Form ITR 4: Changes Made in the Assessment Year 2020 – 2021

Shivani Jain | Updated: Sep 10, 2020 | Category: Income Tax

The term “Form ITR 4” denotes an Income Tax Return (ITR) filed by the taxpayers who are falling under the “Presumptive Income Scheme” under section 44 AD, section 44 ADA, and section 44 E of the IT Act 1961. Further, another name for the Income Tax Return 4 is “Sugam”.

In this blog, we will discuss about Form ITR 4, together with the procedure to file and changes made in the Assessment Year 2020-2021.

Table of Contents

Concept of Presumptive Taxation Scheme

The term “Presumptive Taxation Scheme” denotes a scheme by which the small taxpayers who perform tasks, such as the auditing and maintenance of accounts and ledgers would receive some sort of relief.

That means any individual who is looking to avail of this scheme will be become eligible to declare his/her total taxable income at a predefined rates, while acquiring relief from the burdensome task of Account Maintenance and Audit.

The different types of Presumptive Taxation Schemes are as follows:

- Section 44AD;

- Section 44ADA;

- Section 44E;

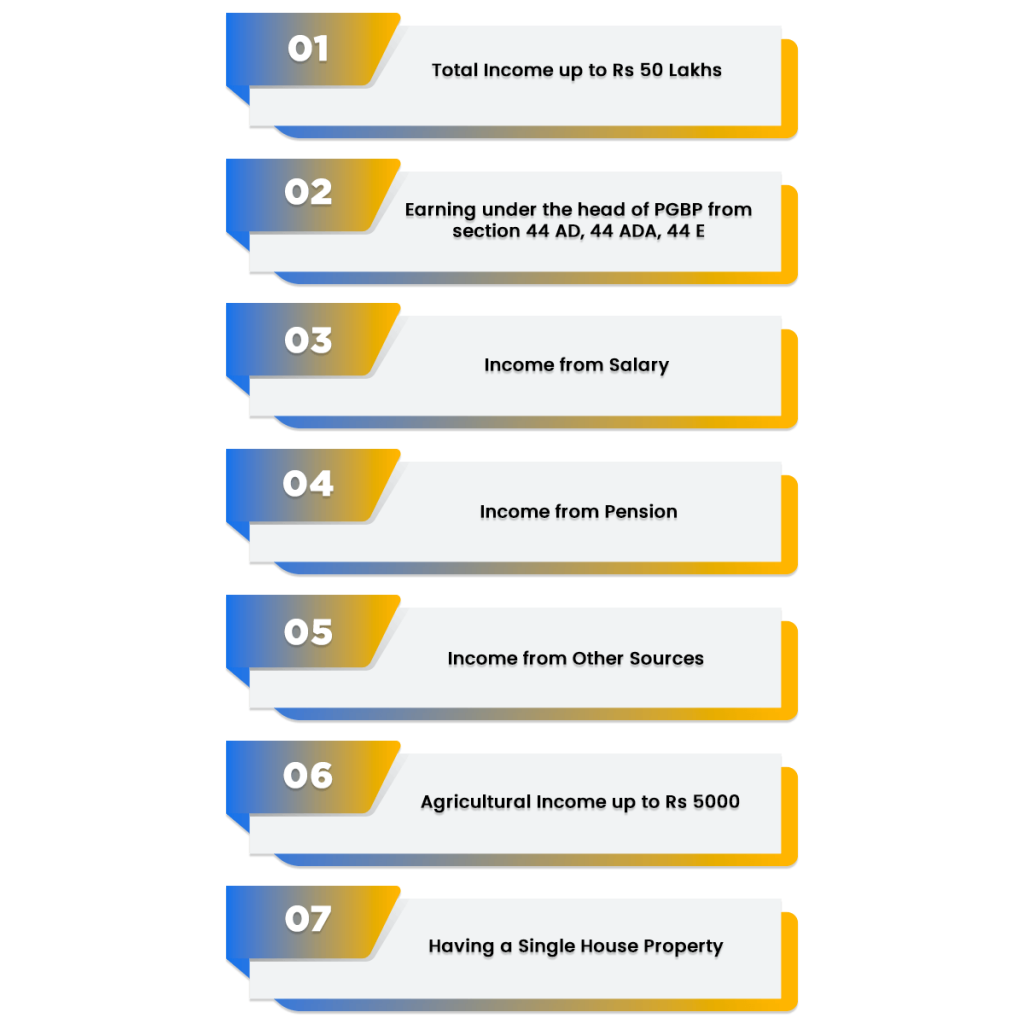

Who are all eligible to File Form ITR 4?

An Individual, Hindu Undivided Family, and Firms (other than Limited Liability Partnerships), who is an Indian Resident and who are falling under any of the following sources are eligible to file ITR 4:

- Total Income up to Rs 50 Lakhs;

- Earning under the head of PGBP from section 44 AD, 44 ADA, 44 E;

- Income from Salary;

- Income from Pension;

- Income from Other Sources;

- Agricultural Income up to Rs 5000;

- Having a Single House Property;

Who are all not Eligible to File Form ITR 4?

The ones who are not eligible to file Form ITR 4 are as follows:

- Director of a Company;

- Shareholder of an Unlisted Company;

- An individual who is having an Asset located outside India;

- An Individual who has signing authority in an account located outside India;

