What are the Documents Needed to obtain Insurance Broker License in India?

Shivani Jain | Updated: Dec 04, 2020 | Category: Insurance Broker

Today, a wide range of insurance products are available in the financial market. As a result, a layperson with no financial knowledge or background gets confused regarding the right insurance choice. Therefore, it always advised to approach an experienced Insurance Broker, who can assist you with the right financial decisions. However, if an individual or business entity wants to start dealing in insurance brokerage-related activities, it needs to first acquire an Insurance Broker License in India.

In this blog, we will discuss the concept, basic requirements, and documents needed to obtain Insurance Broker License in India.

Table of Contents

Concept of Insurance Broker

The term “Insurance Broker” denotes a business entity /company /firm of partners/or a person who is registered as an insurance adviser and had expert knowledge and previous experience with insurance based laws. Further, the main work of an insurance broker is to lead customers to their insurance requirements.

In other words, an Insurance Broker acts as a Mediator between the Insurance Company and Customers who are willing to buy insurance policies.

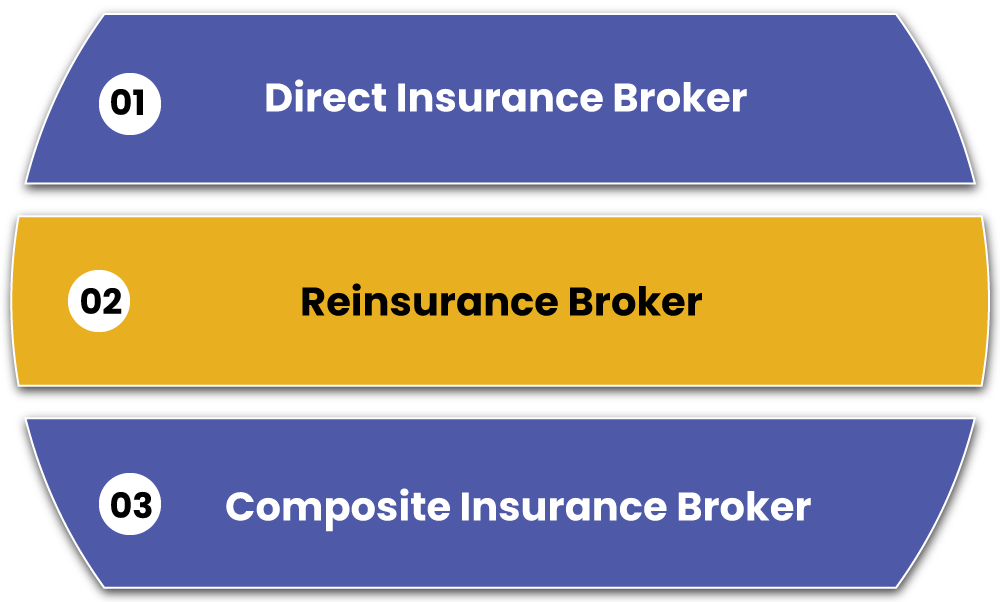

Three Main Types of Insurance Brokers

Further, the different types of Insurance Broker prevalent in India are as follows:

- Direct Insurance Broker;

- Reinsurance Broker;

- Composite Insurance Broker;

Concept of Insurance Broker License

In India, IRDA or Insurance Regulatory and Development Authority is responsible for governing and administering the functions and operations for Insurance Broker License in India. Also, every individual or business entity that wants to deals in insurance brokerage-related activities, it needs to first acquire an Insurance Broker License from IRDA.

