What are the Different Types of NBFCs?

Karan Singh | Updated: Mar 06, 2021 | Category: NBFC, RBI Advisory

In India, the Non-Banking Financial Company sector is a systematically important component of the financial system. The growth of NBFC is increasing consistently year by year, and Non-Banking Financial Companies are governed and regulated by the Reserve Bank of India (RBI). The Reserve Bank of India has been given the power to check on different types of NBFCs in India. In this blog, we discuss the basic requirements for NBFC Registration and different types of NBFCs in India based on their business activities and deposits.

Table of Contents

What is NBFC? – Overview

Before we discuss the different types of NBFCs in India, let us first discuss the meaning of NBFC. NBFC is a financial company incorporated under the Companies Act, 2013. Non-Banking Financial Company is governed by both the MCA (Ministry of Corporate Affairs) and RBI (Reserve Bank of India). Though Non-Banking Financial Company offers financial services and it is different from regular banks in many ways, i.e. it cannot accept savings, issue a cheque and various activities that a regular bank performs. Though its Personalized Customer services, Customized Loan Products, Implementation of advance Technology, Non-Banking Financial Company, helps in providing financial support to the financially weaker section of the society.

Also, Read: What are the Vital Documents Required for NBFC Registration?

Basic Requirements for NBFC Registration

In India, any company registered under the Companies Act 2013 or Companies Act, 1956 willing to start a financial business shall comply with the guidelines of the Reserve Bank of India (RBI). After registration, every Non-Banking Financial Company needs to attain a Certificate of Registration (COR) from the Reserve Bank of India to carry out any financial activity. For the registration, an applicant company is required to follow the following requirements:

- A company shall be registered under the Companies Act, 2013, or the Companies Act, 1956.

- NOF or Net Owned Fund shall be minimum of Rs. 2 crores.

- The financial activities are defined under Section 45I (a) of the RBI Act, 1934.

Different Types of NBFCs in India

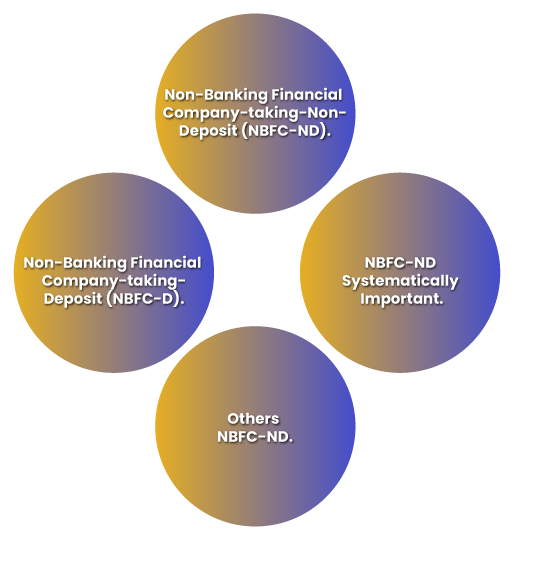

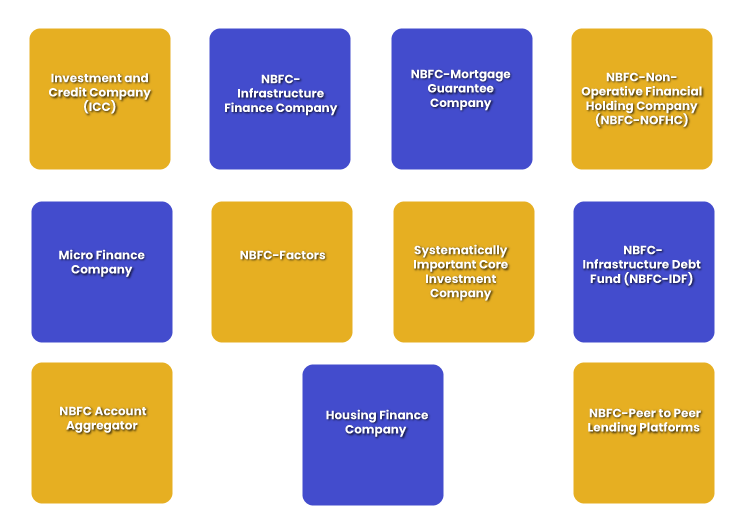

The growth and expansion of the NBFC have resulted in the classification of NBFCs, prearranged to focus on specific sectors or classes. The categories of NBFC is based on deposits, and the kind of business activity is performed. Below you can check the different types of NBFCs in India:

Based on Deposits, NBFC is classified as:

- Non-Banking Financial Company-taking-Deposit (NBFC-D).

