Overview of Mergers and Amalgamation

Nowadays, the deals of Merger and Amalgamation in India are increasing rapidly due to continuous change of dynamics, increased competition, technology adaption, business expansion and globalization. Therefore, every company opts for the process of merger to reap the benefits of associating with a large company.

Further, merger and amalgamation are often known as a single expression. However, there is significant differences between the two concepts.

As per the dictionary, ‘Merger’ is a combination of two or more companies that decide to merge and form a company. In contrast, ‘Amalgamation’ denotes the association of two or more independent companies into a single enterprise.

Further, a ‘Transferor Company’ means the company that proposes a merger, and a ‘Transferee Company’ means the company which is formed after the merger. However, in the case of amalgamation, Transferor Company is the ‘Amalgamating Company’ and Transferee Company is the ‘Amalgamated Company’.

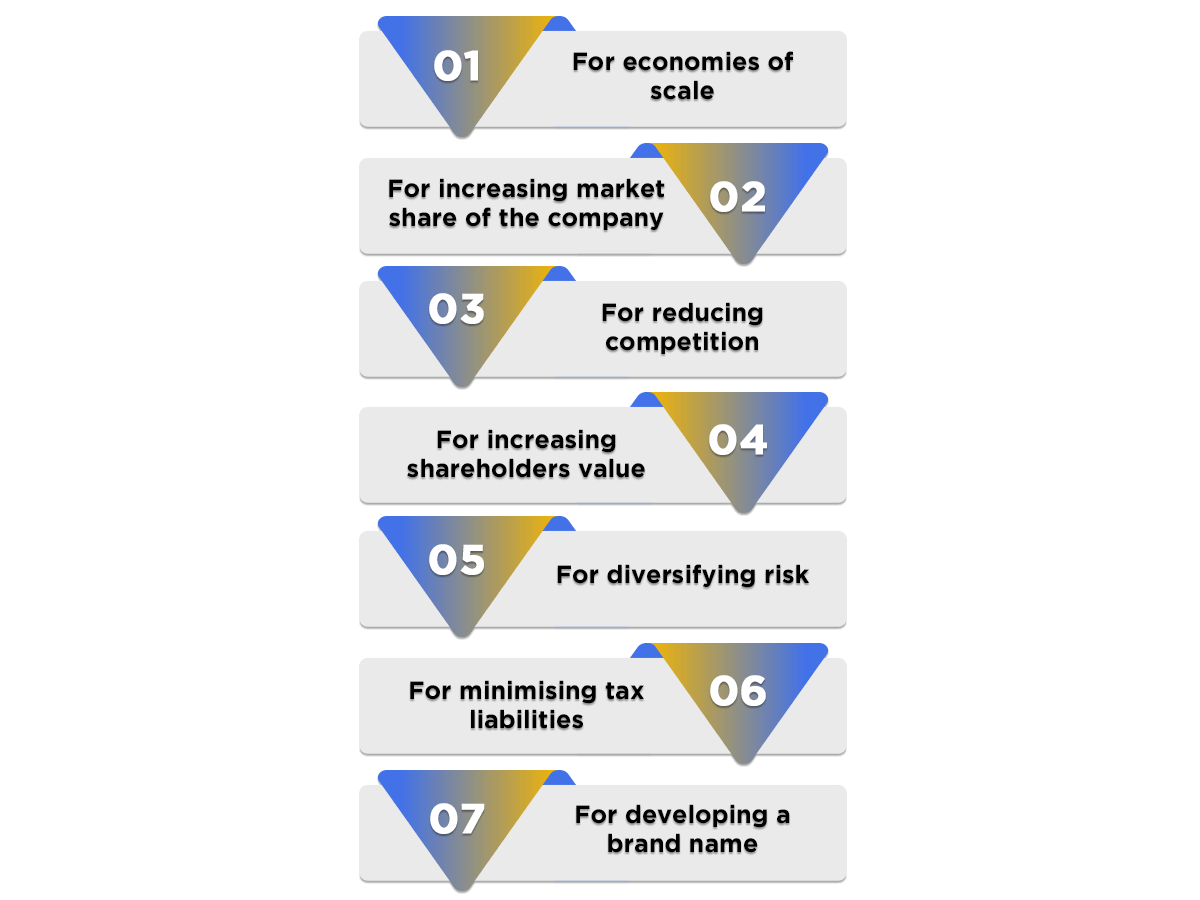

Reasons to Choose Merger and Amalgamation

The reasons why companies choose Merger and Amalgamation in India are:

- For economies of scale;

- For increasing market share of the company;

- For reducing competition;

- For increasing shareholders value;

- For diversifying risk;

- For minimising tax liabilities;

- For developing a brand name.

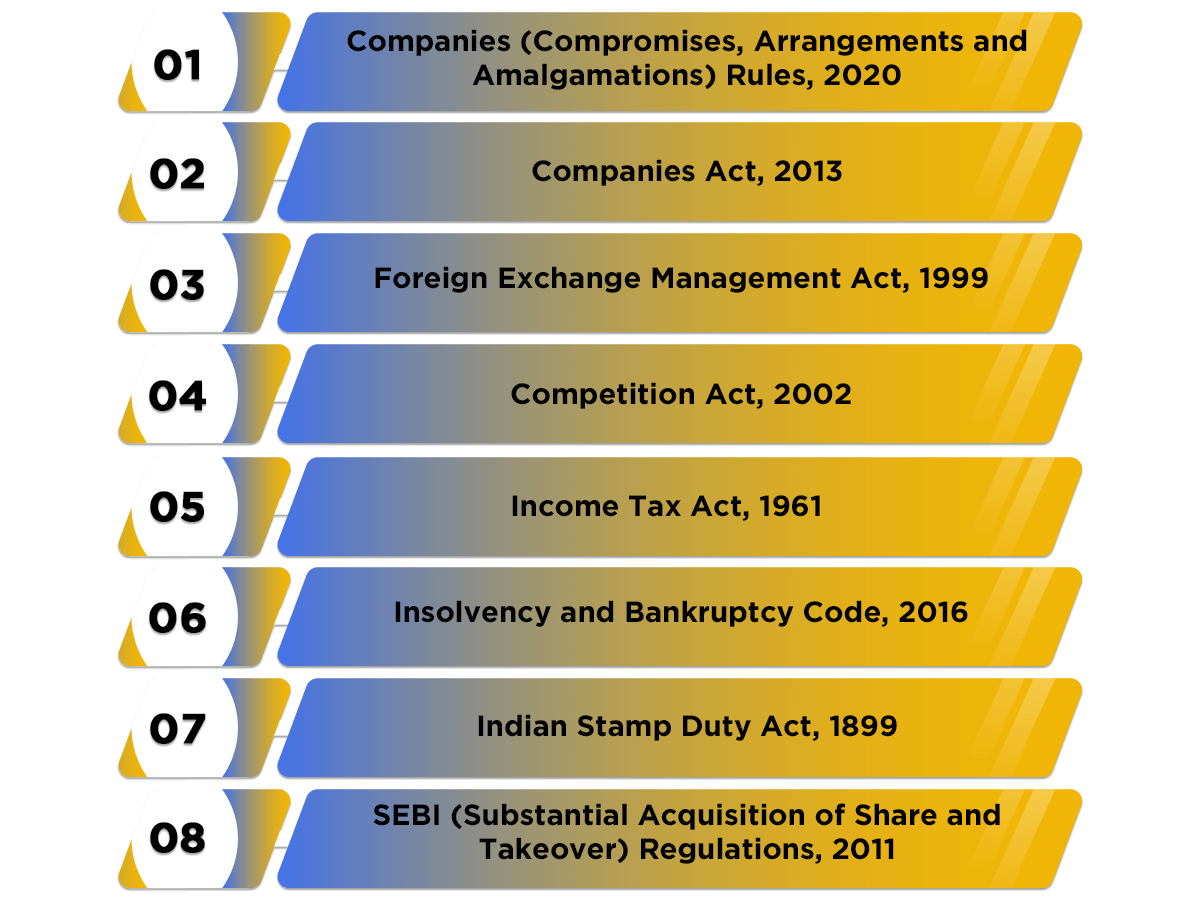

Governing Laws for Merger and Amalgamation

In India, the concept of Merger and Amalgamation is primarily governed by the regulations of the Companies (Compromises, Arrangements and Amalgamations) Rules, 2020, and Section 230 to 234 of the Companies Act, 2013. However, the following key legislation also regulate the activities of Merger and Amalgamation in India:

- Foreign Exchange Management Act, 1999;

- Competition Act, 2002;

- Income Tax Act, 1961;

- Insolvency and Bankruptcy Code, 2016;

- Indian Stamp Duty Act, 1899;

- SEBI (Substantial Acquisition of Share and Takeover) Regulations, 2011.

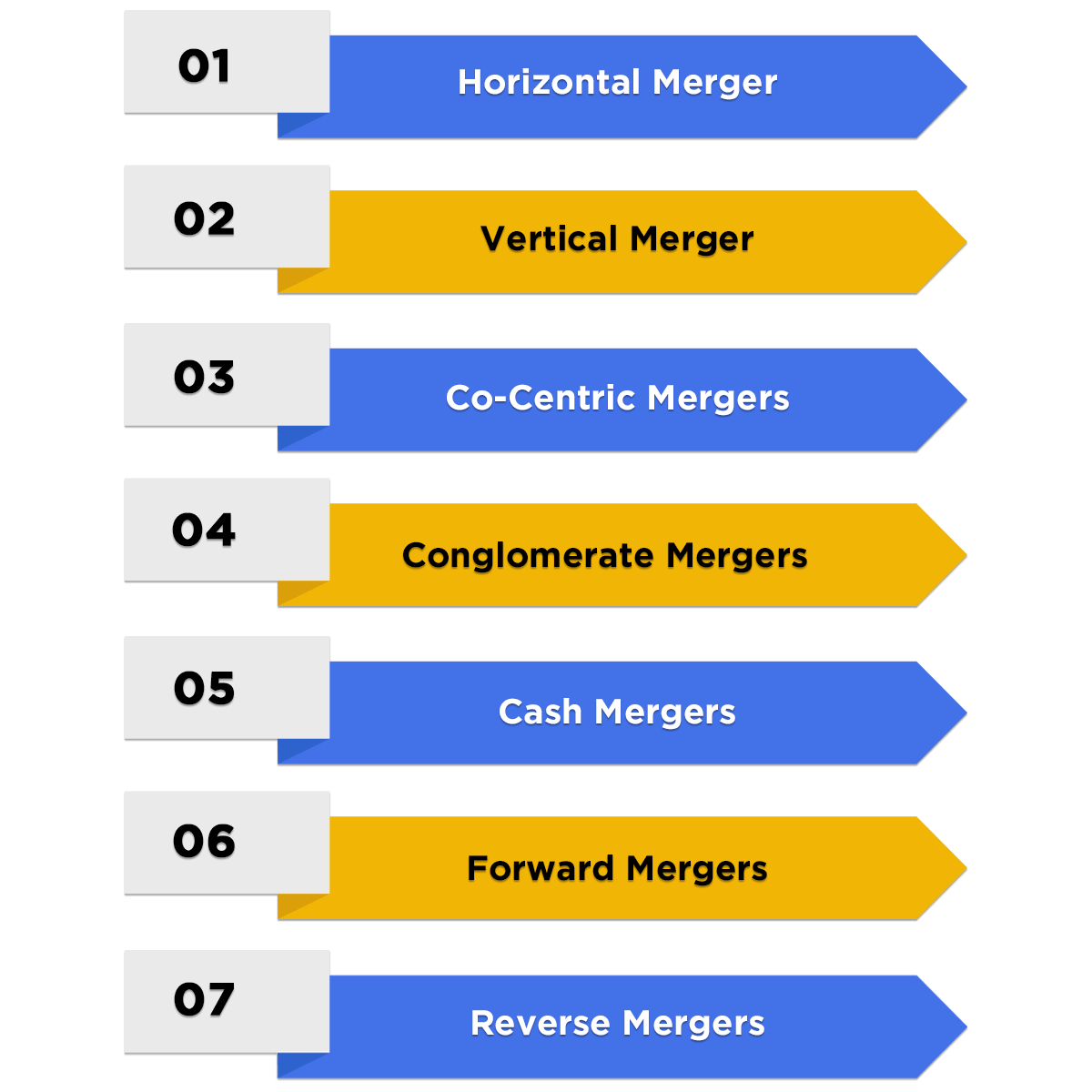

Types of Mergers in India

The different types of mergers in India are as follows:

- Horizontal Merger

A Horizontal Merger takes place between the companies dealing with similar products. The purpose of merger is to reduce competition, acquire a dominant market position, and expand the market reach. For example, Mergers of Brooke Bond and Lipton India; Hindustan Unilever and Patanjali.

- Vertical Merger

The main aim of a vertical merger is to combine two companies which deal in the same types of products. However, the stages of production at which they are operating are different. For example, Reliance Industries and FLAG Telecom group.

- Co-Centric Mergers

The term Co-centric Merger denotes that the organisations serve the same type of customers. In this case, the products and services of both companies complement each other even if they are entirely different. For example, Axis Bank acquiring Freecharge; Citi Group acquiring Salomon Smith Barney; Flipkart acquiring Walmart India.

- Conglomerate Mergers

When two or more unrelated industries/ companies merge with each other, it is termed as Conglomerate Mergers. The aims and objectives of both companies are completely different from each other. However, the main purpose of this type of merger is to boost business in terms of operations, profits and size. For example, Voltas Ltd and L&T.

- Cash Mergers

When the shareholders are offered cash in place of the shares of the newly formed company, it is known as Cash Mergers.

- Forward Mergers

When a company chooses to merge with its customers, it is known as Forward Merger. For example, ICICI Bank acquired Bank of Mathura.

- Reverse Mergers

In Reverse Mergers, a company decides to merge with its suppliers. For example, Gujarat Godrej Innovative Chemicals acquired Godrej soap.

Types of Amalgamations in India

In India, the different types of Amalgamation are:

- Amalgamation in the Nature of Merger

When both the Transferor and Transferee Company decide to combine their shareholders’ interest along with their assets and liabilities, it is known as Amalgamation in the nature of Merger. In this kind of amalgamation, alterations are made to the book values of the assets and liabilities. Moreover, the shareholders of the Transferor Company become the shareholders of the Transferee Company with at least 90% shareholding.

- Amalgamation in the Nature of Purchase

When the conditions for the amalgamation in the nature of merger are not satisfied, the same is termed as Amalgamation in the Nature of Purchase. In this method, a transferor company acquires a transferee company and the shareholders of the transferee company do not have any proportionate shareholding in the amalgamated company.

