Difference between Merger and Amalgamation in India

Japsanjam Kaur Wadhera | Updated: Feb 12, 2021 | Category: Merger and Amalgamation, SEBI Advisory

Merger and Amalgamation are two terms which are quite frequently used in takeovers of business to grow and make returns in the market. The deals in merger and amalgamation are increasing day by day. Amalgamation means where one business entity acquires one or more business entities to form a new one. Whereas, Merger means the consolidation of two or more companies to form one single joint entity having new management structure and business ownership where both the companies come together to merger together as a one unit with a new name to gain the benefits and synergies in operations. This article will discuss about the difference between merger and amalgamation in India.

Table of Contents

Understanding Amalgamation of Companies in India

Amalgamation of companies occurs when two or more companies combine and create a new one from it. Amalgamation happens between one large company and several smaller or less financially stable companies.

Amalgamation is a strategy adopted by the company for various purposes such as:

- To expand the business.

- Gaining advantage in the competition.

- Enhancing the efficiency of the companies by amalgamating/ combining into one.

- Economies of large scale production.

For example: Maruti Motors in India and Suzuki based in Japan amalgamated to form a new company Maruti Suzuki (Idia) Limited.

Also, Read: The Financial Impact of Merger and Amalgamation on Banking Sector

Understanding Merger of Companies in India

A merger of the companies means the absorption of one company by another company. The companies in merger are in the same line or industry and want to grow or diversify their offerings. All the assets and liabilities of the company that is merged belong to the company in which it is merged. The reasons why the companies merge are:

- To remove trade barriers.

- Taking away the competition and create a strong company.

- Combining the resources of the companies.

For example: Reliance Industries and Flag Telecom group.

Difference between Merger and Amalgamation

| Merger | Amalgamation | |

| Meaning | Similar line of businesses merges for gaining advantages and synergy. | Amalgamation generally happens when bigger company acquires smaller ones. |

| Type | Horizontal, Vertical, Reverse and Co- generic. | Nature of Purchase of Nature of Merger. |

| Retaining Identity | The acquiring company may retain its identity. | The acquiring company retains its identity and small company losses. |

| Initiative | Initiative to merge is generally taken by the acquiring company. | Both the companies take initiative to amalgamate. |

| Controlling Stake | The controlling stake can be mutually agreed and discussed between the 2 parties under merger. | The controlling stake is with the acquirer and the target company is a minority shareholder in it. |

| Legal Formalities | Legal formalities are comparatively more. | Legal formalities are comparatively less as compared to merger. |

| Assets and Liabilities | The existing company keeps its assets and liabilities and also takes up the assets and liabilities of the other company. | Assets and liabilities of amalgamating companies transfer to a new entity. |

| Transfer of Assets and Liabilities | Assets and liabilities are consolidated in merged company. | Assets and liabilities get transferred to balance sheet of new company. |

| Size of the Company | Companies are bigger in size and operations. | Target companies are typically smaller size. |

Why do Companies Prefer Amalgamation and Merger?

Companies prefer to amalgamate and merge due to following reasons:

- Diversifying into multiple industries without a need to start afresh.

- To achieve the objective economies of scale for cost optimization, effective utilization of resources, access to a larger market and etc.

- To achieve synergy in operations by targeting companies in the similar product line or industry.

- To achieve growth in less time.

- To get advantage in taxation by combining a profit making company with loss making company, thereby reducing the tax liabilities.

- To reduce the competition in specific industry by combining the two entities together.

- To utilize the financial resources effectively and achieve effective financial planning with an entity having bigger balance sheet.

- To increase control over the value chain in a particular industry by way of backward integration and forward integration.

