Corporate Governance in NBFCs – A Complete Guide

Karan Singh | Updated: May 31, 2021 | Category: NBFC

Corporate Governance mentions to a set of principles, system, and process by which an organisation is ruled. It supports guidelines as to how an organisation can be directed to meet its objectives such that it adds value and is useful for shareholder as well. Since Corporate Governance also establishes a framework for obtaining the objectives of an organisation, it covers practically every aspect of management, from internal actions plans and controls to routine measurement and corporate disclosure. Clear and responsive corporate governance authorises an entity to make informed and ethical decisions that expel anything against stakeholder interest. An entity or a company with bad corporate governance is more likely to engage in bankruptcy and scandals. In this blog, we shall discuss explain Corporate Governance in NBFCs.

Table of Contents

Importance of Corporate Governance in NBFCs

The Following aspects can aid you to understand the importance of Corporate Governance in NBFCs:

- Fortify Shareholder Value: Corporate Governance build-ups and protects the interest of a shareholder. It plays a key role in protecting the firm’s value as the primary objective of corporate governance is to provide overall protection to its shareholder.

- Risk Alleviation and Compliance: Governance, risk alleviation, and compliance are somehow consistent. An entity stands out on principles that make sure legal and smooth implantation of compliance. If an entity carries out its operation in an authentic way, it can handle any risk whatsoever.

- Improves Organisational Efficiency: Corporate Governance is a KPI (Key Performance Indicator) of industrial competitiveness. Better Corporate Governance in NBFCs make sure improved performance of corporate and also communicates better economic results.

- Essential for Mergers and Acquisitions (M&A): Corporate Governance is vital, especially in the event of Mergers and Acquisitions (M&A). It permits an organisation to draw a line of dissimilarity between the bad and legit deals. M&A can aid to improve the quality of corporate governance.

Steps Taken by the Private Lender for Corporate Governance in NBFCs

Most of the steps taken for better Corporate Governance in NBFCs are as follows:

- Committees’ constitution like investor’s complaints committee, Management committee, Asset Liability Management Committee, etc.;

- According to the Reserve Bank of India, steady inculcation of prudential norms;

- Introduction of the citizen’s charter in Non-Banking Financial Companies;

- Indoctrination of the idea of KYC (Know Your Customer[1]);

- Responsibility of top management and BODs for better corporate governance.

Serious Ethical Issues in Corporate Governance

Corporate frauds mention an illegal practice that occurs within an entity by its managers or owners and involves:

- Public;

- Spiteful intention to mislead the investor.

- Lending avenues, thereby resulting in financial earns to the entity or the individual.

Most of the Corporate Frauds in the form of:

- Money Laundering;

- Accounting frauds;

- Asset Misuse;

- Frauds at the Senior Level Management;

- Regulatory Non-compliance.

All the practices, as we mentioned above, has smashed the image of our financial infrastructure. The entities hereafter need to be watchful and cautious about these issues and concerns. They should be embraced anti-fraud measures as opposed to being reactive.

Remedies to Ethical Issues Damaging Corporate Governance in NBFCs

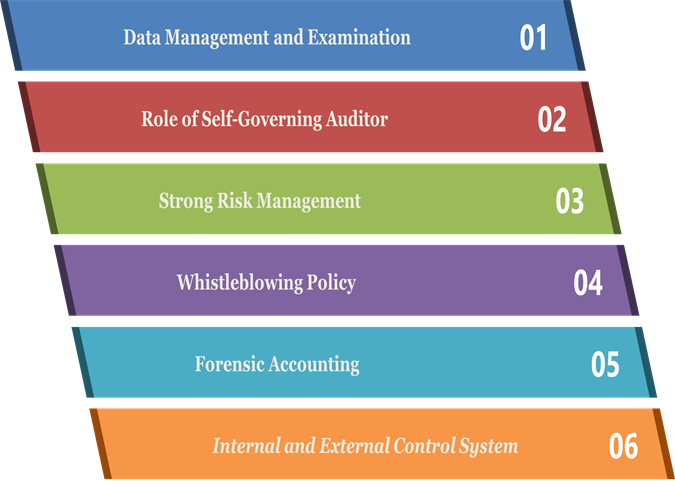

Following are some aspects that can help to improve ethical issues in Corporate Governance in NBFCs:

- Data Management and Examination: The company’s capability to gather revenue, manage risks, and handle expenses is shown in its ability to store, spare, and retrieve the ever-growing data. Simple management of data can aid to promote an enormous customer base, thereby developing the ROI of the company.

- Role of Self-Governing Auditor: The primary goal of estimating a set of codes for corporate governance is to develop the auditing rule to preserve the interest of the stakeholders. The auditor owns the right to question to the defaulter, discard intolerance from the financial report of the company. Recently, a lot of stress has been provided to the auditor’s role in the context of Corporate Governance in NBFCs. It’s because these officials are responsible for recognising scams.

- Strong Risk Management: The former financial crisis has compelled financial and non-financial institutions to adopt a robust risk management framework. Financial organisations, in particular, give more stress on financial risks such as liquidity, market risks, and credit.

- Whistleblowing Policy: It is a vital part of the organisation corporate governance strategy. Such policies authorise employees to practice their rights to report any suspicious activities and misconduct to the management, which are against the interest of the company.

- Forensic Accounting: As the name recommends, forensic accounting gives out with the accountancy profession wherein accountants inspire their skill concerning accounting, auditing, and investigations to recognise frauds, malpractices, and other litigations. Forensic accounting is yet to accomplish a good grip in the banking sector despite its efficiency in searching corporate frauds.

- Internal and External Control System: The internal system predicts systematic improvement of the operational structure through the inculcation of appropriate procedures and policies for the easier execution of the business. It aids lessen several forms of risks such as illegal transactions, poor maintenance, and frauds of accounts which can concession the financial performance of the company. An external control system requires government regulations, market competition, public release, and assessment of financial statements.

Conclusion

Having transparent and robust Corporate Governance in NBFCs is vital. It not only reduces the pressing issues however also provides a good relationship with investors and customers. Good corporate governance is must give necessities as it’s the only way to stay in front of pressing problems and operates effortlessly.

Read our article:How to Obtain NBFC License from RBI in India?