Form ITR 5: A Complete Guide on This Income Tax Return

Shivani Jain | Updated: Sep 14, 2020 | Category: Income Tax

The term “Form ITR 5” denotes an Income Tax Return filed by every taxpayer who is neither filing Form ITR 7 nor filing any return under section 139 (4A), 139 (4B) or 139 (4D). Further, this ITR includes all the Heads of Income but does not include the income specified under section 11 of the Income Tax Act 1961.

In this blog, we will discuss Form ITR 5, together with the Latest Amendments and Procedure to file it Online.

Table of Contents

Concept of Income Tax Return

The term “Income Tax Return” denotes a form which is used by the taxpayer to file details about his/her income to the Income Tax Department. The tax liability of an assessee is calculated on the basis of the income of the assessee.

It is mandatory for all the Individuals or Businesses that are earning income during a Financial Year to file ITR for that Financial Year.

Further, the process of submitting Income Tax Return to the IT Department is known as Income Tax Return Filing.

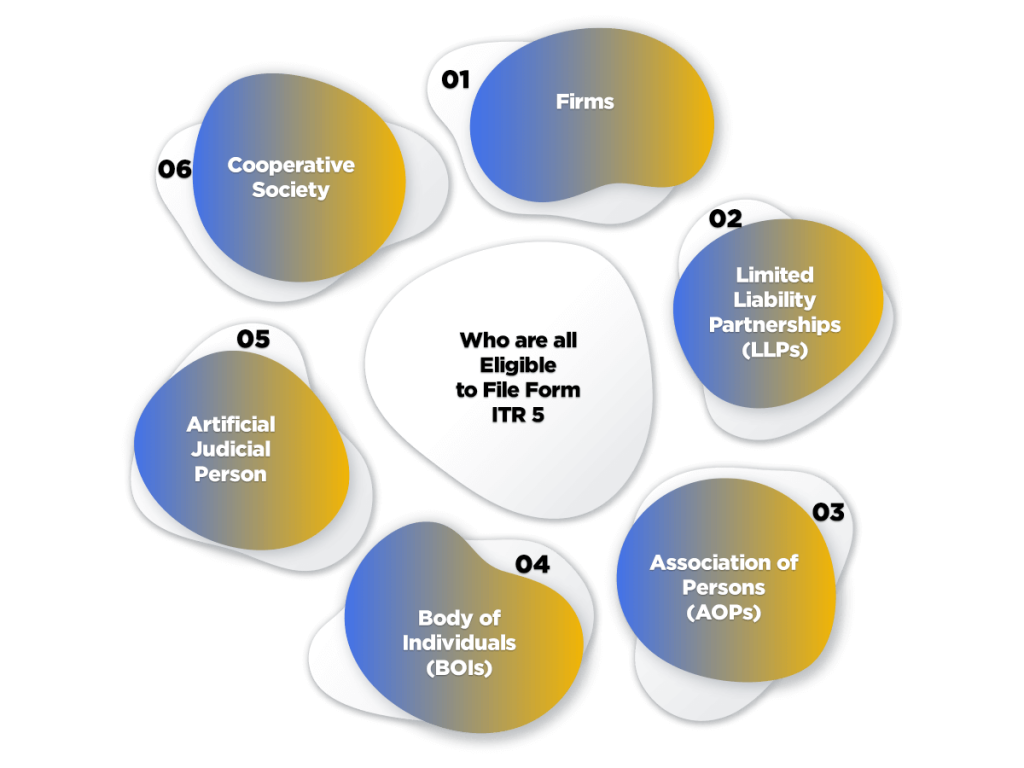

Who are all Eligible to File Form ITR 5?

The ones who are all eligible to file Form ITR 5 are as follows:

- Firms;

- Limited Liability Partnerships (LLPs);

- Association of Persons (AOPs);

- Body of Individuals (BOIs);

- Artificial Judicial Person;

- Cooperative Society;

However, it shall be relevant to note that the business formats mentioned above are eligible to file Form ITR 5 only if they are not filing return under section 139 (4A), 139 (4B), 139 (4C), or 139 (4D).

Who are all not Eligible to File Form ITR 5?

The ones who are not eligible to file Form ITR 5 are as follows:

- Individuals;

- Hindu Undivided Families (HUFs);

- Companies;

Due Dates for Filing Income Tax Return 5

The due dates for filing Income Tax Return (ITR) 5 has been extended till 30.11.2020.

