Overview of Rights Issue

A company issues right shares to its existing shareholders in proportion to their shareholdings in order to raise subscribed capital. The company offers these shares at a price lower than the prevailing market price of its shares. By this method, a company can raise funds without incurring any additional cost. Moreover, right issue is a more feasible option than borrowing money from banks or financial institutions as it involves fewer documentation and compliance requirements.

Section 62 of the Companies Act, 2013 regulates the process of right issue and also provides pre-emptive right to the shareholders to subscribe to such shares. Therefore, the right issue acts as a formal invitation from the company to its existing shareholders to buy additional shares.

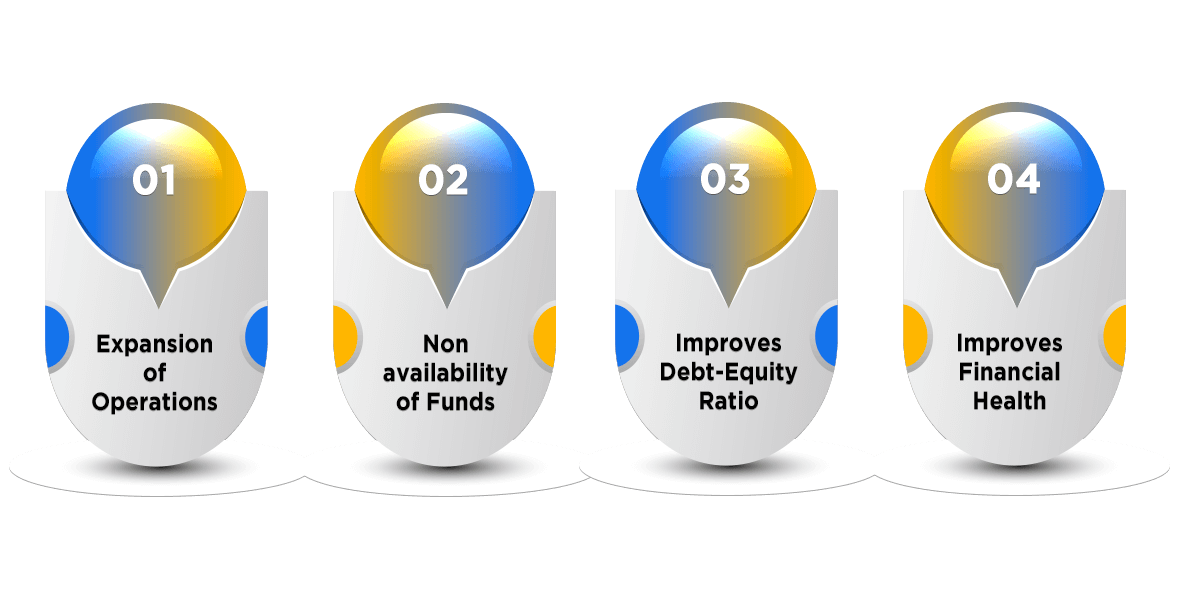

Benefits of Rights Issue

There are several advantages to the process of right issue in India, which can be summarised as follows:

- Expansion of Operations

A company chooses the option of a right issue when it is planning to raise its capital and expand its operations, but also wants to avoid fixed payments of interest.

- Non-availability of Funds

At times, a company needs to raise funds through a right issue when a debt/ loan funding is not available/ suitable or expensive to borrow.

- Improves Debt-Equity Ratio

When a company aims to improve its debt-equity ratio or looking forward to acquire a new company, it may choose the route of the right issue to raise funds.

- Improves Financial Health

When a company wants to pay off its debts to improve its financial health, it can choose the option of the right issue.

