How to Set Up an Insurance Brokerage Company in India?

Karan Singh | Updated: May 05, 2021 | Category: Insurance Broker

From 2003 onwards, lots of insurance brokers have entered the insurance industry in India and encouraged it to great heights. The insurance business has always been highly money-making and risk fee. Here are some figures proving the same: The gross insurance premiums collected in the Financial Year 2019 totalized at an enormous Rs. 962.05 Billion for a non-life insurer. For life insurers, it reached at Rs. 1.09 trillion experiences a hike of 3.66% within a single year as per IBAI (Insurance Brokers Association of India).

The overall premiums collective via insurance brokers expanded at 17% CAGR in the year of 2014 to 2019. Further, according to a report by primefeed, around 469 insurance brokers stand licensed by the insurance regulating authority IRDAI as of July 2020.

All such facts clearly prove that the insurance brokerage company in India is experiencing stable growth. Therefore, such a small start-up idea is worth a try. Also, there is not so much risk concerned here, and the Indian Government also has been progressively pushing the insurance business in India.

If you want to set up an Insurance Brokerage Company in India, then you need to follow all the guidelines and instructions as we described in this article. In this blog, you are going to know how to set up an Insurance Brokerage Company in India.

Table of Contents

What is meant by an Insurance Brokerage Company?

Such a company works as an advisor of insurance plans, and you may face some problems with decisions like whether to choose an investment plan or insurance. Whether to buy a health insurance policy for family or individual health insurance. This is what an insurance brokerage company assist you with.

Such brokerage firms or companies have qualified or well-trained staff who partner with the insurance firms and possess good knowledge regarding the insurance and insurance-related laws. Insurance brokers guide people concerning their insurance requirements. They perform as an intermediary between the insurance firm and an individual eager to buy an insurance plan.

What are the Tasks Performed by Insurance Brokerage Company?

An insurance brokerage company is highly skilled in handling different types of insurance and regulating insurance concerning risks. Such a firm or company requires to possess an insurance broker license. Now, getting the insurance broker license involves having to pass specific examinations. Hence, education needs to make sure that insurance brokers have an extraordinary level of proficiency in the field.

Further, the Chief Officers of such brokerage companies are well informed about all the different types of insurance policies and how they work. They will guide you perfectly when it comes to selecting the right policy as per your needs. Whether it health insurance, general insurance, life insurance or any other type of insurance, they have got your back. For example, a broker can correctly explain to their customer about all the risks involved and the particular coverage offered by the insurance in question. Also, they have a good idea of what type of or which insurance you required. They describe the liabilities & risks involved in various types of insurance plans and how to govern them.

Unlike insurance agents whose only duty is to sell the insurance policies to the clients, insurance brokers hold a higher level of responsibilities. In fact, the customer can even sue an insurance brokerage company if they fail to provide the promised results.

Different Types of Insurance Broking Companies

- Direct Insurance Broker: Such broker tries to procure insurance policies. They help their customers with the policy buying procedure. They also assist the customers in choosing from a group of insurance policies and earning a commission for selling a policy. Direct Insurance Brokerage company also render market information regarding insurance. Moreover, Direct Brokers are divided into three different types:

- Direct Life Insurance Broker;

- Direct Non-Life Insurance Broker;

- Direct Life and Non-Life Insurance.

- Reinsurance Broker: Such type of brokers’ purchases reinsurance for a company. The procedure involves negotiating rates and searching for valid policies.

- Composite Insurance Broker: Such brokers have a valid license for delivering insurance services. They can provide both general and life insurance plans. The authorities or insurance companies selectively provide a license to such applicants.

Criteria for Insurance Brokerage License

To safeguard an insurance broker license, you need to register with the IRDAI (Insurance Regulator and Development Authority of India). Moreover, the Indian Government has put forward some minimum criteria for procuring an insurance broker license. So to get this License, you need to fulfil such requirements to apply for an insurance brokerage license.

Who can apply for this License?

- Companies registered under the Companies Act, 2013;

- LLPs or Limited Liability Partnerships registered under the LLP Act, 2008;

- Co-operative Society registered under the Co-operative Societies Act, 1912 or any other version of it.

