IEC Registration in India: Process and Documents Required

Shivani Jain | Updated: Dec 15, 2020 | Category: IEC

Nowadays, the opportunities and occasions to start a cross border business have increased considerably due to the rapid rise in globalization. Further, it shall be considerate to state that to unlock the growth prospects at the global platform, every individual who is dealing in the import and export business needs to obtain IEC Registration in India.

In this blog, we will discuss the concept, procedure, and documents required for obtaining IEC Registration in India.

Table of Contents

Concept of Import Export Code

The term IEC or Import Export Code denotes a 10 digits code that is required by the individual for carrying out business and operations at the global platform. That means any business that does not possess the Import Export Code is not eligible to operate internationally.

Further, the DGFT or the Director-General of Foreign Trade, MoC (Ministry of Commerce) has the authority to grant IEC Certificate.

Also, it shall be considerate to mention the IEC registration has lifetime validity. That means there is no need for the IEC holder to apply for its renewal.

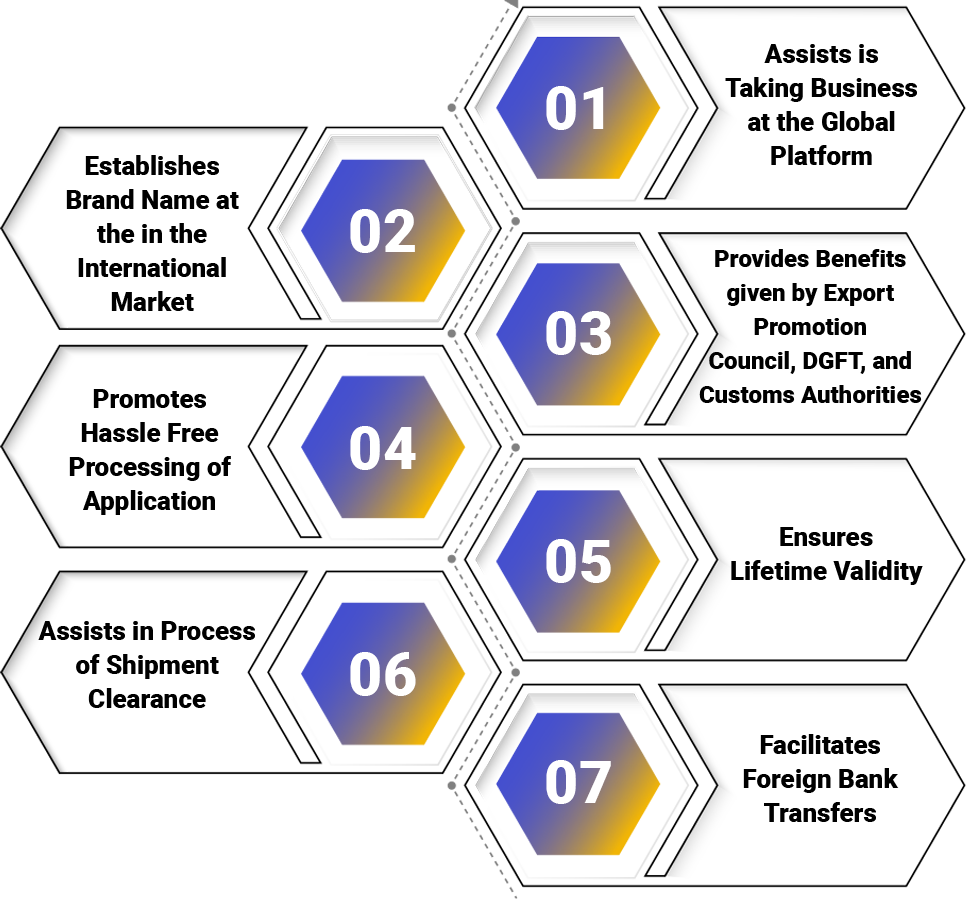

Benefits of IEC Registration in India

The benefits of IEC Registration in India are as follows:

- Assists is Taking Business at the Global Platform;

- Establishes Brand Name at the in the International Market;

- Provides Benefits given by Export Promotion Council, DGFT, and Customs Authorities;

- Promotes Hassle-Free Processing of Application;

- Ensures Lifetime Validity;

- Assists in the Process of Shipment Clearance;

- Facilitates Foreign Bank Transfers;

