Steps to Take your Business to the International Market with Import Export Code

Japsanjam Kaur Wadhera | Updated: Dec 21, 2020 | Category: IEC

The business of Import and Export in the international market is a challenging task. There are many requirements that have to be fulfilled by the entrepreneur to trade their business globally. Import Export Code is a mandatory license that has to be obtained for importing or exporting goods and services to or from India. Therefore, this article will guide you and provide you with the steps to take your business to the International market with Import Export Code.

India’s foreign trade is regulated by the foreign trade policy notified by the Central Government in discharge of powers conferred by section 5 of Foreign Trade (Development and Regulation) Act, 1992.

The 2015-20 foreign trade policy is effective from 1st April 2015. According to the Foreign Trade Act export means an act of sending goods or services to another country for sale by air, land or sea with proper money transaction.

Table of Contents

Procedure to Register for Import Export Code

To obtain an Import Export License, the below mentioned procedure to register for IEC has to be followed: –

Step 1: Visit https://www.dgft.gov.in/CP/ and click on the “Apply for IEC”.

Step 2: Begin to put Registration details such as: –

- First and last name

- Register User as “Importer/ Exporter”

- Pin-code, State and City, District

- Mobile number and Email id

Click on “Send OTP” after entering the details. Put the OTP received on mobile number and email id. Applicant will receive a notification upon successful confirmation of OTP, which the applicant has to change ahead of first login. Now, click on “Apply IEC”; and then click on start fresh application and log – in to the “Customer Portal” using the identifications inserting in step 2.

Step 3: Start filing the particulars in the IEC registration application which are as follows:-

1. General Information

- Nature of the Establishment

- Company/Firm Name

- PAN Card of Establishment

- Insert Name as per PAN Card

- Date of Birth /Incorporation of the entity.

- The category of the exporter.

- Mention whether the firm is located in SEZ or not.

- Select whether the firm is located in EHTP Scheme, EOU Scheme, BTP scheme or STP Scheme.

- Enter the LLPIN/CIN in case of company/LLP.

- Enter GST Number.

- Enter the mobile number and E-mail.

- Upload proof of establishment/registration/incorporation. This additional document is compulsory for HUF, Partnership, Registered Society, Trust, and Others.

- Enter the particulars of the firms’ address.

- Upload supporting documents as “Address Proof”. Address proof can be any of the following documents: Sale Deed, lease deed, electricity bill, MoU, telephone landline bill, post-paid bill.

Select “Save and Next” after entering details successfully.

2. Details of Director/Karta/Proprietor/Partner of the Entity which is comprised of the following agenda:-

- Add the name as per PAN Card.

- Add PAN Card number of Karta/Proprietor/Partner/Director.

- Enter Date of birth as mentioned in the PAN Card.

- Address of the Karta/Proprietor/Partner/Director.

- Mobile no of the Karta/Proprietor/Partner/Director.

- Select “Save and Next” and move to next step.

- Enter Bank Information of the Establishment

Bank Information such as Bank, Branch name, account number, IFSC code, account holder name. Upload cancelled cheque or Bank certificate as prescribed.

Select “Save and Next.”

- Select other details I.E. Preferred area of Operations.

Click on the “Save and Next” after submitting the details successfully.

- Select The Acceptance Of Undertaking/Declaration And Fill The Place As Well.

Click on “Save and Next” after entering details to proceed further.

Step 4: Concluding Submission:-

Click on “Sign” at the bottom of the page – after completing step 3.

- Select the manner of submission i.e. either through Digital signature certificate or Aadhaar OTP. Enter the ‘Aadhaar number/Virtual ID’ and click on send OTP if the manner of submission is Aadhaar OTP, and submit the form

- Confirm it and carry on to make the payment of INR 500 against application after the prescribed form is signed. For completion of payment, you will be redirected to the Payment Gateway.

- After the payment is completed you will be redirected to the official Website of DGFT and the payment receipt will be displayed on the screen. The applicant can also download the payment receipt for future reference. In case of payment failure, wait for some time to reflect the payment on the ‘BharatKosh’ Payment Gateway.

NOTE: – The applicant will receive the IEC registration certificate on the registered e-mail address. You can also download the certificate by logging on the official Website of DGFT by clicking on “Print Certificate” under “Manage IEC.” After that, the Import Export Code must be communicated to CBIC.

Also, Read: Process and Documents Required for IEC Registration in India:

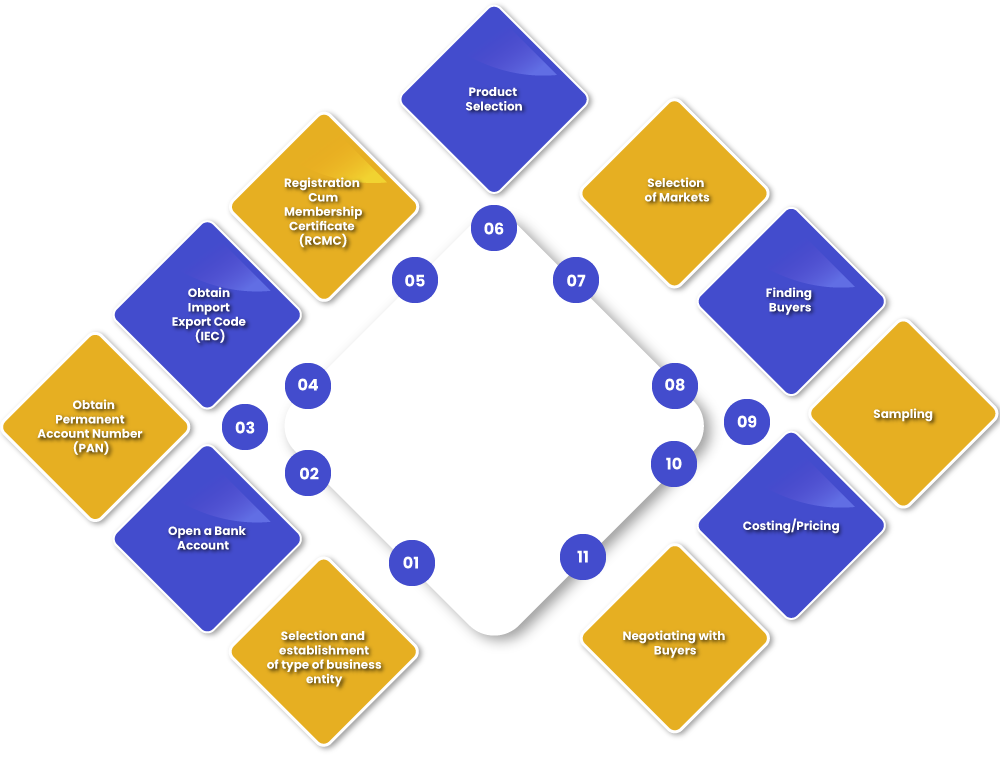

What are the ways to expand your business to the International market with Import Export Code?

The entrepreneur who wishes to expand its business globally needs to prepare and plan strategies before starting an export business. The below mentioned steps should be followed to expand your business to the International market with Import Export code.

1- Selection and Establishment of a Type of Business Entity

To expand the business to the International market with Import Export Code, one first needs to decide the type of business entity that it will establish on the structure of ownership. A Partnership firm, sole proprietorship, private limited company, public limited company or LLP has to be set up as per procedure and a name and a logo has to be chosen for the business entity.

2- Open a Bank Account

A bank account has to be opened by the business entity. For this, a current bank account is created to transact with the vendors and customers in the Import Export business. Depending upon the type of business entity, the documents required to open a current account varies accordingly.

3- Obtain Permanent Account Number (PAN)

To expand the business to the International market, a PAN Card has to be obtained which helps to identify the valid identity and address proof of the business. It is important for every registered business entity to apply for Permanent Account Number with the Income Tax Department.

4- Obtain Import Export Code (IEC)

In India, it is mandatory to obtain the Import Export Code (IEC) as per the Foreign Trade Policy. The IEC application along with supporting documents has to be filed with the Director-General of Foreign Trade (DGFT) to obtain IEC.

5- Registration Cum Membership Certificate (RCMC)

There are number of export promotion councils that operate to promote the export of different goods and services in India. Registration with these councils gives the exporters’ opportunity to access the events and a benefit to expand their business and other benefits under Indian Foreign Trade Policy. There the RCMC is mandatory to register which takes roughly a week to get registered and is valid all over India. It helps to avail authorization to import and export or any other concessions or benefits under Foreign Trade Policy.

6- Product Selection

Proper selection of products to be exported must be made and all items can be freely exported except the few items which are restricted or prohibited under the prohibited products list.

7- Selection of Markets

An entrepreneur must make sure that his export goods or services have the right market reach in the world. Various factors must be considered while exporting the goods in the international market such as, Trade barriers, demand for the product, political environment, profitability and etc. Depending upon these factors the exporter must examine the viability and choose his export market accordingly.

8- Finding Buyers

The next step that involves, once the product and the market are selected, is to figure out how to find out buyers for the export products. This can be done by adopting several ideas such as registering on buyer seller platforms, creating a website, utilizing government bodies’ line export promotion councils, participating in Trade Fairs and etc.

9- Sampling

According to the demands of the foreign buyers, provide customized samples which would help to get export orders. Exports of bonafide trade and technical samples of freely exportable goods are allowed without any limits, as per the Foreign Trade Policy 2015-2020.

10- Costing/Pricing

It is necessary for an entrepreneur to do product pricing in order to get the attention of buyers and promote sales in view of the international market. It is necessary to start with an estimation of the business financial requirements. Also, one must plan the type of export financing that would be best suited for the business. The pricing should be done taking into consideration all the expenses from sampling to the export proceeds realization on the basis of terms of sale. The entrepreneur should prepare a costing sheet for every export product.

11- Negotiating with Buyers

The entrepreneur should also focus on the demand for giving reasonable discounts and allowances in price in future, once the business reaches out in the international market.

Conclusion

The expansion and growth of the business, by making it available in the foreign market helps the exports to become successful. It provides benefits to the entrepreneur in exploring the international markets and becoming more potential in its business. Following the steps as mentioned above will take the business of the entrepreneur to the International market with Import Export code, which is a necessary license for the trade of Business.

Also, Read: Important Features of Import Export Code