Conversion of Nidhi Company to NBFC: A Complete Guide

Shivani Jain | Updated: Jan 19, 2021 | Category: NBFC, Nidhi Company

In India, the concept of Nidhi Company is emerging as a popular trend, as it the cheapest way to incorporate an NBFC or Non Banking Financial Company. It shall be considerate to note that an NBFC is governed by the Apex Bank, i.e., RBI. In contrast, a Nidhi Company is governed by the provisions specified in the Companies Act 2013. Moreover, it shall be considerate to record that the conversion of Nidhi Company to NBFC is not possible in India.

In this blog, we will discuss the concept and reasons as to why conversion of Nidhi Company to NBFC is not possible.

Table of Contents

Concept of Nidhi Company

The term Nidhi Company means a business entity that is although an NBFC but is governed by the provisions of section 406 of the Companies Act 2013. Also, it needs to comply with the rules and regulations mentioned in the Nidhi Rules 2014. Therefore, to obtain Nidhi Company Registration in India, one needs to adhere to both the provisions mentioned above.

Further, this business structure deals only with its members and their welfare. That means it works for the mutual benefit of the members. Furthermore, the other name for this business format is Mutual Benefit Finance Company.

Concept of NBFC

The term NBFC or Non Banking Financial Company means a business entity that is governed by the provisions and directions issued by RBI. That means these entities are strictly monitored by RBI.

Further, for obtaining NBFC Registration in India, one must have a net worth of Rs 2 crores. Also, the principal business of an NBFC is to receive deposits either in instalments or lump sum by way of contributions.

Reasons as to Why Conversion of Nidhi Company to NBFC is not Possible

As mentioned under the provisions of the Nidhi Rules 2014[1], a Nidhi Company is not allowed to engage in any other business activity than the ones provided in the rules. Henceforth, the Nidhi Rules clearly restricts a Nidhi Company to enter into the business activities of other NBFC’s.

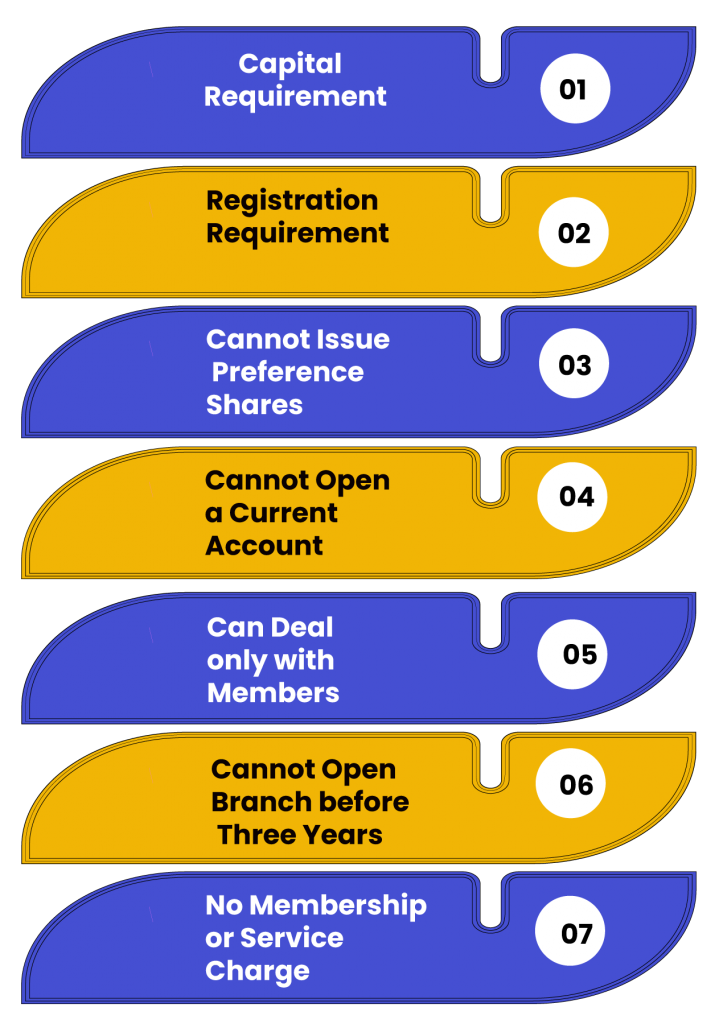

Further, given below is a basic difference between NBFC and Nidhi Company which will provide a clear understanding as to why the Conversion of Nidhi Company to NBFC is not possible:

Capital Requirement

To incorporate a Nidhi Company, a minimum of Rs 5 lakhs are required as the Net Worth. However, a minimum of Rs 2 crores are required to obtain NBFC Registration in India.

Registration Requirement

Unlike an NBFC, Nidhi Company does not require prior approval from RBI to operate in India.

Cannot Issue Preference Shares

In India, Nidhi Companies are restricted to raise funds either by way of preference shares or by issuing debentures. That means it is not allowed to take deposits from the general public.

In contrast, an NBFC is allowed to take deposits from the general public.

Cannot Open a Current Account

In India, a Nidhi Company is not allowed to open a current bank with its member, whereas an NBFC can get a current bank account opened.

Can Deal only with Members

A Nidhi Company can only lend or borrow money from its members, as no public dealing is allowed. In the case of NBFC, no such restriction prevails.

Cannot Open Branch before Three Years

In India, a Nidhi Company is not allowed to open its branch offices, until it earns profit for a consecutive period of three years. Also, it shall be taken into due consideration that such a condition is of mandatory nature and is not eligible to be compromised in any situation.

However, the same is not the case with an NBFC registered in India.

No Membership or Service Charge

A Nidhi Company cannot charge any service charge or fee from its members for the issuance of shares. However, it is permitted to charge some processing fee on the loans taken by the members.

Can a Nidhi Company Apply for NBFC Registration if it satisfies all the Conditions Necessary?

The simple answer to this question is that the conversion of Nidhi Company to NBFC is not possible and the simplest way to obtain NBFC Registration is to wind up the affairs of the Nidhi Company permanently.

If an individual still needs to undergo a conversion of Nidhi Company to NBFC, then, in that case, he/she needs to change the company’s name, objectives mentioned in Memorandum of Association, rules specified in Articles of Association, and other legal necessities. However, the same is neither practically advised nor feasible to convert as per Indian Laws.

Conclusion

In a nutshell, the concept of Nidhi Companies comes with several restrictions and limitations. However, the same has been an emerging business format as well. Therefore, it is better to reach professionals to have a better understanding prior to applying for registration.

On the other hand, an NBFC offers a wide range of financial services, such as chit funds, loans, etc. Also, the same is termed as game changer mechanism for the country’s economy.

However, it shall be taken into due consideration that conversion of Nidhi Company to NBFC is not possible. A Nidhi Company can only offer both secured and unsecured loans but only to its member. In contrast, an NBFC is able to provide both the secured and unsecured loans to the general public. But due to several restrictions, it is always advised to go for an NBFC if the applicant wants to grow at a larger scale.

Also, Read: A Complete Overview of Regulations for NBFCs