An Overview of Insurance Broker License

Nowadays, many insurance products are available in the market, which may confuse a layperson in making the right insurance choice. An Insurance Broker suggests and guides people about the best for their needs and helps them make the right financial decisions. An Insurance Broker acts as a middleman between the general public and insurance companies. They assist people in buying the most suitable insurance policies as per their financial needs. A company needs to obtain the Insurance Broker License to start any insurance broker-related activities.

In India, the legal provisions regulating the Insurance Broker License are as follows:

- The Insurance Regulatory Development Authority Act, 1999;

- The Insurance Regulatory Development Authority of India (Insurance Brokers) Regulations, 2018.

Who is an Insurance Broker?

An Insurance Broker is a company or person registered under IRDA and provides advisory on the matters related to insurance. It aids the client in the process of getting insurance coverage from an insurer. An Insurance Broker is an expert and qualified individual who works with the motive to provide insurance cover. A Broker acts as a mediator between the insurance company & the clients who are wandering in search of purchasing an insurance policy.

Types of Insurance Brokers in India

In India, the different types of Insurance Broker can be summarised as follows:

- Direct Insurance Broker

Direct Insurance Brokers provide details about the various insurance products and businesses available in the market. They assist clients in choosing the appropriate policy as per their needs. Also, activities like opening an e-insurance account for a client or assisting them in paying the premium to their insurers are included in the working of a direct insurance broker.

- Reinsurance Broker

A Reinsurance Broker performs similar operations to the Direct Insurance Broker. The activities related to a reinsurance insurance broker are as follows:

- Maintaining market statistics of the reinsurance market;

- Selling of Products related to reinsurance;

- Negotiating on behalf of the client.

- Composite Insurance Broker: A Composite Insurance Broker provides services on insurance-related matters to insurance buyers. The insurance services provided by a Composite Insurance Broker are related to general and life insurance. However, the licensing of a Composite Insurance Broker by the IRDAI is very selective.

Functions of Insurance Broker

In India, the functions of an Insurance Broker are:

- Direct Insurance Broker: The functions of a Direct Insurance Broker are as follows:

- Gather information on the insurance business and risk retention strategy of the client;

- Render advice regarding the suitable insurance cover and terms;

- Gain complete knowledge about the different insurance products and insurance markets available;

- Provide a quotation as per the consideration of the client.

- Reinsurance Broker: The functions of a Reinsurance Broker are as follows:

- Understand the client’s business nature and risk management strategy;

- Maintain precise and proper records of the insurer's business;

- Render advice on the matters relating to insurance covers and various types of insurance covers available in the reinsurance markets;

- Establish a database of the available reinsurance markets, which also includes the solvency rating of each reinsurer;

- Protect the reinsurance market,

- Deliver risk management services;

- Propose a reinsurer or a group of reinsurers;

- Negotiate with a reinsurer on behalf of the client.

- Composite Broker: A Composite Broker performs all the functions of a direct insurance broker and reinsurance broker.

Importance of Insurance Broker License in India

- To make sure that there is compliance with relevant laws & regulations concerning insurance products;

- This license would also assure customers regarding the sincerity of the broker;

- To ensure that an important number of insurance products are sold on behalf of the Insurance Business;

- To act on behalf of customers to negotiate for insurance-related products;

- To monitor activities & conduct market research on insurance-related products;

- To negotiate policies & premiums on behalf of clients.

Eligibility for Insurance Broker License

The entities eligible to apply for the Insurance Broker License in India are as follows:

- Any company registered under the provisions of the Companies Act, 2013;

- Any registered co-operative society incorporated as per the norms of the Co-operative Societies Act, 1912;

- Any Limited Liability Partnership (LLP) registered under the Limited Liability Partnership Act, 2008;

- Any other person recognised by the Authority.

In case the applicant for Insurance Broker License is a registered Limited Liability Partnership, then the following are not eligible to become a partner:

- Non-Resident Entity;

- Any foreign Limited Liability Partnership registered as per the law of that foreign country;

- Any person who resides outside India.