Amendments Made in ITR Form 5

The key amendments made in the ITR Form 5 for the Assessment Year 2020-2021, are as follows:

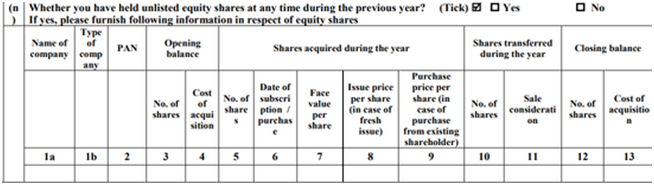

Type of Company

Under the General Information in ITR Form 5, where the assessee needs to disclose about his/her Directorship in companies, Holdings of Unlisted Equity Shares, a new column named “Type of Company” has been added.

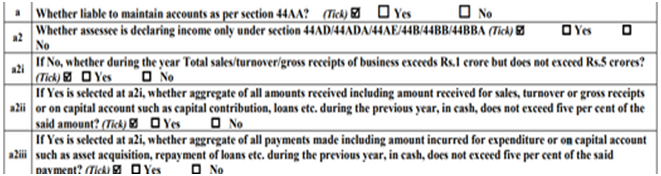

New Disclosure Criteria

Now, the Income Tax Department has introduced new disclosure criteria for declaring income under the Presumptive Income Scheme, such as section 44AE, 44B, 44BB, 44AD, 44ADA, 44BBA, 44BBB.

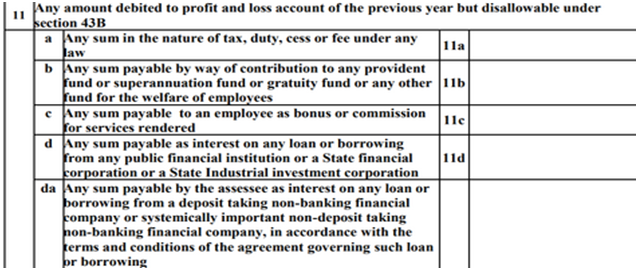

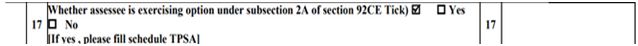

Insertion of Point 11 (Da) and 17

For the Assessment Year 2020-2021 the Income Tax Department and the Central Government have introduced 2 new points under the head Other Information, named Point 11(Da) and Point 17.

Point 11

Any amount debited to the profit and loss account for the previous year but disallowable under section 43 B.

Sub Point DA

Any amount payable by the assessee or taxpayer as interest on any loan or borrowing either from a deposit taking NBFC or systemically important non-deposit taking NBFC, in accordance with the terms and conditions of the agreement regulating such loan or borrowing.

Point 17

Under this head, the assessee needs to mark the option whether he is exercising the option under subsection 2A of section 92 CE or not.

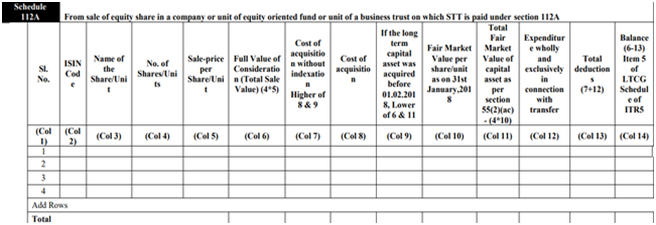

Introduction of New Schedule 112A

All the details concerning Equity Shares, Equity Oriented Fund, or Unit of a Business Trust on which Securities Transaction Tax (STT) is paid under section 112 A.

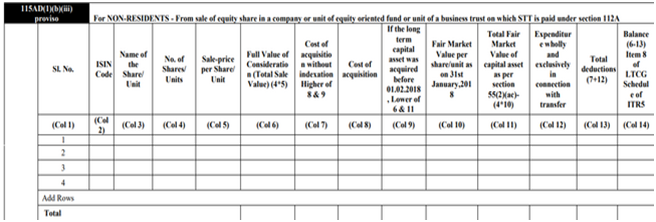

Introduction of New Schedule 115 AD (1) (b) (iii) Proviso

This schedule deals specifically with the NRIs (Non Residents Indians), who have been involved in the Sale of Shares, Unit of Equity-oriented Fund, or Unit of a Business on which STT (Securities Transaction Tax) has been paid under section 112A.

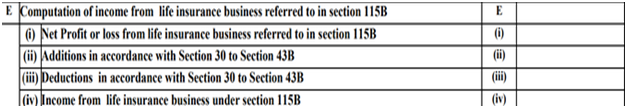

Introduction of Section E

The Central Government, together with the Income Tax Department, has introduced a new section named Computation of Income from Life Insurance Business specified in Section 115 B. This section has been made under the Head of Income from Business or Profession.

