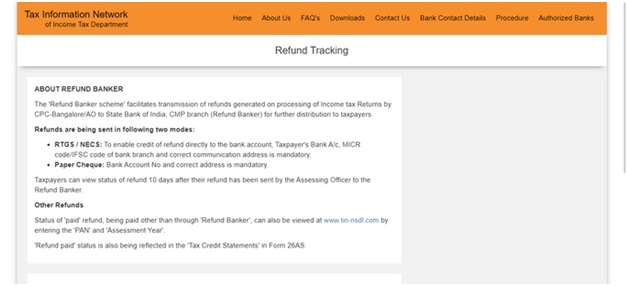

- Firstly, visit the official website of the Tax Information Network (TIN) NSDL[1].

- Now, enter PAN (Permanent Account Number);

- After that, choose the relevant AY (Assessment Year) for the Online TDS Refund;

- Lastly, enter the Captcha to proceed further;

Conclusion

In a nutshell, Tax Deducted at Source denotes the percentage of the amount deducted by the employer from the employee’s salary. It is a type of Advance Tax paid by the deductor to the Central Government on a periodic basis.

In contrast, TDS Refund denotes a situation wherein the tax paid in the form of TDS is more than the actual tax paid for that year. Further, it is calculated after consolidating income from various sources.

At Swarit Advisors, our tax professionals will guide you through the process to claim online TDA Refund and to file Income Tax Return.

Also, Read: Online TDS Payment: A Guide on the Concept & Process to File