Procedure for Issue of Debentures: A Complete Guide

Japsanjam Kaur Wadhera | Updated: Feb 16, 2021 | Category: Issue of Debentures, SEBI Advisory

A debenture is a legal document through which a creditor lends money to the debtor. Under the Companies Act 2013, Section 2(30) states, debenture includes debenture bonds, stock or any other instrument of the company which is an evidence of a debt, whether it has or has not constituted a charge on the assets. Debentures are classified as secured debentures and unsecured debentures. This article will give a complete guide on procedure for issue of debentures.

Table of Contents

What are Debentures?

According to Section 71 of the Act, a company can issue debentures with an option to convert the debentures into shares, either partly or wholly at the time of redemption. Provided that the issue of debentures with the option to convert such debentures into shares shall be accepted by a Special resolution passed by the directors or shareholders in an Extra- Ordinary General Meeting held by the company.

A debenture is a legal document in the form of a certificate issued under the common seal of the company. It is used for the payment of a specific sum at a specified date.

Also, Read: Issue and Redemption of Debentures – Problems and Solutions

Types of Debentures

Debentures are classified as secured and unsecured debentures:

- Secured Debenture- This type of debenture is backed by a specific piece of property, that is for example, a factory, bunch of oil wells, pipelines etc. secured debentures may be issued by a company subject to certain terms and conditions as may be prescribed under the Companies Rules 2014 and amendment thereof.

- Unsecured Debenture- this type of debenture is basically a loan without any kind of protection. It is only backed by the general creditworthiness of the issuer of debentures.

What are the Mandatory Requirements for Issue of Debentures?

- A debenture cannot be issued by any company carrying voting rights.

- A company shall not make an offer, a prospectus or an invitation to the public or its members being more than five hundred for the subscription of debentures, unless the company previously to such issue or offer, selected one or more debenture trustees and the conditions that govern the appointment of such trustees.

- Without the creation of trust, an issue of debentures for over more than 500 members or any number of public subjected to clarification from government is forbidden.

- A debenture trustee shall take necessary steps to protect the interest of the debenture holders and provide remedy to their grievances.

- Any provision of trust deed or any contract protected by trust deed, excluding a trustee or indemnifying him against any liability for breach and infringement of trust shall be void.

- If any default in compliance with the order of the Tribunal is made, every officer of the company who is at default will be punished with imprisonment for term which may be extended to a period of 3 years or with a fine which will not be less than Rs. 2 lakh but may extend to Rs. 5 lakh or both.

What is the Procedure for Issue of Debentures?

