Benefits of FFMC License from RBI: A Complete Guide

Shivani Jain | Updated: Feb 27, 2021 | Category: FFMC, RBI Advisory

Due to a sudden increase in the foreign trips, the option to have a money changer business is very much in trend. Any entity or an individual who wants to deal in Money Exchange activities needs to obtain FFMC License from RBI. The term FFMC stands for Full Fledged Money Changer License and is granted based on the provisions of section 10 of FEMA 1999. In this blog, we will cover the concept and benefits of FFMC License from RBI.

Table of Contents

Concept of Full Fledged Money Changer License

A company that wants to carry out the activities of foreign currency exchange needs to obtain prior approval from RBI in the form of FFMC License. Further, such a license or permit to operate is granted under the provisions of section 10 of FEMA 1999.

However, it shall be noted that this license is issued only for the activities as permitted by the Apex Bank. Also, the entities engaged in the business of currency exchange are known as Authorised Money Changers.

Also, Read: Discover the List of Documents Required for FFMC License in Delhi

Different Types of AMC License

The different types of AMC or Authorised Money Changer License are as follows:

- AD Category – I Banks;

- AD Category – II;

- FFMCs;

Further, the terms AD and FFMC stand for Authorised Dealers and Full Fledged Money Changers respectively.

Regulatory Framework for Authorised Money Changer License

Any individual wants to undertake the activities pertaining to money or foreign exchange must apply to acquire FFMC License under the provisions of section 10 of the Foreign Exchange Management Act 1999.

Also, it shall be noteworthy to state that any person or a business carrying out the operations of money exchange without a valid AMC License, then the same will be held liable under the provisions of FEMA 1999.

Conditions to Avail Benefits of FFMC License from RBI

The conditions required to avail of benefits of FFMC License from RBI are as follows:

- Registration under the Companies Act 2013;

- In the case of Single Branch, Rs 25 lakhs as the minimum NOF (Net Owned Fund);

- In the cash of Multiple Branch, Rs 50 lakhs as the minimums NOF;

- The object clause of the MOA (Memorandum of Association) must reflect the intention to carry out money changing activities;

- Must not have any pending proceedings or investigation with the DOE (Department of Enforcement) or DOR (Department of Revenue);

- Should start the business operations within six months from the date of issuance of license by RBI;

Permitted Activities for Money Changers

The activities permitted for an Authorised Money Changer are as follows:

- A Money Changer can undertake the activities such as Currency Notes, Conversion of Foreign Currency into Indian Currency, Travellers’ Cheque, etc.;

- To carry out the restricted activities, a money changer needs to obtain prior permission from the RBI in the form of Franchise Agreement;

- A Money Changer is eligible to freely operate in Travellers’ Cheque, and Coins and Currencies of both NRIs and Indian Residents;

- An AMC license holder can easily deal in the International Debit or Credit Card of Foreigners;

- A registered AMC can sell foreign currency in exchange of Forex Prepaid Cards; Personal Visits, and Business Transactions;

Documents Required to Avail Benefits of FFMC License from RBI

The documents required to avail of benefits of FFMC License from RBI are as follows:

- A copy of COI (Certificate of Incorporation);

- A copy of COC (Certificate of Commencement);

- MOA and AOA of the applicant company;

- Latest audited financial statements of the applicant company;

- A declaration concerning company’s NOF (Net Owned Funds) from the Statutory Auditors;

- Audited Balance Sheets for previous three financial years;

- Audited Profit and Loss Account for the previous three financial years;

- Confidential Report from Bank in a sealed cover;

- Details regarding the nature of the undertaken activities;

- Details of the Associated Companies;

- Certified copy of the Board Resolution passed;

- Certified copy of declaration concerning KYC (Know Your Customer);

- Declaration regarding the AML (Anti Money Laundering);

- Declaration regarding the CFT (Combating the Financing of Terrorism Customer Data);

- Certified copy of the declaration from the Department of Revenue Intelligence, stating that there are no pending proceedings against the applicant company;

