Download GST Certificate: How to Download and Check Status?

Shivani Jain | Updated: Sep 03, 2020 | Category: GST

The term “Download GST Certificate” denotes the procedure for downloading the GST Registration Certificate from the Official Portal. The authorities do not issue this certificate in a Physical Paper Format. Further, this certificate acts as the legal proof for GST Registration and is issued in Form GST REG 06.

In this blog, we will talk about the Process to Download GST Certificate and Check Verification Status.

Table of Contents

GST Registration Certificate

The term “GST Registration Certificate” denotes a certificate issued by the Tax Authorities to each taxpayer. It is a must requirement for every business that satisfies the eligibility criteria of GST Registration and acts as a legal proof for a business.

Further, this certificate is issued after the Provisional GST Registration Certificate and includes a 15-digit alphanumeric code known as GSTIN (Goods and Service Tax Identification Number).

Provisional GST Registration Certificate

The term “Provisional GST Registration Certificate” denotes the certificate issued by the Tax Authorities to every taxpayer before issuing the actual GST Certificate.

Further, this certificate is similar to the GST Registration Certificate. It includes all the details of business and Identification Number known as PGSTIN (Provisional Goods and Service Tax Identification Number) or Provisional GSTIN.

Who are all eligible to Download GST Certificate?

Every supplier who is earning an Annual Turnover of more than Rs 40 Lakhs or Rs 20 Lakhs in special states is eligible to obtain GST Registration and then download GST Certificate.

Further, every Manufacturer or Trader who is earning an Annual Turnover above Rs 1.5 crore needs to get itself registered under the GST Composition Scheme. That means the ones who are registered under the GST Composition are eligible to Download GST Certificate from the Official Portal as well.

Contents of GST Registration Certificate

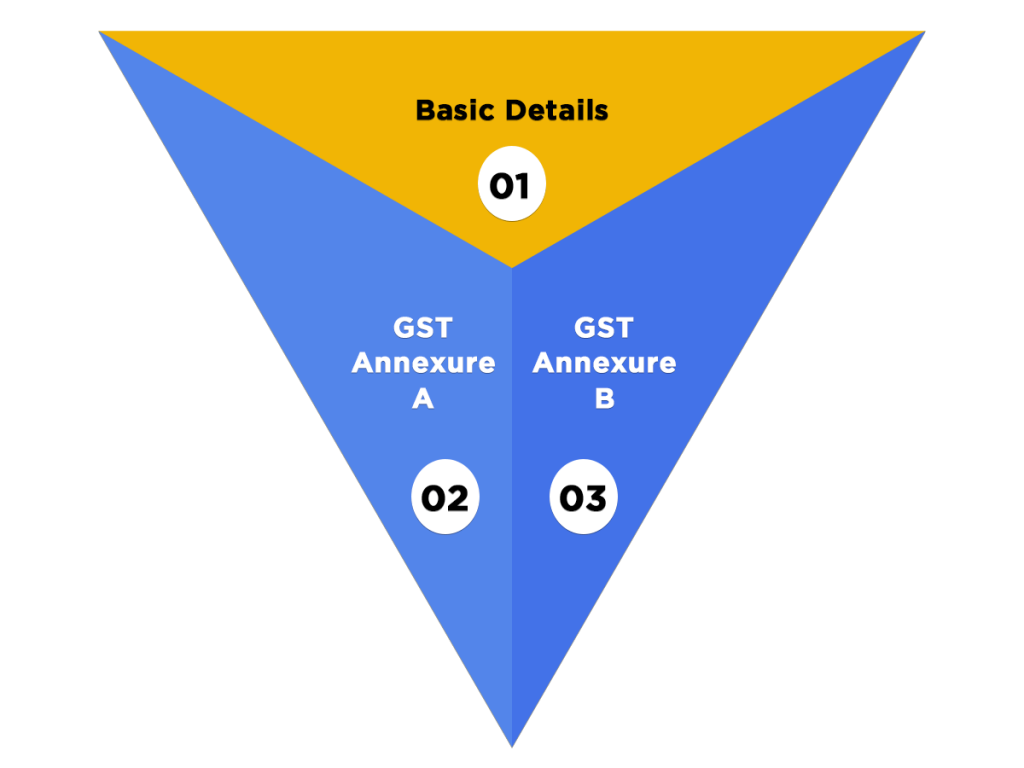

The GST Registration Certificate or GST REG 06 is a 3 Page document, which is divided into 3 parts as follows:

- Basic Details

- GST Annexure A

- GST Annexure B

Basic Details

This section of the certificate includes the details as follows:

Registration Number

It includes the 15 digits unique identification number, known as GSTIN, provided by the Tax Authorities to each taxpayer.

