Types of Prepaid Wallet License: A Guide on Different PPIs

Shivani Jain | Updated: Feb 27, 2021 | Category: Prepaid Wallet, RBI Advisory

Since demonetisation, the Reserve Bank of India has constantly been emphasising and making efforts to increase the use of Cashless Transactions for any monetary purpose. Further, the financial instruments that facilitate the monetary transactions in digital form are known as Prepaid Wallets. Only the apex bank has the authority to grant Prepaid Wallet License. However, it shall be noted that there are various types of prepaid wallet license available, and one needs to be aware of these different types of licenses before starting a prepaid wallet license business.

In this blog, we will cover the concept and different types of prepaid wallet license.

Table of Contents

Concept of Prepaid Wallet Instruments

The term Prepaid Wallet Instruments means the instruments that have some monetary value stored in them and are used for purchasing goods and services and for transferring funds. Further, the term monetary value means the amount transferred in PPIs by way of cash, credit card, or by debiting the bank account.

It shall be noted that PPIs are a popular and convenient alternative for cash transaction, and the same are known as E-wallets as well.

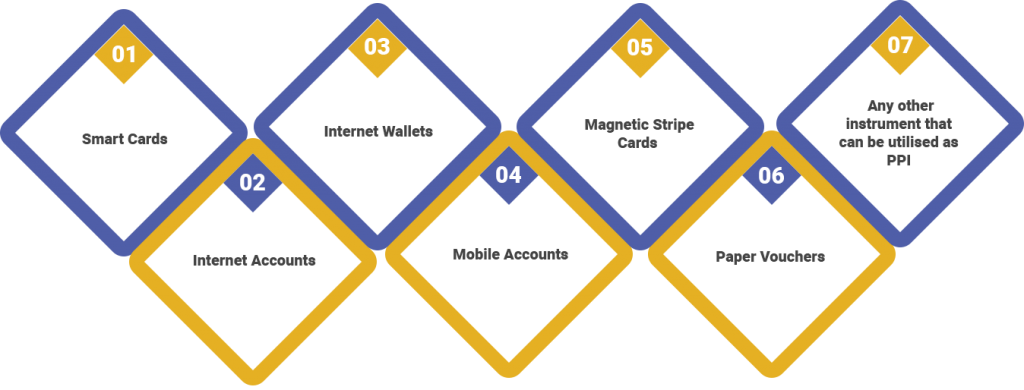

Different Types of Prepaid Wallet Instruments

The different types if Prepaid Wallet Instruments are as follows:

- Smart Cards;

- Internet Accounts;

- Internet Wallets;

- Mobile Accounts;

- Magnetic Stripe Cards;

- Paper Vouchers;

- Any other instrument that can be utilised as PPI;

Also, Read: Procedure for Prepaid Wallet License in India

Benefits of Prepaid Wallet Instruments

The benefits of Prepaid Wallet Instruments are as follows:

- Convenient and Safe for making Transactions;

- Saves Time;

- Facilitates Online Payment of bills, such as Electricity Bill, Mobile Charges, Telephone Bills;

- Provides facility to make Online Transactions from anywhere;

- Infuses Transparency and Accountability in Transactions;

- Aims to make India Digitally Capable;

Minimum Requirements for Types of Prepaid Wallet License

The minimum requirements for Types of Prepaid Wallet License are as follows:

Approval from RBI

For starting a Prepaid Wallet License, there is no need for any NBFC or scheduled bank to have any amount as minimum capital. However, it shall be relevant to state that they do need RBI approval on a mandatory basis.

Capital Requirement for Other Entity

Any entity other than an NBFC and Scheduled Bank needs to have Rs 5 crores as the minimum capital to obtain a license from RBI.

Exemption for FEMA Authorised Entities

All the entities that are registered under the FEMA 1999, to issue foreign exchange PPIs are exempt from the requirement of minimum capital. However, it shall be noted that PPIs can only be used for a permitted current account.

Eligibility Criteria for Prepaid Wallet License

The eligibility criteria for Prepaid Wallet License are as follows:

- All the banks and NBFCs must obtain prior approval from RBI pertaining to the issuance of PPIs (Prepaid Payment Instruments);

- Any entity other than an NBFC and Scheduled Bank needs to have Rs 15 crores as the positive net worth;

- All the entities need to file an application with RBI for seeking approval of issuing Prepaid Payment Instruments;

- In the case of an incorporated company, the director need to furnish a certificate concerning the current Net Worth, together with the Provisional Balance Sheet;

- A company must have obtained registration under the provisions of the Companies Act 2013 or the Companies Act 1956;

- The Object Clause of the Memorandum of Association must state the intention to operate as PPI Issuer;