- An Individual who is earning income from any source outside India;

- Total Income is above Rs 50 Lakhs;

- Having more than 1 House Property;

- A Resident but Not Ordinary Resident;

- Having Foreign Income and Foreign Assets;

Also, Read:Form ITR 1

Due Dates of Filing ITR 4

The government and the Income Tax Department have decides to extend the due dates of filing ITR Form 4 till 30.11.2020.

Latest Modifications Made in ITR 4

The latest modifications made in ITR Form 4 are as follows:

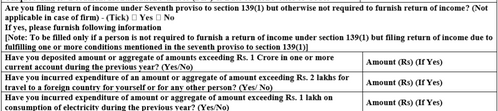

Details Regarding High Value Transactions

Under Part A of the ITR Form 4, a taxpayer now requires to fill additional information asked under the7th Proviso of section 139(1) of the IT Act 1961. Such additional details and information are as follows:

- If in case the taxpayer has deposited above Rs 1 crores in one or more Current Bank Accounts;

- If in case the taxpayer has incurred expenses above Rs 2 lakhs on Foreign Travelling;

- If in case the taxpayer has incurred a cost of Rs 1 lakh on Electricity Consumption;

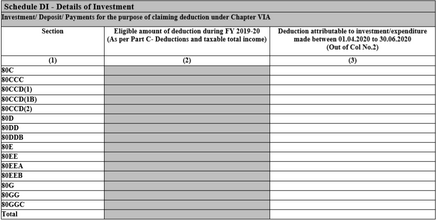

Introduction of Schedule D1

As we all aware that the IT Department had allowed the taxpayers with a privilege to make some tax saving investments for the F.Y. 2019-2020 till 30.06.2020 due to the COVID-19 lockdown. Therefore, the tax department decided to introduce this schedule.

Under this section, the taxpayer requires to provide details and information for every deposit, donations, and investments made by him/her up to30.06.2020.

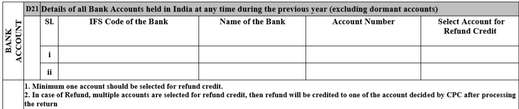

More than 1 Bank Account for Refund

Earlier, there was a requirement for the taxpayer to choose only 1 bank account in which he/she wants to get a refund. However, as per the new modifications made in form ITR 4, the taxpayer can now opt for more than 1 bank account to claim a refund. Further, the CPC (Centralized Processing Centre) will credit the amount claimed in 1 of the bank account after duly processing the return filed.