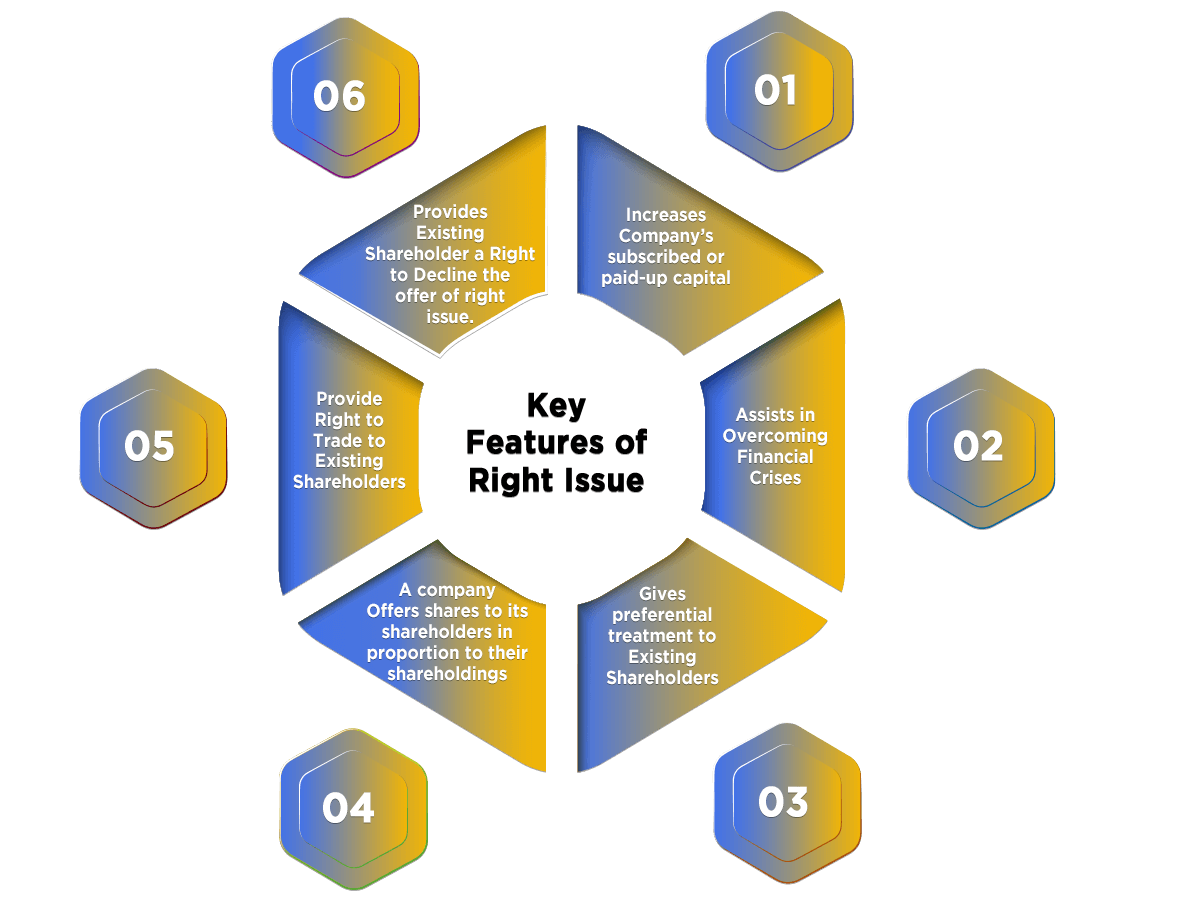

Key Features of Right Issue

The key features of the Right Issue in India are as follows:

- A company issues right shares to increase its subscribed or paid-up capital;

- When a company faces any financial shortage, it usually decides to issue the right shares without incurring underwriting charges;

- A right issue gives preferential treatment to existing shareholders;

- A company offers shares to its shareholders in proportion to their shareholdings;

- All the existing shareholders enjoy the right to trade with other market participants;

- The existing shareholders can also decline the offer of the right issue. However, if they do not subscribe to the additional shares offered, their shareholding gets reduced after the closure of the offer.

Conditions relating to Right Issue

A company needs to fulfil the following conditions before undergoing the process of Right Issue:

- Every unlisted company making the offer of the right issue needs to get its securities converted into a dematerialised form. The KMP (Key Managerial Personnel), Directors and Promoters hold these securities as per the provisions of the Depositories Act, 1996;

- Any shareholder who intends to subscribe the shares offered also needs to get their securities converted into dematerialised form;

- A company needs to check whether its authorised capital is enough to issue the right shares. If not, then the company needs to alter the capital clause of its MOA (Memorandum of Association);

- A company needs to verify whether the AOA (Article of Association) authorises the issue of the right shares or not. If not, then the company also needs to alter AOA by including the provision of the right issue;

- A company can issue the right shares only to the shareholders of the company.

