How Does an Insurance Broker Makes Money?

Karan Singh | Updated: Feb 22, 2021 | Category: Insurance Broker, IRDA Advisory

An Insurance Broker makes money from selling various insurances to businesses or individuals. Insurance Brokers sell different insurance types, including life insurance, health insurance, accident insurance, home insurance, car insurance, annuities, etc. Unlike insurance agents, insurance brokers sell different insurance policies from various insurance providers and must be aware of all the different insurance policies every company offers. Insurance Brokers have better customer relationship than insurance agents because they guide the customers through all the negotiable discount options. That’s why it is advisable to contact insurance broker to purchase any insurance policies. Usually, insurance brokers are paid a commission through insurance companies where they are working, and there are some other ways where insurance broker makes money. In this blog, we will discuss how an insurance broker makes money, but before that, we should know about an Insurance Broker.

Table of Contents

Insurance Broker – An Overview

An insurance broker is an intermediate between an insurance company and customer, who negotiates, sells or solicits insurance on behalf of a customer for the compensation. They help the customers by finding a perfect insurance policy that best suits customer’s need. An insurance broker represents customers, not an insurance company, and for that reason, they cannot drag coverage on behalf of the insurer. Whereas, an insurance agent represents a company, not a customer and can complete insurance sales.

To become an insurance broker, it is compulsory to obtain an Insurance Broker License. Insurance Broker License is only issued to a qualified and expert individual performing through its partners/directors/workers to understand insurance-related laws as perspicacity information on insurance items. An insurance broker provides skilful support to the customers and acts as a negotiator between an individual and the insurance company.

Also, Read: Why Insurance Broker License is required in India?

Let us Understand How an Insurance Broker makes Money

Following are some different ways where an insurance broker makes money:

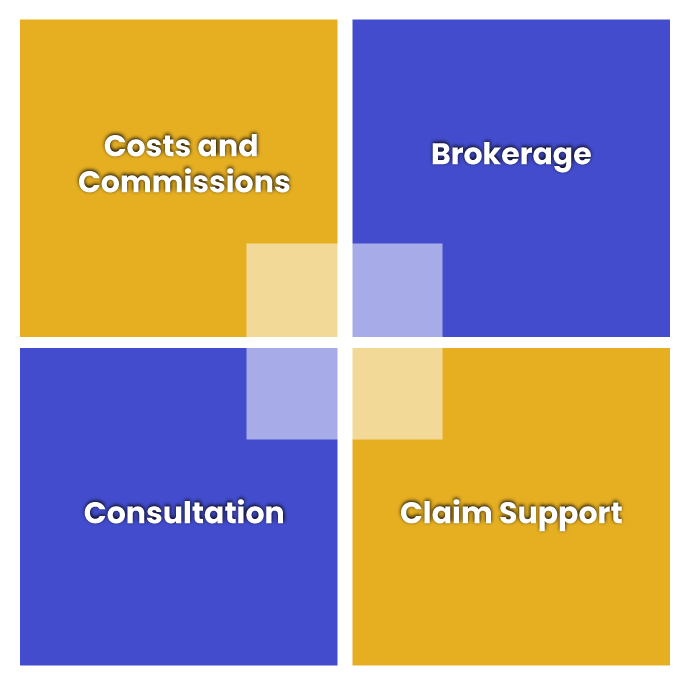

- Costs and Commissions: The crucial ways an insurance broker makes money is costs and commissions supported by insurance policies sold. These commissions are usually a percentage maintained by the yearly premium the insurance policy is sold for. A premium is the quantity of money an individual or a business pays for a policy. Insurance premiums are purchased insurance policies that include auto insurance, health insurance, life insurance, home insurance, etc. Once an insurance policy is purchased by an individual or business, the premium is income for the insurance company. It also signifies a liability because the insurer must offer coverage for claims against the insurance policy. Insurers use premiums to cover liabilities connected with the policies they guarantee. They will invest the premium in wishing higher returns and offsetting a variety of costs of providing the coverage, which helps an insurer keep prices reasonable.

- Brokerage: Insurance brokers symbolizes both the customers and the insurance companies. They are certified to offer a customer an appropriate policy from any insurance company. In this situation, the insurance broker is paid by a brokerage by the insurance company whose insurance policy a customer ultimately choose.

- Consultation: There are many cases where the customer requires a bit of expert advice regarding insurance policies, financial planning, etc. For this, an insurance broker can provide consultation on a fee basis. For example, if a customer is searching for a life-term insurance policy, definitely they do not know about insurance policies. In that case, an insurance broker helps the customer by giving suggestions and knowledge regarding insurance policies and get a consultation fee in return.

- Claim Support: Without any professional’s help, it is very difficult to file a claim, and it may get worse. Hence, insurance brokers are available to help the customer file a claim because they know the process of filing a claim very well and have worked under many insurance companies. When an insurance broker files a claim on behalf of the customer, the broker can charge a particular amount of fees in the name of claim support. For example, if any individual or business’s property is damaged, the insurance broker can help to get the claim settled instead of a customer find out by himself. According to the IRDAI (Insurance Regulatory and Development Authority) Regulations, if the insurance policy has been serviced by him, an insurance broker could not charge for a claim.

Comparison Table between Insurance Agent and Insurance Broker

| Comparison Points | Insurance Agents | Insurance Brokers |

| Representation | It only represents one Insurance Company. | It represents multiple Insurance Companies for the potential customer. |

| Types | There are two types of Insurance Agents: Independent and Captive. | Two types of Insurance Broker: Retail or Wholesale. |

| Selection | Selected by the insurance companies. | Insurance brokers are selected by buyers or customers, after careful and informed inspection from a bunch of brokers. |

| Purpose | The primary purpose of an insurance agent is to sell those company’s products which help them earn the maximum individual profits. | Whereas, the insurance broker doesn’t get anything extra for a particular range of products. |

| Weakness | They cannot provide the customer with the best insurance policy because they do not navigate through multiple options in the market. | They don’t upgrade themselves with any updates or modifications in a given policy. |

| Number of companies | They work under only one company, and sometimes they may fetch data from multiple insurance companies as required. | It represents by taking out plans and policy documents from different but significant insurance companies to the buyer. |

Conclusion

It may be noted that the primary way of how an insurance broker makes money is through fees and commissions based on insurance policies sold. These commissions include a percentage based on the amount of the annual premium the policy is sold for. Insurance Brokers sell different insurance types, including life insurance, health insurance, accident insurance, home insurance, car insurance, etc.

Also, Read: How to Start Insurance Brokerage Business in India?