Importance of Micro Finance Company Registration in India

Japsanjam Kaur Wadhera | Updated: Jan 21, 2021 | Category: Microfinance Company

Micro Finance Companies are the financial institutions that provide finances to the people who have low income and the financial requirement is less as compared to the other sectors of the society. Such people in requirement of the finance do not have access to traditional financial institutions such as banks and other financial institutions. There are two types of micro finance companies in India that is Non Banking Financial Companies (NBFC) and Section 8 Company. The NBFC is required to be registered with the RBI and the Section 8 Company is a non- profit organisation and does not need RBI approval. This article will talk about the importance of Micro Finance Company Registration in India.

Table of Contents

Objective/ Need for Micro Finance Company

The objective or need for Micro Finance Company in India is for the following purposes: –

- It helps in starting up by supporting the small businesses.

- It provides financial assistance to firms or companies that cannot place any security or collateral.

- It helps in providing a nominal amount as well, which are generally funded as hand loans to the people.

- It encourages women to entrepreneurship.

- It brings discipline in borrowing by formalizing the process of lending to low-income groups. This helps to prevent over-borrowing and reduces complications arising from high future debts.

- Gives opportunity to the low-income groups in becoming self-sufficient.

- Offering banking services at small amounts.

- Provides access to quality health care.

- Creates opportunities for self-employment.

How is Micro Finance Company Registration done in India?

Generally, only Non Banking Financial Companies are allowed to conduct financial business as authorized by the Reserve Bank of India. However, there are certain exceptions as provided by RBI for some businesses to perform financial activities to a specific limit. A Micro Finance Company Registration can be done in 2 ways in India, such as: –

- Non Banking Financial Companies (NBFC) registered with RBI.

- Section 8 Companies under Companies Act, 2013.

Micro Finance Company Registration as NBFC in India

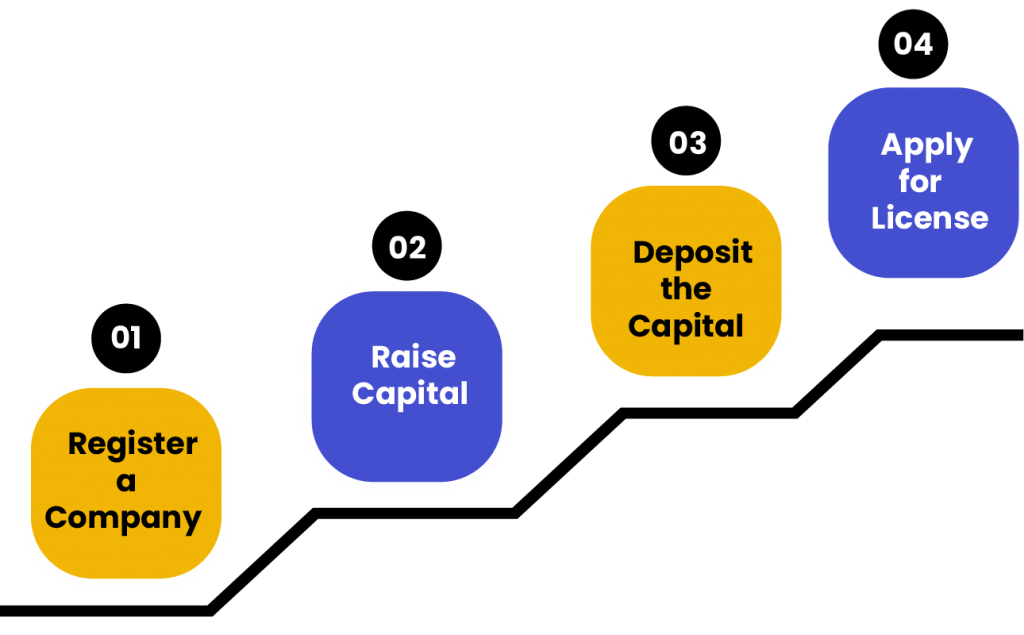

The Micro Finance Company Registration as NBFC in India is done in the following manner:

Register a Company

To register as a micro finance NBFC, the first step is to form a public or private company. At least 2 members and a capital of Rs 1 Lakh is required to form a private company and at least 7 members are required to form a public company.

Raise Capital

The next step is to raise the required minimum net owned funds of Rs 5 crore and for the northeastern region, the requirement is of 2 crores.

Deposit the Capital

The next step is to deposit the capital in the bank and obtain “No lien” certificate for the same.

Apply for License

Further, an online application is required to be filled by the NBFC for the license and submit it along with the certified documents. It is also mandatory to submit the hard copy of the application and the license at the regional office of the Reserve Bank of India. Finally, wait and coordinate with the RBI for further instructions.

