Procedure for Insurance Broker License: A Complete Guide

Shivani Jain | Updated: Feb 25, 2021 | Category: Insurance Broker, IRDA Advisory

Nowadays, a lot of Insurance Products are available in the market, but choosing the right one is a challenging task. Further, an insurance broker advises people about the best insurance product available based on their financial needs. It acts as an intermediary between the Issuer Company and the general public. However, to start an Insurance Broker business in India, one needs to follow the complete procedure for Insurance Broker License.

In this blog, we will cover the concept and procedure for Insurance Broker License.

Table of Contents

Concept of Insurance Broker

The term Insurance Broker means a person or a company, which is registered under the Insurance Regulatory Development Authority of India (IRDAI) and offers advisory services on matters concerning insurance. Further, it is a qualified expert who is engaged in providing insurance covers. That means this business entity assists the clients in getting the best insurance coverage from an insurer and acts as a bridge for them.

Also, Read: How to Start Insurance Brokerage Business in India?

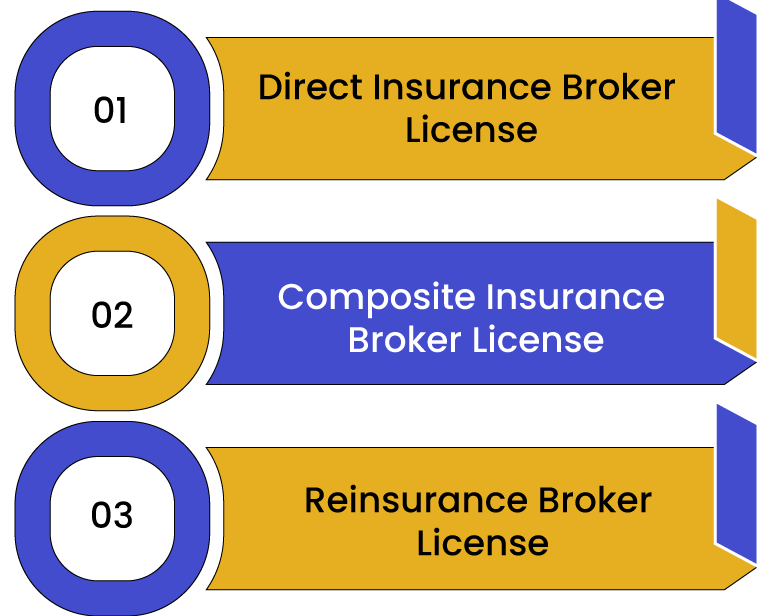

Types of Insurance Broker License

The different types of Insurance Broker License are as follows:

- Direct Insurance Broker License;

- Composite Insurance Broker License;

- Reinsurance Broker License;

Entities Eligible for the Procedure for Insurance Broker License

The entities eligible for the procedure for Insurance Broker License are as follows:

- Any company registered under the Companies Act 2013;

- Any registered cooperative society under the Cooperative Societies Act 1912;

- Any Limited Liability Partnership Firm under the LLP Act 2008;

- Any other acknowledged authority;

Entities Not Eligible for Insurance Broker License

The entities that are not eligible for Insurance Broker License are as follows:

- Non Resident Entity;

- Any Foreign Limited Liability Partnership;

- Any Individual who resides outside India;

Laws Governing the Procedure for Insurance Broker License

The laws governing the procedure for Insurance Broker License are as follows:

- Insurance Regulatory Development Authority Act 1999;

- IRDAI (Insurance Brokers) Regulations 2018;

Minimum Requirements for Obtaining Insurance Broker License

The minimum requirements for obtaining Insurance Broker License are as follows:

Financial Requirements

The financial requirements for obtaining Insurance Broker License can be summarised as:

- Rs 75 lakhs for Direct Insurance Broker License;

- Rs 4 crore for Reinsurance Broker License;

- Rs 5 crore for Composite Broker License

Net Worth Requirements

The net worth requirements for obtaining Insurance Broker License can be summarised as:

- Rs 50 lakhs for Direct Insurance Broker License;

- 50 percent of the Minimum Capital Requirement for Reinsurance Broker License;

- 50 percent of the Minimum Capital Requirement for Composite Broker License

Deposit Requirements

The deposit requirements for obtaining Insurance Broker License can be summarised as:

- Rs 10 lakhs for Direct Insurance Broker License;

- 10 percent of the Minimum Capital Requirement for Reinsurance Broker License;

- 10 percent of the Minimum Capital Requirement for Composite Broker License

Checklist for Obtaining Insurance Broker License

The checklist for obtaining Insurance Broker License in India can be summarised as:

- Need to use the term “Broking” at the end of the Company’s name;

- MOA (Memorandum of Association) must include Insurance Activities as its Principal Business;

- Needs to fulfil the Financial, Net Worth, and Capital Requirements;

- Must not hold any Foreign Investment above 26% of the total paid up capital;

- Should deposit 20% of the Initial Capital with any registered scheduled bank;

- The Principal Officer must possess the necessary qualification and training and must have cleared the Broker Examination;

- Should appoint at least two people with compulsory education and qualification;

- Must have the necessary infrastructure and experienced employees for carrying out the activities of Insurance Broking Business;

Necessary Documents for Insurance Broker License

Based on the provisions of the IRDA (Insurance Broker) Regulations, the necessary documents for Insurance Broker License are as follows:

- Application for Registration in Form B;

- Copies of duly certified MOA and AOA;

- Details of Principal Officer in Form G of Schedule I;

- A declaration that the KMPs, Principal Officers, Directors/ Partners, and other key administrative workforce are not covered under section 42 D of the Insurance Act;

- Complete Bank details of the applicant company;

- Complete list concerning the appointed agents along with their qualifications;

- Complete list concerning the advertiser, partners, KMPs (Key Managerial Personnel), directors, etc.;

- Details of the Principal Officers along with their Statutory Advisors;

- Audited Balance Sheet of the Company;

- Complete list concerning the Shareholders of the applicant Company;

- Certified copy of the Board Resolution passed regarding the promotion and investment in the company;

- Any other detail, if in case required;

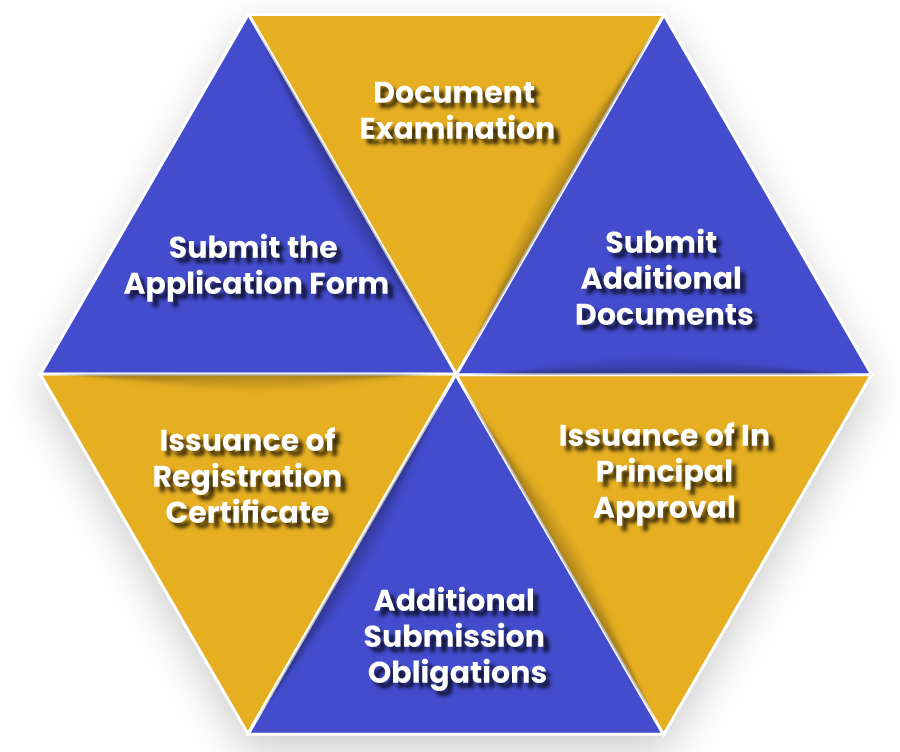

Procedure for Insurance Broker License in India

The steps involved in the procedure to obtain an Insurance Broker License in India are as follows:

Submit the Application Form

In the first step of the procedure for Insurance Broker License, the applicant company requires to submit the application form for registration in Form B of Schedule I. Further, the said application form must be furnished with the non-refundable fee and the documents required.

Document Examination

Further, the authorities will examine the form and documents submitted and, if in case required, can raise queries and request additional information and clarification as well. Also, it can ask for the submission of additional documents as well.

Submit Additional Documents

If in case the applicant has been asked by the authorities to submit some additional documents, the same needs to be furnished within 30 days from the date of receiving intimation from the Insurance Regulatory Development Authority of India.

Issuance of In Principal Approval

Once the documents submitted are fully examined and verified, and the authorities are of the opinion that the applicant has satisfied all the conditions, in that case, it will issue an in house principal approval for the Insurance Broker License.

Additional Submission Obligations

Once the applicant has received the in-principal Approval, it needs to comply with all the additional conditions, requirements as imposed by the authorities.

Issuance of Registration Certificate

Lastly, after satisfying all the steps mentioned above, the applicant will be granted a Certificate of Registration by the IRDAI authorities.

Fees for the Procedure for Insurance Broker License

The fees involved in the procedure for Insurance Broker License can be summarised as:

Non Refundable Application Fees

The non-refundable application fee levied for the procedure for Insurance Broker License can be summarised as:

- Rs 25000 for the Direct Insurance Broker;

- Rs 50000 for the Reinsurance Broker;

- Rs 75000 for the Composite Broker;

Registration Fees for Fresh Application

The registration fee levied in the case of a fresh Insurance Broker License application can be summarised as:

- Rs 50000 for the Direct Insurance Broker;

- Rs 1.50 lakhs for the Reinsurance Broker;

- Rs 2.5 lakhs for the Composite Broker;

Conclusion

In a nutshell, Insurance Broker means an entity or person who is engaged in the business of offering advisory services concerning Insurance Products. Further, this concept is bifurcated into three parts and is governed by the provisions of the Insurance Act and the rules made thereunder. However, one needs to satisfy the procedure for Insurance Broker License to carry out the functions of an Insurance Broker.

Also, Read: Why Insurance Broker License is required in India?