Relaxation and Benefits by SEBI to the Families of the Deceased Employee

Karan Singh | Updated: Aug 10, 2021 | Category: SEBI Advisory

As we all know that On March 2020 the World Health Organisation had declared the Covid-19 Pandemic as a worldwide Coronavirus outbreak. We have seen thousands of people get infected and many of them even died because of this pandemic. Amidst this significant situation now, entities are facing difficulty in managing and operating their business efficiently. It has also been noticed that in this Covid-19, many of the company’s employees died, and the employee’s whole family went into the depression because they were the only source of income in the family. So by seeing this, the Government of India has come up with a definite type of scheme to support such families financially. In this write-up, we are going to understand the various relaxation and benefits by SEBI to the families of the deceased employee.

Table of Contents

What are the Powers of SEBI in India?

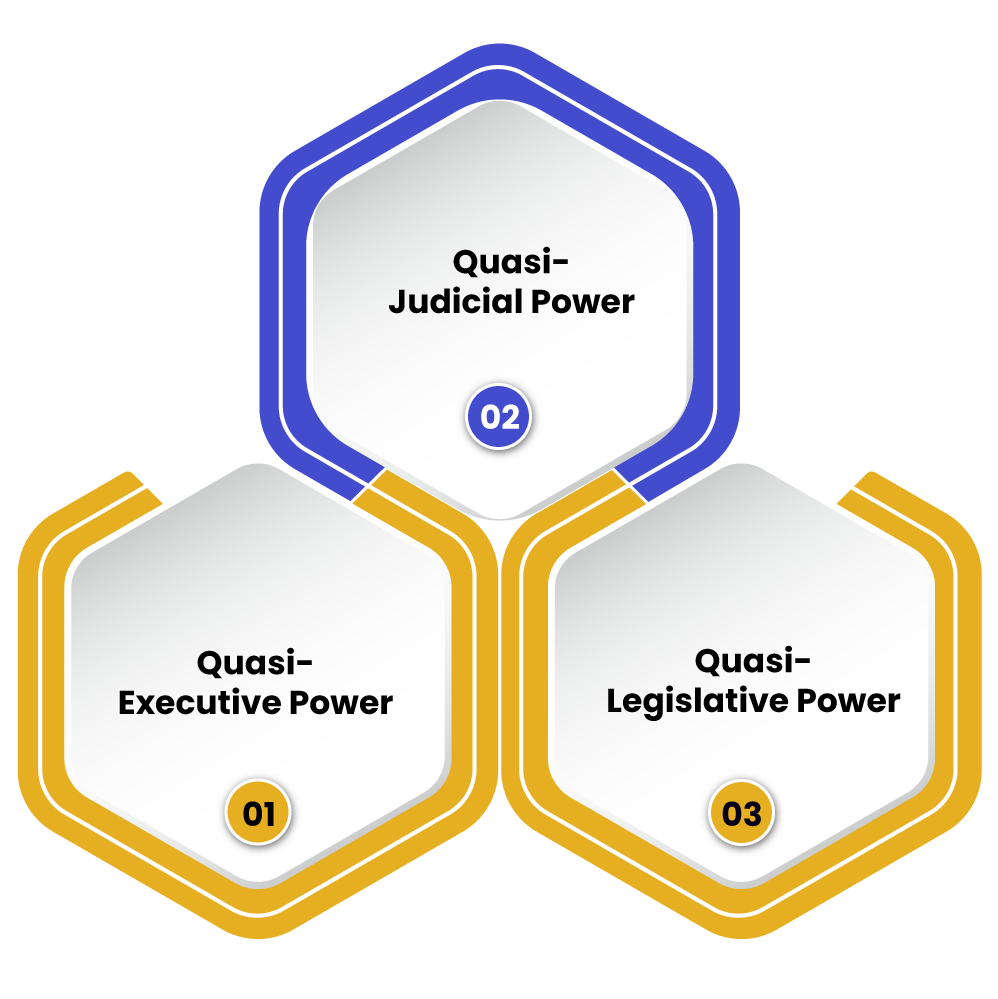

Before we discuss the relaxation and benefits by SEBI to the families of the deceased employee, it’s essential to know the powers of SEBI (Security and Exchange Board of India), and you can check the same below:

- Quasi-Executive Power: Security and Exchange Board of India (SEBI) has the power to execute the judgements & regulations made and can take any legitimate action against the infringers. It also has the power to inspect the books of account & any other documents.

- Quasi-Judicial Power: In case of any unethical and fraudulent practices related to the securities markets, the SEBI has the power to deliver judgments, and it aids in ensuring transparency & fairness.

- Quasi-Legislative Power: SEBI has the power to frame rules & regulations to safeguard the investors’ interest. Rules like listing obligations, inside trading, and disclosure necessities are formulated to keep the malpractices at bay.

Some Relaxation and Benefits by SEBI to the Families

In an outlook of the Covid-19 situation in India, SEBI decided to provide some relief to the families of the dead employee who worked in the listed companies. SEBI said that the provisions of Share-Based Employee Benefit Regulation (SBEBR), 2014[1], concerning a minimum period of 1 year, would not be going to be applied in the case of demise.