Insertion of Section 80 EEA and 80 EEB

Now, section 80 EEA and 80 EEB as new deductions have been included under ‘Schedule VI-A’. Further, a drop down menu has been provided to provide the details of donations under section 80G.

Have a look at:Form ITR 2

When is SUGAM not mandatory to File?

SUGAM or Form ITR 4 is a simplified Return Form used by the Taxpayer, at his/her choice, if he/she is eligible to declare income earned from Business and Profession on Presumptive Basis Scheme under Section 44 AD, 44 ADA, or 44 AE.

However, the cases where there is no need for the Assessee to file Form ITR 4 on a mandatory basis are as follows:

- Maintains all the Books of Accounts and other Relevant Documents referred under section 44 AA; and

- Gets his/her accounts audited and collected the Audit Report under section 44 AB as well;

In these situations, the assessee needs to file a Regular Return, i.e., ITR 3 and ITR 4 as applicable.

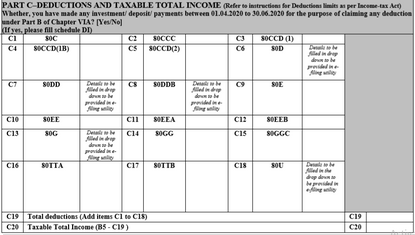

Structure of ITR Form 4

The structure of ITR Form 4 can be summarised as follows:

- Part A: General Information;

- Part B: Gross Total Income from the 5 Heads of Income;

- Part C: Deduction and Total Income Taxable;

- Part D: Computation of Tax and Status of Tax;

- Schedule BP: Details of the Income Earned From the Business or Profession and Computation of the Presumptive Business Income as per Section 44 AD;

- Schedule IT: Statement of the Payment of Advance Tax and Tax Charged on Self Assessment;

- Schedule TCS: Statement of the Tax Collected at Source;

- Schedule TD S1: Statement of the Tax Deducted at Source on Salary;

- Schedule TD S2: Statement of the Tax Deducted at Source on the Income other than Salary;

- Schedule D1: Statement of the Investments or Payments or Deposits in the extended period from 01.04.2020 until 30.06.2020.