What are the Essential Documents Required to get Insurance Broker License?

The applicant should provide the essential documents and other required details as per Form C of Schedule I. This is done as per the specifications of the IRDA Regulations. You can check the documents as mentioned below:

- Fill the application form in addition to all the vital information in Form B;

- Submit the copies of MOA or Memorandum of Association and AOA or Article of Association of the article company;

- Form G of Schedule I comprise information regarding the Principal Officer. This would contain information such as if the capable Principal Officer satisfies the criteria mentioned in Form G or not;

- Submit Form C of Schedule I;

- Declaration stating that the Principal Officers, the Directors, Partners, etc. are not excluded as per the Section 42D of the Insurance Act;

- Details of directors, promoters, partners, advertisers, etc.;

- A list of all the well-trained agents with their qualifications;

- Details of the bank account of the company;

- Audited company balance sheet;

- Submit a copy of the board resolution passed by the members for promoting the company;

- Details of the infrastructure of the company consisting particulars such as work power, office space, IT infrastructure equipment, and so on;

- Principal Banks plus details of the statutory auditors;

- List of all the shareholders of the company (present +proposed);

- Additional details if needed.

How can you apply for an Insurance Broker License?

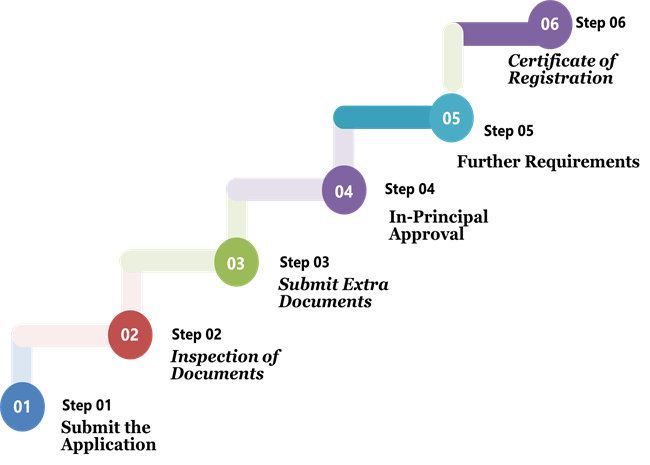

Step 1: Submit the Application: First, you need to submit a duly filled application form for an insurance broker license (Form B of Schedule I). Other essential documents, along with the fees, need to be submitted to IRDAI.

Step 2: Inspection of Documents: Once you filled and submitted the application form along with the documents to the IRDAI, then your documents will be inspected briefly by the authorities.

Step 3: Submit Extra Documents: After being informed by the authority, you need to submit some extra documents asked for. The due time is given for this is around thirty days or a month.

Step 4: In-Principal Approval: The vital documents of the insurance brokerage company are verified, and if the documents and details provided by the applicant seem agreeable, then they will issue the in-principal approval to the insurance brokerage company. This approval means that you have complied with all the requirements for the registration certificate.

Step 5: Further Requirements: After receiving the above approval, the company should abide by all the further requirements and also pay the license fees. The fee can be paid through DD or through an electronic medium in favour of IRDAI, Hyderabad.

Step 6: COR (Certificate of Registration): If all the requirements and regulations suggested by the IRDA Insurance Broker Regulations, 2018[1] are fulfilled, then a Certificate of Registration is granted to the insurance brokerage company.

Step 7: Approval: Then, the relevant authority will inspect to verify the data and documents. If the applicant satisfied all the conditions, then the authority will approve the application for insurance broker registration. If the necessary eligibility criteria are met, then an insurance broker license will be issued in the applicant’s name. The License is only valid for three years from the date of issuance.

Conclusion

Insurance firms convert accumulated capital into productive investment. Insurance loss enables financial stability to be reduced and promotes trade and commerce activities that result in suitable economic growth and improvement. Hence, insurance companies play an essential role in the feasible development of the national economy. Insurance brokers are authorized to provide the best insurance policy from any insurance company. Insurance Brokerage Company can give you professional advice on suitable insurance policies.

Read our article:A Complete Guide on the Compliance of Insurance Broker under IRDAI