Overview of Mergers and Acquisitions

Nowadays, Merger and Acquisition is the pathway businesses choose to reach exponential heights and continue to engender attention. The Indian Merger and Acquisition sector works in a similar fashion and has observed various large M&A deals in the past few years in the banking, insurance, and telecom sectors. Hence, over a period, M&A has become an essential part of the Indian Economy.

Further, time and again. M&A are misunderstood as one since both the terms denote consolidation of two or more companies. However, they are complete opposites in terms of their implementation.

The term “merger” means a combination of two or more companies that agree to merge and structure a new company. Moreover, the process of merger is carried out with the intent to boost business growth and increase its goodwill and reach. In contrast, acquisition is an act where an acquirer company acquires a target company by way of a legal agreement.

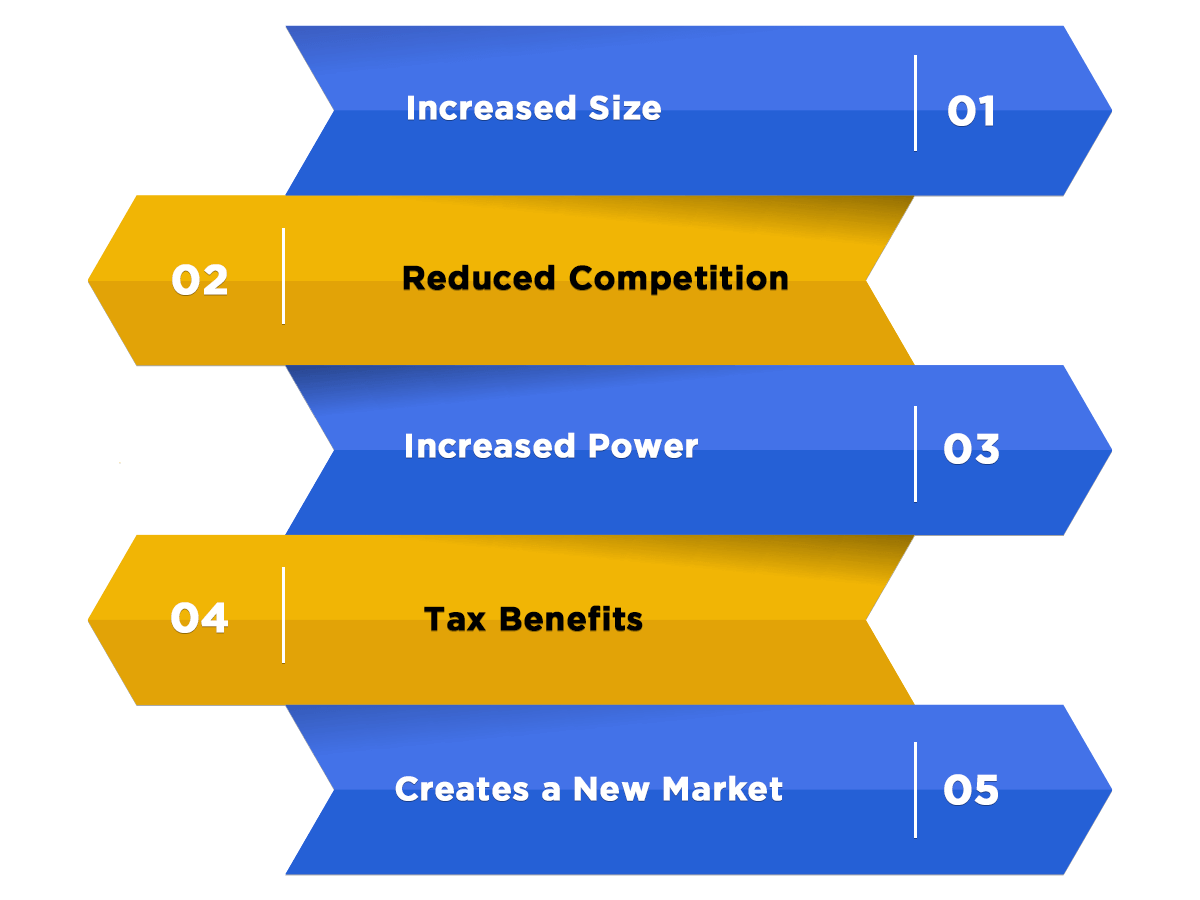

Advantages of Merger and Acquisition

The advantages of Merger and Acquisition are as follows:

- Increased Size

The process of M&A assists companies in increasing their net worth and operations, which may take years otherwise. Moreover, these strategic tools help in boosting the company’s share price.

