Merger or Amalgamation of Company with Foreign Company

Karan Singh | Updated: Jul 21, 2021 | Category: Merger and Amalgamation

In today’s present economics, the businesses are very different from the businesses previous. The rise in the adaption of technology is difficult for the business operating nowadays. Due to the rising wave of globalisation, the idea of Merger and Amalgamation with foreign country or nation has now gained significant significance in current times. Under the Companies Act, 2013, the provisions for Merger or Amalgamation of Company are given in Section 234 of the Companies Act.

Table of Contents

Meaning of Merger or Amalgamation of Company with Foreign Company

A Merger or Amalgamation of Company with Foreign Company or across the border. Mergers and Acquisition is an idea when one entity acquires another entity that is based in a dissimilar country. The Merger or Amalgamation of Company with a Foreign Company aids the entities or companies to spread their businesses around the globe. An entity or a company should also do the due diligence examines to find the correct match of an overseas company for the procedure of Merger or Amalgamation with a Foreign Company to commence.

Under the Section 234 of the Companies Act, 2013, furnishes for the provisions for Merger or Amalgamation of Company with an overseas company. The prior permission of the Reserve Bank of India is required for Merger or Amalgamation with Foreign Company according to the Rule 25A of Companies (Amalgamation, Compromises, and Arrangement) Rules, 2017, in discussion with the RBI. The Reserve Bank of India announced the Foreign Exchange Management Regulations, 2017[1] (Cross Border Merger), which signifies that the Merger or Amalgamation of Company with the foreign company should be consented to by the RBI if the Merger or Amalgamation is in accordance with the regulations.

Legitimate Provisions linked with Merger or Amalgamation of Company with Foreign Company

In India, the Merger or Amalgamation Foreign Company is primarily controlled under the following legitimate provisions:

- SEBI, 2015 (Listing Obligation and Disclosure Requirements);

- The Competition Act, 2002;

- Insolvency and Bankruptcy Code, 2016;

- Companies Rules, 2017 (Compromises, Arrangement & Amalgamation);

- SEBI (Substantial Acquisition of Share and Takeover) Regulations, 2011;

- The Companies Act, 2013;

- Indian Stamp Act, 1899 and all other Stamp Acts;

- Central Goods and Services Act, 2017 and other State GST Acts;

- Foreign Exchange Management (Cross Border Mergers) Regulations, 2018.

Conditions for Merger or Amalgamation of Company with Foreign Company

Following are the conditions for Merger or Amalgamation of Company with Foreign Company:

- Consent of National Company Law Tribunal (NCLT), Creditors, Shareholder, Securities & Exchange Board of India (SEBI) and Income Tax Authorities must be taken prior to the Merger or Amalgamation with Foreign Company;

- The estimation of the surviving must be submitted to the RBI;

- The Resultant Company is engaged in the Merger or Amalgamation are needed to provide a report from time to time according to the guidelines of the RBI. The company should also discuss with the Indian Government while arranging the report;

- The provisions of Section 230-232 of the Companies Act, 2013 must be followed for the Merger of Amalgamation with Foreign Company;

- The laws concerning the Merger or Amalgamation of the Foreign nation in which overseas company is registered should also be deemed by the NCLYT while consenting the Merger or Amalgamation of Company with Foreign Company;

- Payment of consideration to shareholders of combining company must be furnished in cash or depository receipts or partly in depository receipts & partially in cash;

- The Registration of Foreign Company should be in an allowed jurisdiction;

- The estimation should be done as per the globally accepted principles on Accounting and Valuation. The Valuation report should be made by a valuer who is a member of a known body in its jurisdiction;

- Prior consent is required by the RBI.

Key Provisions of the M&A for Inbound & Outbound Merger

Following are significant provisions of Merger or Amalgamation in the case of Outbound and Inbound Merger:

