What are the Benefits of Microfinance Company Registration in India?

Karan Singh | Updated: Mar 15, 2021 | Category: Microfinance Company, RBI Advisory

If anyone wants to invest in the Microfinance business, then this will be your greatest bet. In India, the Microfinance business is growing rapidly since it gets inspiration from the Government. Microfinance firms or companies have been established to provide financial support to the small sector, which basically includes poor section retailers in rural & semi-urban areas, farmers, and small traders. However, for long term profit and sustainability, one has to look into every side of this business. Scroll down to check the meaning of Microfinance Company and try to understand the benefits of Microfinance Company Registration in India.

Table of Contents

An Overview on Microfinance Company

Before we discuss the benefits of Microfinance Company Registration in India, let us first under the meaning of Microfinance Company. Microfinance companies in India primarily help the low-income group and the deprived section of the society. Offering easy funds without a guarantee is one of the best parts of this business model. They are able to provide credit up to Rs. 50,000/- to Rs. 1.5 lakh to people from rural areas and urban areas. Microfinance companies accurately support people form low wage groups by offering them credit through relaxed provision. A Microfinance Company can be established through two different business models, and you can check the same below:

- NBFC (Non-Banking Financial Company).

- Section 8 Company.

NBFC is very popular in India because of its flexibility and adaptability in terms of compliance and exposure. On the other hand, Section 8 Company is chosen by those who do not have any resources to establish a company. Just like other financial organizations, Microfinance Company is also regulated by the provision of the Reserve Bank of India (RBI). There is no way these companies can modify the interest rate or any other services without the permission of RBI. They are legally responsible for performing their business activities under the suggested guidelines. The Reserve Bank of India approve the application for Microfinance Company Registration, and the applicant has to arrange some vital documents for the registration process.

Objectives of Microfinance Company in India

Following are some objectives of Microfinance Company in India:

- Encouraging social-economic development at the community level;

- Empowerment of Women;

- Conducting programs for low-income groups or poor peoples;

- Coordinating and organizing based on the ground level;

- Providing vocational training to unskilled or untrained population;

- Encouraging maintainable agriculture and sound conversation of natural resources;

- Making efficient use of all the resources available for livelihood generation.

- Strengthening and developing self-help groups and aiding sustainable development through them;

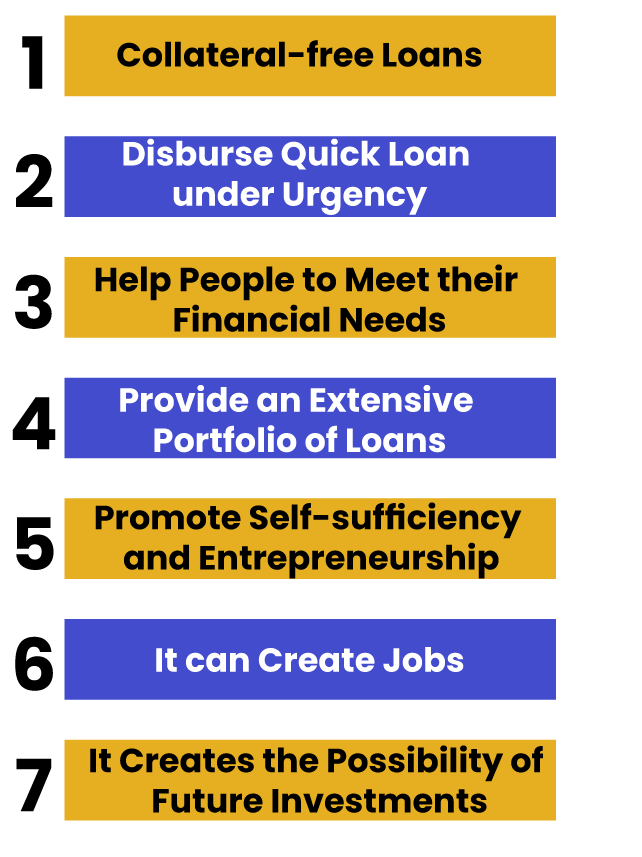

Benefits of Microfinance Company Registration in India

Following is the list of all the benefits of Microfinance Company Registration in India:

- Collateral Free Loans: Most of the microfinance companies in India providing financial credit with no collateral. The registration process is hassle-free, and it requires minimum documentation, which makes them a suitable option for quick fundraising. This is one of the most popular benefits of Microfinance Company Registration in India.

- Disburse Quick Loans under Urgency: The financial emergency is naturally unpredictable as it could come up at any time without telling anybody. But Microfinance companies in India that can offer collateral-free and provide protected funds to an individual in the demanding condition to meet their financial need.

- Help People to meet their Financial Needs: The popular financial institution in India provides unmatched services when it comes to credit. However, the awful part is that they are not reachable for low-income groups. But Microfinance companies provide different proposal altogether. They are dedicated to helping an unemployed individual and a poor individual by providing them with easy financial loans.

- Provide an Extensive Portfolio of Loans: Most of the Microfinance companies in India are not only limited to providing emergency loans but also capable of distributing business loans, working capital loans, and housing loans with minimum processing fees and formalities.

- Promote Self-sufficiency and Entrepreneurship: In India, Microfinance Companies can offer much-needed funds to an individual for establishing a business that seeks low investments and offers sustainable profit in the long run. Thus, these companies make sureentrepreneurship and self-sufficiency among the lower-income group.

- It can Create Jobs: Microfinance companies are also able to let entrepreneurs in impoverished communities and developing countries create new jobs opportunities for others.

- It Creates the Possibilities of Future Investments: Microfinance companies interrupt the poverty cycle by making more money. When basic requirements are met, families can invest in better health care, business, housing, and even small business opportunities.

Conclusion

That’s our take on the benefits of Microfinance Company Registration in India. These companies are a perfect business model for anyone who wants to work for the betterment of the poor section of society. But, there are some hidden difficulties that one has to face while establishing such business activities in India. This business model won’t give you higher interest rates, but it can ensure the finest growth due to constant demand for loans or credit. Hence, we can determine that a Microfinance business is more of an initiative than a company that works afar the profit scope. The imitation of the NBFC business model works in a limited setting and provides financial support for low-income groups or those suffering from the financial crisis. If you really want to invest in this business model, then you have to apply for Micro Finance Company Registration; that is the first step you need to do for the formation of a Microfinance Company. Registration of a Microfinance Company could be a discouraging task for anyone who is not familiar with the requirements for compliance. If you want to make your registration process easy and smooth, we advise you to contact any professional expert.

Also, Read: What are the Essential Documents Required for Micro Finance Company Registration?