Minimum Requirements for Insurance Broker License

In India, the minimum requirements for obtaining an Insurance Broker License can be summarised as follows:

Capital Requirements: The Financial Requirements for obtaining Insurance Broker License are as follows:

- For Direct Insurance Broker

Rs 75 Lakh.

- For Reinsurance Broker

Rs 4 Crore.

- For Composite Broker

Rs 5 Crore.

Net-worth Requirements: The Net-worth Requirements for obtaining Insurance Broker License are as follows:

- For Direct Insurance Broker

Rs 50 Lakh.

- For Reinsurance Broker

50% of the Minimum Capital Requirement.

- For Composite Broker

50% of the Minimum Capital Requirement.

Deposit Requirements: For obtaining an insurance broker license, the applicant company must deposit a certain amount with the scheduled bank. The amount required to be deposited in a scheduled bank is:

- For Direct Insurance Broker

Rs 10 Lakh.

- For Reinsurance Broker

10% of the Minimum Capital Requirement.

- For Composite Broker

10% of the Minimum Capital Requirement.

Checklist for Insurance Broker License

The conditions to be fulfilled by an applicant company before obtaining an Insurance Broker License are as follows:

- The applicant company must end its name with the word Broking;

- The MOA (Memorandum of Association) of the applicant company must contain the activities of insurance broking as its principal objective;

- The applicant company must satisfy the minimum financial, capital and deposit requirement as specified in the regulations;

- The insurance broker company should not hold any foreign investment which exceeds the limit of 26% of the total paid-up capital;

- The company needs to deposit 20% of the initial capital with the registered bank;

- The principal officer must hold a fair qualification, and have cleared the brokers’ exam, and possess the required training;

- The applicant company must hire a minimum of two persons with the compulsory qualification and training;

- The company must have the required infrastructure and well-trained employees to run the insurance broking business.

Documents Needed for Insurance Broker License

The documents needed to be submitted together with Form C of Schedule I of the Insurance Regulatory Development Authority of India (Insurance Brokers) Rule, 2018, are as follows:

- The applicant company needs Form-B to fill the application for the Insurance Broker License;

- Copy of Memorandum of Association and Article of Association of the company;

- Information concerning the Principal Officer in Form G of Schedule I. Further, the Principal Officer must complete the training and pass the insurance examination before submitting the application;

- A declaration expressing that the PO and the directors/partners and other key administrative workforce are not excluded under Section 42 D of the Insurance Act;

- Complete details of the partners, directors, advertisers and other KMP (Key Managerial Personnel).

- A list of at least two qualified agents along with their qualifications.

- Complete details of the company’s bank account;

- Details of the Principal Bankers along with the statutory advisors;

- List of all the shareholders;

- A copy of the board resolution passed in the company’s board meeting for investing and promoting the company;

- Audited Balance Sheet of the Company;

- Any other detail may be required.