Such demise is not necessary to be Covid-19 death can be any reason for a company’s employee. All the employee stock options, SAR (Stock Appreciation Rights) or any benefits permitted to the employee will be given to the lawful nominee or heir on the death date of the employee. This regulation of SEBI will only be available to all employees who have died on or after 1st April, 2020.

As per the SEBI Regulations, Regulation 18(1) and 24(1) provide that there will be a minimum vesting time of 1 year in the case of SAR (Stock Appreciation Rights) and employee stock options. A SAR refers to the right to be paid compensation, which is equal to an increase in the company’s expected stock price over a base or the appreciation value of the equity shares presently being traded on the public market.

Moreover, Regulation 9(4) of SEBI says that in case of demise of any employee, all the options, Stock Appreciation Rights and is there are any other benefits permitted to them under a scheme, then it will be transferred to the lawful nominees ort heirs of the dead employee.

Employee Deposit Linked Insurance Scheme – Relaxation and Benefits by SEBI

If anyone who is an active employee of the company died due to the Covid-19, then his or her legal nominee is liable for money up to Rs. 7 lakh under the EDLI Scheme for salaried employees from the private sector. Employer’s nominees get the lump sum payment in the case of any unlucky event of the proposed person’s death at the time of the service.

To aid private-sector employees impacted by the Covid-19 pandemic, EPFO (Employees Provident Fund Organisation), on 28th April, 2021, issued an annoucement for raising the benefit in this EDLI Scheme from Rs. 6 lakh to Rs. 7 lakh for the member of its EDLI Scheme. In 2015, the benefit was raised from Rs. 3.6 lakh to 6 lakh.

The notification announced in April stated that the provision which was introduced would have effect from 15th Feb 2020, and the benefit will not be less than Rs. 2.50 lakh. If any company or organisation has more than 20 employees, then they have to register for EPF. Hence, any employee who has an EFP account becomes liable for the EDLI Scheme.

To claim the insurance under this scheme, then the only condition is that the EPF account holder should have been demised when he or she was still employed; that is, before the retirement, the dead person should have been the active contributor to the EPF Scheme of their death.

What are the Various Challenges Faced by the Companies?

- Most of the sectors are badly hit by this pandemic in India, such as power generation, textile, manufacturing, mining, etc. Human Resources in the industries are unavailable, & transportation is disrupted, but they have to pay wages to the workers & employees from their reserve;

- Companies are adopting Work From Home (WFH) culture and shifting to the digital mode for conducting conferences & other things leading to exposure to cyber threats for entities, such as leaking of confidential information. When many of the company’s employees are doing WFH, they might be using unsafeguarded personal networks, which shows the organisation to different levels of cyber risks and frauds.

- Another challenge that most of the companies face during this pandemic is conducting the meeting such as Annual General Meeting, Board Meeting, Extraordinary General Meetings, necessary for a decision making instrument.

Relaxation and Benefits by SEBI to Companies in India

Following are some relaxations and benefits by SEBI to companies in India:

- There are some relaxations and benefits by SEBI to companies in India, like the deadline extension given to the companies or organisations for filing financial outcomes for the quarter & the financial year ended 31st March to 30th June. SEBI (Securities and Exchange Board of India) permitted the listed companies to use DSCs (Digital Signature Certificates) made to stock exchanges for filing or submissions made to stock exchanges under their listing obligations & disclosure necessities regulations, 2015 for all the filing until 31st December, 2021.

- To copy with the liquidity calamity created by the Covid-19, SEBI has eased the capital rising for all the listed companies. Markers regulators have changed the takeover code to permit the promoters to get up to 10% in a Financial Year (F.Y) without triggering a penned offer, but this can only be done by issuing preferential issues of equity shares.

In simple terms, we can say that promoters will have to impart fresh capital into their company & not just get shares from the secondary market. Now, the SEBI has incentivised the promoter to do a preferential allotment of vast size then take advantage of increasing the creeping acquisition limit. SEBI has chosen this to give encouragement (incentive) to the coming at higher prices & companies to get more significant amounts from promoters should arise.

- On 25th March of this year, SEBI consented to certain amendments to the delisting regulation by fixing timelines, permitting acquirers to provide indicative prices, & detailing the role of a merchant banker in the delisting process.

Delisting of the listed company or take privates as delisting are known internationally has met with limited success in India primarily due to strict pricing rules under the Delisting Regulations. In delisting, the discovery of price is left with the public shareholders. Reverse book building permits the public shareholders to provide their share with a cost of their choice above a definite level of floor price. The price at which the acquirer can cross 90% of the company’s share capital becomes the final delisting price. It’s for the acquirer to accept or reject this discovered price.

Conclusion – Relaxation and Benefits by SEBI

In this dangerous pandemic, many people lost their precious life and their families suffer from severe financial loss. So to overcome some tension in the families, there are some relaxation and benefits by SEBI to the families, as we discussed above, which provide some relief to the families. These financial cover might seem to be small, but they can aid those who require money urgently. Government must increase the insurance amount cover a little more so that their family members who have urgent requirements of money. SEBI assisted to some extent in such pandemics, especially to the families with urgent needs of money.

Read our article:SEBI Changes Norms for Independent Directors Appointment and Removal