What is the Procedure for NBFC Takeover in India?

Karan Singh | Updated: Mar 01, 2021 | Category: NBFC Takeover, RBI Advisory

With the evolution of the new business model, the NBFCs or Non-Banking Financial Companies are also observing many changes in their activities, regulations, and management. The Reserve Bank of India or RBI is trying very hard to make the NBFC business smoother while recollecting compliance requirements. Worldwide mergers and takeovers are making its existence powerfully felt over the entire corporate situation. Non-Banking Financial Companies are also under the impact of these agreements and negotiations. Based on the industry’s illustrations, the Reserve Bank of India (RBI) lays down the procedure for NBFC Takeover in India. In this, we discuss the procedure for NBFC Takeover in India.

There are two different parts where you can begin your business in NBFC:

- NBFC Takeover of an already set business.

- Incorporating NBFC under Companies Act.

Table of Contents

Different types of NBFC Takeover

The NBFC Takeover has become a well-known habit that companies accept to touch new heights in today’s emerging business world. There are two types of NBFC Takeover in India.

Hostile Takeover

In a hostile takeover, the acquirer uses diverse tactics to acquire the target company’s ownership without the directors’ nod associated with the target Non-Banking Financial Company (NBFC). During such takeovers, entities get to reach out to shareholders by offering them a tender. There is no hesitation in indulging in a proxy tussle to change the management to get the acquisition accepted. In a hostile takeover, the acquirer does not require the support and approval of the target company’s board of directors.

Friendly Takeover

A friendly takeover is a scenario that illustrates the story of the acquisition of the target company peacefully by another company as this takeover is subject to the approval and assistance of the board of directors and the management. The target companies’ shareholders agree to the deal only if they feel that the price per share is good compared to the present market price. Usually, a friendly takeover is likely to occur when the target companies are satisfied with the settlement they have overseen during the prior analysis time frame.

Also, Read: What is the Process of Acquiring an NBFC? Types of NBFC Takeover

What are the Pros and Cons of NBFC Takeover in India?

Following are the pros and cons of NBFC Takeover in India:

Pros of Takeover

- Revenue and sales are coming up.

- Hiking up the profits of the targeted company.

- The vast expansion of distribution channels.

- Reduce the level of competition.

- The economy scale is showing a positive and upward trend.

Cons of Takeover

- Low employee morale.

- Two different companies joining together, cultural clashes are sometimes unavoidable.

- Rare management conflict.

- In a few cases, the amount to be paid during the takeover is less than the actual price.

- After the merger, the masked liabilities of the target companies can be problematic in future.

What is the Procedure for NBFC Takeover in India?

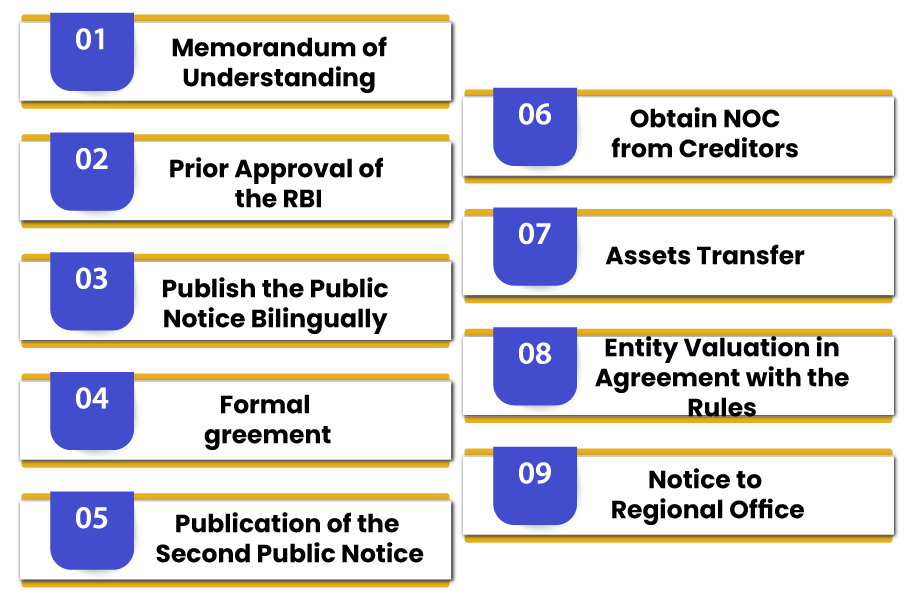

Below is the step by step procedure for NBFC Takeover in India:

Memorandum of Understanding

The procedure for NBFC Takeover triggers off from the MOU (Memorandum of Understanding) to get signed with the proposed company. It specifies that both the target and acquirer companies are ready to form a turnover agreement. The directors of both the companies have to sign the Memorandum of Understanding duly.

Prior Approval of the RBI

We know that NBFCs are governed and controlled by the Reserve Bank of India. The consent of the RBI (Reserve Bank of India) is an essential step. Approval is necessary in the below-mentioned cases:

- At the commencement of the takeover of a Non-Banking Financial Company procedure, RBI’s approval becomes mandatory.

- When the shareholding pattern is changing by becoming responsible for transferring 26% of the company’s paid-up capital to others.

Publish the Public Notice Bilingually

Publication of the public notice must be done in two regional languages. The first language must be English, and the second language must be the regional language. The public notice must be published within 30 after receiving the approval from the Reserve Bank of India (RBI).

Formal Agreement

In this step, two concerned companies/parties can think of entering into a formal takeover agreement. Now, the companies/copies can transfer of administration, transfer of shares, or earlier mentioned takeover concerns.

Publication of the Second Public Notice

Publication of the second public notice must be done in two regional languages. The first language must be English, and the second language must be the regional language. The second public notice must be published before 30 days to purchase transfer of authority, transfer of shares, or before-divulged apprehension for takeover.

Obtain NOC from Creditors

Before the business is transferred, the target company must obtain a No Objection Certificate (NOC) from all the company’s creditors.

Assets Transfer

Once the takeover scheme is approved by the Reserve Bank of India (RBI) with no objections, the assets are transferred.

Entity Valuation in Agreement with the Rules

The RBI has prescribed a set of rules and regulations; the concerned entity’s valuation is made possible following prescribed rules and regulations. The DFC (Discounted Cash Flow) method is the procedure that supports in the valuation process. It is a method that is recognized for depicting the present net value of an entity.

Notice to Regional Office

After the approval and valuation of the Takeover scheme, NMFC shall apply to the Regional Office of Reserve Bank of India.

Following are the details required for the application made to the Regional Office of RBI:

- Details of shareholders and directors.

- Sources of Funds of Acquirer.

- A declaration by the shareholders and directors regarding their association with any entity which is accepting deposit.

- Declarations by the directors regarding no criminal records have been opened against them in the court.

Procedure for changing name while NBFC Takeover is under process

For changing the company’s name, the acquirer company must obtain the name availability certificate from the MCA (Ministry of Corporate Affairs). After that, the acquirer company needs to reach Reserve Bank of India (RBI) for Notice of Default (NOD). Once the NOD is granted, the company can proceed further for the name change.

Conclusion

The procedure for NBFC Takeover in India is much easier than the registration of the new NBFC Company, but it is essential to know everything about NBFC Takeover in India. However, takeover sounds negative but is same as an acquisition. RBI has regulated the compliance and governance requirements for the procedure for NBFC Takeover in India. If anyone wants to apply for NBFC Registration in India or are looking for advice regarding an NBFC Takeover, please contact Swarit advisors.

Also, Read: How to Takeover NBFC: A Complete Process