Online TDS Payment: A Guide on the Concept & Process to File

Shivani Jain | Updated: Dec 11, 2020 | Category: Tax, TDS

In India, the term “Online TDS Payment” denotes the process of paying tax at the point of origin of Income. It is regulated by the provisions of the Income Tax Act 1961. Further, the parties involved are known as Deductor and Deductee.

In this blog, we will discuss the concept, applicability, reasons for implementation, and procedure to file online TDS Payment.

Table of Contents

Concept of Tax Deducted at Source

The term TDS or Tax Deducted at Source was implemented with an aim to collect tax at the point of origin of Income. According to this, the deductor is responsible for making payment of the prescribed nature from the deductee’s salary, and need to remit the same into the Central Government official bank account.

Further, the deductee whose salary has been deducted is eligible to acquire credit on the amount deducted. The same will be based on the TDS Certificate granted by the deductor.

Also, the deductor needs to make online TDS Payment on or before the 7th working day of the succeeding month.

Concept of Tax Deduction and Collection Account Number

The Tax Deduction and Collection Account Number or TAN is a 10 digits alphanumeric number issued to individuals or entities that need to collect or deduct tax payments.

Applicability of TDS Provisions

Apart from salary, the occasions where TDS provisions are applicable are as follows:

- Income from Interest on Securities;

- Income from Interest on Debentures;

- Income from Interest, other than those on Securities;

- Income from Dividends;

- Income from EPF Withdrawal;

- Payment to Contractors;

- Payment to Sub-contractors;

- Payment to Freelancers;

- Winning from Horse Races;

- Winning from Lotteries;

- Winning from Crossword Puzzles;

- Any other game-related winnings;

- Insurance Commissions;

- Commission on Brokerage Earnings;

- Transfer of Immovable Property;

- Income from offering professional services;

- Income from offering technical services;

- Income from Royalty;

Reasons for Introducing Online TDS Payment Mechanism

The reasons behind the implementation of Online TDS Payment Mechanism are as follows:

- To Prevent Tax Evasion;

- To Ensure Timely Collection of Tax;

- To Act as a Steady Source of Revenue for the Central Government;

- To Provide Convenience to Taxpayers;

- To Ease out the Process of Filling Income Tax Return;

Benefits of Filing Online TDS Payment

The benefits of filing online TDS Payments are as follows:

- Provides 24*7 online payment facility.

- Deductor can deduct TDS as per his/ her convenience in terms of time and location.

- Provides acknowledgement of payment on an immediate basis.

- Easy facility to download Challan Acknowledgment for future reference.

- Reduction in the Cases of Corruption and Malpractices;

- Environmental Friendly.