- Reduced Competition

The combined capitals and reserves of the newly formed company help it in reducing competition and gaining a competitive edge.

- Increased Power

The synergy formed by the combination of two or more companies is powerful enough to dominate other market players, guarantee better performance, ensure financial gains, etc. Additionally, it simplifies the task of attracting a larger customer base.

- Tax Benefits

A also provides various tax benefits to the involved companies. The losses incurred by one entity are set off against the profits generated by another entity, in that way minimising the tax liability.

- Creates a New Market

Since M&A makes two companies work together, it provides better sales prospects. Besides this, M&A also assists in increasing the market reach of the business.

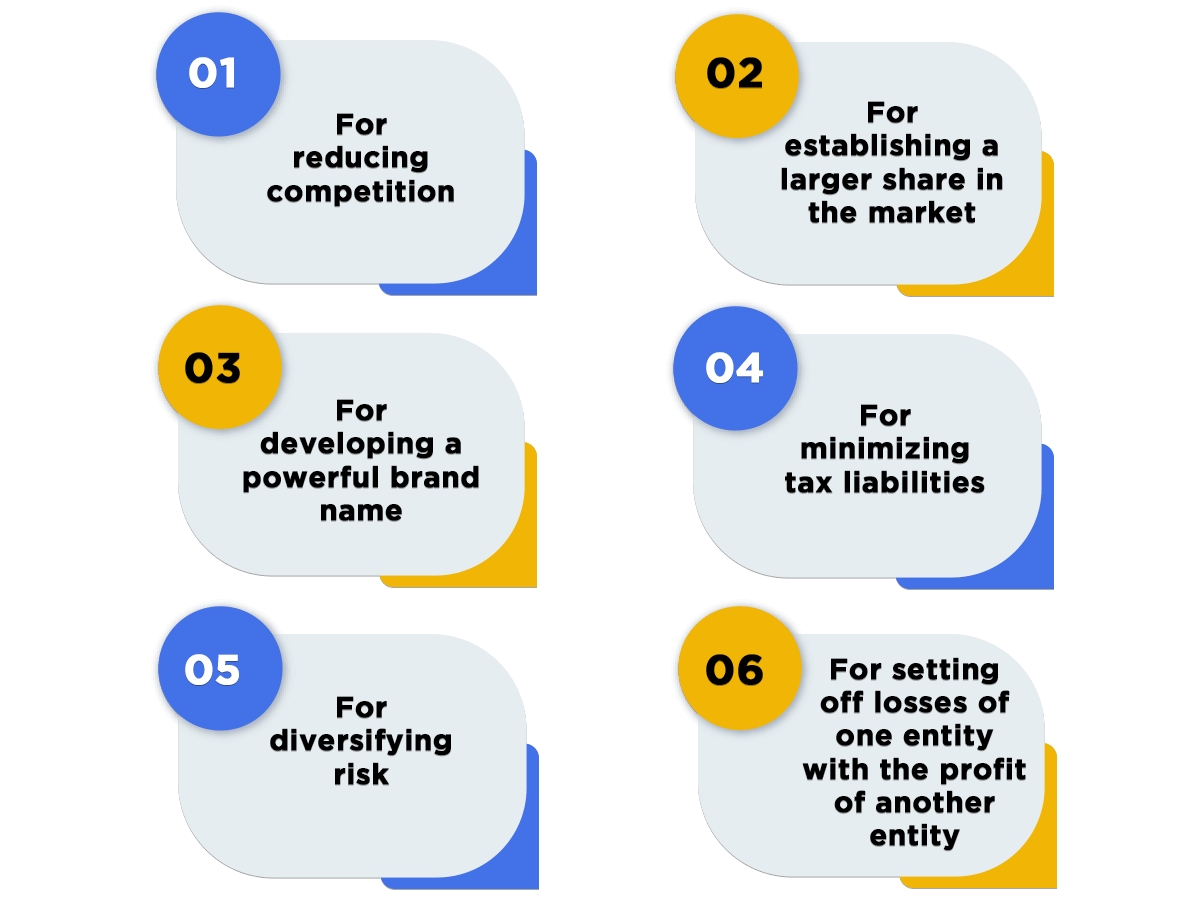

Reasons to Choose Mergers and Acquisitions

The process of Mergers and Acquisitions in India is considered by the companies to augment their business at a global level and ensure sustainable development of their business. The following are the reasons why companies choose M&A:

- For reducing competition;

- For establishing a larger share in the market;

- For developing a powerful brand name;

- For minimising tax liabilities;

- For diversifying risk;

- For setting off losses of one entity with the profit of another entity.

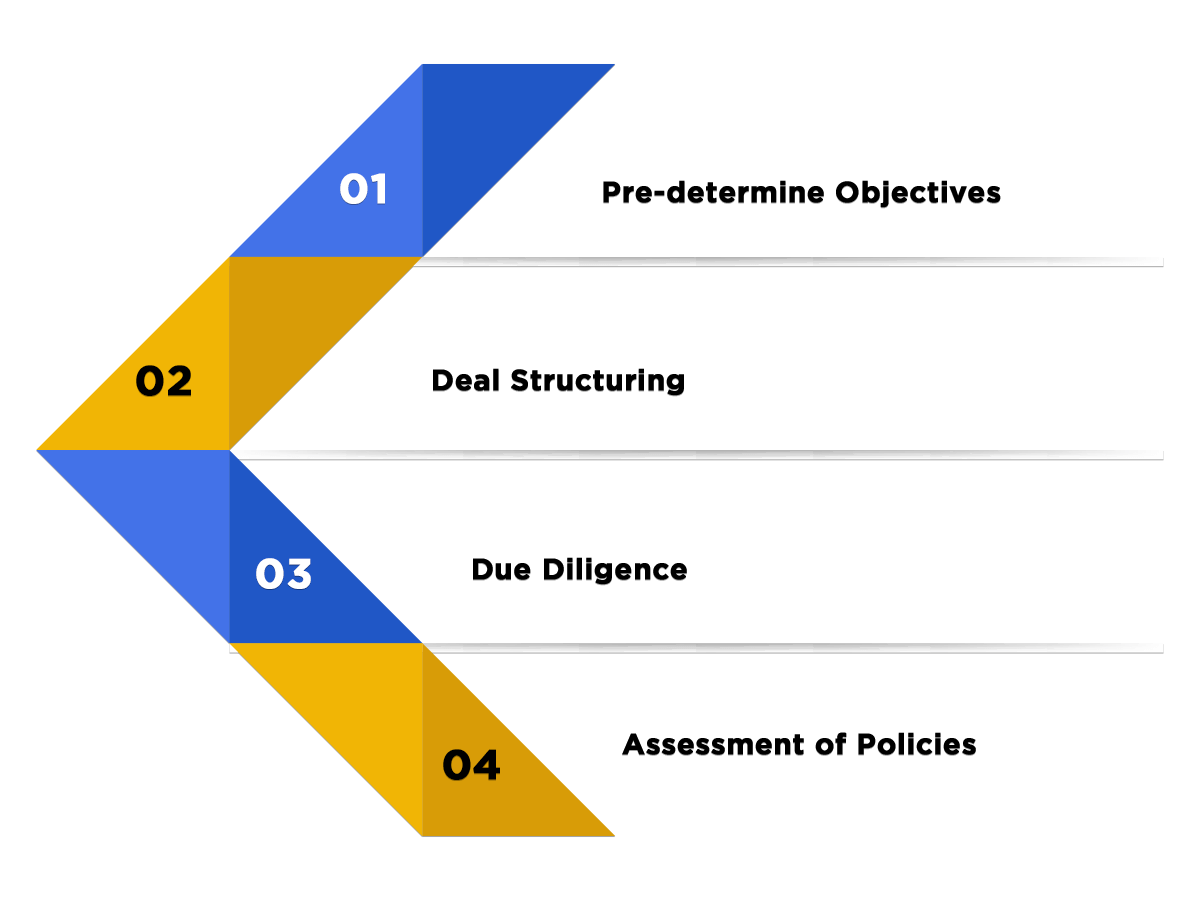

Things to consider before undertaking Merger and Acquisition

The following must be considered before undertaking the process of Merger and Acquisition:

- Pre-determine Objectives

To simply the process of M&A, it is significant to pre-determine the objectives of the Company. Further, it is also necessary to timely check whether the other company was able to achieve the desired goals or not.