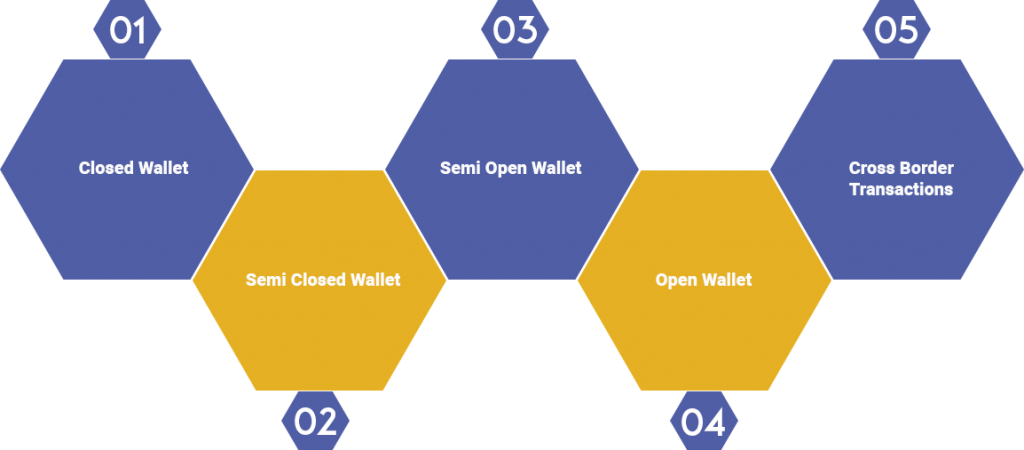

Different Types of Prepaid Wallet License

The different types of Prepaid Wallet License are as follows:

Closed Wallet

The term Closed Wallet denotes a PPI that is issued by a company to its customers exclusively for the purpose of purchasing goods and services. That means this kind of PPI can be used only for the company or entity which has issued it.

Example: Reliance Supermarkets, Myntra, Cleartrip, etc.

Semi Closed Wallet

Under this type of Prepaid Wallet License, an individual can buy goods and services from a selected group of vendors or merchants who have associated for a common purpose. However, it shall be noted that the facilities of Cash Withdrawal and Redemption are not given to the holders of these instruments.

Example: Mobikwik, Paytm, Freecharge, etc.

Semi Open Wallet

In this type of wallet, instruments can be used for purchasing goods and services at any merchant location that accepts cards. Also, in this instrument, holder is not allowed with the facility of Cash Withdrawal or Redemption.

Open Wallet

The term Open Wallet denotes a prepaid payment instrument that can be used anywhere by a holder. Also, it provides the permission of withdrawing cash from ATMs.

Example: RuPay Card, Master Card, Visa Card, etc.

Cross Border Transactions

It shall be pertinent to state that the guidelines issued by RBI are not applicable to the individuals who have been allowed to issue Foreign Exchange denominated PPIs under the provisions of the FEMA 1999. Further, the limit for Cross Border Transactions is Rs 5000.

Basic Documents for Different Types of Prepaid Wallet License

The basic documents required for different types of Prepaid Wallet License are as follows:

- PAN Card of the Applicant;

- Address Proof for the Registered Office;

- Certificate of Incorporation;

- Objects of the Company;

- Details about Company’s Management;

- Details about Statutory Auditors;

- Previous Year’s Audited Balance Sheet;

- Name and Address of the Authorised Bank;

Basic Guidelines for Different Types of Prepaid Wallet License

Based on the provisions of Prepaid Payment Instruments 2017, the basic guidelines for different types of prepaid wallet license are as follows:

- Entities dealing in PPIs can issue both reloadable and non-reloadable instruments under the permissible categories;

- Board need to accept all the terms and policies concerning PPIs;

- A PPI should bear the name of the issuing company, together with its brand name;

- No interest will be calculated on the amount remaining as balance in a payment instrument;

- The entities must have obtained permission to reload PPI by cash, credit card, or debit card;

- Before using any payment wallet, every customer must conduct the process of Due Diligence;

- The maximum limit of loading cash in a payment instrument is Rs 50000 per month;

- Every PPI issuing entity needs to have a Grievance Redressal Mechanism;

- The loading and reloading of cash in a PPI is possible only by way of the Indian National Rupee Currency;

- After the issuance of PPI, a customer or his/ her registered agent will be solely responsible for the cases of omission on their part;

Conclusion

In a nutshell, Prepaid Wallet Instruments are the instruments that have some monetary value stored in them and the best alternative for cash transactions. Also, these instruments are known as e-wallets as well. Further, there are different types of prepaid wallet license available in the market, and for each one of them the entity needs to satisfy the requirements mentioned above. Also, it shall be noted that the maximum loading cash loading limit in a prepaid payment instruments is Rs 50000 per month and the same can only be done in the Indian National Rupee Currency.

Also, Read: How to Start a Prepaid Wallet License Business in India?