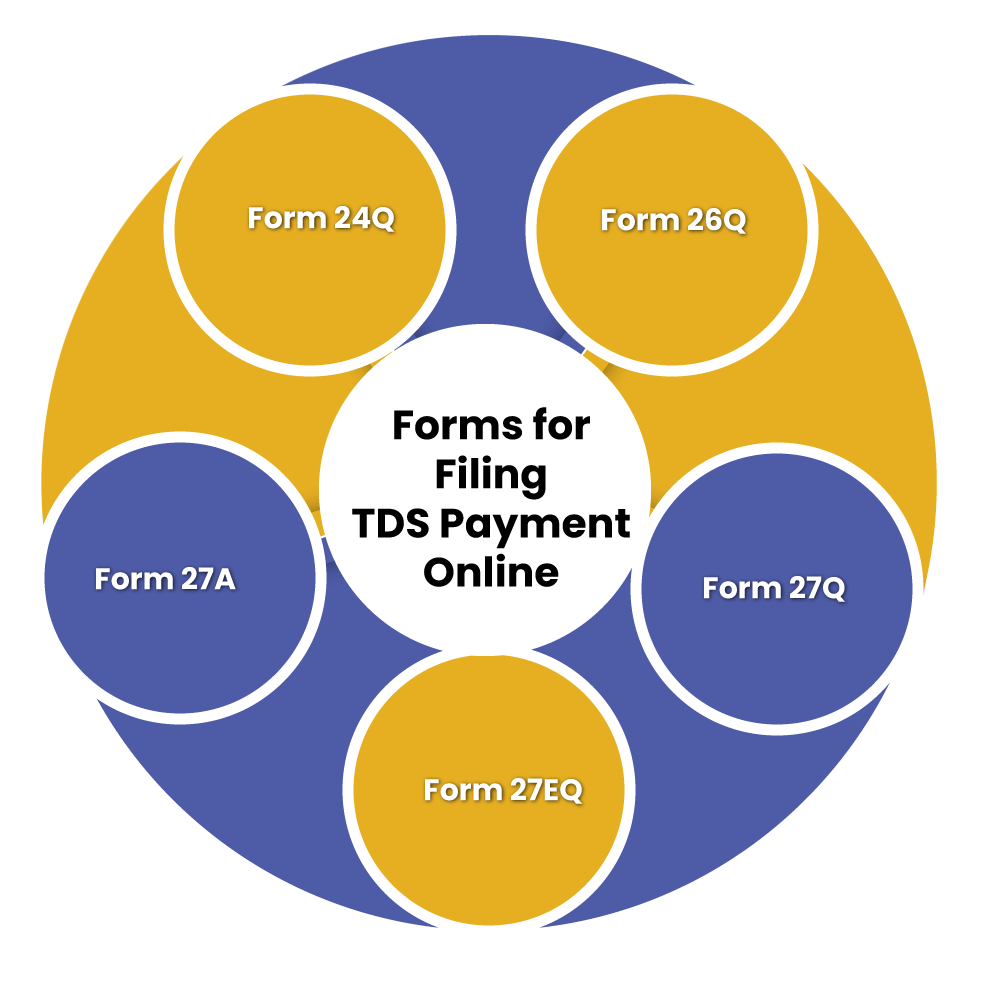

Forms for Filing TDS Payment Online

The forms required for making TDS Payment online are as follows:

Form 24Q

This form is required to be filed for making deductions from salaries;

Form 26Q

This form is required to be filed for making deductions from payments other than salaries;

Form 27Q

It is a quarterly return, and needs to be filed by deductor for all the deductions made in the case of NRIs;

Form 27EQ

It is a TCS (Tax Collected at Source) quarterly return and needs to be filed by deductor;

Form 27A

This form is required to be duly signed and accompanied by quarterly returns;

Timeline for Making Online TDS Payment

The points to consider while making online TDS Payment are as follows:

- The due date for paying the TDS collected is the 7th of the succeeding month;

- For the month of March, the deductor needs to pay the TDS deducted on or before the 30th April of the that Financial Year;

- The timelines for making TDS payment are applicable to both Government and Non-Government assessee;

- If in case a Government Deductor makes TDS payment without filing the copy of challan, then, in that case, he/ she requires to make the payment of TDS on the same day when the Tax was collected;

- If an Assessing Officer with the prior approval of the Joint Commissioner permits the quarterly TDS payment. Then the last date for making the payment is 7th of the succeeding month, after the end of the quarter or the 30th April of the previous quarter of the financial year;

Process for Making TDS Payment Online

The steps involved in the process for making TDS Payment Online are as follows:

In India, the term “Online TDS Payment” denotes the process of paying tax at the point of origin of Income.It is regulated by the provisions of the Income Tax Act 1961. Further, the parties involved are known as Deductor and Deductee.

In this blog, we will discuss the concept, applicability, reasons for implementation, and procedure to file online TDS Payment.

Concept of Tax Deducted at Source

The term TDS or Tax Deducted at Source was implemented with an aim to collect tax at the point of origin of Income. According to this, the deductor is responsible for making payment of the prescribed nature from the deductee’s salary, and need to remit the same into the Central Government official bank account.

Further, the deductee whose salary has been deducted is eligible to acquire credit on the amount deducted. The same will be based on the TDS Certificate granted by the deductor.

Also, the deductor needs to make online TDS Payment on or before the 7th working day of the succeeding month.

Concept of Tax Deduction and Collection Account Number

The Tax Deduction and Collection Account Number or TAN is a 10 digits alphanumeric number issued to individuals or entities that need to collect or deduct tax payments.