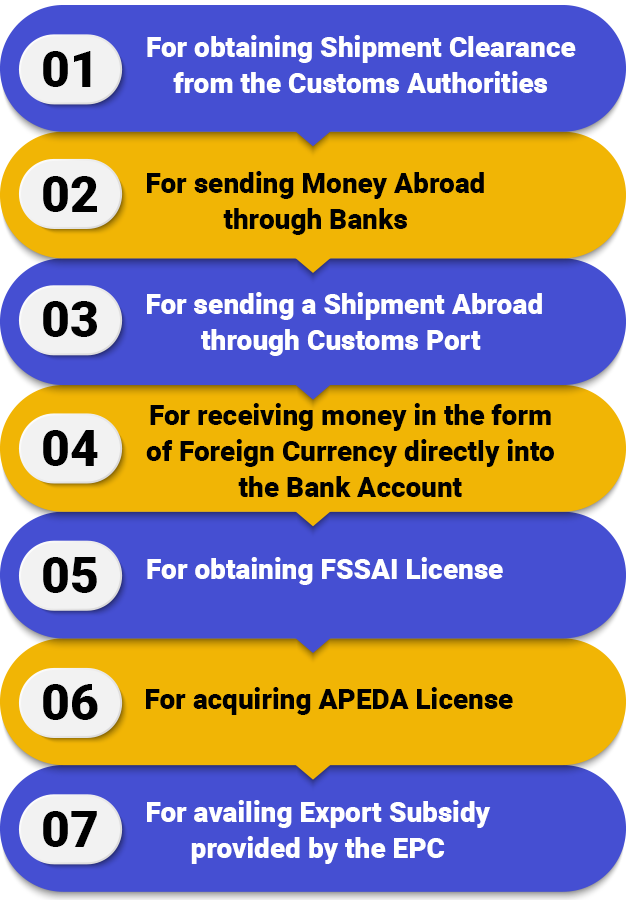

Situations that Require IEC Registration in India

The situations that require IEC Registration in India are as follows:

- For obtaining Shipment Clearance from the Customs Authorities;

- For sending Money Abroad through Banks;

- For sending a Shipment Abroad through Customs Port;

- For receiving money in the form of Foreign Currency directly into the Bank Account;

- For obtaining the FSSAI License;

- For acquiring APEDA License;

- For availing Export Subsidy provided by the EPC (Export Promotion Council);

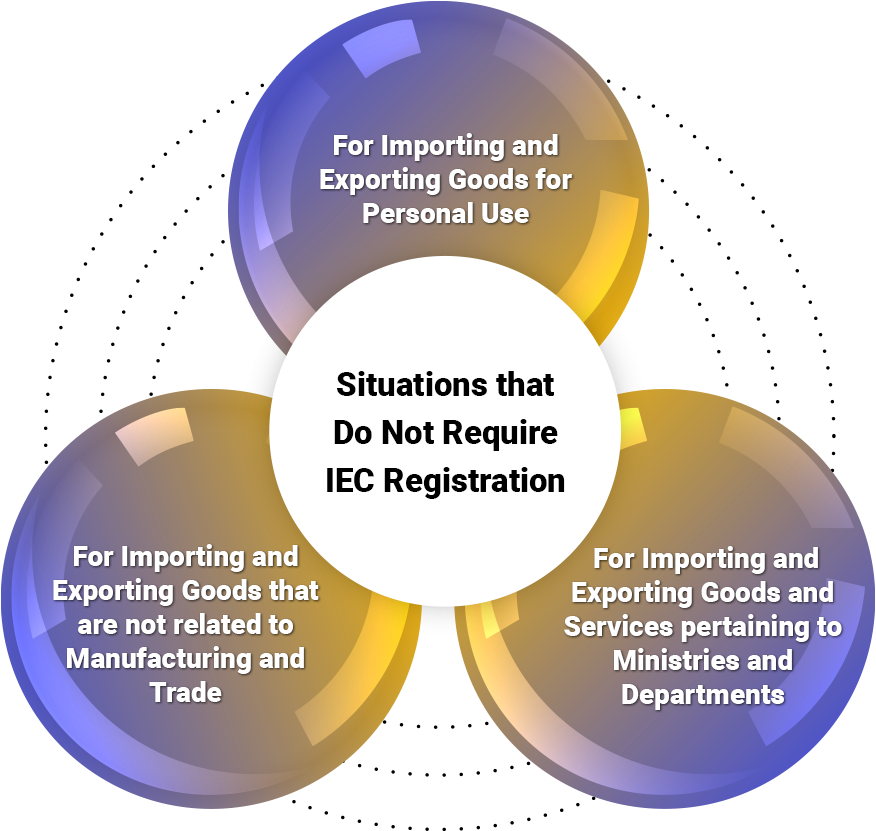

Situations that Do Not Require IEC Registration

The situations that do not require IEC Registration in India are as follows:

- For Importing and Exporting Goods for Personal Use;

- For Importing and Exporting Goods that are not related to Manufacturing and Trade;

- For Importing and Exporting Goods and Services pertaining to Ministries and Departments;

Documents Required for Obtaining IEC Registration in India

The documents required for obtaining IEC Registration in India are as follows:

Documents Required by Sole Proprietorship Firm

The documents that are specifically required by a Sole Proprietorship Firm are as follows:

- Digital Photograph (3*3 size) of the Sole Proprietor;

- A copy of Sole Proprietor’s PAN Card;

- Identity Proof in the form of Passport, Voter ID, UID, or Driving License;

- In case the premise used for business is self-owned, then the copy of the Sale Deed;

- In case the premise used for business is on rent or lease, then the copy of the Lease Deed or Rent Agreement;

Documents Required by Partnership Firm

The documents that are specifically required by a Partnership Firm are as follows:

- Digital Photograph (3*3 size) of the Managing Partner;

- A copy of the Partnership Deed;

- A copy of Managing Director’s PAN Card;

- Identity Proof in the form of Passport, Voter ID, UID, or Driving License;

- In case the premise used for business is self-owned, then the copy of the Sale Deed;

- In case the premise used for business is on rent or lease, then the copy of the Lease Deed or Rent Agreement;

- Bank Certificate in the form ANF 2A;

- Cancelled Cheque bearing the blueprinted name and account number of the applicant entity;

Documents Required by Limited Liability Partnership or Private Company

The documents that are specifically required by an LLP or a Private Company are as follows:

- Digital Photograph (3*3 size) of the Company’s Director or the Designated Partner;

- A copy of the Director’s PAN Card;

- Identity Proof in the form of Passport, Voter ID, UID, or Driving License;

- A copy of the LLP Agreement or MOA (Memorandum of Association) and AOA (Articles of Association);

- In case the premise used for business is self-owned, then the copy of the Sale Deed;

- In case the premise used for business is on rent or lease, then the copy of the Lease Deed or Rent Agreement;

- Bank Certificate in the form ANF 2A;

- Cancelled Cheque bearing the blueprinted name and account number of the applicant entity;

Documents Required by Trust or Society

The documents that are specifically required by a Trust or Society are as follows:

- Digital Photograph (3*3 size) of the Chief Executive, Managing Trustee, or Authorised Signatory;

- A copy of the Certificate of Registration for Society.

- A copy of the Trust Deed;

- Identity Proof in the form of Passport, Voter ID, UID, or Driving License;

- In case the premise used for business is self-owned, then the copy of the Sale Deed;

- In case the premise used for business is on rent or lease, then the copy of the Lease Deed or Rent Agreement;

- Bank Certificate in the form ANF 2A;

- Cancelled Cheque bearing the blueprinted name and account number of the applicant entity;

Documents Required by Hindu Undivided Family

The documents that are specifically required by a HUF (Hindu Undivided Family) are as follows:

- Digital Photograph (3*3 size) of the Karta;

- A copy of Karta’s PAN Card;

- Identity Proof in the form of Passport, Voter ID, UID, or Driving License;

- In case the premise used for business is self-owned, then the copy of the Sale Deed;

- In case the premise used for business is on rent or lease, then the copy of the Lease Deed or Rent Agreement;

- Bank Certificate in the form ANF 2A;

- Cancelled Cheque bearing the blueprinted name and account number of the applicant entity;