- Deal Structuring

It is the most significant part of any M&A deal. Both the acquirer and the target company are required to resolve all the probable differences beforehand, like financial liabilities, price of the deal, sharing of assets, etc.

- Due Diligence

Based on the nature of the industry, various types of taxes are levied which involve constant regulatory supervision. By conducting tax due diligence, the acquirer company gets an overview of the target company in terms of transfer pricing, ITR filing and other tax liabilities.

- Assessment of Policies

All the insurance policies concerning intellectual property, employee liability and general liability of the target Company must be inspected by the acquirer company to determine whether they will be favourable for the company or not.

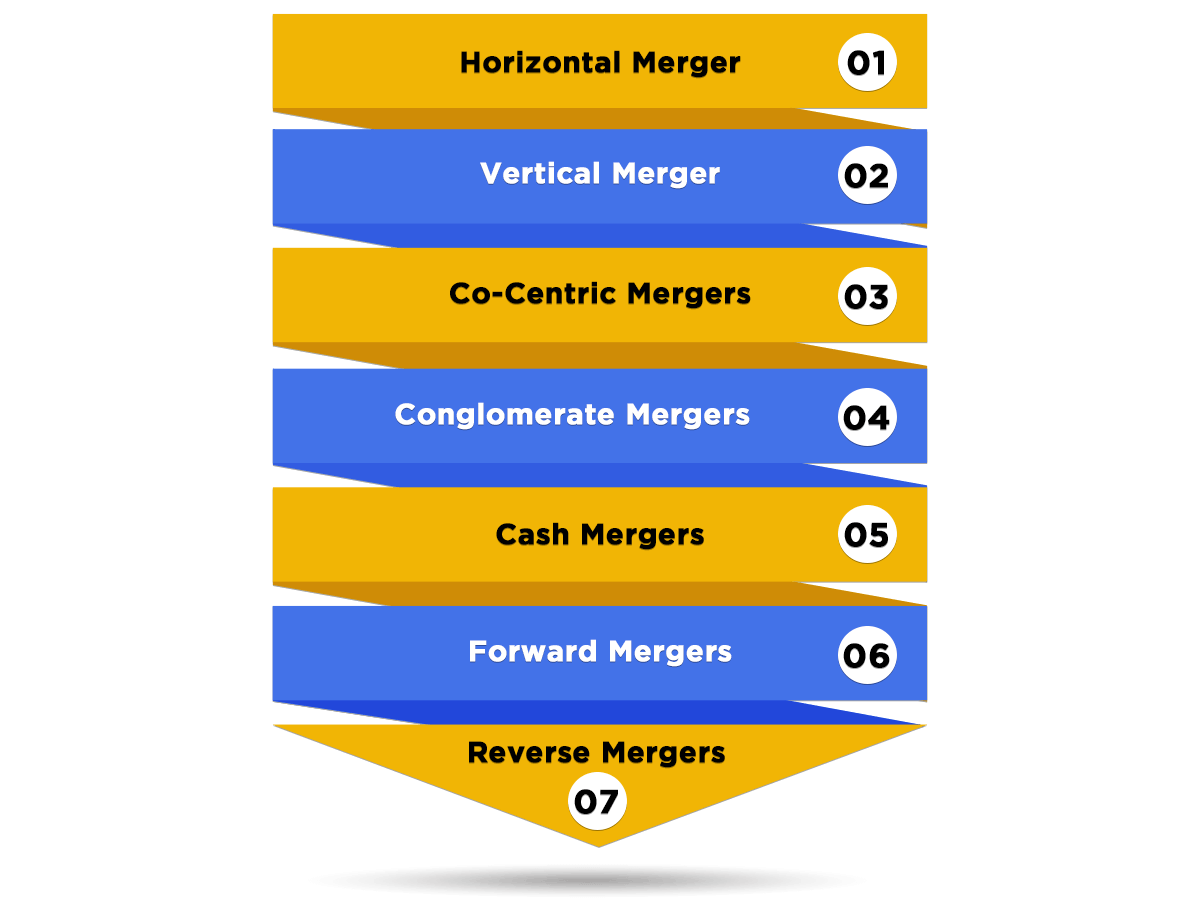

Types of Mergers and Acquisition in India

The different types of mergers and acquisition in India are as follows:

- Horizontal Merger

The term horizontal merger means the combination of two or more companies dealing in the same type of products. The main aim behind this merger is to expand the market reach, acquire a dominant position, and reduce competition. For example: Mergers of Hindustan Unilever and Patanjali; Brooke Bond and Lipton India.

