Difference between Mergers and Acquisitions in India

Karan Singh | Updated: Feb 25, 2021 | Category: Mergers and Acquisitions, SEBI Advisory

In India, Merger and Acquisition are the two most frequently applied corporate reformation strategies, often expressed in the same sniff, but they are not the same. Both Merger and Acquisitions refer to joining two different companies, but there is some key difference between Mergers and Acquisitions involved in using them. It helps the business in maximizing growth and profit by increasing the production level and marketing process. A merger means a combination of two separate entities to create a new joint organization. Whereas, an acquisition means the takeover of one company or entity by another. Scroll down to check the definition and difference between mergers and acquisitions in India.

Table of Contents

Meaning of Merger

Merger states the mutual alliance of two or more companies to form a new one with a new name. In a merger, different companies of the same size agree to mix their operations into a single company, where ownership, profit, and control of the company is shared. For example, if an X Ltd. And Y Ltd. Company combine together to form a new company Z Ltd.

The primary reason behind choosing the Merger by several companies is to unite the weakness, strength, resources, a profit of the merging companies, and eliminate trade obstructions, reduce competition, and gain interaction. The members of the old companies become the member of the new one. There are five different types of Merger, and you can check the same below:

- Vertical Merger: Merging with customers or suppliers.

- Horizontal Merger: Merging with competitors.

- Conglomerate Merger: It means merging with a company that deals with distinct business activities.

- Market Extension Merger: It means merging with a company that deals with similar products but operates in a different market.

- Product Extension Merger: Merging a company with another company that deals with products that are operating and similar in the same market.

Also, Read: What are the Benefits of Mergers and Acquisitions?

Meaning of Acquisition

Acquisition means purchasing a company’s business by another company. This can be completed by purchasing the company’s assets or buying ownership over 51% of its paid-up share capital. In Acquisition, the firm which purchases another firm is called as acquiring company while the company which is being acquired is called Target Company. The purchasing company is more dominant in terms of structure, size, and operations which takeover the weaker company or target company. Most of the companies in India uses this acquisition strategy for gaining immediate growth, spreading their operation area, profitability, market share, etc. There are three different types of Acquisition, and you can check the same below:

- Hostile Takeover: The purchasing company takes over a company by gaining to company’s shareholders.

- Friendly Takeover: The purchasing company takes over a company by discussing terms with its management.

- Buyout Takeover: The purchasing company takes over a company by purchasing more than 50% of the company.

Comparison Table between Mergers and Acquisitions in India

| Comparison | Merger | Acquisition |

| Definition | It means the combinations of two or more companies to form a new company. | Acquisition means when one company purchases the business of another company. |

| Purpose | The purpose of the Merger is to decrease the competition level and increase the efficiency of operations. | The primary purpose of Acquisition is for sudden growth. |

| Legal Formalities | The Merger requires more legal formalities. | The Acquisition requires less legal formalities. |

| New Company Formation | In a Merger, a new company is formed by combining two different companies. | In Acquisition, there is no formation of a new company. |

| Decision Nature | The common decision of the companies going through mergers. | The friendly decision of attaining and attained companies. |

| Business Size | The size of merging companies is less or more the same. | The acquiring company’s size is more than the acquired company’s size. |

| Minimum number of companies involved | In the Merger, there is a minimum of three companies involved. | Whereas in acquisitions, there is a minimum of two companies involved. |

| Example | The formation of GlaxoSmithKline is done by the merging of Glaxo Wellcome and SmithKline Beecham. | Tata Motors purchasing Jaguar Range Rover. |

What is the Key Difference between Mergers and Acquisitions?

All the points mentioned below explain the key difference between Mergers and Acquisitions in a detailed way:

- A company strategy in which two different companies join together to form a new company is known as a Merger. Whereas, a company strategy in which a company buys another company and take over all the controls over it, is known as Acquisition.

- In a Merger, two different companies combine to form a new one whereas, in Acquisition, two companies don’t lose their existence.

- If two different companies are the same in size and nature, then it goes for the Merger. Whereas, in the Acquisition, the bigger company conquers the smaller company.

- The Merger is done willingly by different companies, whereas the Acquisition is made either willingly or unwillingly.

- There are more legal formalities in a merger than Acquisition.

- In a merger, a minimum of three companies is involved, whereas, in the Acquisition, a minimum of two companies are involved.

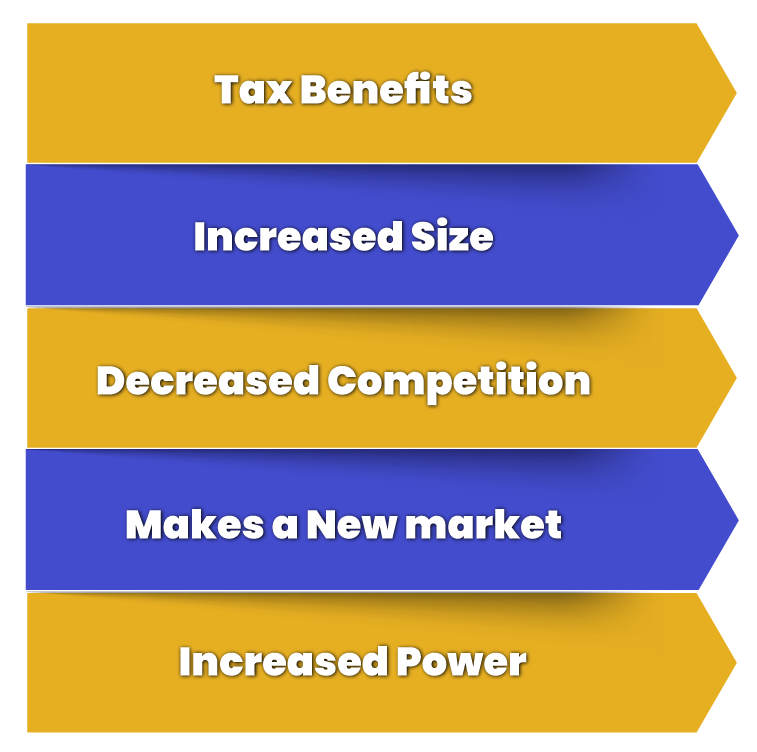

Benefits of Mergers and Acquisitions in India

The benefits of Merger and Acquisitions in India are as follow:

- Tax Benefits: It also offers various tax benefits to the involved companies. One company’s losses are set off against the profits made by another company in that way, decreasing the tax liability.

- Increased Size: The process of Mergers and Acquisitions supports companies by increasing their net revenue and operations, which may take many years otherwise. Furthermore, these planned tools help in encouraging the share price of the company.

- Decreased Competition: The merged reserves and capital of the newly created company and helped it in decreasing competition and gaining a competitive power.

- Makes a New market: With the help of M&A, two different companies are working together, it provides better sales predictions. Apart from this, Mergers and Acquisitions also helps in increasing the market reach of the business.

- Increased Power: The combination of two or more different companies is very strong enough to lead other market companies, ensure better performances, financial gains, etc. Simply, it attracts more and more customers.

Conclusion

Due to strong competition, only a few mergers can be seen, but Acquisition is getting popular day by day. From the above-mentioned difference between Mergers and Acquisitions, it is cleared that both of them are gaining the benefits of taxation, increasing competition, financial benefits, and so on, which can be beneficial. Sometimes, the hostile effect can also be seen, such as increasing turnover of the employee, clashing the organization’s culture and others but all these effects rarely happen.

Also, Read: Cross Border Mergers and Acquisitions in India: A Complete Guide