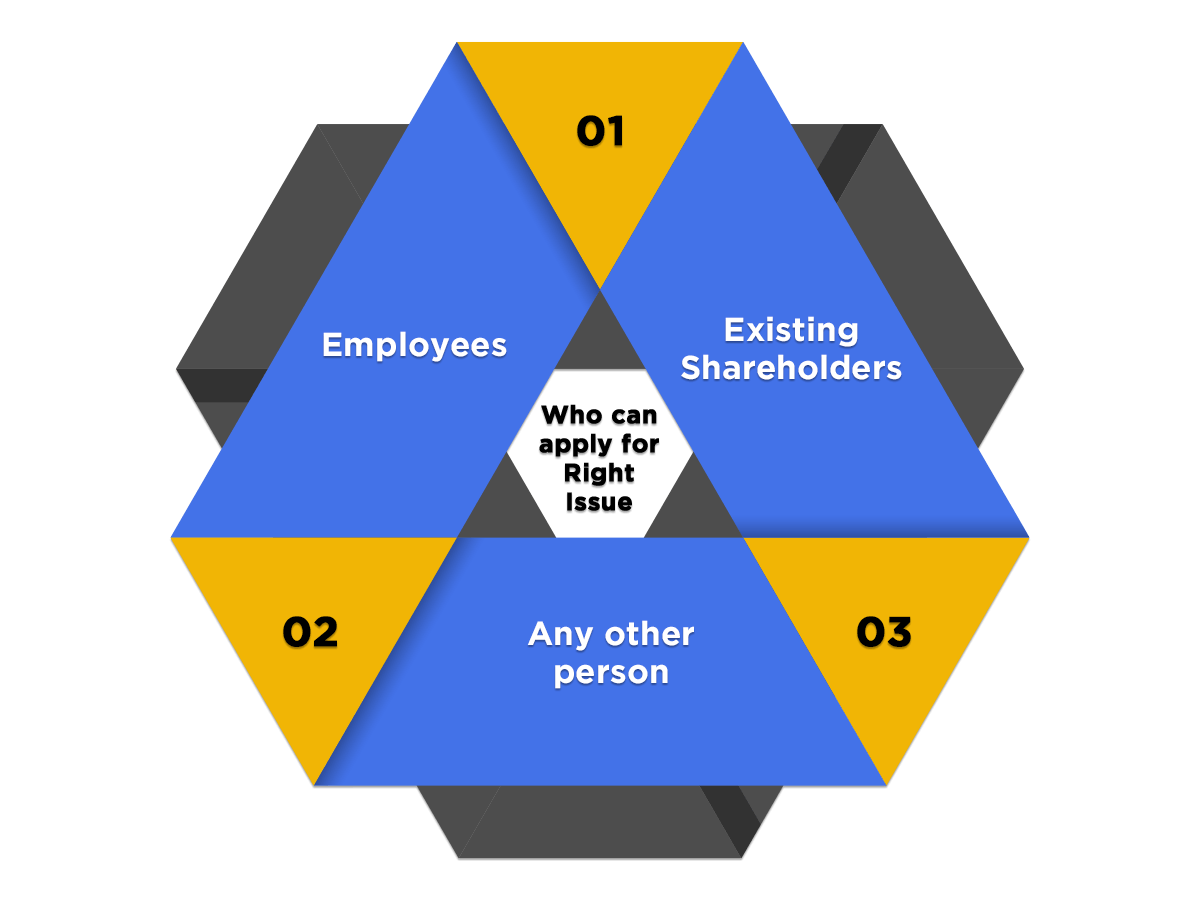

Who can apply for Right Issue?

As per section 62 of the Companies Act, 2013 the following entities can apply for the Right Issue:

- Existing Shareholders

A company can issue right shares to its existing shareholders in proportion to their shareholdings by sending them a letter of offer. However, a company needs to fulfil the following conditions for issuing rights shares:

- A company needs to send a letter of offer to the shareholders specifying the number of shares offered. The shareholders must accept the offer in a minimum of 15 days and a maximum of 30 days;

- If the shareholders do not accept the offer within the prescribed period, the same offer stands declined;

- The letter of offer also includes a right to renounce the shares offered in favour of some other person;

- After the expiry of the prescribed period or on receipt of an intimation from the shareholder regarding their rejection to the shares offered, the BOD (Board of Directors) may dispose of the shares in a manner advantageous to both the company and shareholders.

- Employees

A company can issue the right shares to its employee under a scheme of ESOP (Employee Stock Option Plan) by passing a special resolution and complying with specified conditions.