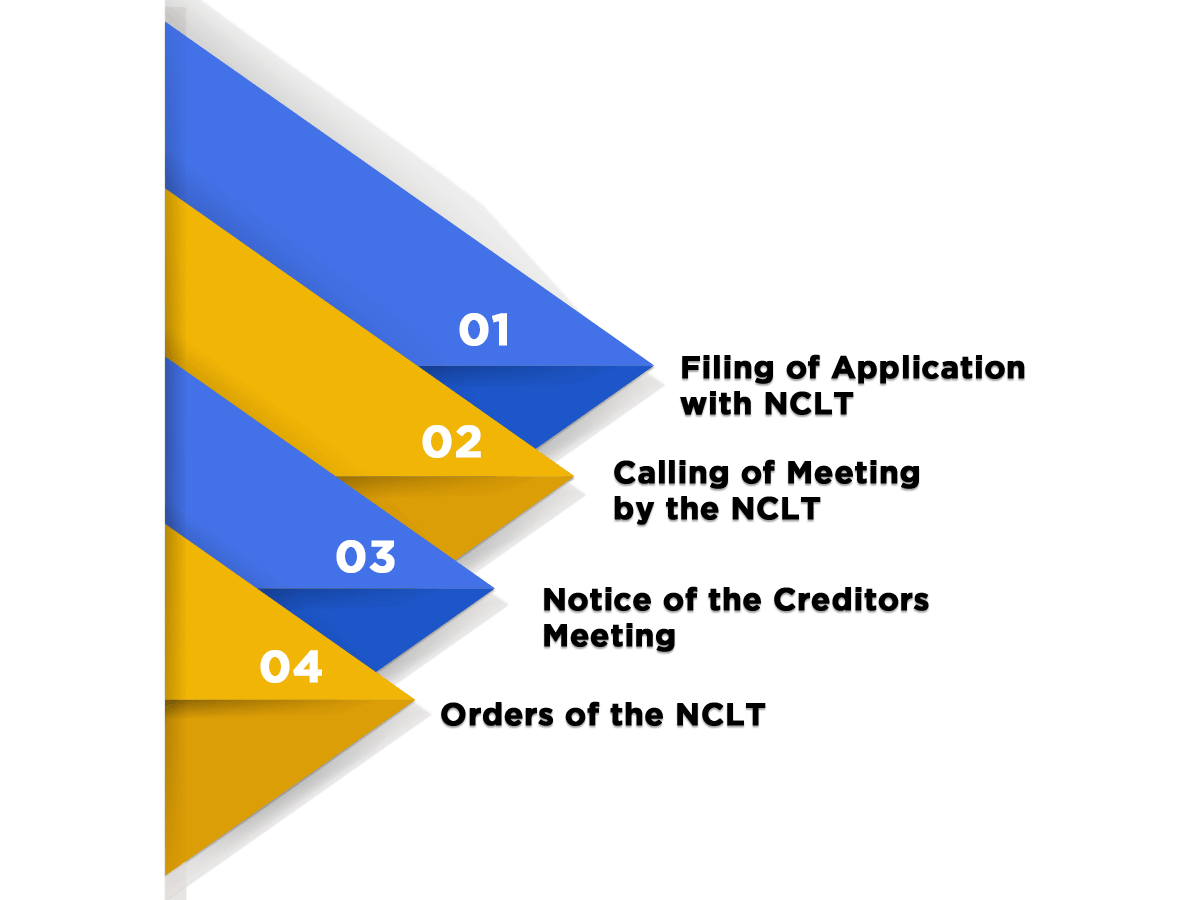

Procedure for Merger and Amalgamation

The steps involved in the procedure of merger and amalgamation are as follows:

Filing of Application with NCLT

The directors of the company need to file an application with the NCLT (National Company Law Tribunal) in form NCLT -1 together with necessary documents. The transferor and transferee company are eligible to file an application in the form of a petition with the NCLT to get the sanction for amalgamation. The application must be filed under section 230-232 of Companies Act, 2013. If the companies involved have the registered office in the same state, then they can file a joint application. However, two separate applications need to be filed in case the companies involved have their registered office in different states. The directors need to draft an application with the following documents:

- Notice of Admission in form NCLT- 2;

- An affidavit in form NCLT-6;

- A copy of the Scheme of Compromise and Arrangement;

- A disclosure in the form of an affidavit comprising of the following points:

- Material facts of the company;

- Latest financial position of the company;

- Any pending legal proceeding or investigation;

- Reduction of the share capital.

- Any scheme of Corporate Debt Restructuring agreed to be not less than 75% of the secured creditors. Such scheme must include the following:

- Creditor Responsibility Statement in form CAA-1;

- Safeguards for the protection of Secured and Unsecured creditor;

- Auditor’s Report;

- Declaration stating that the company has fulfilled all the guidelines of corporate debt restructuring prescribed by the Reserve Bank of India;

- Valuation Report regarding the property, assets, and shares of the company by a registered valuer.

- A petition verifying that the approval of creditors has been obtained for the scheme.

Calling of Meeting by the NCLT

After receiving the petition for merger and amalgamation, if the tribunal thinks that the petition filed is proper and correct in all aspects, it passes an order for holding a meeting of creditors. The company requires to hold a board meeting to discuss the agendas given below:

- To fix a date, time and place of the meeting;

- To appoint a chairperson for the meeting;

- To fix the terms and remuneration of the Chairperson;

- To fix a quorum and procedure for the meeting;

- To decide the methods of voting such as:

- Voting by showing of Hands;

- Voting through Proxy;

- Voting through Postal Ballot.