- Vertical Merger

The purpose of a vertical merger is to combine two companies dealing with similar products. However, the stages of production at which they are functioning are different. For example: Reliance and FLAG Telecom group.

- Co-Centric Mergers

A co-centric merger takes place between the companies serving the same type of customers. In this case, the products of both companies complement each other even if the products are completely different. For Example: Citi Group acquiring Salomon Smith Barney; Axis Bank acquiring Freecharge; Flipkart acquiring Walmart.

- Conglomerate Mergers

When two unrelated industries/ companies combine with each other, it is known as conglomerate mergers. The goals and purposes of both companies are entirely different from each other. However, the main objective of this merger is to increase business in terms of size and operations. For example: L&T and Voltas Ltd.

- Cash Mergers

In cash mergers, shareholders are offered cash instead of the shares of the merger company.

- Forward Mergers

In forward mergers, a company decides to merge with its customer. For example: ICICI Bank acquired Bank of Mathura.

- Reverse Mergers

When a business establishment decides to merge with its raw material suppliers. For example: merger of the Godrej soap with the Gujarat Godrej Innovative Chemicals.

Governing Laws for Merger and Acquisition

In India, the concept of Merger and Acquisition is primarily governed by the provisions of the Companies (Compromises, Arrangements and Amalgamations) Rules, 2016, and section 230 read with section 232 of the Companies Act, 2013. However, the following key legislation also regulate the activities of Merger and Acquisition in India:

- Securities Regulations:

- Securities Exchange Board of India, 1992;

- The SEBI (Substantial Acquisition of Shares and Takeovers) Regulations, 2011;

- The SEBI (Delisting of Equity Shares) Regulations, 2009.

- Foreign Exchange Management Act, 1999;

- Competition Act, 2002;

- Income Tax Act, 1961;

- Insolvency and Bankruptcy Code, 2016.