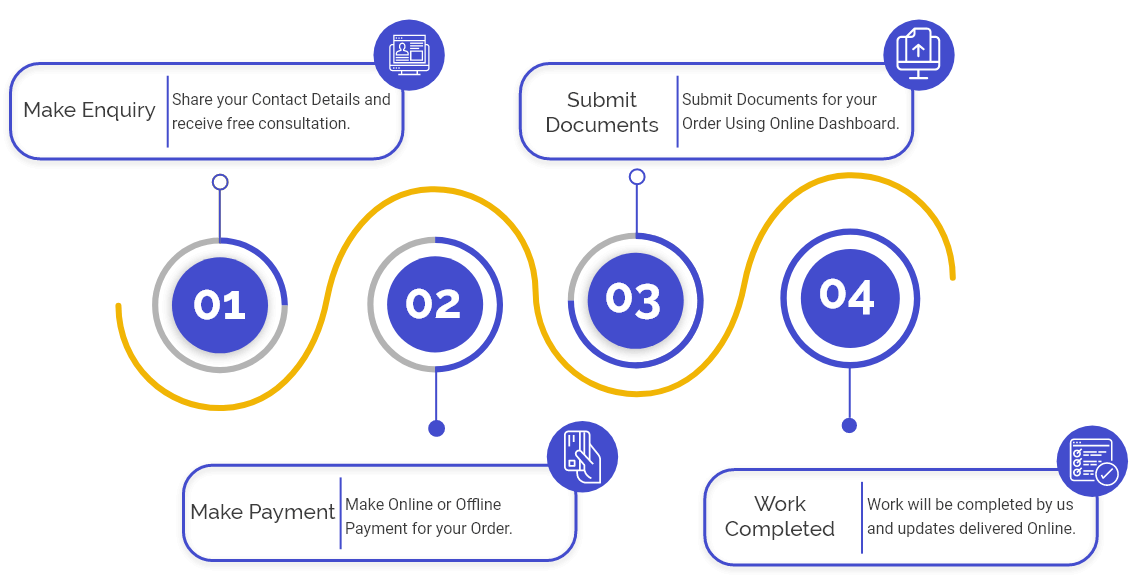

Procedure for obtaining Insurance Broker License

In India, the steps included in the procedure for obtaining an Insurance Broker License can be summarised as follows:

- Submission of Application: The applicant company needs to file Form B of Schedule I for the Insurance Broker License along with the non-refundable application fee. Also, submit the necessary documents with the application form to the Insurance Regulatory Development Authority of India (IRDAI).

- Examination of Documents: The Authority examines the application & documents submitted. At this stage, the Authority can raise queries and ask for more details if it requires further clarity from the applicant. Further, the Authority has the power to ask for additional documents.

- Submission of Additional Documents: The applicant must submit the additional documents within thirty days from the date of receiving the intimation from the Authority.

- Issue of In-Principal Approval: After examining and verifying all the documents submitted, if the Authority thinks that the applicant satisfies all the necessary conditions, it will issue the in-principle approval for the Insurance Broker License.

- Additional Submission: After acquiring the in-principle approval, the applicant company must comply with all the additional requirements and pay the prescribed license fees to the Authority.

- Issue of Certificate of Registration: Once IRDAI is satisfied that the applicant company has complied with all the requirements as prescribed in the IRDA (Insurance Broker) Regulations, 2018, and the in-principle approval, it grants a COR (Certificate of Registration) to the applicant company. Further, the COR is issued in Form J as prescribed in Schedule I of the IRDA Regulations.

Conditions for Issuing the Insurance Broker License

The IRDAI makes certain conditions before issuing the Insurance Broker License:

- The Insurance Broker must conduct the business as per the IRDAI Rules;

- Insurance Broker business must handle all grievance procedures of customers within 14 days of receiving the complaint. The business must keep details regarding the number of complaints received from customers;

- Insurance Broker shouldn’t conduct multi-level marketing/solicitation;

- If the Insurance Broker business has provided false/misleading details regarding the particulars of the business, then the same should be intimated to the Authority;

- Insurance Broker must maintain books of accounts.

Fee for Insurance Broker License

The applicant company needs to submit the fee for the Insurance Broker License in Form D of schedule I. The prescribed fee for the application, registration and renewal can be summarised as follows:

Non-Refundable Application Fees:

- For Direct Broker

Rs 25000.

- For Reinsurance Broker

Rs 50000.

- For Composite Broker

Rs 75000.

Registration Fee for Fresh Application:

- For Direct Broker

Rs 50000.

- For Reinsurance Broker

Rs 150000.

- For Composite Broker

Rs 250000.

Renewal Fee for a period of 3 years:

- For Direct Broker

For 1 Lakh

- For Reinsurance Broker

For 3 Lakh

- For Composite Broker

For 5 Lakh.

Validity and Renewal of Insurance Broker License

The certificate of registration for an Insurance broker business is valid for three years, starting from the date of issuance. Further, the applicant company can file an application for the renewal of the insurance broker license at least one month before the expiry of the validity period.

FAQs of Insurance Broker License

There are 3 different types of Insurance Broker License prevailing in India.

