An Overview of Insurance Broker License Renewal in India

Karan Singh | Updated: Apr 22, 2021 | Category: Insurance Broker

Insurance is the most vital aspects of human life. Insurance plays a crucial role in protecting you against possible future losses or damages, and if you are getting insured, then you have to contact a certified insurance broker. An insurance broker can be a company or a person that helps the customers or clients in choosing the best insurance plans for them as per their requirement. A broker is an intermediary between the insurance company and the customer. For that, the broker requires an insurance broker license to operate their work. Scroll down to check more information regarding the Insurance Broker License Renewal.

Table of Contents

Issuance of an Insurance Broker License

The management of the insurance broker is done by IRDAI (Insurance Regulatory and Development Authority of India)[1]. Only IRDAI is liable for the cancellation, issuance or renewal of an insurance broker license.

Who can apply for Insurance Broker License?

Following is the list who can apply for an insurance broker license:

- A Private Company should be registered under the Companies Act, 2013;

- Any person or individual recognized by the authority;

- Any LLP or Limited Liability Partnership can apply;

- A co-operative society made as per the provisions of the Co-operative Societies Act.

What are the Vital Documents Required for Insurance Broker License Renewal in India?

You can check the list of all essential documents required for an insurance broker license renewal in India below:

- Submit duly filed Schedule I Form K;

- Company’s shareholding pattern certified by a CA;

- List of all broker qualified individuals;

- Submit a certificate from CA confirming compliance with regulation 33;

- Renewal checklist signed by the Partner or Director and the company’s principal officer;

- Undertaking duly signed by the Partner or Director of the company and the company’s principal officer;

- Training certificate for renewal undergone by the principal officer and broker qualified persons;

- Business best figures and list of top ten customers annual wise for the previous three years;

- Any additional document, if required.

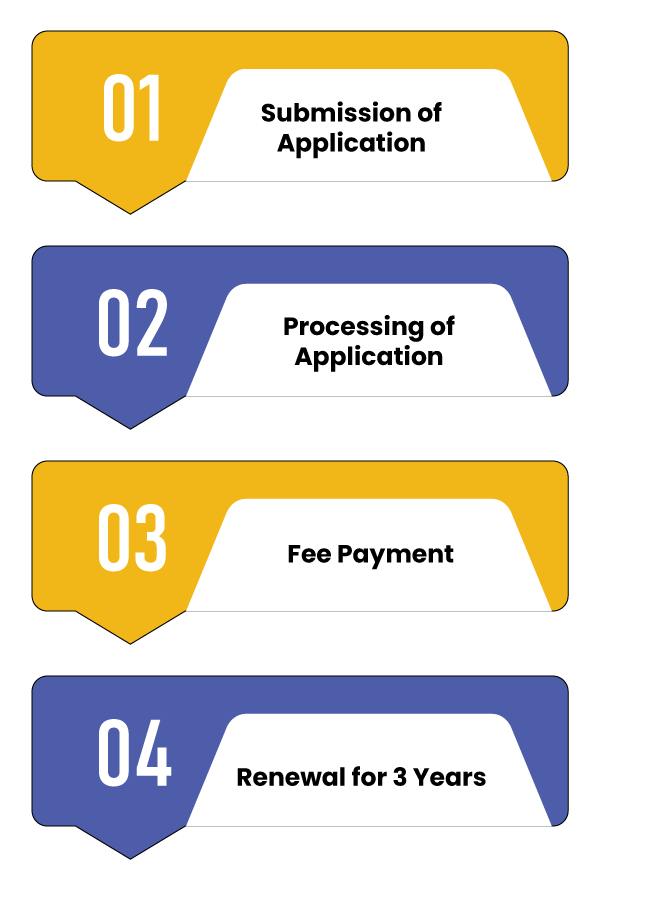

Process for Insurance Broker License Renewal

Following the process of an insurance broker license renewal:

- Submission of Application: The application for insurance broker license renewal should be submitted within thirty days before the expiry of an insurance broker license. It should be submitted to the authority by the broker in Schedule I Form-K.

- Processing of Application: During the processing of an application, the authority, if needed, may look for further information about the application submitted and the insurance broker is needed to submit such information within twenty days.

- Fee Payment: The applicant needs to pay the fees for insurance broker license renewal along with the relevant documents for such a renewal. The application for a license will not be processed unless the fee is paid.

- Renewal for 3 Years: If the authority is fully satisfied that the applicant fulfils all the criteria for renewal of license, it shall renew the registration for the next three years and shall send a notice to that effect to the applicant.

Renewal Fee for Insurance Broker License

- A direct broker needs to pay Rs. 50,000/- in case of new registration whereas the renewal fee is Rs 1 lakh for a period of three years;

- The composite broker needs to pay Rs. 2.5 lakhs in case of new registration where renewal fee is Rs. 5 lakhs for a period of three years;

- The Reinsurance broker is required to pay Rs. 1.5 lakhs in case of new registration, whereas the renewal fee is Rs. 3 lakhs for a period of three years.

What to do in case of non-issuance of an Insurance broker license?

In case the authority is not satisfied by the application submitted by the applicant and does not fulfil the requirements prescribed in the regulations, then they may reject the license.

Such rejection should be communicated to the applicant by sending a notice with thirty days of such refusal by the authority, and the authority should state the ground for which the application has been rejected. Once the applicant learns about the grounds and refusal, they may appeal to the Securities Appellate Tribunal.

What happens if a License for Insurance Broker gets refused from renewal?

Where the renewal application of the insurance broker is refused by the authority, the applicant shall cease to be an insurance broker, but he shall be responsible for the contracts previously entered by him. Such service will continue until the contract expiry or for a maximum of 6 months. Required measures shall be made for another registered broker who shall attend the contracts.

What are the Vital Points to remember while applying for an Insurance Broker License Renewal?

Following are some vital points to think of while applying for an Insurance Broker License Renewal:

- If the application reaches the authority after thirty days but before the expiry of the current registration certificate, then the extra fee of Rs. 100/- shall be paid to the authority by the applicant;

- If the applicant provides a sensible reason in writing for the delay and if the authority is pleased by such reason, it shall accept the application for renewal of a license after the expiry of registration up to sixty days on payment of extra fees of Rs. 750/-;

- A broker can submit the application for renewal of license 90 days prior to the expiry date of the registration;

- The principal officer and the insurance broker qualified persons must finish at least 25 hours of practical & theoretical training before looking for a renewal of license. Such type of training must be communicated by an institution acknowledged by the authority;

- The broker should follow all the compliances under the regulation of the insurance broker in IRDAI.

Conclusion

An insurance broker license is essential for business; without such a license, no one can operate any insurance-related business. It is no different in the case of insurance brokers. One must keep a check on the regulations as mentioned above and guidelines to ensure a smooth process of insurance broker license renewal.

Also, Read: What is the Procedure for Renewal of Insurance Broker License?