- Any other person

A company can also issue the right shares to any other person by passing a Special Resolution either for cash or for consideration other than cash. However, the registered valuer determines the price of such shares by making a valuation report subject to prescribed conditions.

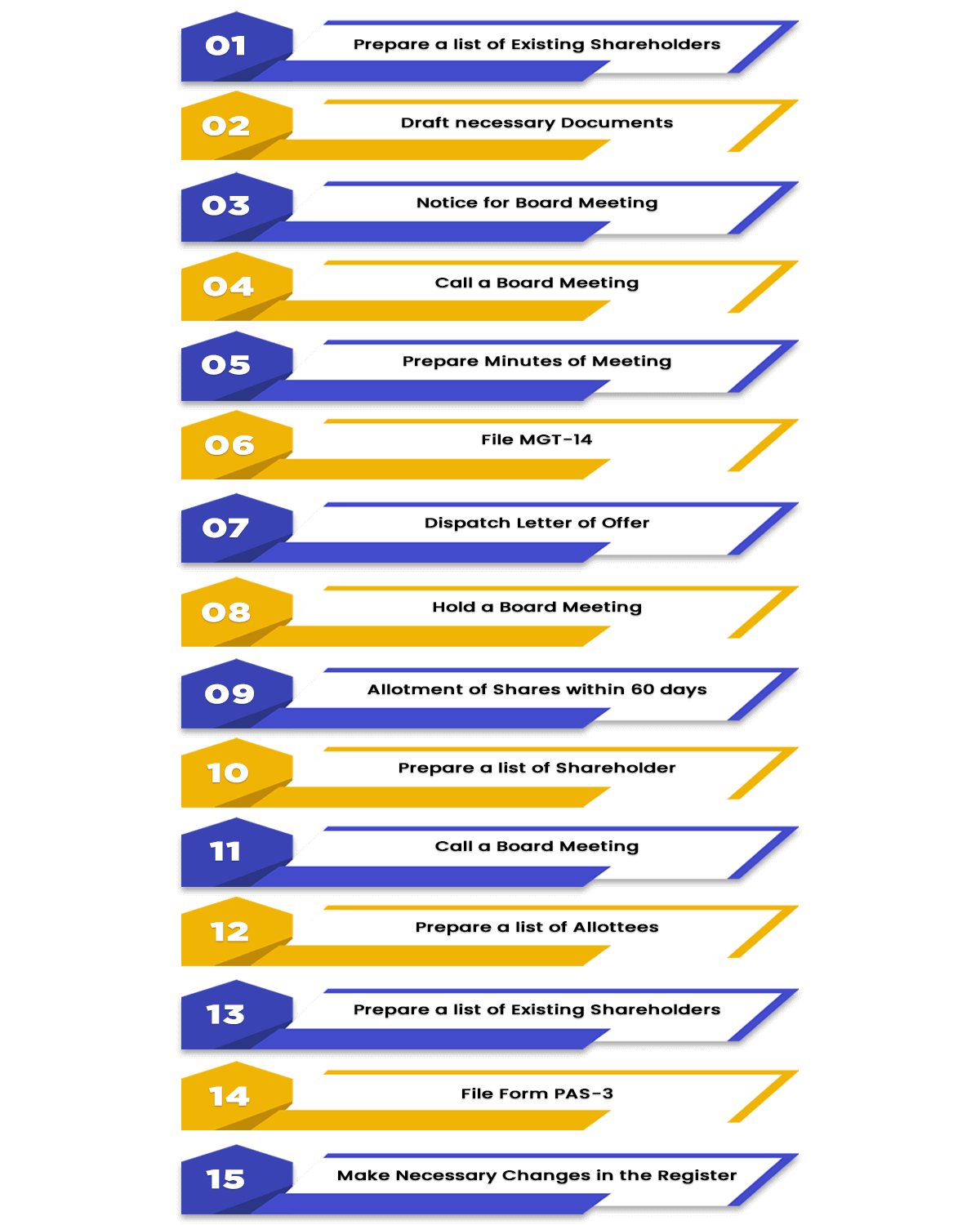

Process for Issuing Right Shares

The steps involved in the process for Issuing Right Shares in India are as follows:

- Prepare a list of Existing Shareholders

The directors need to prepare a list of existing shareholders together with the details of shares held by them. This is required to ascertain the number of right shares received by shareholders.