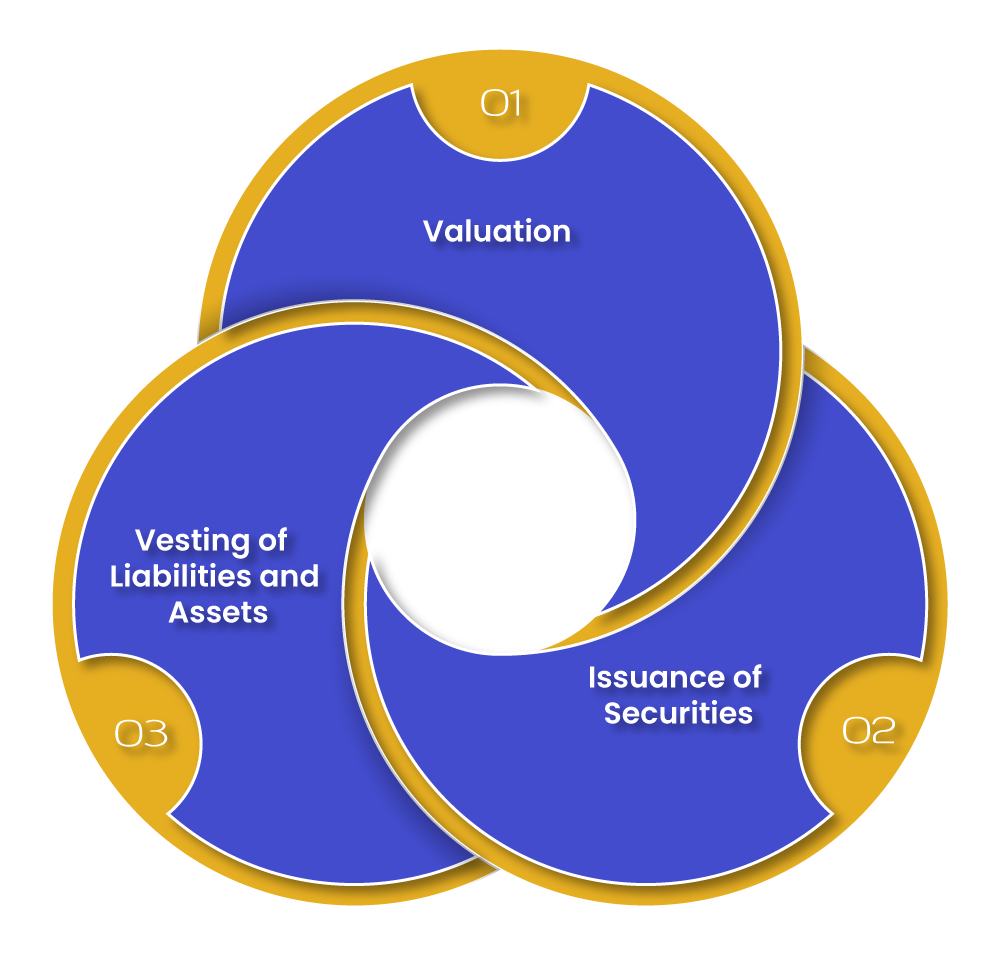

- Valuation: According to Rule 25A of the Companies Rules, 2017 (Compromises, Arrangement & Amalgamation) Rules, 2017, the evaluation should be made by incorporated valuers who are a member of known bodies in the jurisdiction of the Transferee Company. Moreover, the evaluation must be done in accordance with the global standard accepted principles of Accounting & Valuation.

- Issuance of Securities: The Resultant Company can do the issue of securities to an individual resident outside India as per the Foreign Exchange Management (Issue or Transfer of Securities by an Individual Resident Outside India) (Amendment) Regulations, 2019;

- Vesting of Liabilities and Assets: In the case of Inbound Merger, the guarantees & borrowings of Transferor Company should become the guarantees & borrowings of Resultant Company. On the other side, the guarantees & borrowings of Resultant Company undergoing Outbound Merger must be paid accordingly to the NCLT Regulations.

Inbound Merger; the Resultant Company can open an account in a bank in the jurisdiction of an overseas country for overseeing the transactions concerning the Merger or Amalgamation of Company with the overseas nation. On the other side, in the case of Outbound Merger, the Resultant Company can open an account in the bank for the transactions concerning the Merger or Amalgamation with Foreign Company.

Advantages of the Merger or Amalgamation of Company with Foreign Nation

- There is employment creation in the long run when the business spread and becomes victorious;

- If the policies of the Government are in favour of the Merger/Amalgamation, then it will lead to economic growth and expansion of the nation;

- There will be sharing of good management practices & skills when entities across the globe come together in business;

- There will be a rise in productivity of the host nation;

- The Merger/Amalgamation aids in capital accumulation for the long term;

- There will be a development of technology when the good practices & skills come together in business from around the various nations of the globe.

Conclusion

Companies Act, 2013 (Section 234), furnishes for the Merger or Amalgamation of Company with Foreign Company. The Companies Act delivers the much-required process for advancement of the Merger or Amalgamation architecture in India. The Merger or Amalgamation with the overseas company is done on a vast scale these days in India. The problematic issue in Merger or Amalgamation with an overseas company depends upon the scale, geographic scope, facts, and dynamics of both entities. Therefore, the company’s Merger or Amalgamation procedure with a Foreign Company is difficult and time-taken.

Read our article:A Complete Guide on Fast Track Mergers and Amalgamation