What are the Latest Trends in NBFC Business Model?

Dashmeet Kaur | Updated: Feb 25, 2020 | Category: NBFC, RBI Advisory

Recently, Non-Banking Financial Companies have outperformed the traditional lenders, banks in the sphere of credit deployment. NBFC leverage technology-driven solutions to penetrate credit facilities in the remote sectors. Such institutes focus on capitalizing at the inefficiency of banks to scale operations rapidly and amend stringent policies. It emphasizes upon reforming the lending services by collaborating with FinTech business entities. The idea is to revolutionize the outdated methods with innovative techniques. This write-up will introduce you to the latest trends in NBFC Business Model that will be a major game-changer.

Table of Contents

Evolution of NBFC in India

NBFCs have come a long way from the year of its emergence in 1960’s. During this period, NBFC was established as an alternative to satiate the needs of investors and savers. It used to operate on a limited scale and did not have any significant impact on the Indian economy. However, after a while, Reserve Bank of India initiated measures to regulate NBFCs.

Non-Banking Financial Companies gained a large number of investors due to their customer-friendly approach during the era 1980-1990. There was tremendous growth in NBFC’s from being 7000 in 1981 to around 30,000 in 1992.

Therefore, some amendments were made in RBI Act, 1934 for seamless functions of NBFC structure and to safeguard the interests of the customers. It results in the development of NBFC’s in terms of operations, diversification in the range of market products and technological advancement.

In the last 20 years, NBFC’s have become a prominent part of the financial sector. Union Cabinet has given acceptance for FDI to regulated NBFCs through automated route.

Reasons behind the success of NBFC’s

Non-Banking Financial Companies have proven their mettle and acquired a strong position in India. Let’s take a look at the factors that led to the success of NBFC Business Model:

- Tailor-made financial services– NBFC particularly apprehend the needs of the unorganized and underserved segments. Thus, it enables customized products and services based on the customer’s profile.

- Agile risk management system– NBFC minimizes the tendency of any risks through a pro-active and robust risk management model. It increases the credibility of NBFC’s among the customers.

- Faster loan facilities– A Non-Banking Financial Company aims to accentuate the customer experience by facilitating rapid credit with the use of advanced technology. By deploying SaaS technology, NBFC optimizes business operations, automate the process of the credit assessment and gives real-time solutions.

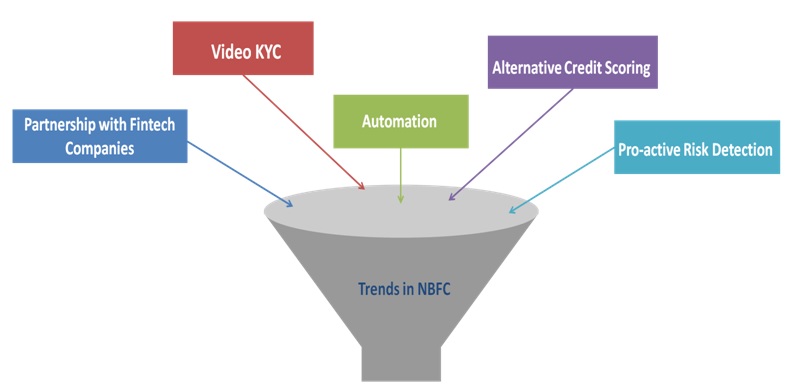

Trends in NBFC Business Model that makes it next-generation ready

Here is the list of NBFC trends that will help this business model sustain for an extended period in the financial market.

Partnership with Fintech Companies

The collaboration of NBFC’s with Fintech startups creates a win-win situation for both the parties. Since it boosts the lending capabilities of NBFC’s and provides a competitive edge to Fintech newbie. The benefits that NBFC’s accrue by cooperating with Fintech players are as follows:

- Generating new product offerings: NBFC innovates new products by using technology-based tools of Fintech. The partnership of NBFC’s and Fintech helps to launch new product offerings such as POS Financing, Invoice Financing, Consumer Durable Loans, Payday Loans and more.

- Reinforce digital business operation: Non-Banking Financial Companies get access to the advanced techniques by uniting with a Fintech Company. It compels NBFC to replace the existing manual process with paper-less digital methods. Consequently, digital onboarding and verification have reduced the operational cost.

- Higher productivity– Fintech has streamlined the internal and external functions of NBFC. Hence, encourage NBFC’s to revamp their back-office activities, resulting in increased productivity.

Video KYC

Video KYC will soon be a notable trend in NBFC Business Model. Since several fraud identity cases were reported in the financial realm, it calls for a new initiative. Presently, the financial institutions verify the customer’s identity through documents and signature on the forms. However, this method is proven to be unsafe in contrast to authenticating the live digital footprints.

The industry seeks to remove identity theft cases through numerous digital video KYC checks. In the method of Video KYC, the investors shall have to upload their identity proofs like address proof, PAN Card, photograph and signatures via Mobile Application or website. Once, the investors upload all the documents, they need to start real-time video recording by using the front camera of their smartphone and display a hard copy of each document for at least 10 seconds.

Automation

NBFC can harness automation to speed up the lending procedure by predetermining certain steps to process a Loan Application. Automation can bring radical changes in the functioning of Non-Banking Financial Companies.

Alternative Credit Scoring

NBFC will adopt alternative credit scoring based on non-financial data, as many citizens of India still do not have adequate financial footprint data. The new-age platforms such as ATMs, Mobile Banking, Social Media, Smartphones, Internet Banking leave the footprints of transactions everywhere. Thus, NBFC can utilize the data of such transactions to check the credit score.

Pro-active Risk Detection

NBFC must develop risk management frameworks to pro-actively manage, detect and mitigate any types of internal or external risks. The non-banking financial lenders should protect against information leaks. If NBFC does not take any rigorous action, then it can potentially threaten the customer’s financial security and tarnish the lender’s image. Therefore, the NBFC lenders need to periodically assess IT controls which are responsible to maintain information integrity.

Conclusion

In case, you need some additional knowledge regarding the innovation and trends in NBFC Business Model, reach out to Swarit Advisors. We are a legal consultancy firm that holds years of experience in the context of NBFC Registration and compliance. Our team can provide you with custom-made NBFC solutions over the phone.