- Non-Banking Financial Company-taking-Non-Deposit (NBFC-ND).

- NBFC-ND Systematically Important.

- Others NBFC-ND.

Based on Business Activity only, there are different types of NBFCs in India:

- Investment and Credit Company (ICC): This is a company carrying on its principal business-asset finance, providing finance whether by making advance or loans or otherwise for any activity other than its own and the acquisition of securities. In 2019, the RBI had released a notification on “Harmonization of NBFCs Categories”. In this notification, the Reserve Bank of India has decided to merge the three Non-Banking Financial Companies (Asset Company, Loan Company, and Investment Company) into a single named NBFC-ICC NBFC-Investment and Credit Company.

- NBFC-Infrastructure Finance Company: This Company utilizes at least 75% of its assets in infrastructure loans. An NBFC-Infrastructure Finance Company has a minimum Net Owned Fund (NOF) of Rs. 300 crores and a CRAR of 15%. Infrastructure Finance Company is a type of NBFC (Non-Banking Financial Company) which requires excellent credit rating from agencies of credit rating.

- NBFC-Mortgage Guarantee Company: This company is the Non-Banking Financial Company whose:

- NOF or Net Owned Fund of the Micro Finance Company is Rs. 100 crores.

- At least 90% turnover of the Micro Finance Company business is mortgage guarantee business.

- At least 90% of the total income of the Microfinance Company is from mortgage guarantee business.

- NBFC-Non-Operative Financial Holding Company (NBFC-NOFHC): With this company, a promoter or promoter groups will be authorized to set up a new bank, and it is a type of Non-Banking Financial Company which hold the bank and all other financial institutions regulated or governed by the Reserve Bank of India or other financial regulators, to the extent allowed under the applicable regulatory prescriptions.

- Micro Finance Company: In NBFC, Microfinance companies perform functions similar to Banks. Loans are provided by the Microfinance companies to various small businesses that don’t have any access to the banking channels and are not eligible for availing of loans.

Micro Finance Company shall qualify the following criteria:

- 85% of certified assets are to be maintained regularly.

- The loan offered by the Micro Finance Company to a borrower having an annual income:

- In the rural sector, not more than Rs. 1.25 lakhs.

- In the urban and semi-urban not more than Rs. 2 lakhs.

- The loan amount shall not more than Rs. 75 thousand in the 1st cycle and Rs. 1.25 lakhs in subsequent cycles. But, the tenure of the loan is not more than twenty-four months.

- The total of borrower’s indebtedness does not exceed Rs. 1.25 lakhs.

- Loan to be provided without collateral.

- The loan repayment is at the borrower’s choice.

- NBFC-Factors: This is a different type of NBFC (Non-deposit taking) engaged in the principal business of factoring. The financial assets in the NBFC Factor should aggregate at least 50% of its total assets and income obtained from factoring business should at least 50% of the gross income.

- Systematically Important Core Investment Company: This is a type of NBFC which carry on the business of share and securities acquisition but subject to a condition that:

- CIC-ND-SI Assets shall be over 100 crores and above.

- It shall hold at least 90% of its assets in investments in shares and securities with a further condition that out of 90% at least 60% of its net assets shall be invested in equity shares.

- NBFC-Infrastructure Debt Fund (NBFC-IDF): It is a non-deposit taking Non-Banking Financial Company that deals in the facilitation of long-term debt into an infrastructure sector. NBFC-IDF raises the resources either through dollar or rupee-denominated bonds of five years and can only be supported by Infrastructure Finance Company.

- NBFC Account Aggregator: It’s a new concept in the NBFC. It provides data of users and shifts their financial needs to various financial institutions. The activities of an NBFC-Account Aggregator involve providing financial information in a combined and retrievable manner to the clients, and it also provides reliable information.

- Housing Finance Company: It is a form of Non-Banking Financial Company with the business of financing the construction of houses. Housing Finance Company are governed by RBI or the Reserve Bank of India, and it cannot begin the business without attaining a Certificate of Registration from RBI.

- NBFC-Peer to Peer Lending Platforms: This provides a platform to bring borrowers and lenders together by using a digital stage. NBFC-Peer to Peer Lending Platforms also provides an opportunity for investors to expand their portfolio. NBFC-Peer to Peer Lending Platforms has removed the burdensome loan process and has provided loan processing comfort.

Conclusion

In India, you may quickly find out the list of registered NBFCs. It is available on the website of Reserve Bank of India. The directions related to different types of NBFCs are hosted at www.rbi.org.in. No company can mislead the public by making a false impression of being regulated by the RBI.

Also, Read: A Complete Guide on NBFC Funding In India