Applicability of TDS Provisions

Apart from salary, the occasions where TDS provisions are applicable are as follows:

- Income from Interest on Securities;

- Income from Interest on Debentures;

- Income from Interest, other than those on Securities;

- Income from Dividends;

- Income from EPF Withdrawal;

- Payment to Contractors;

- Payment to Sub-contractors;

- Payment to Freelancers;

- Winning from Horse Races;

- Winning from Lotteries;

- Winning from Crossword Puzzles;

- Any other game related winnings;

- Insurance Commissions;

- Commission on Brokerage Earnings;

- Transfer of Immovable Property;

- Income from offering professional services;

- Income from offering technical services;

- Income from Royalty;

Reasons for Introducing Online TDS Payment Mechanism

The reasons behind the implementation of Online TDS Payment Mechanism are as follows:

- To Prevent Tax Evasion;

- To Ensure Timely Collection of Tax;

- To Act as a Steady Source of Revenue for the Central Government;

- To Provide Convenience to Taxpayers;

- To Ease out the Process of Filing Income Tax Return;

Benefits of Filing Online TDS Payment

The benefits of filing online TDS Payments are as follows:

- Provides 24*7 online payment facility;

- Deductor can deduct TDS as per his/ her convenience in terms of time and location;

- Provides acknowledgement of payment on an immediate basis;

- Easy facility to download Challan Acknowledgment for future reference;

- Reduction in the Cases of Corruption and Malpractices;

- Environmental Friendly;

Forms for Filing TDS Payment Online

The forms required for making TDS Payment online are as follows:

Form 24Q

This form is required to be filed for making deductions from salaries;

Form 26Q

This form is required to be filed for making deductions from payments other than salaries;

Form 27Q

It is a quarterly return, and needs to be filed by deductor for all the deductions made in the case of NRIs;

Form 27EQ

It is a TCS (Tax Collected at Source) quarterly return and needs to be filed by deductor;

Form 27A

This form is required to be duly signed and accompanied by quarterly returns;

Timeline for Making Online TDS Payment

The points to consider while making online TDS Payment are as follows:

- The due date for paying the TDS collected is the 7th of the succeeding month;

- For the month of March, the deductor needs to pay the TDS deducted on or before the 30th April of the that Financial Year;

- The timelines for making TDS payment are applicable to both Government and Non-Government assessee;

- If in case a Government Deductor makes TDS payment without filing the copy of challan, then, in that case, he/ she requires to make the payment of TDS on the same day when the Tax was collected;

- If an Assessing Officer with the prior approval of the Joint Commissioner permits the quarterly TDS payment. Then the last date for making the payment is 7th of the succeeding month, after the end of the quarter or the 30th April of the previous quarter of the financial year;

Process for Making TDS Payment Online

The steps involved in the process for making TDS Payment Online are as follows:

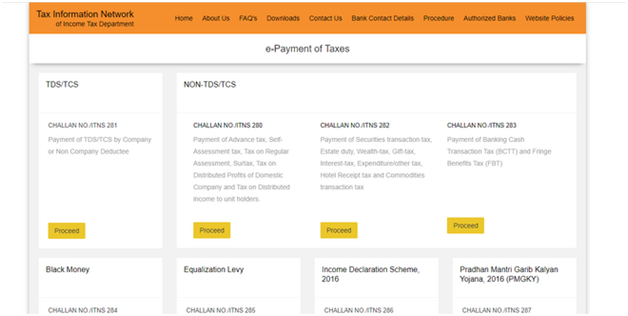

1- Visit the Official NSDL website[1].

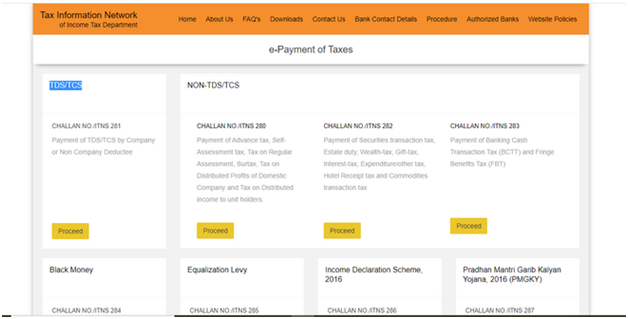

2- Click on “Challan No./ITNS 281” under the option TDS/ TCS.

