Conversion of Debentures Into Shares: Its Complete Procedure

Shivani Jain | Updated: Sep 24, 2020 | Category: Issue of Debentures

The term Conversion of Debentures into Shares denotes a process under which a Debenture Holder decides to become a Shareholder of the company by converting his/ her Debentures into Shares. Further, after becoming a Shareholder in the company, the said person will get the Right to Vote.

In this blog, we will discuss the concept of Conversion of Debentures into Shares and the Procedure for the same.

Table of Contents

Concept of Debentures

The term “Debenture” denotes a Long Term Security having a Fixed Interest Rate, issued by a Private Limited Company against the Assets. In other words, Debentures denotes a Certificate Loan issued by a company at a Fixed Rate of Interest.

Further, Section 2(30) of the Companies Act 2013 defines the term “Debenture” as a Debenture Stock, bond, or any other instrument issued by the company for evidencing a debt.

Moreover, Section 71 of the Companies Act 2013 and Rule 18 of the Companies (Share Capital and Debenture) Rules 2020 acts as the Regulatory Framework for the Issue of Debentures.

Key Features of Debentures

The key features of a Debenture are as follows:

- A Debenture does not have a Voting Right;

- It acts as a Debt or Liability for a Company;

- A Debenture can be both Secured or Unsecured;

- It carries a Fixed Rate of Interest;

- It can carry a Zero Rate of Interest as well;

- A Debenture bears a Common Seal of the Company;

- A Debenture Holder is not the Owner of the Company;

- The Interest charged on Debentures is a Tax-Deductible Expense;

- It promotes both Long-term Planning and Long-term Funding;

- During the process of Winding up, a Debenture holder is given preference over a Shareholder;

Benefits of the Issue of Debenture

The benefits of the Issue of Debentures are as follows:

- A Debenture does not alter the Shareholding Pattern of a Company;

- It does not change the Voting Right Pattern of the Shareholders;

- The stamp payable of on a Debenture is just 0.05%, which is comparatively very less than the Stamp Duty payable on Shareholder Loan;

- A company pays Interest on a Yearly Basis;

- There is no Statutory Limit prescribed for the conversion or redemption of Unsecured Debentures;

- During the process of Winding up, a Debenture holder is given preference over a Shareholder;

- Issue of Debentures is a cheaper source of finance than Issue of Share;

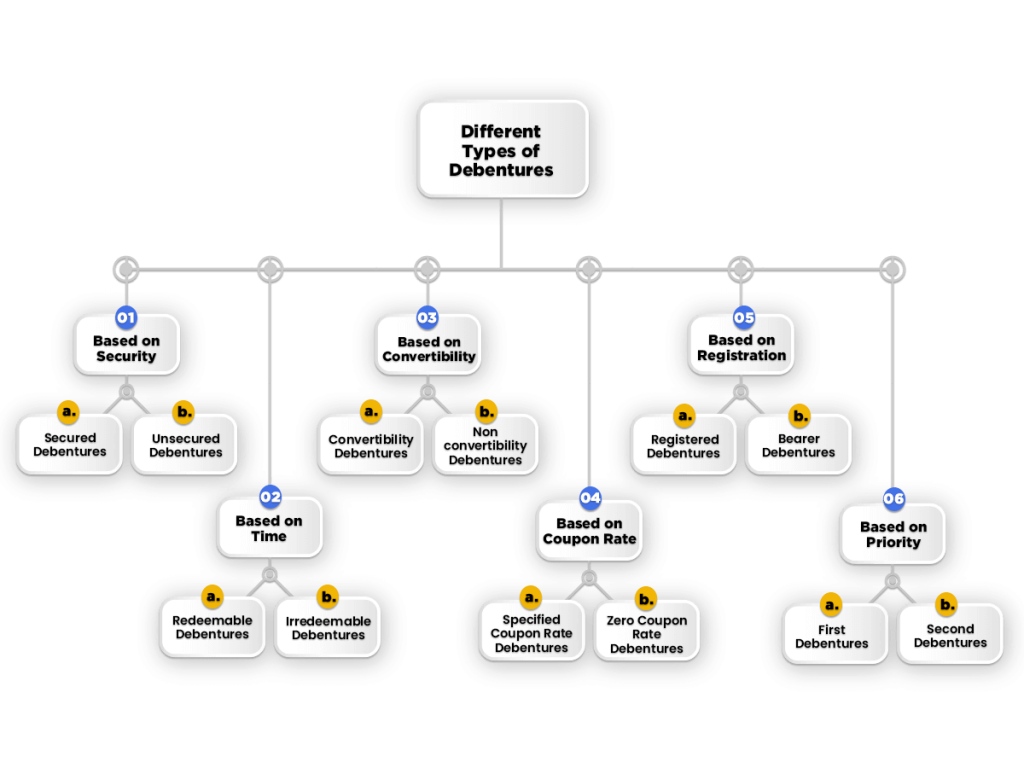

Different Types of Debentures

The different types of Debentures are as follows:

Based on Security

On the Basis of Security, a debenture can be divided into two forms as follows:

Secured Debentures

A debenture that carries a charge on the asset is known as the Secured Debentures. Further, the other name for the Secured Debenture is Mortgage Debenture.