- To determine the values of members or creditors whose meeting has to be held;

- To provide notice, along with its advertisement.

Notice of the Creditors Meeting

The directors of the company need to send a Notice of the creditor meeting in form CAA-2. The following must be considered while sending the Notice for the meeting:

- The company must send the notice for meeting on an individual basis to each debenture holder, member and creditor at their registered address;

- The notice must be sent either by the Chairman of the company or by the liquidator;

- The directors can send this notice by any of the following methods:

- Registered Post;

- Speed post;

- Courier;

- Hand delivery; or

- Any other recognised means.

- The Notice of the creditors meeting must be attached with the following documents:

- Copy of the Scheme of Amalgamation;

- Details of the order passed by the NCLT (National Company Law Tribunal) regarding the directions for holding a creditors meeting.

- The complete details of the company such as:

a) CIN (Company Identification Number);

b) PAN (Permanent Account Number) of the Company;

c) Name of the Company;

d) Date of its Incorporation;

e) Type of Company, such as Private, Public, OPC, etc.;

f) Company’s Registered Address;

g) Authorized Capital of the Company;

h) Total Paid-up Capital of the Company;

i) Name, Address and Details of the Promoters and Directors;

j) In case of Joint application, facts and details of the relationship between the companies involved, including their Holding, Subsidiary, and Associated Companies;

k) Details of the BM (Board Meeting) in which the Scheme of Amalgamation was approved together with the details of the directors who voted in its favour or against, and those who did not cast any vote or participated in the meeting.

- An Explanatory Statement along with the notice containing the following details:

a) Parties involved;

b) Appointed date;

c) Effective date;

d) Share Exchange Ratio;

e) Summary of the Valuation Report;

f) Details of the Debt and Capital Restructuring;

g) Amount due to the Unsecured Creditors.

- Disclosing the effects of such amalgamation on the followings:

a) Key Managerial Personnel (KMP);

b) Directors;

c) Promoters;

d) Non-Promoter Members;

e) Depositors;

f) Creditors;

g) Debenture Holders;

h) Deposit Trustee;

i) Employees;

j) Shareholders;

- Details of any pending proceedings or investigations against the companies under the scheme of amalgamation;

- Details of the Sanction, Approval or No Objection Certificate (NOC) from any regulatory authority or government authority for the proposed scheme of Amalgamation;

- A Statement that any person who is entitled to attend the creditors meeting can vote either in person, proxy or through electronic means.

Orders of the NCLT

If the NCLT is satisfied that procedure has been duly complied with, it may pass an order for such scheme of amalgamation and merger and also provide direction for the following:

- Transfer of assets, liabilities or property of the transferor company to the transferee company, either in full or partial;

- Any previous legal proceeding or investigation against the transferor company to be continued against or in the name of the transferee company;

- Dissolution of the Transferor Company;

- All the employees working in the Transferor Company to be transferred to the Transferee Company;

- If the transferor company is listed on the recognised stock exchange and the transferee is unlisted, the transferee company to continue with the status of an unlisted company until it lists its shares;

- Every company under the scheme of amalgamation has to file a statement with the Registrar of Companies (ROC). Such a statement must declare that all the guidelines and directions passed by the NCLT has been complied with, and the same should be duly certified by a practising CA, CS or CMA.

