Disclosure in Research Reports Required by SEBI

Karan Singh | Updated: Aug 12, 2021 | Category: SEBI Advisory

Before publishing a research report, a RA (Research Analyst) must reveal specific compulsory disclosure in research reports as offered under the Research Analyst regulations. Companies and individuals involved in giving recommendations to their customers via such reports must register with SEBI (Securities and Exchange Board of India) and obey its provisions. In this blog, we will discuss such disclosure in research reports as required by SEBI or the capital markets regulator.

Table of Contents

What is a Disclosure?

It is the process of making information or details known to the public. Appropriate disclosure by corporations is the act of making its investor, customers, and any individual involved in doing business with the entity aware of relevant information.

What is a Research Report?

According to the SEBI (RA) Regulations, 2014[1], any electronic communication involving research recommendation or research analysis or an outlook concerning the Public Offer or Securities, offering a basis for investment decision, is known as Research Report. Research Report is a written report arranged on Research Analysts or sell/buy/hold suggestion of giving an outlook on securities listed in a stock exchange or to be listed in a stock exchange or any other way influencing the investment decision is named as a Research Report.

Disclosure in Research Reports

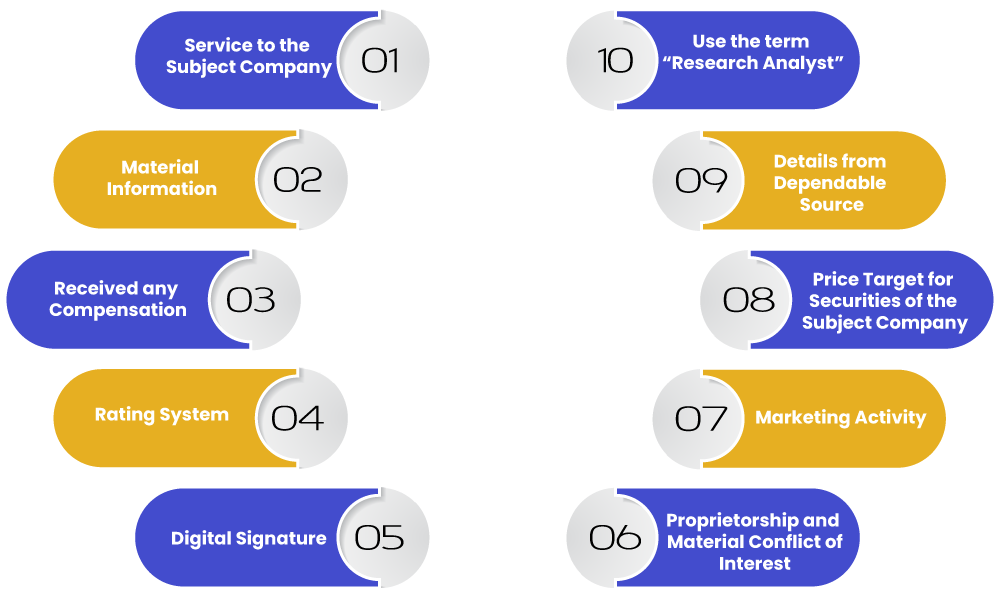

Following are the disclosure in Research Reports which are required by SEBI:

- Service to the Subject Company: This disclosure in Research Reports forms another fraction of disclosure in Research Reports where the RA or Research Analyst should also reveal if they have served as an officer, an employee or a director of the subject company.

- Material Information: It comprises the name of the company or an individual Research Analyst, Terms & Conditions, associate details or information, and such other details should be revealed, which will aid customers in making correct investment decisions.

- Received any Compensation: A Research Company or Research Analyst is required to reveal whether it or its associates in the last twelve months have:

- Co-managed or managed public offering of securities for the subject or target company;

- Received any compensation or reimbursement from the subject company;

- Received any compensation or reimbursement or any other benefits from the subject company or the 3rd party regarding the Research Report;

- Received any reimbursement or compensation for the merchant banking or investment banking or brokerage services from the subject company.

- Rating System: If the Research Company or Research Analyst (RA) uses the rating system, they are required to describe the meaning of each rating with the time horizon & standards on which the rating is used.

- Digital Signature: A Research Report has to be duly signed & the date should be referred. It can be maintained in online or physical form, and it will be maintained for five years. If the Research Reports are maintained in digital form, then they should be signed digitally or electronically.

- Proprietorship and Material Conflict of Interest: A Research Analyst or Research Company is required to reveal if such Research Company, Research Analyst or their relative or representatives has:

- Real or Beneficial proprietorship of 1% or more of the subject or target company at the end of the months instantly preceding the publication date of the research report;

- Any other material divergence of interest at the time of publication or Research Report;

- Have a financial concern in Subject Company and its nature.

- Marketing Activity: The RA or Research Analyst should reveal if they have been involved in the market activity for the subject company.

- Price Target for the securities of the Subject Company: If a Research Report has a price target for securities of the Subject Company for at least one year, then such report must also include the graph of every day closing of such securities for the time assigned or for three years time, whichever is shorter.

- Details from Dependable Source: The Research Company or the Research Analyst should make sure that the facts in the reports are taken from a dependable source. Moreover, the terms used to provide research suggestions have to be well maintained and authenticated in records by the Research Analyst (RA) or the Research Company.

- Use the Term “Research Analyst”: A Research Company or Research Analyst should use the term Research Analyst (RA) after its name with the SEBI Registration Number.

Dos and Don’ts: Disclosure in Research Reports Required by SEBI

Following are certain Dos and Don’ts that should be remembered:

- The Research Report has to be provided to all customers who are eligible to get reports. It cannot be made selectively available to internal trading personnel or to a particular customer or class of customers;

- Research Company or Research Analyst should not make a promise or pledge of encouraging review in the Research Report to an entity with an outlook to influence business connection or to get reimbursement and such other advantages;

- The Research Company has to make sure that the individuals who are employed as Research Analyst change from other employees who perform dealing sales trading, corporate finance advisory or any other activities that can impact the sovereignty of the Research Report;

- There should be any discrepancy in Research Report. This report has to be reliable with the views of individual employed as Research Analyst concerning any subject company.

Conclusion

The disclosure in Research Reports, as mentioned above, is vital and should obey the regulations of SEBI. These companies and individuals who involve in expanding suggestions to their customers through Research Reports should register with SEBI and obey their provisions.

Read our article:SEBI Changes Norms for Independent Directors Appointment and Removal