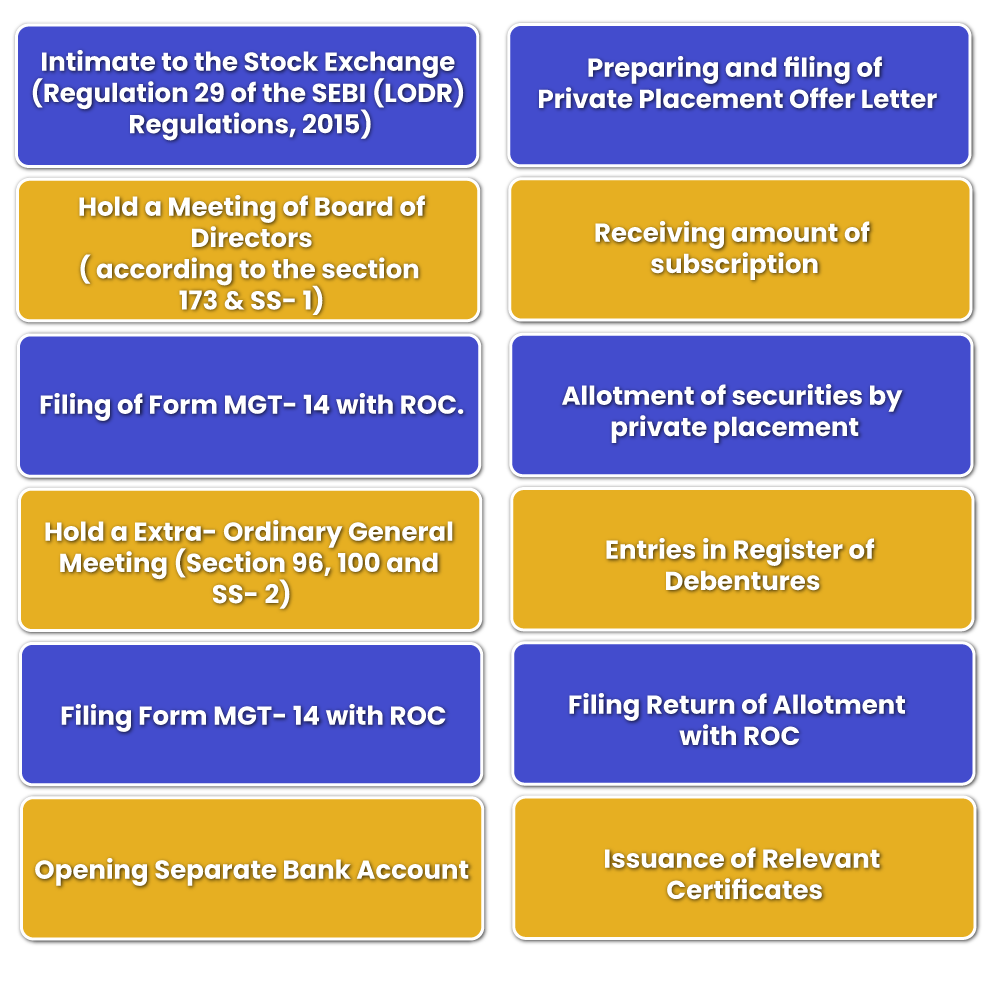

Intimate to the Stock Exchange (Regulation 29 of the SEBI (LODR) Regulations, 2015)

The listed companies shall make the prior intimation to the stock exchange at least 2 working days in advance regarding the meeting of the Board of Directors in which the proposal for the issue of debentures through the private placement shall be considered, excluding the date of intimation and date of meeting.

Hold a Meeting of Board of Directors (According to the section 173 & SS- 1)

- A notice of Board meeting shall be issued at least 7 days before the date of the Board Meeting to all the Directors of the Company at their respective registered addresses with the company. A shorter notice can be issued in case of urgent meeting.

- The Agenda or notes to Agenda are required to be attached with the notice and Draft resolution with the notice.

- A meeting of Board of Directors of the company is to be held to pass necessary Board Resolution:

- To consider and approve issued of debentures through private placements.

- To approve private placement offer letter.

- To identify the group of persons to whom the Private Placement is to be made.

- To fix date, day and time and venue to hold the Extra – Ordinary General Meeting of the Company.

- To approve the draft notice of the Extra- Ordinary General Meeting along with the explanatory statement annexed to the notice as the requirement under the Section 102 of the Companies Act, 2013.

- To Authorize the Director of the Company or the Company Secretary to sign and issue notice of the Extra- Ordinary General Meeting and to perform such acts, deeds and things as required giving effect to the Board’s decision.

- The listed company shall submit the outcome of the Board meeting within 30 minutes from the conclusion of the Board Meeting and publish the same on the website of the company with 2 working days. (Regulation 30 & 46(3) of the SEBI (LODR) Regulations, 2015).

- A Draft Minutes is required to be prepared and circulated within 15 days from the date of the Conclusion of the Board Meeting either by registered post, speed post, email or in person to all the directors for their comments.

Filing of Form MGT- 14 with ROC.

The company is required to file a copy of the Board Resolution to ROC in Form MGT0- 14 within 30 days of the passing of the resolution in the Board Meeting.

- Obtaining Shareholders Approval

- By holding a Extra- Ordinary General Meeting, or

- By passing a resolution through Postal Ballot.

Hold an Extra- Ordinary General Meeting (Section 96, 100 and SS- 2)

- A notice of Extra- Ordinary General Meeting shall be provided at least 21 days before the date of the meeting in writing, either by registered post/ speed post or in person or email or any other electronic means or shorter notice issued with the consent of at least majority in number and 95% of such part of the paid up share capital of the company giving right to vote at such a meeting in accordance with the Section 101 of the Companies Act.

- The notice shall be sent to all the members, directors, secretarial auditor, auditors of the company, debenture trustees and to others entitled to receive the notice of the Extra- Ordinary General Meeting.

- The notice shall include the date, day, time and complete address of the place of the meeting and contain a statement of the business to be transacted at the extra- ordinary general meeting.