- Draft necessary Documents

The directors need to prepare and draft the following documents:

- Share Application Form;

- Offer Letter for the right issue; and

- Letter of Renunciation.

- Notice for Board Meeting

A notice of the Board Meeting (BM) must be sent at least seven days before the date of BM. The notice must be in a manner specified under section 173 (3) and clause 1 of the Secretarial Standard -1.

- Call a Board Meeting

In a Board Meeting, the directors need to discuss and pass resolutions on the following:

- Approval of Letter of Offer;

- Approval of Share Application Form;

- Approval of Right Issue;

- To fix a record date for the right issue;

- To decide the proportion for right issue;

- To fix the issue price of the right shares.

- To authorise Director/ Company Secretary to sign the documents.

- Prepare Minutes of Meeting

The Company Secretary prepares minutes of the BM (Board Meeting) and circulates the same to the directors within fifteen days, starting from the date of conclusion of that meeting. The company can send minutes by either of the following methods:

- Hand Delivery;

- Speed Post;

- Registered Post;

- Courier;

- E-mail; or

- Any other recognised electronic means.

- File MGT-14

After passing the board resolution, the directors are required to file form MGT-14 with the ROC (Registrar of Companies) within thirty days. However, a public company is exempted from filing a board resolution concerning the right issue.

- Dispatch Letter of Offer

The directors need to send a letter of offer to all the existing shareholders through a registered post/ speed post/ courier/ E-mail/ hand delivery, etc., at least three days before the opening of the issue. Further, the letter of offer must enumerate the number of shares offered and be kept open for a minimum of fifteen days and a maximum of thirty days. However, in case of private companies, a period less than three days and fifteen to thirty days is also valid if 90% of the shareholders have given their consent for the same.

- Hold a Board Meeting

The directors of the company need to hold a board meeting after receiving the following from the holders:

- Acceptance, Renunciation or Rejection of Right;

- Share Application Money.

The company needs to send the notice for the meeting at least seven days before the date of the meeting.

- Allotment of Shares within 60 days

The company needs to allot its shares within sixty days from the date of receipt of share application money. If the company fails to allot the shares, it needs to refund all the amount received within fifteen days from the date of completion of sixty days. However, if the company fails to refund the share application money, it will be liable to pay interest at a rate of 12% p.a., starting from the expiry of the 60th

- Prepare a list of Shareholder

The directors need to prepare a list of shareholders containing the following details:

- Name of the shareholders who have renounced their shares;

- Name of the shareholders who have denied the offer of the right issue;

- Name of the shareholders who have subscribed shares more than the entitlement under the right issue.

- Call a Board Meeting

The directors of the company need to hold a board meeting within sixty days from the receipt of application money to discuss and pass resolutions on the following issues:

- Allotment of shares to the applicants applied for shares;

- Approval for issuing share certificates;

- Approval for making entries in the Register of Members.

- Prepare Minutes of Meeting

The Company Secretary prepares the minutes of the BM (Board Meeting) and circulates the same to the directors within fifteen days from the date of conclusion of that meeting. The company can send minutes by either of the following methods:

- Hand Delivery;

- Speed Post;

- Registered Post;

- Courier;

- E-mail; or

- Any other recognised electronic means.

- Prepare a list of Allottees

The directors need to prepare a list of allottees for filing it with the ROC (Registrar of Companies).

- File Form PAS-3

The directors of the company need to file the Return of Allotment in Form PAS 3 along with all attachments to the Registrar of Companies within thirty days of allotment of shares.

- Make Necessary Changes in the Register

Lastly, the company needs to make mandatory entries in the Register of Members within seven days of passing of the board resolution for the allotment of shares.