Procedure to Avail Benefits of FFMC License from RBI

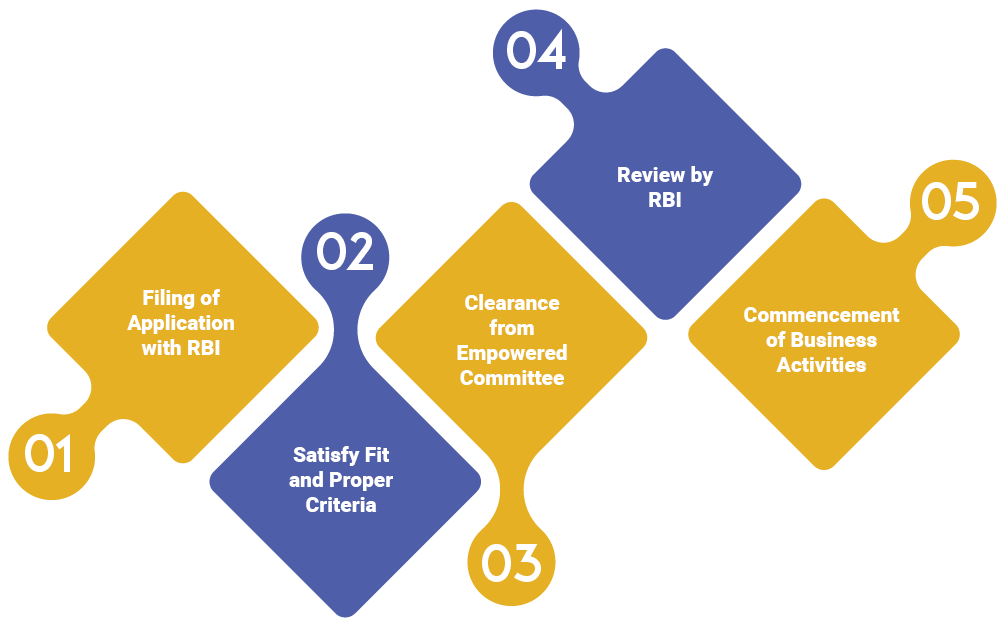

The steps involved in the procedure to avail of benefits of FFMC License from RBI are as follows:

Filing of Application with RBI

Firstly, the applicant needs to furnish an application form for registration with the Apex Bank in the format specified under Annexure – II. The same will be filed at the regional office of the RBI. Also, the applicant company needs to annex the required documents with the application form as well.

Satisfy Fit and Proper Criteria

In the next step for the procedure to avail benefits of FFMC license from RBI, the said applicant needs to satisfy the Fit and Proper Criteria. Also, it is compulsory for the directors of the company to undergo the process of Due Diligence.

The main use of Fit and Proper Criteria is to determine the Expertise, Integrity, Track Record, Qualifications, of the person being appointed as the Director.

Prerequisites of Fit and Proper Criteria

The prerequisites of Fit and Proper Criteria are as follows:

- Should be up to 70 years in age;

- Should not be a member of Legislative Assembly;

- Should not have any Previous Criminal Record;

- Should be the Member of Parliament;

- Should not have received any Sanctions from the Governing Bodies;

- Should not have any previous history of Fraudulent Practises;

Clearance from Empowered Committee

Now, the applicant company requires to obtain clearance from the Empowered Committee. The same will be provided only after proper verification.

Review by RBI

Further, the Apex Bank will review the application and documents submitted and will check whether the company has satisfied the fit and proper criteria or not. Further, if the RBI is satisfied with everything furnished, it will grant the AMC license to the applicant within a period of 2 to 3 months.

Commencement of Business Activities

Once the company has received the FFMC License, it need to start the business activities within a period of six months from the date of grant of license.

Also, it needs to furnish duplicate copy of the documents as follows before the RBI:

- Possession Certificate;

- Lease Agreement;

- Shop and Establishment License;

Conclusion

In a nutshell, to operate as a money changer and to avail of the benefits of FFMC License from RBI, the applicant needs to comply with the provisions of section 10 of FEMA 1999. Also, it shall be noted that no one other than that an Authorised Money Changer is allowed to deal in the activities concerning the foreign currency exchange, and the only authority to grant such license is with the Reserve Bank of India.

Also, Read: FFMC Compliances: A Guide on Pre and Post Registration Compliances