- The meeting is required to be held on a fixed day and a Special Resolution shall be passed for the issue of debentures through Private Placement.

- The listed companies shall disclose the proceedings of the Extra- Ordinary General Meeting to the Stock Exchange within 24 hours from the date of the decision of the General Meeting and the same shall be posted on the official website of the company within 2 working days. (Regulation 30 and 46(3) of the SEBI (LODR) Regulations, 2015).

- The details of the voting results shall be submitted to the stock exchange by the listed companies within 48 hours from the conclusion of the meeting and post the same on the official website of the company. (Regulation 44 of the SEBI (LODR) Regulations, 2015).

- The minutes of the Extra- Ordinary General Meeting is required to be prepared and shall be signed and compiled accordingly.

Filing Form MGT- 14 with ROC

The company shall file the Form MGT- 14 with the ROC within the 30 days of the passing of the Special Resolution in the Extra- Ordinary General Meeting along with the prescribed fee as specified under the Companies Rules, 2014 along with the following attachments:

- Certified true copy of the Special Resolution passed along with the explanatory statement.

- Copy of Notice of meeting sent to the members along with the annexure.

- Shorter notice consent letter from the members in case the Extra- Ordinary General Meeting was held at a shorter notice.

- Copy of attendance sheet of Extra- Ordinary General Meeting.

- Any other attachment as required.

Opening Separate Bank Account

The Company is required to open a separate bank account in the scheduled bank for keeping the money received on the application.

Preparing and filing of Private Placement Offer Letter

- The company shall record the names of the persons to who the debenture through Private placement shall be offered.

- The company shall make a Private Placement Offer Letter in Form PAS- 4 and send these offer letters either in electronic form or in writing within 30 days of the recording of the names of such person along with the an application form serially numbered to the person to whom it is made.

- The company is required to maintain a complete record of persons to whom the Private Placement offer letter is sent in the Form PAS- 5.

Receiving amount of subscription

- The company shall receive the amount of subscription through demand draft, cheque or other banking channels from the bank account of the person subscribing to the debentures except on the case of issue of debentures for consideration other than cash.

- The company shall keep a record of the bank account from where such payments for the subscription have been received.

Allotment of Securities by Private Placement

On closing the Private Placement Offer, the Company shall:

- Hold a Board Meeting. Or

- Pass a Board Resolution by circulation within 60 days from the date of the receipt of the application money.

When a Board meeting is held (as per section 73 & SS- 1):

- Issue notice of board meeting to all the directors of the company at their respective addressed registered with the company at least 7 days before the date of the board meeting. A shorter notice may be issued in case of urgent business.

- Attach the agenda and notes to agenda and draft resolution with the notice.

- Hold a meeting of Board of Directors of the company and pass necessary Board Resolution.

- To consider the debenture allotment through Private Placement.

- To authorize the company secretary or Director to file the allotment return with the ROC.

- Further, the draft minutes are required to be prepared and circulated within 15 days from the conclusion of the Board Meeting either by registered/ speed post, email or in person to all the directors for their comments.

Entries in Register of Debentures

The Private Company is required to make necessary entries in the Register of Debentures in Form- MGT- 2 within 7 days of the Board Meeting in which the debentures allotment was approved.

Filing Return of Allotment with ROC

Within the 15 days from the date of the allotment, the company shall file return of allotment in Form PAS- 3 with the Registrar of Companies (ROC) along with the attachments as below:

- List of allottees, each allotment is required to be added in a separate list.

- Copy of shareholders or board resolution approving allotment of debentures is necessary in all the cases.

- Complete record of private placement offers and acceptance in Form PAS- 5 is necessary in case of private placement.

- Any other information as required may be provided as an optional attachment.

Issuance of Relevant Certificates

The Private Companies which did not allotted debentures in demat format shall issue and deliver the debentures certificates within 6 months period from the date of allotment.

Conclusion

Debenture is a debt acknowledged by a company whether constituting a charge on the company’s asset or not, whether convertible into shares or not. That is, the debentures are in the form of debt, unlike shares and do not carry any voting rights. The procedure for issue of debentures is discussed above in the article and must be issued in accordance with the rules and procedure prescribed under the Companies Act, 2013.

Also, Read: Conversion of Debentures Into Shares: Its Complete Procedure