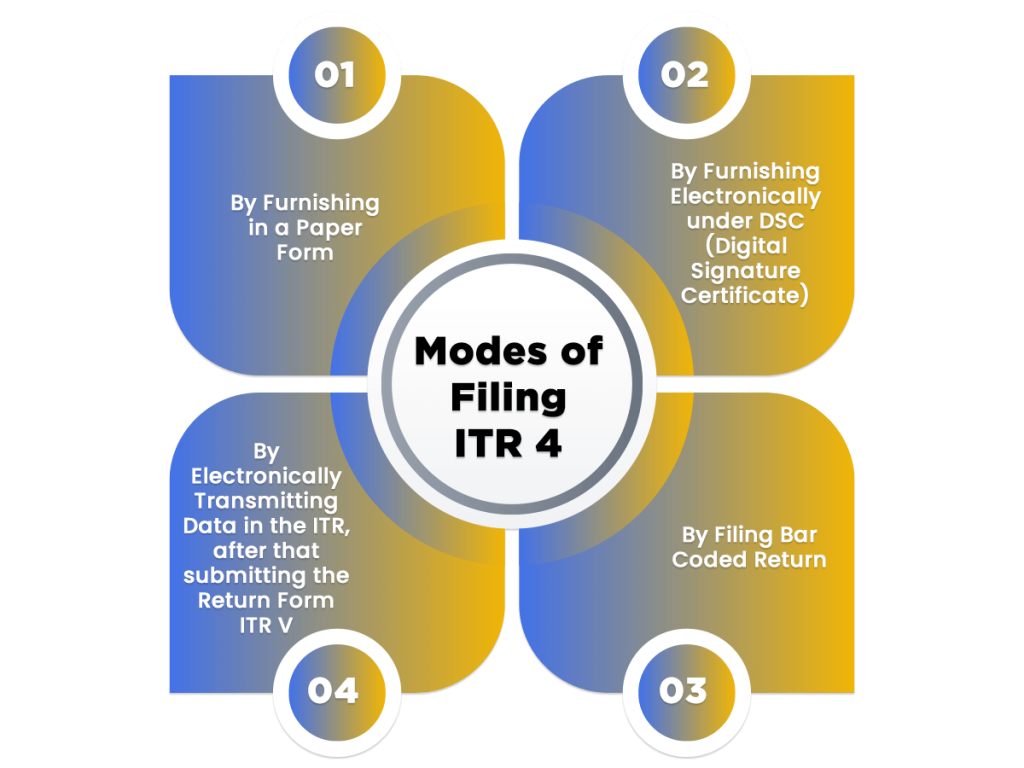

Modes of Filing ITR 4

The modes of filing ITR 4 are as follows:

- By Furnishing in a Paper Form;

- By Furnishing Electronically under DSC (Digital Signature Certificate);

- By Electronically Transmitting Data in the ITR, after that submitting the Return Form ITR V;

- By Filing Bar Coded Return;

Procedure to file Form ITR 4

There are 2 Ways of Filing ITR Form 4, which are as follows:

- Offline Procedure;

- Online Procedure;

Offline Procedure

The particulars of Offline Procedure are as follows:

- Who can File ITR 4 offline? and

- How to File ITR 4 offline?

Who can File ITR 4 offline?

The ones eligible to file ITR 4 are as follow:

- An Individual who is above the age of 80 years;

- The total income of an Individual is below Rs 5 lakhs; and

- One who is not eligible to claim a refund in the Income Tax Act;

How to File ITR 4 offline?

The ways of filing ITR 4 offline are as follows:

- By Providing Return in a Physical Paper Form; or

- By Furnishing a Bar Coded ITR;

Online Procedure

The particulars of Online Procedure are as follows:

- Who can File ITR 4 offline?; and

- How to File ITR 4 offline?

Who can File ITR 4 online?

Every person who is not covered under the offline mode of filing ITR 4 needs to file the same online on a mandatory basis.

How to File ITR 4 offline?

The steps included in the process to file Form ITR 4 online are as follows:

Download the E-Form

Firstly, the applicant or the taxpayer needs to download the E-form ITR 4 from the official Income Tax Portal at http://www.incometaxindiaefiling.gov.in/home;

Fill in the Details

Now, the taxpayer or assessee requires to fill in all the details asked in different parts and schedules of the form.

Verification of Form

At this stage, the taxpayer or the assessee needs to get his/her Form ITR 4 verified or authenticated. The ways for Verification and Authentication are as follows:

- Getting the Form signed Digitally; or

- By Validating the ITR by Electronic Verification Code[1] (EVC);

Submit the Form

Now, if the taxpayer or assessee wants to submit his/her ITR online, then an acknowledgment will be sent on the registered email id.

However, if he/she desires to send it manually, then first download the E-form from the official website, and then courier or speed post the same to the CPC Office of the Income Tax Department, located at Bangalore, within 120 days, starting from the date of filing.

Moreover, it shall be noteworthy to note that Form ITR 4 is an annexure less Income Tax Return, i.e., there is no need to annex any record or document.

Conclusion

After discussing in-depth it will be right to say that, nowadays, the prime objective of the government is to provide tax benefits to taxpayers or assesses of all income groups in the mid of the COVID-19 crisis.

Further, the due dates for Filing ITR Form 4 have been extended by the Income Tax Department and Central Government to 30.11.2020.

In case of any other confusion, then visit our service page named Income Tax Return Filing.

Performa for Form ITR 4

itr4_englishSee our Recent Publish :Form ITR 3: Latest Updates and Procedure to File Online