How to Differentiate Enterprise Value and Equity Value? – An Overview

Karan Singh | Updated: Aug 21, 2021 | Category: SEBI Advisory

In the background of Mergers and Acquisitions, LBOs (Leveraged Buyouts), stock investment, financial research, stock option assessment, and practically all other evaluation conditions, company values are significant. Enterprise Value and Equity Value are two usual ways that a business may be appreciated in a Merger or Acquisition. Enterprise Value and Equity Value may be used in the evaluation or business sale, but each provides a slightly different view. While enterprise value gives a correct estimation of the overall present value of a business, same to a balance sheet, equity value provides a picture of both present and future value.

Majority of cases, a stock market investor, or anyone who is interested in buying a controlling interest in an entity, will rely on an enterprise value for a quick & simple way to calculate the value. On the other side, Equity Value is generally used by present owners & shareholders to aid in a future decision. In this write-up, we will discuss how to differentiate Enterprise Value and Equity Value.

Table of Contents

What is Enterprise Value?

Enterprise Value represents more than just outstanding equity. It theoretically discloses how much a business is worth, which is beneficial in comparing firms with different capital structures since the capital structure does not affect a firm’s value. In simple words, it is a value of a company refers to the company’s value in the investors’ eyes. The Enterprise Value of a company depends on various aspects like preference shares, minority interest & total cash, Equity Value, and cash equivalents.

The company’s Enterprise Value gives a more informative picture than the market cap. The value of Enterprise Value stems from its capacity to compare organisations with different capital arrangements. Investors can get a better sense of whether a company is actually undervalued by using Enterprise Value instead of market capitalisation to assess their value.

What is Equity Value?

Equity Value represents the value of the company’s shares & loans that the shareholders have made available to the business. The estimation for Equity Value adds Enterprise Value to disused assets and then minus the debt net of cash available. Further, total Equity Value can be broken down into the value of shareholders’ loans & shares outstanding. Equity Value is commonly known as Market Capitalisation. As per their Market Capitalisation, companies can be divided in three different categories, and you can check the same:

- Small-Cap Companies: Companies or entities with a Market Capitalisation of not more than Rs. 5000 crores come under this category. These companies are comparatively smaller in size. They are tremendously volatile and come with a higher level of risk.

- Mid-Cap Companies. Companies are having a Market Capitalisation of more than Rs. 5000 crores but not more than 20,000 crores come under this category. These are more impulsive than large-cap companies and hence pose a higher risk. They also have a good capability for growth and hence attract more & more investors.

- Large-Cap Companies: Companies with Market Capitalisation of at least Rs. 20,000 or more come under this category. There are well-known businesses with a positive reputation. They are less risk as they are less volatile.

How to Estimate Enterprise Value and Equity Value?

- Estimate Enterprise Value: It is calculated by adding preference value, debt, Equity Value, minority interest and subtracting cash and cash equivalents.

Formula for calculating Enterprise Value = Equity Value + Market Value of Debt + Preferred Shares + Minority Interest – Cash & Cahs Equivalents.

| Details | Amount in Rs. |

| Current Market Price | 30 |

| Number of Outstanding Shares | 600 |

| Equity Value (Current Market Price * No. Of Outstanding Shares) | 18,000 |

| Preferred Shares | 2000 |

| Long-Term Debt | 300 |

| Short-Term Debt | 200 |

| Total Debt = Long-Term Debt + Short-Term Debt | 500 |

| Minority Interest | Nil |

| Cash and Cash Equivalents | 250 |

So the Enterprise Value = (18000+2000+500+0-250) = Rs. 20,250.

2. Estimate Equity Value: The company’s equity value is estimated by multiplying its outstanding shares with the present market prices of a share, that is, the total number of outstanding shares * present market price of a share.

Let’s take an example, a company of 15, 00,000 outstanding shares and the present share price as per BSE is Rs. 100 per share. So the Equity Value of the company = 15,00,000 * 100 = Rs. 15,00,00,000 that is Rs. 15 crores.

Enterprise Value and Equity Value Multiples

When estimating companies, analysts can make more correct predictions by using multiples. When multiples are engaged correctly as they convey beneficial information regarding a company’s financial position. Multiples are also vital as they comprise significant statistics that are relevant to investing decisions. Finally, multiples are well-situated to use for most analysts due to their simplicity.

But, because it eases difficult details into a single value, this easiness can also be considered a disadvantage. This simplification can create misunderstandings and make it complicated to separate the effects of various elements. As an outcome, they show how a business progresses. As an effect, they show how to business progresses. Multiples signify short-term values rather than long-term values.

- Equity Value Multiples:

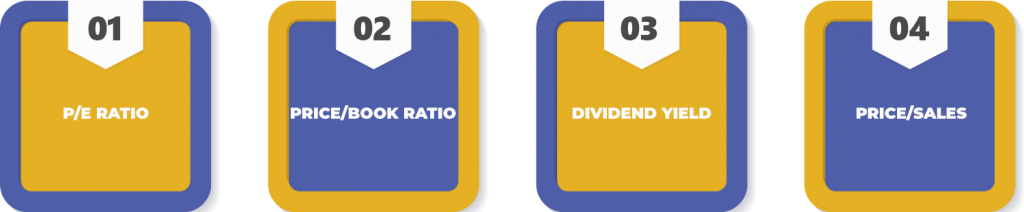

These are used in investment decisions, especially when investors are looking to but minor stakes in entities or companies. Some common equity multiplies used in estimations are listed below:

- P/E Ratio: It is one of the most used equity multiples input data is eagerly available, estimates as the ratio of Share Price (SP) to Earnings Per Share (EPS).

- Price/Book Ratio: If assets are the main driver of earnings, then this ratio is vital; it is estimated as the ratio of Share Price to Book Value Per Share.

- Dividend Yield: Estimated as a proportion of Dividend Per Share to Share Price for comparisons between types of investment & cash returns.

- Price/Sales: Employed for loss-making entities, rapid valuations, calculated as the ratio of Share prices to Sales (Revenue) Per Share.

- Enterprise Value Multiples:

EV/EBIDTA; here EVI is Enterprise Value, and EBITA is Earnings Before Interest, Depreciation, Taxes and Amortisation. EBIDTA is a sum of the Company’s Earnings, Interest, Depreciation, Taxes, and Amortisation. EBIDTA can be used to replace free cash flows; it is commonly used Enterprise Value Multiple. It can be used for the following objectives:

- Estimation of capital-intensive businesses with considerable amortisation and depreciation;

- Makes it simpler to compare organisations with various capital structures;

- Makes it simpler to compare entities, even if their financial control is dissimilar.

EV/Sales ratio is a ratio that takes into account the debt amount that should be paid off. The lower the EV/Sales ratio is, the more underestimated a company under scrutiny is. EV/Invested Capital ratio is estimated as the ratio of Enterprise Value to Invested Capital in capital-intensive sectors.

There are many Enterprise Value and Equity Value Multiples that are used in the estimation of company value. Analysts can better employ multiples in financial studies if they have a strong understanding of each multiple & related idea.

Conclusion

In an M&A, a business or company can be estimated in two different methods: Enterprise Value[1] and Equity Value. Both Enterprise Value and Equity Value can be used to sell or value a company; however, they deliver considerably different viewpoints. While Enterprise Value, like a balance sheet, delivers a correct measurement of the current value of a company, Equity Value delivers an image of both the current and future value of a company or business.

Read our article:What are the Different Types of Private Equity Funds?