The Companies (Amendment) Bill 2020- A Change to Business and Commerce

Sanchita Choudhary | Updated: Oct 08, 2020 | Category: Change in Business

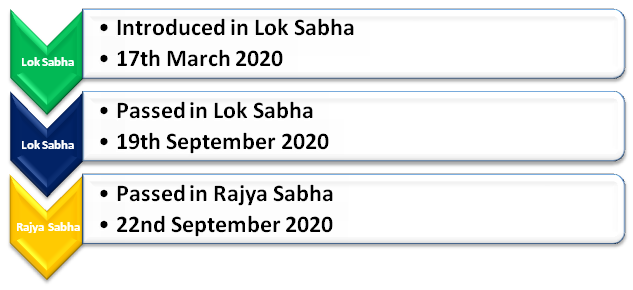

It seems to appear that 2020 has been the year of changes and one such amendment was made for the corporate. The Companies (Amendment) Bill 2020 with amendments brought under the provisions of Corporate Social Responsibility, Incorporation of Companies etc., the Central Government further laid down the amendments before the Lok Sabha on 17th March,2020 by the way of The Companies (Amendment) Bill,2020. The same was passed by the Lok Sabha on 19th September 2020 and then by the Rajya Sabha on 22nd September,2020.

Table of Contents

Objective

Based on the report submitted by CLC, the Ministry of Finance has introduced the Companies (Amendment) Bill, 2020 which seeks to make amendments under the Companies Act, 2013. The bill has primarily two objectives:-

- It decriminalizes “minor procedural or technical lapses….into civil wrong” thus approaching to principle “to further remove criminality in case of defaults, which can be determined objectively and which otherwise lack any element of fraud or do not involve larger public interest”and

- Focuses on providing certain relaxation and benefits for greater ease of living for law abiding corporate.

Company Law Committee Report

Under the chairmanship of Shri InjetiSrinivas in September, 2019 CLC was constituted with a view to decriminalize offences as well as provide ease of doing business for corporate and stakeholders. It further provided the guideline of revoking 46 penal provisions in the following manner:-

- Re-categorising of 23 offences out of 66 compoundable offences to in-house adjudication framework wherein penalty will be levied by an adjudication officer.

- Omitting 7 compoundable offences.

- Restricting 11 compoundable offences to fine only (exclusion of imprisonment).

- Recommending 5 offences to be dealt with an alternative framework.

Furthermore, the Companies (Amendment) Bill, 2020 provides majorly the following:-

Major Highlights of the Companies (Amendment) Bill 2020

While several changes has been proposed by the Company Law Committee (CLC), the key changes are as follows:-

- Decriminalization Of Certain Offences – The bill proposes changes to certain offences in relation to technical and procedural defaults which can be determined objectively or otherwise lack any element of fraud or do not involve larger public interest. Speaking on the bill, Sitaraman said “there are currently around 124 penal provisions compared to 134 under Companies Act 2013”. The said amendment will be carried out in Section 23 of the Companies Act.

- Producer Companies – The Companies (Amendment) Bill, 2020[1] proposes a new chapter XXIA relating to “producer companies and its incorporation”. This chapter has been introduced for the benefit of farmers, handloom, agriculture as well as cottage industries. The CLC Report defines a “Producer Companies as, “a body corporate comprising of farmers and agriculturists who work in cooperation with each other to promote better standard of living and gain easier access to credit, technology, market, etc.”

- Corporate Social Responsibility – The bill exempts the companies with a CSR liability of up to Rs. 50 lakh a year from setting up CSR committee. Furthermore, the Bill allows eligible companies to set off the excess amount towards there CSR obligations in the subsequent financial years.

- Direct Listing – The Companies (Amendment) Bill,2020 is to allow direct listing of securities by Indian companies in permissible foreign jurisdiction as per rules to be prescribed. This would be considered beneficial for start-ups to tap overseas market for raising capitals.

- Reduced Timeline For Issue Of Rights – As per section 62 of the Act the timeline of providing offer letter to the existing shareholder has been reduced to 15 days to not more than 30 days, beyond which the offer is to be deemed declined.

- Exemption of Filing Resolutions and Agreements-Section 117 requires the filing of resolution with the ROC. As per Companies Act, 2013 it exempts banking companies providing loan, guarantee, and security in connection of providing loan from filing the resolution in e-Form MGT-14. The current bill now proposes to extend such exemption to registered NBFC license and HFCs.

- Benches Of NCLAT – The Companies (Amendment) Bill,2020 proposes section 418A for setting up benches of the National Company Law Appellate Tribunal in order to ease the burden and also to decrease the pendency of cases. The ceiling of the maximum strength of NCLAT under section 410 of the Act has been proposed to be removed in the bill.

- Periodical Financial Results – This is a newly inserted clause in the bill under section 129A. The Central Government shall require such class or classes of Unlisted companies as may be prescribed-

- To prepare financial results on periodical basis

- Obtain approval of the Board of Directors

- File a copy of periodical financial results with the ROC within 30 days of the completion of the relevant period with such fees as may be prescribed.

Conclusion

Thus, the Companies (Amendment) Bill,2020 gives effect to decriminalization of certain offences under the Companies Act, 2013 in order to provide greater ease of living and doing business for companies. This would further lead to de-clogging of NCLT and lesser applicability of penalty would thus reduce the burden of the start-ups and producer companies which would ultimately lead to a healthy business. Thus the bill can be stated and considered to be a big step in the direction of growth of companies in India.

Also, Read: Foreign Contribution Regulation Amendment Bill 2020.