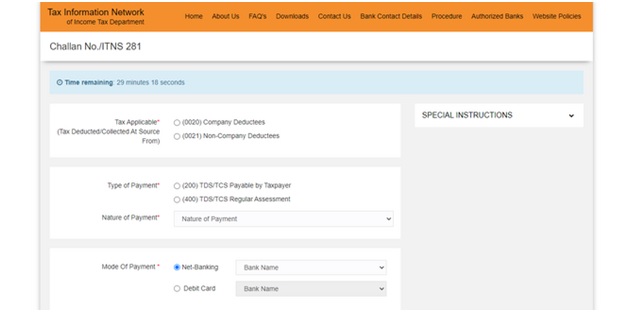

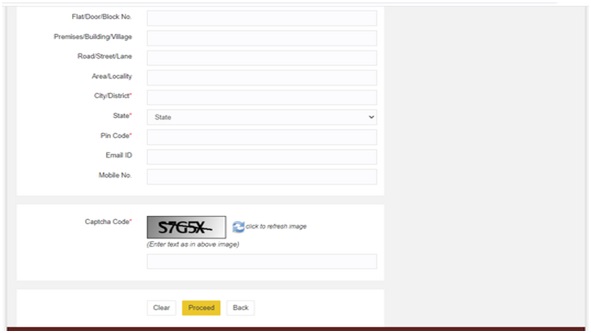

3- After selecting the option, the applicant will be re-directed to a new page, wherein, he/she requires to fill in the details asked;

4- Once the deductor has filed the form, he/she needs to enter the CAPTCHA code provided, and press the “Proceed Button”.

5- Once a TDS form is duly submitted, the TAN (Tax Deduction and Collection Account Number) will get verified and authenticated.

6- If the form is successfully verified, then the taxpayer’s full name will be shown on the screen.

7- After confirmation, the data will be re-directed to the net banking website of the concerned bank.

8- In the next step, the user will need to log in to his /her Internet Banking Profile to TDS payment.

9- Once the user has made the successful payment, a counterfoil Challan Number will be generated and displayed on the screen.

10- The user needs to save the generate Challan Copy for future reference.

Note: the Challan Copy will include CIN (Company Identification Number), details pertaining to the TDS payment, bank name, etc.

Consequences of Making Delayed TDS Payment

The consequence of making Delayed TDS Payment are as follows:

- In case of delay in making TDS payment online due to the non-deduction of tax at source or TDS, then, in that case, an interest of 1% per month will be charged on the amount due. Further, the interest will be charged from the date when the tax was deductible first time to the date when the actual deduction is made;

- In case there is a delay in making TDS payment after a deduction of tax at source or TDS, then, in that case, an interest of 1.5% per month will be charged on the amount due. Further, the interest will be charged for every such month during which the payment was delayed. Also, the rate of interest will be charged from the date of making a deduction of the tax amount;

Due Dates of Making Online TDS Payment for A.Y. 2021 – 2022

| Month of Deduction | Last Date of the Quarter | Last date for making TDS payment | Due Date for Filing TDS Return |

| April | 30th June | 7th May | 31st July |

| May | – | 7th June | – |

| June | – | 7th July | – |

| July | 30th September | 7th August | 31st October |

| August | – | 7th September | – |

| September | – | 7th October | – |

| October | 31st December | 7th November | 31st January |

| November | – | 7th December | – |

| December | – | 7th January | – |

| January | 31st March | 7th February | 31st May |

| February | – | 7th March | – |

Conclusion

In a nutshell, the online TDS payment mechanism has been based upon a concept known as “Any Time and Anywhere”. Also, the same has been implemented with the aim to make the process of user friendly and transparent, and to minimize the cases of Tax Evasion.

Further, it shall be relevant to note that the deductee whose salary has been deducted is eligible to acquire credit on the amount deducted. The same will be based on the TDS Certificate granted by the deductor.

Lastly, in case of any doubt or perplexity, contact Swarit Advisors, our skilled and proficient experts are there to cater all your confusion and queries.

Also, Read: Web Aggregator License in India: Its Concept & Process To Register