Unsecured Debentures

A debenture that does not carry a charge on the asset is known as the Unsecured Debentures. Further, the other name for Unsecured Debenture is Naked Debenture.

Based on Time

On the Basis of Time, a debenture can be divided into two forms as follows:

Redeemable Debentures

A debenture that is repayable by the company after the expiry of the prescribed period is known as Redeemable Debenture;

Irredeemable Debentures

A debenture that is not repayable by the company during its existence is known as Irredeemable Debenture;

Based on Convertibility

On the Basis of Convertibility, a debenture can be divided into two forms as follows:

Convertibility Debentures

A Debenture that is convertible into Equity Share after a period of time is known as Convertible Debenture.

Non-convertibility Debentures

A Debenture that is not convertible into Equity Share after a period of time is known as Non-Convertible Debenture.

Based on Coupon Rate

On the Basis of Coupon Rate, a debenture can be divided into two forms as follows:

Specified Coupon Rate Debentures

When a company issues a debenture with a specific interest rate, the same is known as Coupon Rate Debenture.

Zero Coupon Rate Debentures

When a company issues a debenture that does not carry a specific interest rate, the same is known as Zero Coupon Rate Debenture.

Based on Registration

On the Basis of Registration, a debenture can be divided into two forms as follows:

Registered Debentures

When a company issues a debenture by recording the name of the holder, the same is known as the Registered Debenture.

Bearer Debentures

When a company issues a debenture by mere delivery, the same is known as Bearer Debenture.

Based on Priority

On the Basis of Priority, a debenture can be divided into two forms as follows:

First Debentures

A debenture that is given priority at the time of repayment is known as the First Debenture.

Second Debentures

A debenture that is repaid after the first debenture is known as Second Debenture.

Also, Read: An Analysis of Debentures issued as Collateral Security

Concept of Equity Shares

The term “Equity Shares” denotes the primary source of finance for a limited company. These shares provide various benefits to investors, such as follows:

- Right to Vote;

- Profit Sharing; and

- Claim of the Assets;

Further, an equity shareholder acts as the owner of the company. Moreover, section 43 (a) of the Companies Act 2013 states that an equity shareholder has the rights as follows:

- Right to cast a Vote; and

- Right to receive Dividend;

Benefits of the Issue of Equity Shares

The benefits of Equity Shares can be summarised as follows:

- An Equity Shares does not create an obligation to pay Dividend at a Fixed Rate;

- A Company can issue an Equity Share without creating a Charge over an Asset;

- An Equity Shares acts as the Permanent Source of Capital;

- A company needs to repay to its Shareholder at the time of Liquidation ;

- An Equity Shareholder act as the Real Owner of the Company;

- An Equity Shareholder has a Right to Cast Vote in Company’s Meetings;

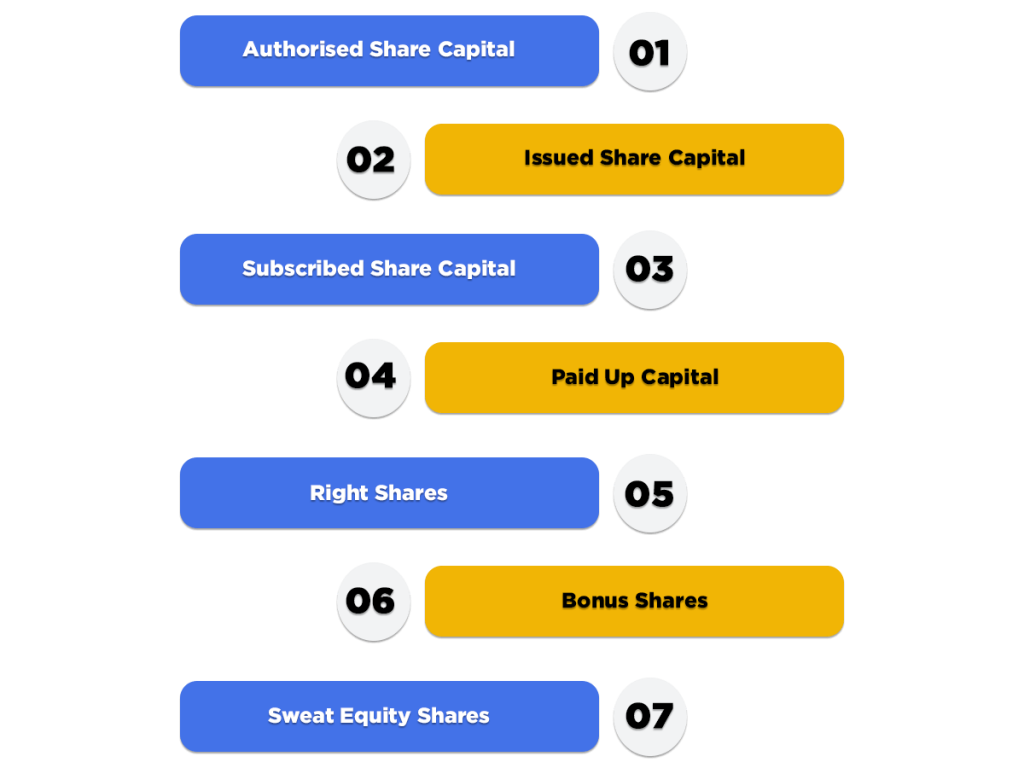

Different Types of Share Capital

The different types of Share Capital are as follows:

Authorised Share Capital

The term “Authorised Share Capital” denotes the maximum amount of capital that a company can issue. Further, a company can increase its Authorised Capital only after taking permission from the respective authorities.