Difference between Right Shares and Bonus Shares

|

Points of Difference |

Bonus Shares |

Right Shares |

|

Meaning |

When a company issues shares to its existing shareholders on a pro-rata basis and out of Free Reserves, it is known as Bonus Shares. |

When a company issues right shares to its existing shareholders in proportion to their shareholdings, it is known as Right shares. |

|

Issue Price |

A company offer these shares free of cost. |

A company offers these shares at a price lower than the prevailing market price of the shares. |

|

Cash Flow |

The bonus issue results in no cash flow as shares are given free of cost. |

The right issue results in cash inflow as the shares are given at a discounted price. |

|

Consideration |

A company does not receive any consideration as shares are issued free of cost. |

A company receive consideration as shares are issued against cash. |

|

Authorization |

Bonus issue requires approval from the board in the general meeting. |

In case of right issue, the directors can obtain approval from the members by passing an ordinary or special resolution. |

|

Market Value |

Bonus issue does not affect the market value of the company. |

The right issue affects the market value of the company. |

|

Governing Section |

Section 63 of the Companies Act, 2013 regulates the process of bonus issue. |

Section 62 of the Companies Act, 2013 governs the process of right issue. |

Rights Issue FAQs

The term “Rights Issue” denotes an invitation to the existing shareholders to purchase some new shares in the company. Further, this type of issue provides securities to the existing shareholders, known as Rights.

One can apply for Rights Issue through ASBA (Applications Supported by Blocked Amount.

Yes, one can apply online for Right Issue, just like an Initial Public Offer (IPO). However, the same is possible only if the applicant’s bank supports the same.

The term “Value of Right” denotes the difference between the market value of shares and the result that is obtained.

The formula for calculating the Value of Right is No of Right Shares/ Total Shares (New Shares + Old Shares) X (Market Value – Issue Price).

The section 62 of the Companies Act 2013 deals with the concept of Rights Issue.

The benefits of the Rights Issue are the Expansion of Operations, Non-availability of Funds, Improves Debt-Equity Ratio, and Improves Financial Health.

The stock price gets diluted and goes down when more shares are issued in the market.

All the Existing Shareholders and Employees are eligible to apply for Rights Share.

The term “Split Application Form” denotes a form required by the shareholder to renounce a portion of their holdings and also to apply for the rest of their holdings.

Yes, a shareholder can use the Split Application Form for renouncing share holding to 2 or more people.

The term “Right Issue” denotes an invitation to the already existing shareholders to buy additional shares in the company, that too, at the discounted rates than the market price.

The Alternative Formula to calculate the Value of Rights Issue is Right shares/ Total Shares after Right Issue X (Cum Right Price – New Issue Price).

Yes, ASBA is mandatory only in the situation where not more than one payment option is given to the concerned issuer.

The steps involved in the process to issue Rights Share are Prepare a List of Existing Shareholders; Draft Necessary Documents; Notice for Board Meetings; Call a Board Meeting; Prepare Minutes for Meetings; File MGT 14; Dispatch Letter of Offer; Hold a Board Meeting; Allotment of Shares within 60 days; Prepare a List of Shareholders; Call a Board Meeting; Prepare Minutes for Meetings; Prepare a List of Allottees; File Form PAS 3; Make Necessary Changes in the Register.

All the private, public or unlisted companies are eligible to issue the right shares.

Form PAS-3 and Form MGT-14 are required for the Process of Rights Issue.

Yes, Rights Shares can assist in increasing the value of subscribed and paid-up capital.

Existing Shareholders are given preferential treatment in the case of Rights Issue.

Yes, the Right Issue is a Pre-emptive right for the shareholders.

The Right Issue results in cash inflow as the shares are given at a discounted price.

No, a company cannot issue Right Shares without passing a Resolution (Ordinary or Special) in the Meetings.

Yes, the Right Issue can affect the Market Value of the Company.

Yes, a company needs to verify the provisions of AOA for permission before issuing Right Shares.

Yes, the option of issuing Right Shares is more feasible than borrowing from Banks.

No, there is no need for the company to incur extra costs for issuing Right Shares.

The right shares are issued to its existing shareholders in proportion to their shareholdings.

Generally, small companies choose the option of the Right Issue.

There are no Direct Penal Provisions governing the violation of Rights Issue.

No Direct Penal Provisions are governing the violation of the Rights Issue.

A company offers these shares at a price lower than the prevailing market price of the shares.

After passing the Board Resolution, the directors are required to file form MGT-14 with the ROC (Registrar of Companies) within 30 days.

The company needs to allot Right Shares within 60 days from the date of receiving Share Application Money.

In this case, the company needs to refund the entire amount received within 15 days from the date of completion of 60 days.

A shareholder must accept the offer of Right Issue in a minimum of 15 days and a maximum of 30 days;

No, a company can issue right shares only to its shareholders.

If in case the shares are issued to the shareholders according to Sec 62(1)(a), then, in that case, the passing of special resolution and filing of MGT-14 is mandatory.