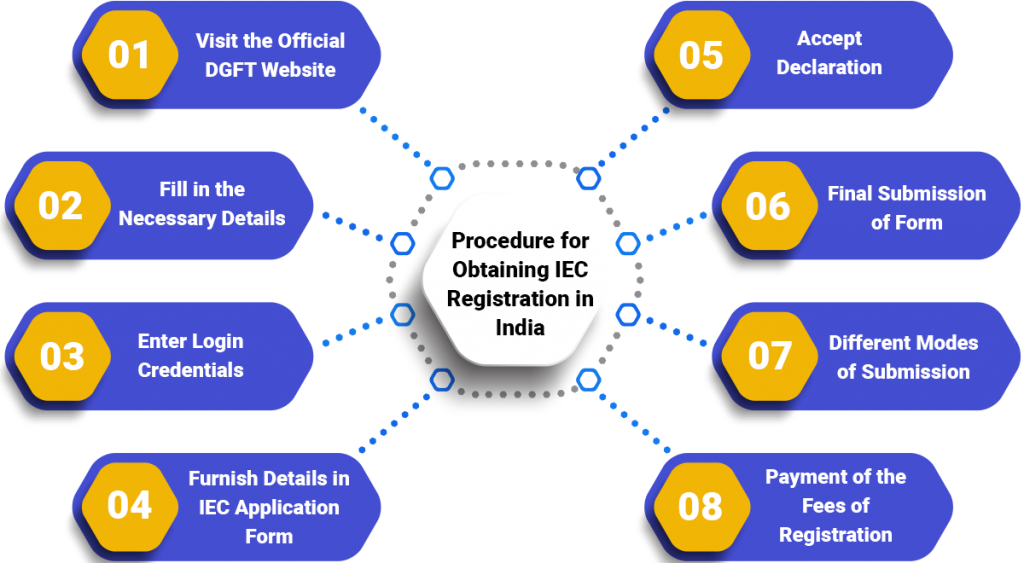

Procedure for Obtaining IEC Registration in India

The steps involved in the procedure for obtaining IEC Registration in India are as follows:

Visit the Official DGFT Website

In the first step, the applicant requires to visit the official website of DGFT (Director General of Foreign Trade) at https://www.dgft.gov.in/CP/. After that, he/ she needs to choose the option “Apply for IEC” placed on the right side of the homepage.

Fill in the Necessary Details

Now, the applicant requires to fill in the required details, such as follows:

- Register User as “Importer” or “Exporter”;

- First Name of the Applicant;

- Last Name of the Applicant;

- Email Address of the Applicant;

- Registered Mobile Number of the Applicant;

- Pin Code;

- District’s Name;

- City’s Name;

- State’s Name;

Further, after filing all the required details, the applicant needs to select the option “Send OTP”. After that, he/she will receive an OTP (One Time Password) for the verification on his/her Registered Email Address and Mobile Number.

Now, the applicant will again receive a temporary password on the registered E-mail Address, which he/ she requires to compulsorily change after the first login.

Enter Login Credentials

In this step, the said applicant needs to visit the homepage again to select the option “Apply for IEC. After that, he/she requires to furnish the provided Login Credentials by choosing the option “Login”.

Furnish Details in IEC Application Form

Now in the next step, the said applicant needs to choose the option “Start a Fresh Application” to furnish the details required.

Further, the term “Required” comprises of the details, such as

- General Details;

- Bank Details;

- Specific Details;

- Other Details;

Thereafter, he/she needs to choose the option “Save and Next”.

Accept Declaration

In this step, the applicant needs to tick the box termed as “Declaration” and fill the place. After that, select the option “Save and Next”.

Final Submission of Form

After selecting the option, the applicant will be redirected to a new webpage, wherein he/ she needs to select the option “Sign” place at the bottom of the said webpage.

Different Modes of Submission

There are two different methods available by way of which an applicant can submit or sign his/her IEC registration form. The two methods are as follows:

- Aadhar OTP (One Time Password);

- DSC (Digital Signature Certificate).

However, it shall be relevant to note that in the case of Aadhar OTP, the applicant will need to furnish either his/her Aadhar Number or the Virtual ID as well to submit the IEC Application Form.

Payment of the Fees of Registration

The last step in the process of obtaining IEC Registration in India is to make the payment of the fees prescribed. Further, for making payment, the applicant requires to click the option “Confirm and Proceed to Make Payment”.

After that, he/she will be redirected towards the Payment Gateway known as “Bharatkosh”, wherein he/she needs to pay the application fees of Rs 500 to obtain IEC Code Certificate.

Conclusion

In a nutshell, obtaining an IEC Registration in India is a mandatory requirement for every individual who wants to start his/her business operations at the global level. That means if a merchant or the business owner has not acquired the IEC registration, but continues to operations of import or export, then the same will be termed as illegal in the eyes of the law.

Further, there is no need for the IEC holder to apply for the renewal of the Import Export Code, as the same has lifetime validity.

Lastly, in case of any other doubt or perplexity, reach out to Swarit Advisors, our IEC experts are there to cater to all your needs and doubts.

Read our article:Amendment of IEC Provisions under Foreign Trade Policy by DGFT