Issued Share Capital

The term “Issued Share Capital” denotes the portion of the Authorised Capital that has been given to the investors for the subscription.

Subscribed Share Capital

The term “Subscribed Share Capital” denotes the number of shares that are actually accepted and agreed by the shareholders.

Paid Up Capital

The term “Paid up Capital” denotes a portion of the Subscribed Share Capital and is known as the amount of funds used by the company in the business.

Right Shares

When a company issues shares to the existing shareholders in the proportion of their shareholding are known as Right Shares. Further, these are issued by the company to raise its Subscribed Capital.

Bonus Shares

When a company decides to give a dividend to its shareholders in the form of additional shares, the same is known as Bonus Shares.

Sweat Equity Shares

The term “Sweat Equity Shares” denotes the shares issued by the company to its employees and directors whenever they perform their job correctly.

Procedure for the Conversion of Debentures into Shares

As per section 71 (1) of the Companies Act 2013, a company has the power to issue debentures with an option of Conversion of Debentures into Shares.

Further, the steps involved in the Process for the Conversion of Debentures into Equity Shares are as follows:

Check Articles for Association

The directors of the company must check the Articles of Association before the Conversion of Debentures into Shares. That means the process of conversion must be allowed in the AOA of the company.

Send Notice for Board Meeting

The directors of the company need to send a notice of the board meeting at least 7 days before the date of the meeting.

Hold a Board Meeting

The directors of the company must pass a BR (Board Resolution) for allowing the process of Conversion of Debentures into Shares. Moreover, in the same meeting, the directors must allow the notice for GM (General Meeting). The reason behind holding a General Meeting is to take approval from shareholders of the company.

Hold a General Meeting

Now, the shareholders of the company need to pass an SR (Special Resolution) for allowing the process of Conversion of Debentures into Shares. However, it shall be relevant to note that the shareholders of a company cannot pass an SR unless and until the AOA (Articles of Association) of the company gives the permission of Conversion of Debentures into Shares.

File Form MGT 14

Now, the directors of the company need to file the SR with the ROC (Registrar of Companies) in the MCA Form MGT 14. Further, the directors need to file the form within 30 days, starting from the date of passing of SR.

Letter of Option

The term “Letter of Option” denotes a letter sent to the debenture holders for verifying the process of Conversion of Debentures into Shares. Further, it shall be relevant to note that one copy of this document is sent to Debenture Holder and the other one is sent to the SEBI (Securities Exchange Board of India).

Moreover, the secretary of the company has the authority to send the letter of option to the debenture holders.

Allotment of Equity Shares

After the Conversion of Debentures into Shares, all the debenture holders are asked to return their Debenture Certificates to the company concerned.

Further, the Secretary of the company has the authority to allot the shares to the Debenture holders.

Issuance of Share Certificate

In the next step of the process of conversion of debentures into shares, the company will issue the Share Certificates to all the shareholders in the MCA Form SH-1.

Changes in the Register of Charges

Now, the directors of the company will cancel the charges against assets, which were created during the Issue of Debentures.

Further, after the Allotment of Shares, the company needs to make necessary changes in the Register of Charges.

Entry in the Register of Members

After issuance of Share Certificate to the Shareholders, the directors of the company will enter their name in the Register of Members.

Filing of the Return of Allotment

Lastly, the directors of a limited company need to file a Return named Return of Allotment with the Registrar of Companies (RoC) within a period of 30 days, starting from the date of Allotment of Shares.

Further, the directors need to file Return of Allotment in the Form PAS 3, together with the (Registration and Offices and Fees) Rules 2020. Also, the attachments required to be filed with the MCA Form PAS 3 are as follows:

- A complete list of the Allottees;

- A copy of the BR (Board Resolution) passed;

- A copy of the SR (Special Resolution) passed; and

- The Valuation Report;

Conclusion

The provisions of the Companies Act, 2013 authorizes for the process of Conversion of Debentures into Shares. Further, the main reason as to why a company chooses this type of conversion is the economic benefit to the shareholders.

The Procedure for the Conversion of Debentures into Shares is a Tiring, Intricate and Time-consuming task. We at Swarit Advisors have an experienced and qualified team of professionals to assist you with the Procedure of Conversion. Our experts will not only plan ideally but will make certain the successful completion of your work.

Also, Read: Issue and Redemption of Debentures