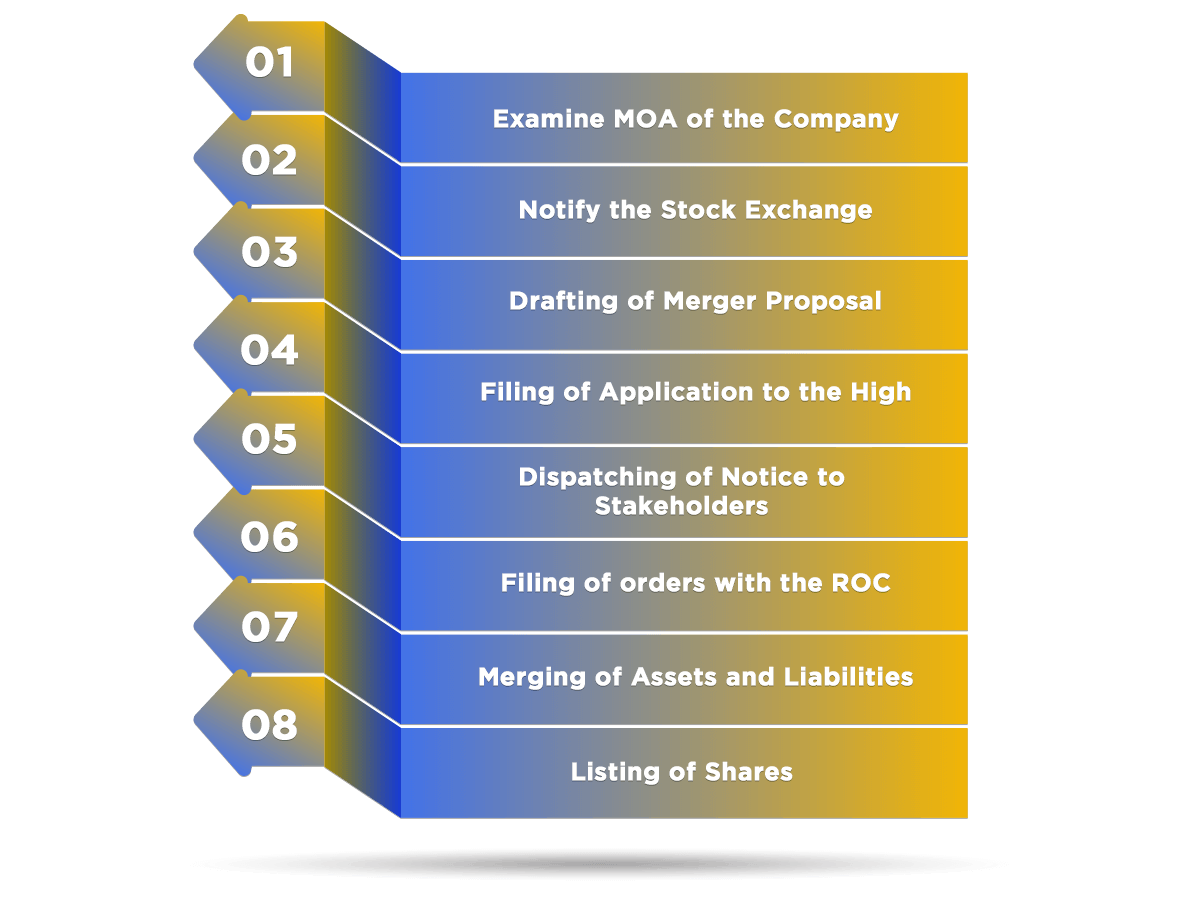

Procedure for Merger and Acquisition in India

The steps involved in the procedure of merger and acquisition are as follows:

- Examine MOA of the Company

The first and the foremost step in an M&A deal is to duly examine the company’s MOA (Memorandum of Association). The same is done to confirm whether the object clause of the company grants the power of merger or not.

- Notify the Stock Exchange

In the next step, the companies which are going to enter in an M&A deal, must inform the recognised stock exchange about the same. Moreover, they need to send copies of orders, notices, and resolutions to the stock exchange within a prescribed period.

- Drafting of Merger Proposal

After that, the Boards of the Director (BOD) of both the companies need to confirm the drafting of the merger proposal. Moreover, they are also required to pass a special resolution (SR) to authorise its KMP (Key Managerial Personnel) to carry out the matter.

- Filing of Application to the High Court

After obtaining the confirmation from the Boards of Directors, both the companies are required to apply to the High Court of the respective state, where the company’s registered office is located.

- Dispatching of Notice to Stakeholders

If the High Court approves the application, the company is required to send a notice regarding a meeting to all the stakeholders, i.e., shareholders and creditors. The notice must be sent at least twenty-one days before the date of the meeting. Moreover, the notice must also be published in two newspapers, i.e., in English and Vernacular newspapers.

- Filing of orders with the ROC

Thereafter, the company needs to file a certified copy of the order passed by the High Court with the ROC (Registrar of Companies) within the stipulated period as prescribed by the High Court.

- Merging of Assets and Liabilities

The concerned companies can then combine their assets and liabilities as per the stipulations mentioned in the merger proposal to complete the process of merger.

- Listing of Shares

Lastly, when both the companies have been combined as one and received the status of a separate legal entity, the company formed is qualified to list its shares on the recognised stock exchange.

Difference between Merger and Acquisition

|

S.no |

Point of Difference |

Merger |

Acquisition |

|

1. |

Definition |

When two or more entities come forward to work together as one, it is termed as merger. |

When one company acquires the control and management of another company, it is termed as acquisition. |

|

2. |

Terms |

Mergers are always planned and happen with the mutual consent of the parties. |

At times, acquisition can be hostile and involuntary. |

|

3. |

Title |

A new name is given to the merged company. |

No new name is given to the target company. |

|

4. |

Scenario |

Two or more companies who work similarly tend to choose the process of merger. |

It shall be pertinent to consider that the target company is always smaller in terms of size, operations, growth, market than the acquirer company. |

|

5. |

Authority |

Both the companies are same in terms of authority. |

The acquirer company supervises and monitors the operation of the target company. |

|

6. |

Stocks |

New stocks are issued for the merged company. |

No new stocks are issues for the acquired company. |

|

7. |

Legal Formalities |

Legal compliances are more in the process of merger. |

Legal compliances are comparatively less in the process of acquisition. |

|

8. |

Purpose |

The main purpose of the merger is to reduce competition and to boost operational competence. |

