Start Insurance Brokerage Business in India: A Complete Guide

Shivani Jain | Updated: Feb 17, 2021 | Category: Insurance Broker, IRDA Advisory

In comparison to a decade ago, today there are various options available of the Insurance Products in the market. Due to which, a layperson may suffer confusion in selecting the right choice. Further, an Insurance Broker acts as a middleman between the insurance companies and the general public, and helps the people make the right financial decisions based on their financial needs. To start Insurance Brokerage Business in India, one needs to acquire the Insurance Broker License from IRDAI (Insurance Regulatory Development Authority of India).

In this blog, we will discuss the concept, requirements, and procedure to start Insurance Brokerage Business in India.

Table of Contents

Concept of Insurance Broker

The term Insurance Broker means a person who advises people on their financial and insurance needs and negotiates insurance deed and contracts on behalf of the Insurers. That means an Insurance Broker abridges a gap between Insurance Companies and the General Public.

Also, it shall be considerate to take into consideration that an Insurance Broker charges a fixed fee against the services provided by them.

Laws Governing Insurance Brokerage Business in India

The laws governing the operations of an Insurance Brokerage Business are as follows:

- Insurance Regulatory Development Authority Act 1999;

- IRDA (Insurance Brokers) Regulations 2018;

Also, Read: Documents Needed to obtain Insurance Broker License

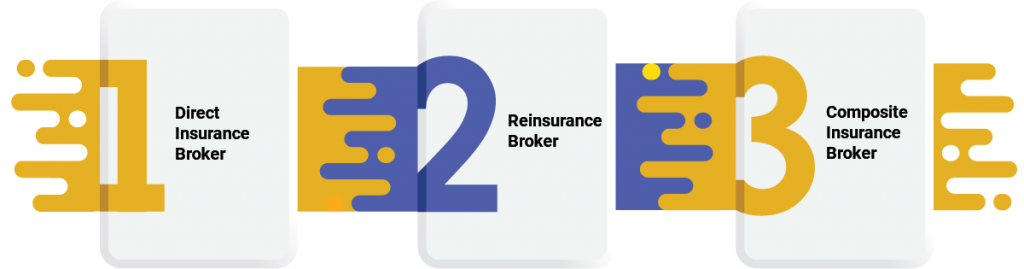

Different Types of Insurance Broker in India

The different types of Insurance Broker operating in India are as follows:

Direct Insurance Broker

The term Direct Insurance Broker means a person who provides details concerning the various insurance businesses and products available in the market. Further, they assist customers in choosing the right policy based on their financial needs as well.

Also, the activities, such as assisting clients in paying the premium or in opening an e-insurance account for a customer, etc., are included in the working of a Direct Insurance Broker as well.

Reinsurance Broker

A Reinsurance Broker carries out similar operations that of a Direct Insurance Broker. Further, the activities undertaken by a Reinsurance Broker are as follows:

- Negotiation on behalf of Client;

- Maintenance of Statistics of the Reinsurance Sector;

- Selling of Products concerning Reinsurance;

Composite Insurance Broker

The term Composite Insurance Broker means a person who deals in the Insurance related matters to buyers. Further, the services offered by a Composite Insurance Broker relates to Life and General Insurance. However, it shall be significant to state that IRDAI grants Composite Insurance Broker license to only a few applicants, that, too, on a very selective basis.

Eligibility Criteria to Start Insurance Brokerage Business in India

The eligibility criteria to start Insurance Brokerage Business in India are as follows:

- The applicant company must be registered under the Companies Act 2013;

- In the case of a cooperative society, the same must be registered based on the provisions of the Cooperatives Societies Act 1912;

- In the case of Limited Liability Partnership, the same must be registered based on the provisions of the LLP Act 2008;

- Any other person recognized by the Authority;

However, in the case of LLP, the following are not eligible to become the partners of the firm:

- Non Resident Entity;

- Any Foreign LLP;

- Any Person who resides outside India;

Minimum Requirements to Start Insurance Brokerage Business in India

The minimum requirements to start Insurance Brokerage Business in India are as follows:

Financial Requirements

The financial requirements for an Insurance Broker License are as follows:

- Rs 75 lakhs for Direct Insurance Broker;

- Rs 4 crore for Reinsurance Broker;

- Rs 5 crore for Composite Broker;

Net Worth Requirements

The net worth requirements for an Insurance Broker License are as follows:

- Rs 50 lakhs for Direct Insurance Broker;

- 50% of the Minimum Capital for Reinsurance Broker;

- 50% of the Minimum Capital for Composite Broker;

Deposits Requirements

The deposit requirements for an Insurance Broker License are as follows:

- Rs 10 lakhs for Direct Insurance Broker;

- 10% of the Minimum Capital for Reinsurance Broker;

- 10% of the Minimum Capital for Composite Broker;

Functions of Insurance Broker in India

The key functions of an Insurance Broker in India are as follows:

Direct Insurance Broker

The key functions of a Direct Insurance Broker are as follows:

- Gather information on the Insurance Business and Risk Retention Plan of the Client;

- Offer advice concerning the best Insurance Cover and Terms;

- Guide about the available insurance market and products available;

- Provide a quotation based on the client’s consideration;

Reinsurance Insurance Broker

The key functions of a Reinsurance Broker are as follows:

- Understand the nature of client’s business and risk management strategy;

- Maintains clear and proper records and accounts of the Insurer’s business;

- Renders advice on the issues concerning Insurance Cover and types of Insurance Covers available in the market;

- Forms a database on the available reinsurance market, which comprises of solvency rating of each reinsurer as well;

- Safeguards reinsurance sector;

- Delivers risk management services;

- Proposes either reinsurer or group of reinsurers;

- Negotiates with a reinsurer on behalf of the customer;

Composite Broker

A composite broker performs functions of both Reinsurance Broker and Direct Insurance Broker.

Checklist to Start Insurance Brokerage Business in India

The checklist to start Insurance Brokerage Business in India can be summarised as:

- Must end the company’s name with the term “Broking”;

- The Memorandum of Association must include the activities of Insurance Broking as its principal business;

- Must satisfy the criteria fixed for the financial, deposit, and capital requirements;

- Should not hold any Foreign Investment that exceeds the threshold of 26% of the total paid up capital;

- Needs to deposit 20% of the Initial Capital with any registered bank;

- The Principal Officer must have a fair qualification and adequate training, and must have passed the broker examination;

- Needs to hire at least two people with compulsory training and qualification;

- Should have the necessary infrastructure, together with well experienced employees to carry out the business of Insurance Broking;

Documents Required to Start Insurance Brokerage Business in India

Based on the provisions of the IRDAI (Insurance Brokers) Regulation 2018, the documents required to start insurance brokerage business in India are as follows:

- Application in Form B;

- A copy of the drafted MOA and AOA;

- Details concerning Principal Officer in Form G of Schedule I;

- A declaration stating that the Principal Officers, Directors/ Partners, and other key administrative workforce are not covered under the provision of section 42D of the Insurance Act;

- Complete details concerning partners, advertisers, directors, and other KMPs (Key Managerial Personnel);

- A complete list regarding the agents appointed, together with their qualifications;

- Bank details of the applicant company;

- Details concerning Principal Bankers, together with Statutory Advisors;

- A complete list with the details of the shareholders of the applicant company;

- A copy of the BR (Board Resolution) passed regarding the investment and promotion of the company in the board meeting;

- Audited Balance sheet of the applicant company;

- Any other detail if in case required;