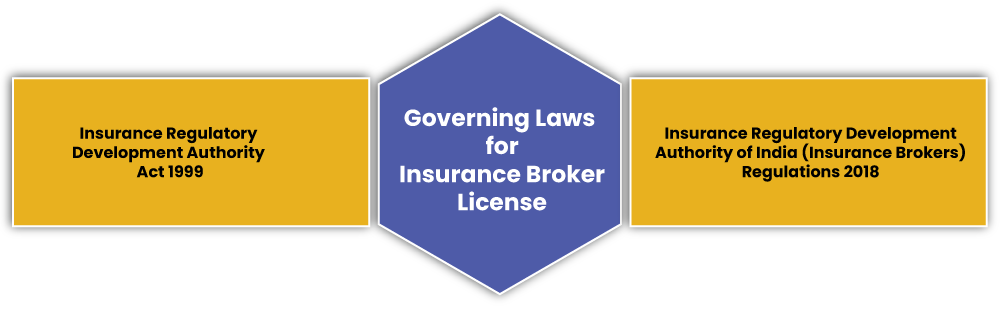

Governing Laws for Insurance Broker License

The laws and regulations governing the Insurance Broker License in India are as follows:

- Insurance Regulatory Development Authority Act 1999;

- Insurance Regulatory Development Authority of India (Insurance Brokers) Regulations 2018;

Eligibility Criteria for Obtaining Insurance Broker License in India

The eligibility criteria for obtaining Insurance Broker License in India are as follows:

- Any company incorporated under the provisions of the Companies Act 2013;

- Any registered co-operative society formulated as per the norms and regulations of the Co-operative Societies Act 1912;

- Any LLP registered under the provisions of the Limited Liability Partnership Act 2008;

- Any other person acknowledged by the Authority;

However, it shall be relevant to note that in the case of Limited Liability Partnership, the persons that are not allowed to become partners are as follows:

- Non Resident Entity;

- Any Foreign LLP (Limited Liability Partnership) registered based on the law of that foreign country;

- Any person or individual who resides outside India;

Documents Needed to obtain Insurance Broker License in India

The Documents needed to obtain Insurance Broker License in India are as follows:

- Application in Form B;

- A copy of MOA (Memorandum of Association);

- A copy of AOA (Articles of Association);

- Form G of Schedule I for furnishing the details regarding the Principal Officer;

- A Statement of Declaration expressing that the Principal Officer, Directors/ Partners, and any other administrative workforce are not excluded under the provisions of section 42D of the IRDA Act 1999[1];

- Complete details concerning Partners/ Advertisers/ Directors and other Key Managerial Personnel;

- Name and Qualification details of at least two qualified agents;

- Complete Bank Account details;

- Details of the Principal Bankers, together with the Statutory Advisors;

- List of all the Shareholders;

- A copy of Board Resolution passed in company’s Board Meeting;

- Audited Balance Sheet of the company for the previous financial years;

- Any other detail as may be required;

Procedure to Obtain Insurance Broker License in India

The steps involved in the procedure to obtain an Insurance Broker License in India are as follows:

- Firstly, the applicant requires to furnish Form B of Schedule I as the application for registration with IRDA, together with the fees prescribed;

- After the submission of application, the authorities will verify the same;

- In the next step, the applicant needs to submit the required documents with the authorities within 30 days of filing the application;

- If the authorities are satisfied with the application form and documents filed, they will grant the Certificate of Registration to the applicant in the form J of Schedule I;

Fees for Obtaining Insurance Broker License

The fees for obtaining Insurance Broker License can be summarised as:

Non-Refundable Application Fees

- For Direct Broker: Rs 25000;

- For Reinsurance Broker: Rs 50000;

- Form Composite Broker: Rs 75000;

Fresh Application Form Registration Fees

- For Direct Broker: Rs 50000;

- For Reinsurance Broker: Rs 150000;

- Form Composite Broker: Rs 250000;

Renewal Fees

- For Direct Broker: Rs 100000;

- For Reinsurance Broker: Rs 300000;

- Form Composite Broker: Rs 500000;

Validity of Insurance Broker License

In India, the certificate of Insurance Broker License remains valid for a period of 3 years, commencing from the date of issuance of the certificate. That means the applicant requires to file the application for renewal prior to the expiry of the validity period.

Conclusion

In a nutshell, Insurance Broker acts as a Mediator between the Insurance Company and Customers, who are willing to buy insurance policies. Also, to start dealing in the insurance brokerage-related activities, an individual or a person needs to first acquire Insurance Broker License, which again is an intricate and complex task and requires a lot of documents and basic requirements.

Also, Read: Insurance Broker Educational Requirements for Insurance Broker License