The main purpose of the acquisition is to acquire instant growth. |

|

9. |

Example |

The merger of Max HealthCare with Radiant Life. |

Acquisition of Jaguar Land Rover by the Tata Motors Private Ltd. |

FAQs of Mergers and Acquisitions

The term mergers and acquisitions (M&A) denotes the consolidation or alliance of companies. Further, it is a combination of two companies coming together to form one.

The term “Acquisition” denotes the process wherein one company is taken over by another company.

The term “cross border mergers and acquisitions” denotes the deals in which the acquirer company is situated in one country and the target company situated in another company.

The main aim of doing Cross Border Merger and Acquisition is that the acquirer wants to expand its operations at a global level by having a local business in that country.

The term Due Diligence denotes the process of audit or investigation of a deal or an investment opportunity.

The main aim of the process of Due Diligence is that it provides buyers an assurance of what they are buying.

The process of Due Diligence helps a buyer in understanding the growth potential of a business, different synergies, and ways of getting more customers.

A synergy arises when the combined worth of both the entities is higher than the pre-merger worth of both the firms.

The reasons for the Failure of Mergers and Acquisition are Misled Value for Investment; Poor Integration Process; Mismatch in the Culture, Poor Communication; External Factors, and Negotiation Errors.

The reasons for entering into Merger and Acquisition are to eradicate competition; establishing a bigger market share; creating a powerful brand; and setting off the losses of one company with the profits of another company.

The concept of Mergers and Acquisitions in India are governed and regulated by the provisions of Companies (Compromises, Arrangements and Amalgamations) Rules 2016, and under section 230 read with section 232 of the Companies Act, 2013.

The term “Major Factors” include Value Creation, Diversification, Acquisition of Assets, Increase in Financial Capacity, Tax Purposes, Incentive for Managers, Economies of scale, Acceleration of growth, Improve Company’s Performance, Due Diligence, Gaining entry into new markets, Strategic Drivers, Increased Market Share, and Obtaining New Products.

It helps in determining a fair value for the companies engaged in the transactions. Further, these banks also introduce new securities in the market to finance the activity of mergers and acquisitions.

The benefits of mergers and acquisition Increased Size, Reduced Competition, Increased Powers, Tax Benefits, Better Research and Visibility, and Synergies and Economies of Scale.

Synergies happen when two companies of a similar nature and type of business combine with each other.

The factors included are the Number of Clients, Revenue Generated, Revenue per Client, Run rate Savings, Cross-Selling of Services, Cash Flows, Clients Complaints, Quality of New Clients, Stress level of the Staff Employed, and Staff turnover.

The major disadvantages of mergers and acquisitions are the Substantial Increase in Price, Employees Losing their Jobs, Diseconomies of Scale, Loss in Productivity, Increased Cost, Requires re-skilling of the Employees.

Yes, the share price of the acquiring company falls down and whereas the share price of the company acquired or the target company will rise.

The reason behind this is that the acquiring company is required to pay a slightly extra premium than the value of the target company.

The ways of Creating Value through Merger and Acquisition are Combine Expertise, Value of Shareholders, Dow Chemical, and DuPont.

The different types of Mergers are Horizontal Merger, Vertical Merger, Co-centric Merger, Cash Merger, Forward Merger, and Reverse Merger.

The laws included are Securities Regulations, Foreign Exchange Management Act, 1999, Competition Act, 2002, Income Tax Act, 1961, and Insolvency and Bankruptcy Code, 2016.

The steps involved are Examine MOA of the Company, Notify the Stock Exchange, Drafting of Merger Proposal, Filing of Application to the High Court, Dispatching of Notice to Stakeholders, Filing of orders with the ROC, Merging of Assets and Liabilities, and Listing of Shares.

The factors to be considered are Pre-determine Objectives, Deal Structuring, Due Diligence, and Assessment of Objectives.