Documents required for the Micro Finance Company Registration as NBFC

The following documents are required to be submitted by the NBFC for the registration: –

- Memorandum of Association (MOA) and Articles of Association (AOA).

- Copy of Board Resolution.

- Company’s Incorporation Certificate.

- Copy of Auditors report of receipt or fixed deposit receipt.

- Banker’s report about the company.

- Banker certificate of No lien stating the net owned worth.

- Directors’ Net worth certificate.

- Directors recent credit report.

- Director’s KYC and income proof.

- Education and qualification proof of the directors.

- Organization’s structural plan.

- Proof of working experience in the financial sector.

Micro Finance Company Registration as Section 8 Company

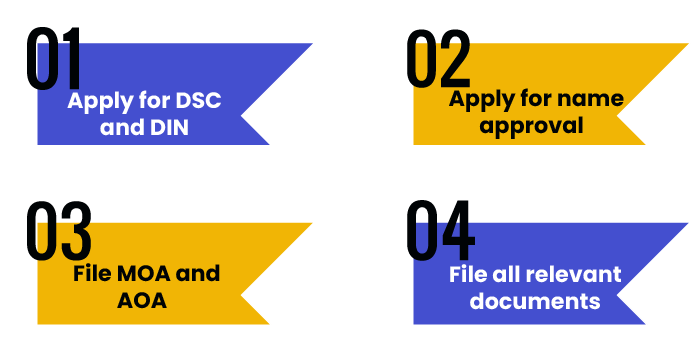

The Micro Finance Company Registration as Section 8 Company in India is done in the following manner:

Apply for DSC and DIN

The first step to register a company is to apply for the digital signature certificate (DSC) and director identification number (DIN). It is essential to obtain DSC for authorizing the e- form.

Apply for name approval

The next step in the Importance of Micro Finance Company Registration as Section 8 Company is to apply for name approval in Form INC- 1. The name must suggest that it is registered as a section 8 company. So the words such as foundation, Sanstha or micro credit must be used.

File MOA and AOA

Once the company has applied for name approval, the next step is to draft the Memorandum of Association (MOA) and Articles of Association (AOA) and file it along with the required documents.

File all relevant documents

The final step is to file all the necessary documents along with the incorporation certificate and Form INC- 12 to obtain the license.

Documents required for the Micro Finance Company Registration as Section 8 Company

- Identity proof documents.

- PAN Card[1] of all the promoters and directors.

- Address proof documents.

- Photograph of all the promoters and directors.

- If the office is rented then the No Objection Certificate of the owner.

- If the office is self-owned, then the proof of ownership of the registered office, that is an electricity bill or water bill.

- Applicable stamp duty as mandated by the state.

- Any other documents as required.

Difference between Micro Finance Company as NBFC and Section 8 Company

|

Basis of Difference |

NBFC |

Section 8 Company |

|

RBI approval |

NBFC requires RBI approval. |

Section 8 Company does not require RBI approval. |

|

Minimum Capital |

Requires minimum net owner funds of Rs 5 crore and for the north eastern region the requirement is of 2 crore. |

No minimum capital requirement. |

|

Director Experience |

One director must have the experience in financial services of more than 10 years. |

No prior experience required. |

|

Compliance |

Heavy Compliance. |

Less compliance. |

|

Loan Limit |

Maximum of 10% of total assets. |

Loan up to Rs. 1. 25 lakh to dwelling residence and unsecured loans of Rs 50,000 to small businesses. |

|

Cost of Registration |

High Cost, Rs 4 to 5 lakh. |

Low cost, Rs. 25,000. |

|

Loan |

As defined by RBI. |

Gives unsecured loan to small businesses, households etc. |

|

Complexity of micro finance company registration |

All processes involved in forming a company have to be performed. |

Simple as compared to NBFC as it is a non- profit organization. |

|

No of Members |

Minimum 2 members in case of private limited company and minimum 7 members in case of public limited company. |

Minimum 2 members are required. |

|

Interest Rate |

As per RBI guidelines. |

As per RBI guidelines. |

|

Organization Status |

Profit organization. |

Non- profit organization. |

Conclusion

A Micro finance company can provide loans to the people at very inexpensive rates as directed by the Central government and the RBI. It is clear from the above information that Importance of Micro Finance Company Registration as Section 8 Company is relatively easier; however, the lending capacity is also very limited. A company must take into consideration all the information and facts and make a wise decision to whether to start micro finance company as NBFC or a Section company.

Also, Read: A Complete Summary of NBFC Compliance under FEMA