The minimum capital requirement for obtaining a Direct Insurance Broker License in India is Rs 75 Lakhs.

The minimum capital requirement for obtaining a Composite Insurance Broker License in India is Rs 5 Crores.

The minimum capital requirement for obtaining a Reinsurance Broker License in India is Rs 4 Crores.

The term “Insurance Broker” denotes a middleman acting in between the general public and insurance companies.

An Insurance Broker assists people in buying the most suitable insurance policies as per their financial needs.

There are 3 types of Insurance Broker License, which are Direct Insurance Broker; Composite Insurance Broker; and Reinsurance Broker.

Any company that wants to start any insurance brokerage-related activities in India needs to obtain the Insurance Broker License.

The IRDAI regulates the insurance Broker License in India. In contrast, Insurance Brokers are regulated by the IRDA (Insurance Broker) Regulations, 2018 issued by the IRDAI.

Yes, a company registered under the provisions of Companies Act 2013 can apply for Insurance Broker License.

Yes, any registered co-operative society formulated under the Co-operative Societies Act 1912 can apply for Insurance Broker License.

Yes, any Limited Liability Partnership registered under the LLP Act 2008 can apply for Insurance Broker License.

The certificate of Insurance broker license is valid for a period of 3 years, starting from the date of issuance.

An application for the renewal of the registration of insurance broker license can be filed least 1 month before the date of expiry of the registration.

The functions of a reinsurance broker include familiarising with the client’s business nature and risk retention strategy; maintaining clear, transparent and healthy records of the insurer’s business; advising clients on the matters relating to insurance covers and different types of insurance covers available in the transnational insurance and reinsurance markets.

The main difference between the two is that the former displays the information and facilitate comparison between different insurance policies available in India. In contrast, the latter guides the insurance buyers to buy the best insurance product available, depending upon their financial and coverage requirements.

Swarit Advisors provide Insurance Broker License services PAN-India. We have successfully completed Insurance Broker License services for hundreds of businesses in Delhi, Mumbai, Gurgaon, Bangalore, Noida, Chennai, Ahmedabad, Hyderabad, Kolkata, Pune, Surat, Lucknow, Jaipur, Kanpur, Nagpur and various other Indian cities.

Yes, Swarit Advisors is a 100% online platform rendering services all over the nation no matters wherever the individual is conducting his or her business. The only thing required is an internet connection on the mobile or laptop, and we are all set to assist you.

The Fee Charged for the Renewal of Direct Insurance Broker License in India is Rs 1 Lakh.

The Fee Charged for the Renewal of Reinsurance Broker License in India is Rs 3 Lakh.

The Fee Charged for the Renewal of Composite Insurance Broker License in India is Rs 3 Lakh.

A Composite Broker conducts all the Functions and Roles that ate performed by a Direct Broker and Re-insurance broker.

Yes, FDI (Foreign Direct Investment) is permitted through Government Route and Automatic Route.

Yes, a Director can become an Insurance Broker in India if he/he has the required qualifications and experience for managing the insurance business.

A Non-resident Entity; An NRI (Non Resident Indian); and a Foreign Partnership Firm are not eligible to become an Insurance Broker in India.

Yes, an Insurance broker is eligible to provide additional services, such as claim consultancy, risk management services, and other services like risk advisory, risk mitigation, and risk audit.

No, an Insurance Agent acts on behalf of Insurance Companies and is eligible to sell what his/her principal insurer has to offer.

The Key Management Person (KMP) includes Chief Executive Officer (CEO), Chief Marketing Officer (CMO), Chief Finance Officer (CFO), Chief Technical Officer (CTO)/ Head- IT, Head-Reinsurance and Compliance Officer.

Yes, it is mandatory to obtain NOC (No Objection Certificate) from the Authority to use the word “Insurance Broking”, “Insurance Broker”, or Insurance Brokers.

The maximum permissible limit for the FDI in Insurance Broker Business in India is 49% of the total paid-up capital of the broking entity.