Legal Name

The term “Legal Name” denotes the business name or the name mentioned in the legal documents.

Trade Name

A Trade Name can either be the same as the Legal Name or different from it.

Business Constitution

This section talks about the business structure, such as Sole Proprietorship, Partnership Firm, Private Limited Company, etc.

Address of the Registered Office

The term “Registered Office” denotes the main or head office of a business. The same address must be mentioned in all the legal documents.

Date of Liability

The term “Date of Liability” denotes the date on which the company got registered with the Tax Authorities.

Date of Validity

This part of the form contains details regarding the commencement and expiry of the GST Registration. Further, there is no expiry date for the GST Registration Certificate issued to the taxpayer under the Normal Scheme.

However, the GST Certificate issued to a Casual Taxpayer or NRI (Non-Residents of India) does have a specified expiry date.

Type of Registration

The term “Type of Registration” denotes the scheme under which a taxpayer is registered. Under GST Law, there are 2 types of schemes prescribed, such as

- GST Composition Scheme

- Normal Taxpayer Scheme

Date of Issuance

The date on which the GST Registration Certificate is issued to the taxpayer is covered under this heading.

Details of the Jurisdictional Office

All the details regarding the officer who has approved the GST Registration for the taxpayer are covered under this head.

Annexure A

All the details concerning the Proprietor/Partners/MD (Managing Director) and WTD (Whole Time Director)/Karta/AOP (Association of Persons)/Board of Trustees, etc.

Annexure B

All the details concerning the Additional Place of Business are included under Annexure B of the GST Registration Certificate Or GST REG 06.

Display of GST Registration Certificate

It is mandatory for every entity registered under the GST Act to download GST Certificate and annex or display it at its Registered Office. Further, an entity needs to show the same at all the additional places of business as well.

Moreover, one can attach or display it at places such as the Billing Section or Entrance Gate. Non-compliance of the same will make the entity liable for penalties.

How to Download GST Certificate?

The steps included in the process to download GST Certificate are as follows:

Visit the Official Portal

The first step for the applicant is to visit the official GST portal at https://www.gst.gov.in/.

Click on Login

After visiting the portal, the applicant needs to click on the option saying “Login”, located at the top right corner of the Homepage.

Enter Login Credentials

Now, the applicant needs to enter the Username and Password. After that, he/she requires to click on the option “Login”.

Choose Services

Now, the applicant will be redirected to a new page, wherein he/she needs to choose the second option, named as “Services”.

Select User Services

After that, he/she needs to select the fifth tab, named as “User Services”.

View or Download Certificate

After selecting the tab user services, the applicant requires to click on the option “View/Download GST Certificate”.

Click on Download

In the last step, the applicant needs to click on the option “Download” to download the GST Certificate issued to him/her by the tax authorities. Further, the GST Certificate issued will be in form GST REG 06.

Validity of a GST Certificate

A GST Certificate issued to a Normal Taxpayer does not have a specific expiry date. It remains valid till the surrender or cancellation by the GST Authority.

However, in the case of an NRI (Non-Resident India) or Casual Taxpayer, the certificate has a validity of a maximum of 90 days. That means after the expiry, the taxpayer has the liberty to extend or renew the certificate.

