All That You Need To Know: When IEC Code is Required?

Japsanjam Kaur Wadhera | Updated: Dec 31, 2020 | Category: IEC

For any industry that is indulged in the business of import and export of goods and services, it is mandatory to obtain an IEC License. IEC stands for Import Export Code. It is a unique 10 digit code that is issued by the Directorate General of Foreign Trade, Ministry of Commerce & Industries (DGFT). The importance of IEC is to transfer or receive money to or from foreign banks and clear the customs and shipment. This article will provide you with the information regarding all that you need to know about IEC and when IEC code is required?

Table of Contents

IEC Code in India

For all the businesses who wish to expand their business globally, has to obtain IEC Code. Import Export Code allows the movement of goods and services without any hindrances. Obtaining import export license is mandatory to clear the customs and allow shipment. IEC code helps the individuals and companies to take off their business to the international market.

Conditions in which IEC Code is required

The IEC code is required in the below mentioned situations: –

- When an importer has to clear his shipments from the customs then an IEC code is required by the customs authorities.

- The IEC code is required by the banks when money is sent to abroad through banks by the importer.

- The IEC code is required by the customs port when the shipment has to be sent by the exporter.

- The IEC code is required by the banks when the money in foreign currency is received by the exporter directly in his bank account.

Conditions in which IEC Code is not required

- When the government departments are exporting and importing then the IEC code is not required.

- When the certain notified charitable NGOs are importing and exporting.

- When products are imported and exported by a person for his or her personal use.

Registration of IEC Code online

The registration of the IEC code is required by a person who is involved in the business of importing and exporting its goods globally. The procedure for registration is as follows: –

The application for registration is submitted on the Directorate General of Foreign Trade (DGFT) website by the applicant. The full information regarding the list of documents required is provided on the website. The following steps have to be fulfilled by the applicant for applying for IEC code.

- The first step in the registration of IEC code is that the applicant is required to go to the DGFT website and click on the Service Tab and is required to fill the details of his PAN Card

- Then the applicant is required to enter the name, date of birth, incorporation details once is the PAN Card is submitted.

- Upon the verification of the PAN Card, the next step is to provide the phone number and email id of the applicant for the OTP.

- A 20 digit ECOM (e-commerce) reference number shall be provided to the applicant, as a unique identifier for the application.

- Further, the applicant is required to provide the information regarding his import export business entity.

- Lastly, a payment has to be made either through debit card or credit card and can also be done through net banking.

- Now, the applicant is required to upload the supporting documents and the information so provided by the applicant will appear on the window in ANF- 2A Form.

Once all the above-mentioned steps are completed, the applicant shall receive an e- IEC certificate. And the import export license will be received within 15 days from the date of the application.

Documents required for the registration of IEC Code

The IEC code is required for the import export trade, and the documents that are required for the registration of IEC code are as follows: –

- PAN Card of the individual or the company.

- Aadhar Card, Passport or voter id and Photograph of the applicant.

- Memorandum of Association (MOA), Articles of Association (AOA), Partnership deed of the company.

- Certificate of Incorporation, Sale deed, Bank certificate.

- Copy of cancelled cheque of a current bank account.

- Personal or Current bank account statement of the individual or company.

- Copy of electricity bill or rent agreement.

What are the benefits of IEC Code?

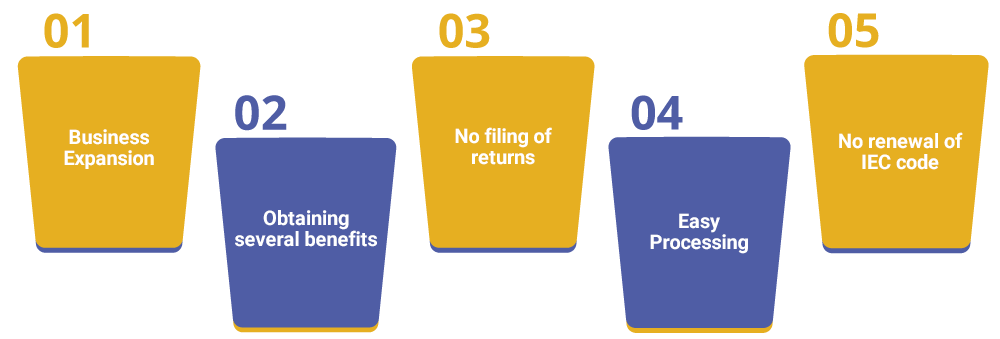

IEC Code is required by every individual or company engaged in the business of import and export. There are many benefits of IEC Code, some of which are discussed as follows:

Business Expansion

IEC code helps to make goods and services of the individual or company, reach to the global market and this leads to the expansion and growth of the business.

Obtaining several benefits

The individuals or companies can obtain several benefits on their import or export of goods and services from the Directorate General of Foreign Trade (DGFT), Export Promotion Council, customs and etc on the grounds of their IEC Code registration.

No filing of returns

One the IEC code is obtain there is no need to file any returns. It does not require following any sort of processes for upholding the validity of IEC code once obtained. There is no need to file any returns with the DGFT for export transactions.

Easy Processing

Once the application is submitted for the registration of IEC code, it is quite easy to obtain it from the DGFT within a period of 10 to 15 days.

No renewal of IEC code

Once the IEC code is obtained, it is not required to renew the IEC code again and is effective for a lifetime of an entity and can be used by it against all the import and export transactions.

Conclusion

Once the IEC code is obtained by an individual or a company, there is no need to renew it till the lifetime of the business. For every individual or a company who wants to grow and expand their business globally, it is mandatory to obtain IEC code. IEC code is required, for import export trade and there are many benefits that can be enjoyed by an individual or a company, once it is obtained.

Also, Read: What to do if Your IEC Application is Rejected?