What are the Benefits of Mergers and Acquisitions?

Karan Singh | Updated: Feb 24, 2021 | Category: Mergers and Acquisitions

Mergers and Acquisitions (M&A) is the best way to reach exponential heights and continue to create attention, and it is the process of one company combining with another company. Nowadays, it has become an essential part of the Indian Economy. The term acquisition means one company purchases the other outright. In contrast, a merger means a combination of two or more companies or firms that form a new company under one company’s banner. But in terms of execution, they both are dissimilar. In this blog, we discuss the Benefits of Mergers and Acquisitions.

Table of Contents

What are Mergers and Acquisitions?

Before we discuss the benefits of mergers and acquisitions, let us first understand the meaning of Mergers and Acquisitions. Merger and Acquisitions state to transactions between two different companies combining in some form. Although they both are used interchangeably, they come with different legal meanings. In a merger, two different companies of the same size combine together to form a new company, whereas, in an acquisition, when a bigger company acquires or buy a smaller company, thereby absorbing the smaller company’s business. Mergers and Acquisitions deals can be hostile or responsive depending on the approval of the target company’ board.

Roles and responsibilities in the Mergers & Acquisitions Process

Below is a list of some roles and responsibilities in the Mergers & Acquisitions Process:

- CEO: CEO signs off on the deals and take all the responsibilities for decision making based on rewards and risks.

- CFO: CFO or Chief Financial Officer[1] is responsible for evaluating all the liabilities and risks related to deal reward, finance, managing the due diligence process, and reporting all this information to the CEO of the company.

- Legal: Most companies take some legal help to guide them through the deal and help them follow and meet all the legal parameters.

- Investment Bankers: In the Mergers & Acquisitions process, the investment bankers act as a financial advisor and signify either the seller or buyer at the time of the Mergers & Acquisitions process.

- External Consultant: Most companies take help from third-party consultant to help in the evaluation and in the process of due diligence. In this process, you may face some issues or problems objectively.

Read our article:Mergers and Acquisitions: Trends and Outlook in this Sector

Benefits of Mergers and Acquisitions

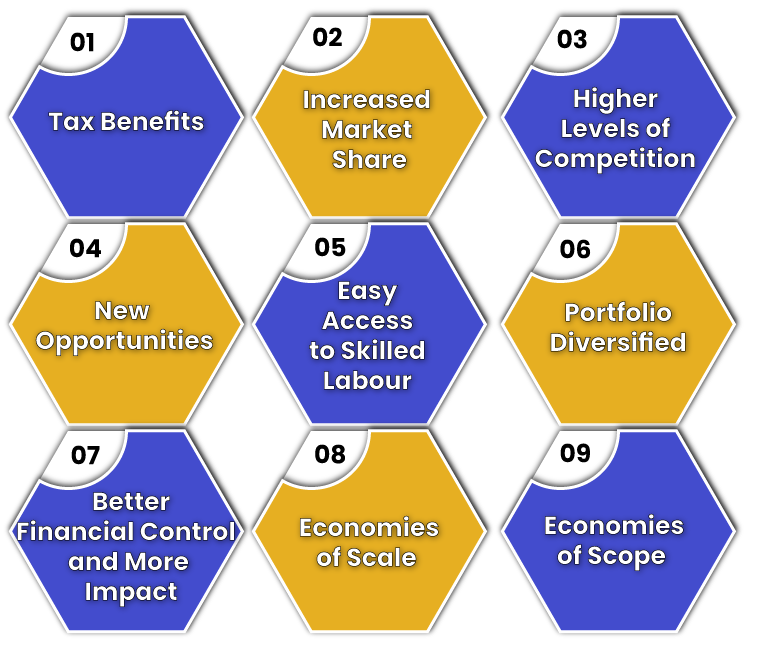

Following is the list of all the benefits of mergers and acquisitions:

- Tax Benefits: Sometimes, acquisitions bring tax benefits if the targeted company is in a strategic industry or a country with a promising tax regime.

- Increased Market Share: One of the most common purposes of undertaking mergers and acquisition is increased market share. Generally, retail banks have looked at geographical footmark as being key to accomplishing market share. As a result, there is always a high level of the industry association in retail banking. For example, a Spanish Retail Bank Santander, which has made the acquisition of smaller banks on policy, allowing Santander to become one of the biggest retail banks in the world.

- Higher Levels of Competition: Larger the company, the more competitive it becomes. This is one of the benefits of economies of scale: being allows you to compete for more. There are numbers of unknown companies entering the plant-based meat market, offering a range of vegetable-based meats.

- New Opportunities: If you are a businessman or an investor who wants to enter India and is struggling to carry out the business, you no need to worry; there are lavish opportunities available in India. Mergers and Acquisitions save the time and energy of an individual. By changing the business structure, and with some documentation, a business can recover itself and increase the company’s value.

- Easy Access to Skilled Labour: Especially in India, where the population is huge, and the number of jobs isn’t suitable due to the formation of a new venture, there will be new job opportunities to carry out business. With Mergers and Acquisition, the company will prefer recollecting their present employees and fulfil all the legal requirements. There is much availability of skilled labour in India, but the opportunities are not as per the demand, which can be achieved by this reformation.

- Portfolio Diversified: Under Mergers and Acquisitions (M&A), there is a vast availability of new goods, products, and services that can be used to raise the company. To better estimate a company, it is advisable to go through with the services of mergers and acquisitions. A newly established company will increase more experience and will enlarge access to a larger market share.

- Better Financial Control and More Impact: Mergers and Acquisitions provide financial strength as the resources and employees already exist in the company; only the structure needs to be improved, which eventually gains the growth of both the businesses. As a result, the more the financial strength more it will impact the consumers by shrinking the competition.

- Economies of Scale: Supporting all the activities of Mergers and Acquisitions is the promise of economies of scale. The benefits that will come after becoming huge:

- Lower costs.

- Better bargaining power with distributors.

- Increased access to capital.

9. Economies of Scope: Mergers and Acquisitions helps to bring economies of scope, which is very tough through organic growth, and it allows the companies to tap into the demand of a much larger customer’s base.

Conclusion

Besides this list, as mentioned above in this blog, there are several Benefits of Mergers and Acquisitions. The activities of M&A plays a vital role in a company’s growth, and its benefits improve and support long-term development. This method is one of the most useful ways to overcome present difficulties and enhance the company’s growth.

Read our article:Cross Border Mergers and Acquisitions in India: A Complete Guide