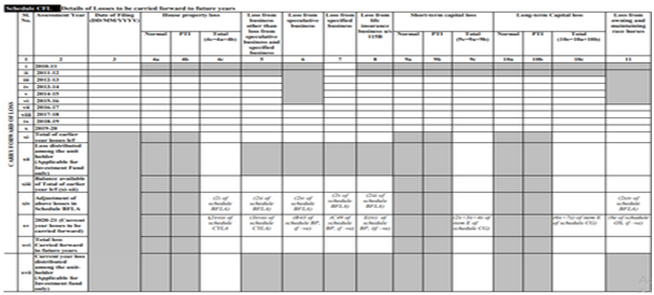

Introduction of Schedule CFL

The term “CFL” is the acronym form for the Carry Forward Losses. As per this head of income, the taxpayer or assessee needs to provide details and information concerning the Loss Incurred in the two columns, named as follows:

- Normal Loss;

- PTI

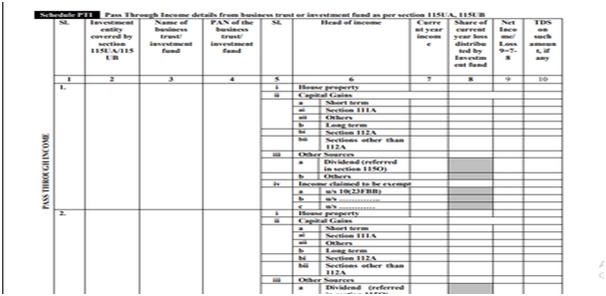

Introduction of Schedule PTI

This new schedule will comprise of the information as follows:

- Investments covered under section 115 UA and 115 UB;

- Classification of Income as follows:

- Current Year Income;

- Share in the Current Year Loss distributed by the Investment Fund;

- Net Income or Loss;

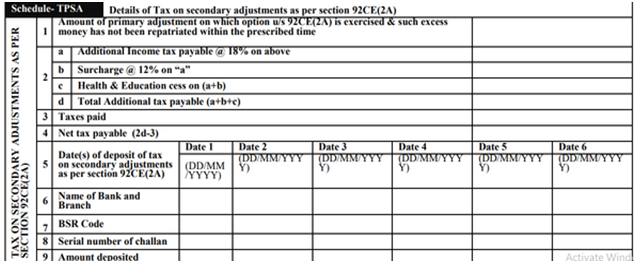

Introduction of Schedule TPSA

All the details concerning the Tax on Secondary Adjustments as per section 92 CE (2A) are included under this schedule.

Introduction of Schedule D1

Under this schedule of the form, the taxpayer or assessee needs to submit all the details and information concerning every donation, deposit, and investments made by him/ her till 31.07.2020.

Further, these investments are eligible to be claimed as deduction under chapter VI- A of the Income Tax Act for the Financial Year 2019-2020.

Points to Remember while Filing Form ITR 5

The points to be considered while Filing Form ITR 5 are as follows:

- In case a Schedule is not applicable, mention the same as “N/A”;

- If an item mentioned is inappropriate, write “N/A” against that;

- The acronym “NIL” stands for NIL figures, i.e., Zero Value;

- For a negative figure, write “-“ against such A figure;

- All the figures and amount must be represented in a round-off manner to the nearest 1 rupee;

- In the same manner, the figures and amount for Total Income/Loss and Tax payable must be round-off to the nearest 10 rupees.

Structure of ITR Form 5

The structure of Form ITR 5 can be summarised as:

- Part A: General Information;

- Part A: BS: Balance Sheet as on 31.03.2019;

- Part A: Manufacturing Account for the Financial Year 2018- 2019;

- Part A: Trading Account for the Financial Year 2018- 2019;

- Part A– P&L: Profit and Loss Account for the Financial Year 2018- 2019;

- Part A- OI: Other Information;

- Part A- QD: Quantitative Details;

- Schedule HP: Computation of the Income from the head “House Property”;

- Schedule BP: Computation of the Income from the head “Profit and Gains from Business or Profession”;

- Schedule DPM: Computation of the Depreciation Charged on Plant and Machinery under the Income Tax Act;

- Schedule DOA: Computation of the Depreciation Charged on the other assets under the Income Tax Act;

- Schedule DEP: Summary of the Depreciation Charged on all the assets mentioned under the Income Tax Act;

- Schedule DCG: Computation of the Deemed Capital Gains on the Sale of Depreciable Assets;

- Schedule ESR: Deduction under section 35 of the Income Tax Act (Expenditure on Scientific Research);

- Schedule CG: Computation of the Income under the Head of Income from Capital Gains;

- Schedule OS: Computation of the Income under the Head of Income from Other Sources;