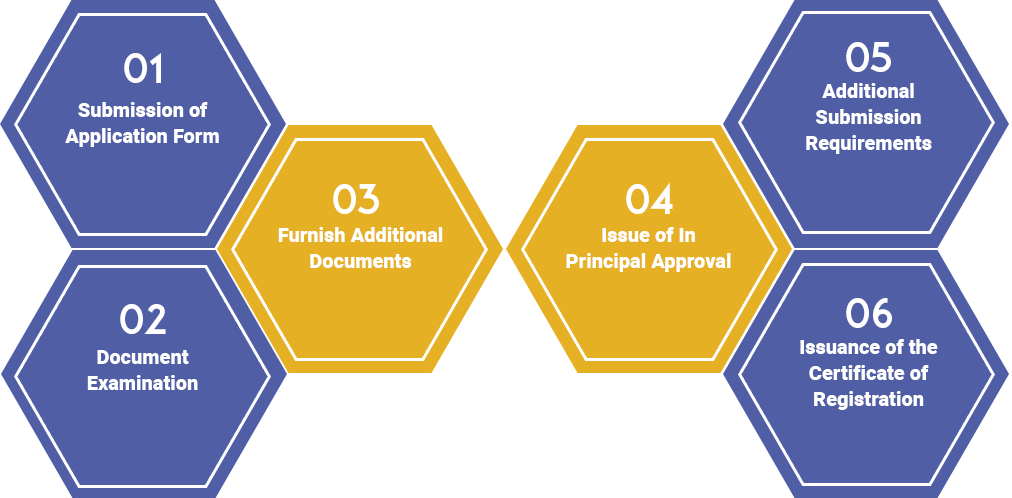

Procedure to Start Insurance Brokerage Business in India

The steps involved in the procedure to start insurance brokerage business in India are as follows:

Submission of Application Form

In the first step, the applicant company requires to furnish Form B of Schedule I as a registration form for the Insurance Broker License, together with the non-refundable application fee. Also, it needs to annex the required documents in the application form to the IRDAI.

Document Examination

Now, the authority will examine the documents and application form submitted. Also, it shall be considerate to take into note that at this stage, authority can raise queries and can request for more details, if it needs some clarification. Moreover, the authority can ask for the submission of additional documents as well.

Furnish Additional Documents

If in case the authority has asked the applicant to submit some additional documents, then, in this step, the applicant needs to furnish the same within 30 days, starting from the date of receiving the intimation from IRDAI.

Issue of In Principal Approval

Once the documents furnished are examined and properly verified, and the authority if of the opinion that the said applicant had satisfied all the mandatory conditions and stipulations, then, in that case, it will grant the in principal approval for the Insurance Broker License.

Additional Submission Requirements

After getting the in principle approval, the said applicant company requires to adhere to all the additional requirements and conditions and needs to pay the specified license fees to the authority.

Issuance of the Certificate of Registration

In the last step, if all the steps are properly met and all the documents are verified, and the authority has granted in principal approval as well, then, in that case a certificate of registration will be issued in the name of the applicant company by IRDAI.

Fees for obtaining Insurance Broker License in India

The fees charged for the Insurance Broker License can be summarised as:

Non Refundable Application Fees

The non-refundable application fee charged for an Insurance Broker License are as follows:

- Rs 25 thousand for Direct Insurance Broker;

- Rs 50 thousand for Reinsurance Broker;

- Rs 75 thousand for Composite Broker;

Registration Fees for Fresh Application

The registration fee charged for a fresh Insurance Broker License application are as follows:

- Rs 50 thousand for Direct Insurance Broker;

- Rs 1.50 lakh for Reinsurance Broker;

- Rs 2.5 lakh for Composite Broker;

Renewal Fees for 3 years

The renewal fee charged for an Insurance Broker License are as follows:

- Rs 1 lakh for Direct Insurance Broker;

- Rs 3 lakh for Reinsurance Broker;

- Rs 5 lakh for Composite Broker;

Validity of Insurance Broker License in India

In India, the Certificate of Registration issued for an Insurance Broker Business remains valid for a period of three years, starting from the date of the issuance of the certificate. Further, an applicant company needs to file the application for renewal of the license at least one month prior to the expiry of the actual validity period.

Conclusion

In a nutshell, Insurance Broker denotes a person who advises people on their financial and insurance needs and suggests to them the best option available. Also, he negotiates insurance deed and contracts on behalf of the Insurers. In India, there are three types of Insurance Broker available, and all of them have their own separate set of requirements, fees, and functions.

Further, to start insurance brokerage business in India, one needs to satisfy all the intricate requirements and procedures mentioned above. At Swarit Advisors, our IRDA experts are there to solve out all the issues and to assist you in getting the license in an easy and hassle free manner.

Also, Read: Educational Requirements for Insurance Broker License