Why Insurance Broker License is required in India?

Japsanjam Kaur Wadhera | Updated: Feb 19, 2021 | Category: Insurance Broker, IRDA Advisory

Insurance Regulatory and Development Authority (IRDA) Act, 1999 provides for the regulations for Insurance Broker License, the objective of the regulations is to monitor and supervise insurance brokers. The Insurance brokers advise people on their insurance need and help them to choose right kind of product. The broker basically acts as a middleman between the insurance company and the people looking to purchase policies. This article will discuss why insurance broker license is required in India.

Table of Contents

What is an Insurance Broker?

An Insurance Broker is a person registered as an adviser of insurance who acts through its employees, partners or directors with expert knowledge of Insurance based laws. The brokers guide the people for their insurance policy requirements and also provide professional services to its customers and act as a mediator or middleman between an insurance company and a person seeking to purchase insurance policy.

Also, Read: What are the Documents required for Insurance Broker License?

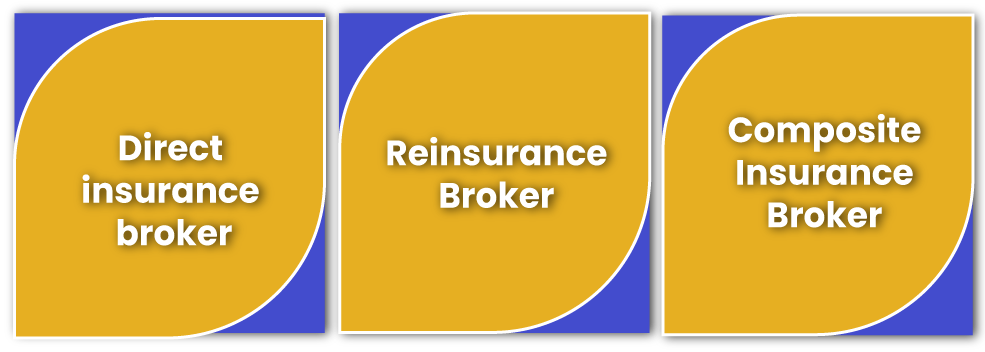

What are the Types of Insurance Brokers?

Certain types of insurance brokers are:

Direct Insurance Brokers

A direct insurance broker is a person who is responsible for the procurement and solicitation of the business and allows the clients to purchase a policy from the website of the insurance company. The broker gets a commission from the insurance company whose policy is sold by him.

Reinsurance Broker

A reinsurance broker is a broker who has the power to buy reinsurance on behalf of the insurance company.

Composite Insurance Broker

This type of broker is an agency who has a valid license to offer the insurance services for general insurance and life insurance. The authority selects the licensing process of a composite insurance broker.

What is the Eligibility to obtain Insurance Broker License in India?

The below mentioned people are eligible to obtain insurance broker license in India:

- A company that is registered under the Companies Act 1956 or 2013.

- An LLP registered under the Limited Liability Partnership Act, 2008.

- Cooperative society created and registered under the Co- operative Societies Act, 1912 or any other similar law.

- Any other person recognised by the Authority.

Note: None of the below mentioned can be the partners for the same, if the applicant is a registered LLP.

- Any individual residing outside India.

- Non- Resident Entity.

- Foreign Limited Liability Partnership enrolled under the Foreign Country Laws.

Need for Insurance Broker License in India

The Insurance Broker License is needed for the following reasons:

- To ensure that insurance policies and products are sold on behalf of the Insurance business.

- To ensure the compliance with relevant laws and regulations related to the insurance products.

- To supervise the activities and conduct market research relating to insurance related products.

- To act on behalf of the clients in negotiating for insurance products.

- To ensure an appropriate authority regulates the business relating to insurance.

- To negotiate the premiums and policies on behalf of the clients.

- The Insurance broker license would assure the clients regarding the genuity of the broker.

Capital Amount Required for Insurance Broker License

The insurance broker license is regulated by the IRDA. According to the regulations, following amount is required for a license:

Capital Requirement

- Direct Insurance Broker License- Rs. 75 lakhs.

- Reinsurance Broker License- Rs. 4 crore.

- Composite Insurance Broker License- 5 crore.

Net worth Requirement

At the time of the registration, the insurance broker is required to maintain a minimum net worth of Rs. 50 lakhs for direct broker and 50% of the minimum capital requirement for reinsurance and composite broker.

Deposit Requirement

According to the category, the applicant is required to place deposit an amount of Rs. 10 lakhs for Direct Broker and 10% of the minimum capital requirement for reinsurance and composite broker with the scheduled bank.

Insurance Broker License Fee

The applicant is required to submit the requisite fees as stated below:

Non- Refundable Application Fees

- Direct Broker- Rs. 25,000.

- Reinsurance Broker- Rs. 50,000

- Composite Broker- Rs. 75,000

Registration fees

- Direct Broker- Rs. 50,000

- Reinsurance Broker- Rs. 2.5 lakhs.

- Composite Broker- Rs. 2.5 lakhs.

Renewal Fee for a period of 3 years

- Direct Broker- Rs. 1 lakh.

- Reinsurance Broker- Rs. 3 lakhs.

- Composite Broker- Rs. 5 lakhs.

Procedure to obtain Insurance Broker License

- Step 1: The applicant is required to submit the application for broker license in Form B as provided in Schedule I of the IRDA laws.

- Step 2: Once the documents are verified, the authority can ask any queries or for more information if needed.

- Step 3: On the completion of 30 days from the date of the communication, the applicant will be required to submit the necessary documents or information. Once being satisfied that all the conditions are fulfilled by the applicant, the authority shall issue an in- principle approval for the registration.

- Step 4: The applicant shall comply with the additional requirement and further submit the license fees with authority, once the in- principle approval is issued.

- Step 5: Once the authority is satisfied with the regulations, rules and requirements and guidelines, it shall issue a Certificate of Registration in Form- J.

Documents Required for Insurance Broker License

- Application of insurance broker license along with the necessary information required to be submitted in Form – B.

- Copy of Memorandum of Association of the applicant company.

- Articles of Association of the company of the applicant.

- The applicant is required to provide information regarding the Principal Officer, and mention whether they fulfil the complete criteria in Form G of the Schedule I. Also, the applicant is required to assure that they have fulfilled the training compliances before submitting the application.

- Written declaration of the Principal Officer affirming that they along with the partners, direction and other managerial personnel do not suffer from any disqualifications as mentioned under the section- 42D of the Act.

- Complete details of all the directors, partners, promoters and other mail managerial personnel.

- To provide bank details and Statutory Auditor.

- The applicant is required to have infrastructure for registration purpose. And hence, the applicant is required to submit the details of the infrastructure along with the application including IT infra, equipment, and workforce and office space.

- Current and proposed shareholders of the company of the applicant.

- Board Resolution to be furnished, if the company is the shareholder.

- Audited/ Unaudited financial statement of the company in addition to certificate on net worth.

- 3 years projected business plan.

- Organization Chart with responsibility and accountability of department head.

Conclusion

It is clear from the above article as to why insurance broker license is required in India. It is important to register and obtain the insurance broker license so as to conduct the activity of selling insurance products and policies. The Insurance Regulatory and Development Authority (IRDA) Act, 1999 lays down the rules and procedures for obtaining the insurance broker license and the purposes for which it must be used.

Also, Read: How to Start Insurance Brokerage Business in India