- Schedule CYLA: Statement of the Income after Set-off of the Current Year’s Losses;

- Schedule BFLA: Statement of the Income after Set-off of the Unabsorbed Loss that is brought forward from the earlier years;

- Schedule CFL: Statement of the Losses to be carried forward to future years;

- Schedule UD: Unabsorbed Depreciation;

- Schedule ICDS: Effect of the Income Computation Disclosure on profit;

- Schedule 10AA: Computation of the Deduction under section 10 AA;

- Schedule 80G: Details of the Donation Entitled for the deduction under section 80G;

- Schedule 80GGA: Details of the Donation for the Scientific Research or Rural Development;

- Schedule RA: Details of the Donation made to Research Associations etc;

- Schedule 80 IA: Computation of the Deduction under section 80 IA;

- Schedule 80 IB: Computation of the Deduction under section 80 IB;

- Schedule 80 IC/ 80 IE: Computation of the Deduction under section 80 IC/ 80 IE;

- Schedule 80 P: Deductions under section 80 P;

- Schedule VIA: Statement of Deductions (from the total income) under Chapter VIA;

- Schedule AMT: Computation of the AMT (Alternate Minimum Tax) payable under section 115 JC;

- Schedule AMTC: Computation of the Tax Credit under section 115 JD;

- Schedule SI: Statement of the Income which is Chargeable to tax at the Special Rate;

- Schedule IF: Information concerning the Partnership Firms in which the taxpayer is a partner;

- Schedule EI: Statement of the Income not covered in total income, i.e., all the exempt incomes;

- Schedule PTI: Pass-Through Income details from the business trust or investment fund as per section 115 UA, 115 UB;

- Schedule TPSA: Secondary Adjustment to Transfer Price according to section 92 CE (2A);

- Schedule FSI: Details of the Income earned from outside India and tax relief;

- Schedule TR: Summary Details of the tax relief claimed for the taxes paid outside India;

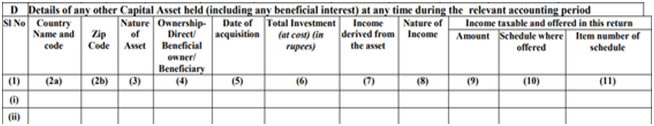

- Schedule FA: Details of the Foreign Assets and Income Earned from any source outside India;

- Schedule GST: Information concerning the Annual Turnover/ gross Receipt reported for GST;

- Schedule D1: Schedule of the Tax-saving Investments or deposits or payments made to claim deduction or exemption for the extended period from 01.04.2020 until 30.06.2020;

- Part B – TI: Computation of the Total Income;

- Part B – TTI: Computation of the Total Tax Liability on Total Income;

- Tax payments;

Procedure to file Form ITR 5

There are 2 different ways of filing Form ITR 5, which are as follows:

- Online Procedure;

- Offline Procedure;

Offline Procedure to File Form ITR 5

The offline modes for Filing ITR (Income Tax Return) 5 are as follows:

- By Submitting the ITR (Income Tax Return) in a Physical Paper Format;

- By Submitting a Bar-coded Return;

Online Procedure to File Form ITR 5

The steps included in the process to file Form ITR 5 online are as follows:

Download the E-Form

Firstly, the applicant or the assessee needs to download the ITR 5 from the official IT portal.

Fill in the Details

Now, the taxpayer or the assessee requires to fill in all the details asked in different parts of the form.

Verification of Form

Under this step, the taxpayer needs to get his/her Form ITR 5 verified or authenticated in the ways as follows:

- By Getting the ITR 5 signed Digitally;

- By Validating the Form ITR 5 through Electronic Verification Code (EVC);

Submit the Form

Now, the concerned taxpayer or assessee who wants to submit his/her ITR forms online will receive an acknowledgment on hid/ her registered email id.

However, if he/she wants to send it manually by downloading it from the official portal, he/she requires to send it through a courier to the Income Tax Department’s CPC office, situated at Bangalore, within 120 days, starting from the date of filing of ITR.

Moreover, it shall be relevant to state that Form ITR 5 is an annexure less form, i.e., the applicant does not require to attach any record or document.

Conclusion

In a nutshell, Income Tax Return Form 5 (ITR 5) requires to be filed by all the entities, such as Firms, Limited Liability Partnerships (LLPs), Association of Persons (AOPs), Artificial Judicial Person, and Body of Individuals (BOIs). Besides this, any Local Authority or Co-operative Society can file ITR (Income Tax Return) using the Form ITR 5 form.

Performa of Form ITR 5

itr5_englishAlso, Read:Form ITR 4: Changes Made in the Assessment Year 2020 – 2021