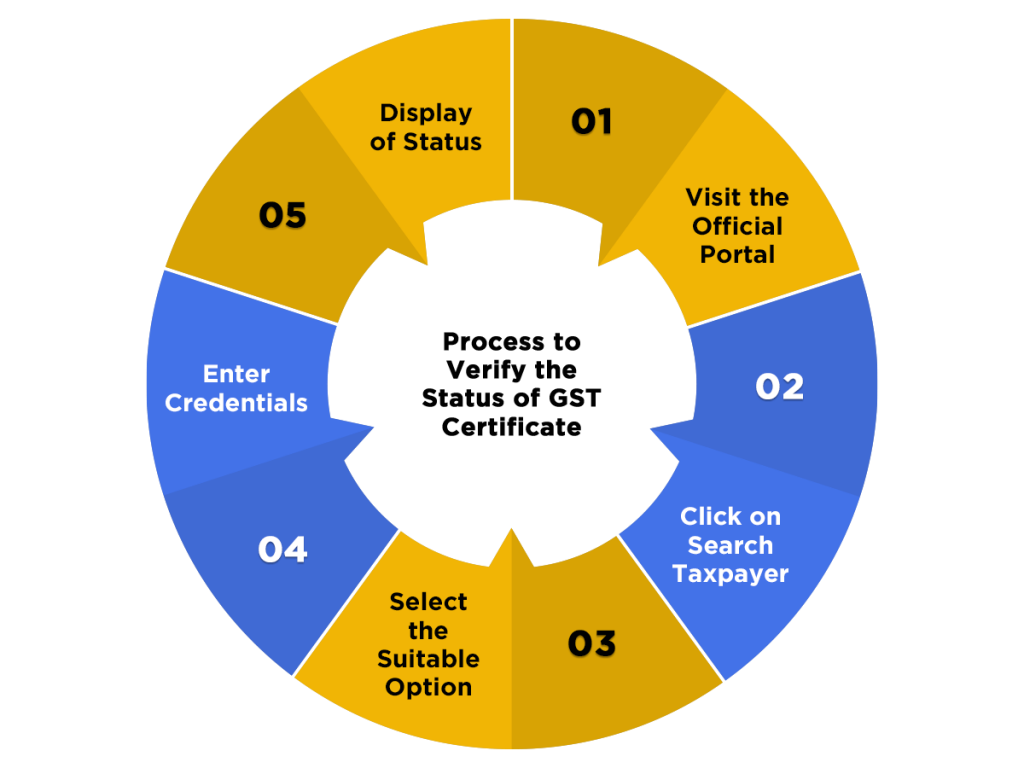

Process to Verify the Status of GST Certificate

The steps included in the process to verify the status of the GST Certificate are as follows:

Visit the Official Portal

The first step for the applicant is to visit the official GST portal at https://www.gst.gov.in/.

Click on Search Taxpayer

After visiting the portal, the applicant needs to click on the option saying “Search Taxpayer”, located at the dashboard of the Homepage.

Select the Suitable Option

Now, the applicant needs to choose from the options available as follows:

- Search by GSTIN/UIN

- Search by PAN

- Search by Composite Taxpayer

Enter Credentials

After selecting the valid option, the applicant needs to enter the details asked and then click on the option “Search”.

Display of Status

At last, the status of the GST Certificate will be displayed on the screen. However, the term “status” includes the following terms:

- Active

- Provisional

- Migrated

- Pending for Verification

- Validation against Error

- Cancelled

Active

The term “Active” denotes that the GST Registration of the applicant is active.

Provisional

The term “Provisional” denotes that the GST Application has been verified, and the authorities will issue a certificate for the same. However, a provisional ID is already issued for the applicant.

Migrated

The term “Migrated” means the application for GST Migration has been approved by the authorities.

Pending for Verification

The term “Pending for Verification” denotes that the application for GST Registration is pending with the Tax Authorities for Verification.

Validation Against Error

The term “Validation Against Error” denotes that the PAN Card details entered by the applicant do not match with the details provided by the other departments. In this case, the applicant needs to re-file the application form for GST Registration.

Cancelled

The term “Cancelled” denotes that the Tax Authorities have cancelled the form filed by the applicant.

Conclusion

At last, it is right to state that a GST Registration Certificate is a must requirement for every business that satisfies the eligibility criteria of GST Registration and acts as a legal proof for a business. It is issued in the form GST REG 06.

Further, it is mandatory for every entity registered under the GST Act to download GST Certificate and annex or display it at its Registered Office.

For further details, visit our service page for GST Registration.

Also, Read: Online GST Calculator