Types of Merger and Amalgamation in India

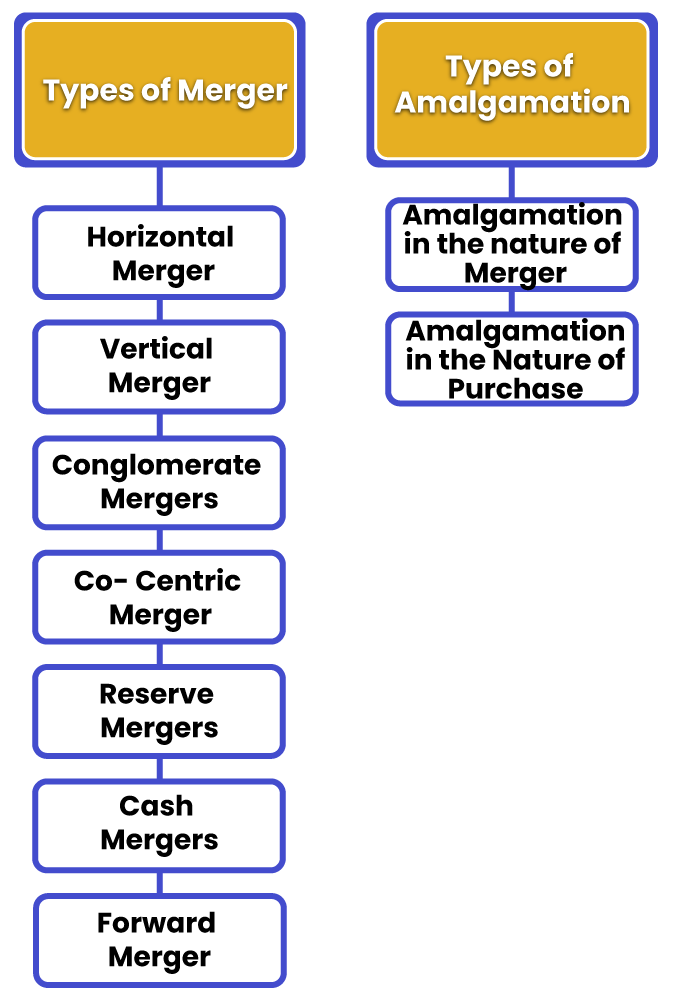

Types of Merger

Horizontal Merger

It takes place between the companies having similar line of business of similar products. The purpose of merger is to acquire an advantageous position in the market, reduce competition and expand its reach in the market.

Vertical Merger

It is the combining of two companies dealing in similar type of products however, the stage of product at which they are operating are not similar.

Conglomerate Mergers

When a merger is done between two or more unrelated industries or companies, it is known as conglomerate merger. The objective of both the companies are absolutely different from one another however, the main purpose behind this type of merger is to encourage business in terms of profits, operations and size.

Co- Centric Merger

Under this type of merger, the organizations serve to the same type of customers. Under this, even if the products and services are completely different of both the companies, still it complements each other.

Reserve Mergers

Under this type of merger, the company decides to merge with its suppliers.

Cash Mergers

Cash mergers means where the shareholders are offered cash instead of shares of the newly formed company.

Forward Merger

When a company opts to merge with its customers, it is known as forward merger.

Types of Amalgamation

Amalgamation in the nature of Merger

When the transferor and the transferee company decide to combine their shareholders interest along with the assets and liabilities of the company, it is termed as Amalgamation in the Nature of Merger. The alterations are made in the book values of the liabilities and assets. Also the shareholder of the transferor company tends to become the shareholder of the transferee company by 90% of the shareholding.

Amalgamation in the Nature of Purchase

When the conditions do not meet for the amalgamation in the nature of merger, the same is referred as amalgamation in the nature of purchase. In this, a transferor company acquires a transferee company and there is no proportionate shareholding of the shareholders of the transferee company in the amalgamated company.

Conclusion

Merger and Amalgamation in India are both useful for the companies to grow and expand its business operations in the market. Amalgamations are possibly mergers but it does not necessarily means that all mergers are amalgamations. The company can opt either of the two depending upon its nature, objective, business environment and structure of the business.

Also, Read: MCA Allows the Entry of Start-up Companies into the Scheme of Merger and Amalgamation