Difference between Merger and Amalgamation

|

Point of Difference |

Merger |

Amalgamation |

|

Definition |

Merger is a process of combining two business entities into one. |

Amalgamation is a type of Merger in which two or more business entities decides to join and form a new company. |

|

Number of Companies required |

A minimum of two companies are required, i.e. Transferor and Transferee. |

A minimum of three companies are needed, as when two companies amalgamate with each other they form a new company. |

|

Size |

In case of Merger, the transferor company is larger than the transferee company |

In case of Amalgamation, the size of the companies is similar. |

|

Identity of the resulting company |

One of the existing companies may merge with the target company. Therefore, it may retain its existence. |

The existing companies lose their identity and form a new company. |

|

Shareholders |

Shares of the transferor company are given to the shareholders of the transferee company |

All the shareholders of the amalgamating companies become the shareholders of the amalgamated company. |

|

Accounting treatment |

Assets and liabilities of both the companies are consolidated. |

Assets and liabilities of the amalgamating company are transferred into the balance sheet of the newly formed company. |

|

Types |

In India, the different types of mergers are Horizontal, Vertical, Co-centric, Conglomerate, Forward, Reverse and Cash Merger. |

The two types of amalgamation prevalent in Indiaare Amalgamation in the nature of Merger and Amalgamation in the nature of purchase. |

|

Controlling stake |

Controlling Stake is mutually decided by the companies involved. |

The amalgamating company holds a larger controlling stake, whereas the minority remains with the amalgamated company. |

FAQs of Merger & Amalgamation

The main difference is that in Merger, the companies engaged are equal in terms of size. In Amalgamation, the sizes of the target companies are comparable. And in Acquisition, the larger companies acquire small to medium-size firms or companies.

The term “Amalgamation” denotes the combination of two or more companies to form a new company.

The two best examples of the process of amalgamation are Maruti Suzuki and Gujarat Gas Limited.

The two types of amalgamation are Amalgamation in the nature of Merger and Amalgamation in the nature of Purchase.

Amalgamation is the process, wherein two or more companies are combined into one. Under this process all the property, rights, assets, privileges, obligations, and liabilities of the amalgamating company are transferred into, and vest in, the amalgamated company.

The main difference between the two is that in the former, two or more companies are combined into one. However, in the latter, one company takes over the other company.

The benefits of the process of Amalgamation are Operating Economies, Diversification, Financial Economies, Growth, Managerial Effectiveness, Helps to face Competition, Revival of Sick Units, Tax Advantages, Increases Market Share, Increases Goodwill, and Miscellaneous Advantages.

The objectives of the process of Amalgamation are Avoids Competition, Reduces Cost, Gains Financially, Achieves Growth, and Diversifies the Activities.

The disadvantages of Amalgamation Chances of Paying Extra Debt, Elimination of Healthy Competition, Reduction of Employees, Chances of Monopoly due to Business Combination, Chances of Losing Brand Name, and Goodwill.

The features of Amalgamation are at least Two Companies, Formation of a New Company, Similar Nature, Vendor and Purchasing Company, and Issue of Shares.

The Methods of Accounting for Amalgamation are the Pooling of Interest Method and Purchase Method.

The term mergers and acquisitions (M&A) denotes the consolidation or alliance of companies. Further, it is a combination of two companies coming together to form one.

The different types of Mergers are Horizontal Merger, Vertical Merger, Co-centric Merger, Cash Merger, Forward Merger, and Reverse Merger.

The steps involved in the procedure for Mergers and Amalgamations are Filing of Application with the NCLT, Calling of Meeting by NCLT, Notice of the Creditors Meeting, and Orders of the NCLT.

The Governing Law for Mergers and Amalgamations are Foreign Exchange Management Act 1999; Competition Act 2002; Income Tax Act 1961; Insolvency and Bankruptcy Code 2016; Indian Stamp Duty Act 1899; SEBI (Substantial Acquisition of Share and Takeover) Regulations 2011.

The reasons to choose Merger and Amalgamation are Economies of Scale, Increasing Market Share of the Company, Reducing Competition, Increasing Shareholders Value, Diversifying Risk, Minimising Tax Liabilities, and Developing a Brand Name.

There is no particular criterion for Merger.

Yes, both Foreign Companies and Indian Companies are allowed to merge with each other.

Yes, the valuation of shares is a mandatory step in the process of Merger.

Yes, there is a need to have prior approval from the authorities for Merger.

The authorities that need to give their approval are Income Tax Authorities, Reserve Bank of India, SEBI (Securities Exchange Board of India), Registrar of Companies, Stock Exchanges, Official Liquidator, CCI (Competition Commission of India), and other regulators.